WW1 was dated from 28th July 1914 – 11th November 1918. Germany incurred huge debts to the countries that sold them tanks, ammunition and rations during WW1. The belief and hope within the country was that they would win the war and pay for the debt of the war through acquisition of foreign land and assets. The efforts of the whole country went into the war. German authorities forced production of military equipment to be an economic priority, even for industries who had nothing to do with it. Their factories, capital and assets all went towards to the war. The debts that Germany recieved was from the loans that they took out from their own central bank and the central banks of other countries to pay for the tanks, ammunition and rations. After the war had finished, and Germany ofcourse lost, they still had the loans to repay. The promise of aquiring the capital of victory had failed. So, Germany was faced with the two same options that any fiat currency faces during a time of debt repayment that is above their means. 1: Defualt on their debts and simply say: 'Sorry, we can't repay that loan you gave us'. Or 2: Print your native currency and pay off the debt that way. Germany chose to do the later.

Why Is This Important?

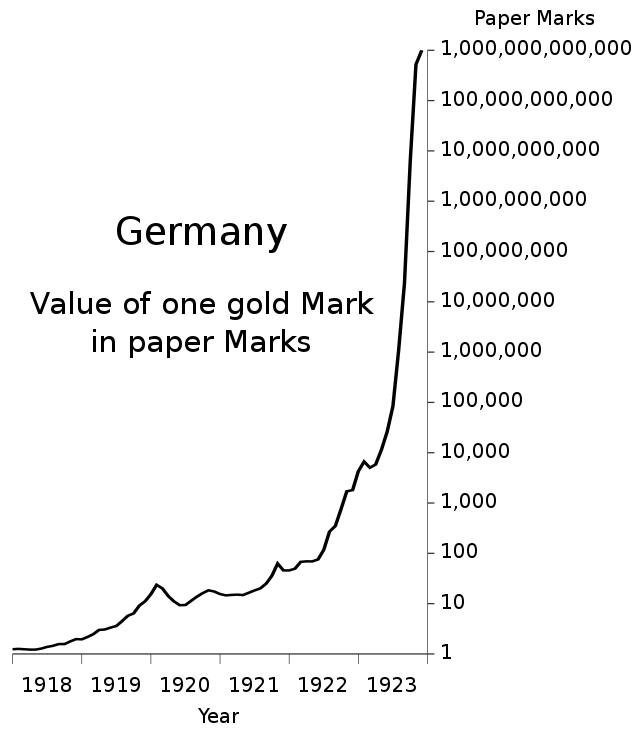

Whenever currency is printed, there is a larger pool of avaliable currency. However, the goods and services within the country stay the same. Thus, naturally, goods and services will cost a higher price in order to have the same purchasing power (relative cost) as they did before the increase in currency supply. Because of the huge increase in currency supply, the quantity on the Papiermark notes increased. First we saw the intoruction of 100 Papiermark notes (1st Nov 1920), then 10,000 Papiermark notes (19th Jan 1922) and then 1 million Papiermark notes (20th Feb 1923). What is staggering here is that we can see within the short space of 2 and a half years, the population of Germany went from have 100 Papiermark notes to 1,000,000 Papiermark notes. This is what we would call a hyperinflation.

German Hyperinflation Post WW1

German Hyperinflation Post WW1 How Did The Hyperinflation Play Out?

In 1923, the value of the currency fell by 50% or more per day. This meant that prices doubled every single day. Nearly everyone spent their money as quickly as possible on essentials. However, this rapid circulation of currency (Velocity) served the inflation even further. In the end, there were 144 printing companies that could not keep up with the demand for bank notes. Emergency money started to be circulated. Everyone was issuing currency to add to what the government was printing. Mark notes with a face value of 1,000,000,000,000 were being printed by the 1st Sep 1923. Here is an account of the New York Times from February that year:

’12 Paper Mills Supply Marks; 45,000,000,000 a Day Issued’

‘Thirty three printing plants and twelve paper mills are being kept busy supplying Germany with new currency which is being issued at the rate of 45,000,000,000 (45Bn) marks a day. The introduction soon of notes of 50,000 mark denomination is expected to increase the daily output of presses by 15,000,000,000 (15Bn) marks a day. It’s estimated that by the end of the month every day will see 125,000,000,000 marks in new notes pouring into circulation through the issuance of notes of 20,000 and 100,000 mark denominations'.

This was the February edition of the new York times. By November, those same paper mills were turning over 500 quadrillion marks per day.

Confidence of the Germany people in their currency and economy was broken. Having watched the purchasing power of their savings collapse by 90% right infront of their eyes in a short space of time, the people knew better. They knew that holding onto their currency would by them less of what they need. So as quickly as the money came in, it went back out again and it was spent. Velocity was at an all time high. Prices continued to rise and rise. Currency was a hot potato and no one wanted to hang onto it.

The Opportunity To Maintain Their Wealth

Before the end of the war 1oz of gold was about 100 marks per ounce. By 1920, the price was fluctuating between 1,000 and 2,000 marks per ounce. Prices followed suit and increase 10-20x. anyone who held onto savings throughout the war were shocked to realise that the money they had saved could only by them 10-20% of the goods that they could have done only a year to 2 earlier. Sound money, Gold and Silver, had held their purchasing power throughout the hyperinflation. Why? Because they are both stores of value!

Personally, I draw parallels to previous wars throughout history and what is happening today with COVID. Of course they are totally different events however I am looking at this through a financial lense. The impact on the economy, speaking as someone from the UK, has been almost as significant as it was during WW1. We have a debt to GDP ratio (how much money our government owes relative to our income to pay it off) of over 100%. The last time we saw the ratio this high was post WW2.

Source

Source Predicting the Next Hyperinflation?

There's a subtle but really powerful piece of information that ties this together. WW1 finished at the end of 1918, however the effects of hyperinflation were not felt untill 2 years after the war. During the war, people were anxious about the economy and job security and thus savd their money. Similarly today, we have the same behaviour. Once the war finished and a small time had passed, people felt more confident economically and the currency that they had saved started to come out into circulation. I'm not sure how long COVID will last, but there will be a time when confidence is restored and people start to spend their saved currency. This is the really important point! Hyperinflation kicks in when the currency supply is high and also velocity is high. This means that the printed currency is actually being spent in circulation and then we have the increase in prices that follow. Hyperinflation can't be felt when everyone is storing up their currency in the bank or under the mattress, as they did in WW1 in Germany and as many people are doing today due to COVID.

One of the reasons I personally got into crypto is for a hedge against hyperinflation. A lot of crpyto people are doomsdayers as they feel that this would be in crpytos favour. The fall in value to currencies such as the US Dollar. A lot of us, me included, seemed to think that hyperinflation was going to happen tomorrow. However, my research would indicate that it would happen once confidence has been re-established after signifcant currency printing. The evidence is clear that throughout COVID, governments have taken out loans and used deficit spending to fund their efforts. Do we see any paralells to Germany in the 1910s? Confidence in spending is low. Yet, there will come a time once COVID has blown over, that people will start to feel confident and spend that stored up economic energy. The confidence period lasted roughly 2 years after the war for hyperinflation to kick in. So, when it comes to hyperinflation, I think we are safe for now!

Source

The Fruit of Economic Crisis?

Out of monetary crisis, you often see the political landscape change. The middle class will have the largest vote, around 70%. Hyperinflation will wipe out the middle class into the lower class. It’s easy for someone to come into that situation when the middle class are in fear that a leader can come and prey on that and use that to their advantage. Look at the rise of Hitler. He came to power after the German hyperinflation. Just one week after the collapse of the Papiermark was where Hitler made his first public appearance. The audience had become impoverished by the hyperinflation and thus Hitler came along and offered them a way out of their poverty and playing on the fear of the public. Could we see something similar play out if the middle class are wiped out?

Financial education is really important, especially right now. COVID is happening and there are significant health and social reciprocations. Yet it is important to understand the financial implications too and what is going on behind the scenes. Please continue to read my blogs about financial education and crypto as they come out. This is aimed to educate people who know nothing about these topics with the aim of having some protection when an inevitable financial collapse happens.

Currently, if you are new to this, you are not too late. The talk in crpyto is that if you aren't already in you are too late. This is not true. This is not true for gold or silver either. There is still an opportunity to educate yourself and make appropriate decisions for yourself!

Please upvote, reblog, and comment! I look forward to your thoughts on these topics too as I want to get this discussion going! Thank you.

Posted Using LeoFinance Beta

I was seeing this coming years ago and there very few safe havens so I started setting aside small purchases of gold and silver. Now I've added Crypto to the strategy. We may not know when it happens but it will happen.

Posted Using LeoFinance Beta

Great idea! I agree with your strategy wholeheartedly. I've perhaps been bullish on crpyto compared to precious metals (85% to 15%) but I saw the upside and went all in. Which country are you from? Many people really don't have the knowledge when it comes to sound money!

Posted Using LeoFinance Beta

I'm in Western Canada. I hope we have a big enough movement to Separate from the (more socialist) Central Canada. Oh great, Prime Minister Trudeau just allowed Chinese Red Army Troops to do joint military exercises here in Canada, now they will be familiar with what little strengths we have, terrain, and all our weaknesses when they decide to Invade. We got a Prime Minister of butt kissing.

Posted Using LeoFinance Beta

I have no idea about the political spectrum in Canada. A lot of people seem to like Trudeau but I have no idea. I do know that Canada have 0 Gold reserves so they're broke.

Posted Using LeoFinance Beta

Justin Trudeau is as slimy and hypocritical as most politicians come and the News monopoly CBC is always under government control as it's propaganda ministry. Plenty of his self serving deals and his relationships with big multinational corporations including his ass kissing of the Chinese govt are far under reported in our mainstream news.

I have more gold in my mouth than the Bank of Canada has in Gold reserves, except for the 70 gold coins in the Royal Canadian Mint Museum. I can hear the money Presses change into a higher gear.

Posted Using LeoFinance Beta

Money go brrrrrrrrrr

Posted Using LeoFinance Beta

Interesting topic, good article. One which could engage hours of discussions ;)

It’s definitely a war, and not necessarily a patriotic one. More like intra-countries war, where the “elite” is trying to step on the mass. We still can act, but for how long ?

Posted Using LeoFinance Beta

I really enjoy talking about these topics, money and monetary history. It allows me to have a better understanding about what is happening today and what is likely to happen in the future. You can act by getting out of your countries FIAT and into a non-sovereign, censorless, borderless and programmable money. Hmmmm where have I heard that before?

Posted Using LeoFinance Beta

Spot on ! Might sound difficult for some people to trust crypto instead of their traditional banks.

Which is ironic as these banks would just raze bank accounts in a blink if they are requested to.

Posted Using LeoFinance Beta

It's all about confidence right now, you're right! People have confidence in the banks (even though there was an unfulfilled bank run here in the UK after 2008). People are simply uneducated about where else to store their wealth! People find the 0.01% interest so inticing!

Posted Using LeoFinance Beta

Haha that's hilarious I'm in the process to convince my gf to move some of her money from her bank to a CeFi and I used the exact same shitty rate of 0.01% to describe her bank savings rate.

Honestly I think it's more than that in HK but I used that anyway :D

Posted Using LeoFinance Beta

Good luck!

Posted Using LeoFinance Beta

All these years of waiting for a black swan and a Hong kong fluey creeps in and starts the printing presses. Has anyone even admitted were in a recession yet? (crazy times)

Posted Using LeoFinance Beta

The word recession wasn't printed everywhere but here in the UK we are I'm a depression (4 consecutive quarters of economic downturn). I have thought why is no one else as shocked as I am. I think they are oblvious to what this is. Doesn't bother me though as I'm involved in crypto and protected against hyperinflation !

Posted Using LeoFinance Beta

that's why holding paper money is dangerous. If i talk about indian currency, 10 rupees had a very good value in past but now 10 rupees is like 1 rupee. So after doing FD in your bank you thinking that you are the smart person then you are wrong here because instead of profit, you will loss your money and bank will take the benefit from your fund.

Posted Using LeoFinance Beta

It's true! You need to know the risks associated with storing your wealth in your native fiat currency. Let's take India, great example! The Indian Rupee has been inflated 195% since 2010. (https://www.inflationtool.com/indian-rupee/2010-to-present-value)

That equates to the same as 'Half of your Indian Rupees in the bank have been stolen over the last 10 years'. It is literally the same thing! Think of all of those hours your parents and yourself may have worked for half of their savings to have been stolen, through inflation, over the past 10 years! Not to mention more!

Let's take this further! Say your grandparents have been saving for their retirement since 1990 and storing Rupees away. They have been inflated 875%. That equates to, 'You have had 90% of your savings for retirement stolen'. (https://www.inflationtool.com/indian-rupee/1990-to-present-value)

Mind blowing.

Thank you so much for the comment!

Posted Using LeoFinance Beta

Appealing article

Nice way to learn and earn at the same time

Good job!!!

Posted Using LeoFinance Beta

Thanks!

Continue to comment and engage and I will continue to upvote your comments!

Posted Using LeoFinance Beta

I loved this issue since I relate something past like the German revolution between the war on their financing and what then leads to the devaluations that is happening through the arrival of the covi, very good this topic I congratulate you.

Posted Using LeoFinance Beta

Yes, there are some parallels between a World War and COVID. There really are! In a financial sense! Thanks for your comment!

Posted Using LeoFinance Beta

You are pumping up these posts real quick. We really have kind of a war going on with COVID-19. It's like a non-military war. We've got so many restrictions, propaganda and other economic issues because of this virus that isn't much worse than flue when looking at real data.

Posted Using LeoFinance Beta

Thanks! That's exactly what it is. You could argue that it is not a physical war but a currency war! That's the thing that baffles me. I'm from the UK and we have 20,000 deaths a year from the common cold. We have had 64,000 deaths from COVID. The common cold only lasts the winter months (says 5 months) and COVID has been going on for 10 months now. COVID therefore only has 1.5x more fatalities than the common cold, yet we are in a world lockdown? They are allowed to impose these rules because they have control of the money. Crypto takes money out of velocity and cripples FIAT. It's ridiculous.

Posted Using LeoFinance Beta

Don't forget these numbers are inflated. I've seen of incidents where someone die in an accident, test positive for COVID-19 and they get treated as COVID-19 deaths. @vimukthi made a great post comparing stats. In 2018 10 million got infected tuberculosis and 1.5 million died. That's 5-6 times current COVID-19 death rate. In some countries COVID-19 mortality rate is under 1% and 80% of those who die are senior citizens.

https://www.dw.com/en/who-tuberculosis-is-the-worlds-deadliest-infectious-disease/a-52895167

https://www.worldometers.info

Posted Using LeoFinance Beta

I know mate. These details and things that don't quite make sense are becoming BS. I think the narrative now is that the 'virus will mutate' or some worse BS.

Posted Using LeoFinance Beta

Viruses mutate all the time. For the younger demographics, death from COVID-19 is less likely than dying from a plane crash. It was all political/economic manipulation.

Posted Using LeoFinance Beta

True, it's just the fact that I have correctly predicted that they have come out with all this 'oh now there's a mutation so you have to go back in lockdown' nonsense.

Posted Using LeoFinance Beta

Thanks

Posted Using LeoFinance Beta

Congratulations @localgrower! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: