Anarchist Investor Weekly

Your weekly review of the Anarchist Investor Newsletter

Now Is A Good Time to Take Profits

If you have money in the Wall Street Casino

THE ANARCHIST INVESTOR

APR 08, 2024

“Time in the market is superior to Timing the Market.” An adage that most financial advisors are brainwashing into repeating over and over. Ironically, the longer your money is invested, the more their annual fee earns them. Mud throwing aside, timing the market is a fool’s errand if you’re doing it with an all or nothing tilt. However, you never make any money unless you sell at some point. Your Wall Street advisor will tell you that time is leading up to or during retirement. Here’s a reason to realize some profits now.

Divergences

I am constantly paying attention to divergences. Why? The price of any asset is only one piece of data. How that price came to be matters. It keys you in on whether or not it’s likely to continue on its’ current path (up or down) or turn Crazy Ivan.

Divergences can appear in many different measures of market activity. Most investment folks have their preferred measures or metrics that they watch. Quite often you’ll see them appear in a single metric and then go away with no real affect. However, the can begin to congregate within some or all of your preferred measures. That is a warning signal. It may not signal an imminent shift. However, I typically use these as good times to lighten up on investments I feel have are overvalued in my portfolio.

Something to also note is that the timeframe in which you identify these divergences matters. A divergence on an hourly basis might mean a trend change is coming for a couple hours or days. As you pan out, those divergences can have longer lasting affects. If you identify divergences on a daily or weekly basis, a resulting change in direction could result in days, months, or years in which that change is felt. This change in direction can take a long time to play out. It’s not an exact science.

Relative Strength

Relative strength measures the momentum of an asset’s price and the Relative Strength Index (RSI) is a numerical measure of this momentum on a scald of 0 to 100. Readings above 70 in the RSI are considered “overbought” and often coincide with reversals in that upward trend. The same can be said about when an investment is headed lower and the RSI reads at or below 30 meaning it is “oversold”.

The relative strength index (RSI) is a momentum indicator used in technical analysis. RSI measures the speed and magnitude of a security's recent price changes to evaluate overvalued or undervalued conditions in the price of that security.

-Investopedia

Relative strength is specific to an asset. However, it can also be applied to indexes and bundles of related investment to key you in on how the broader marketplace may be moving or about to move.

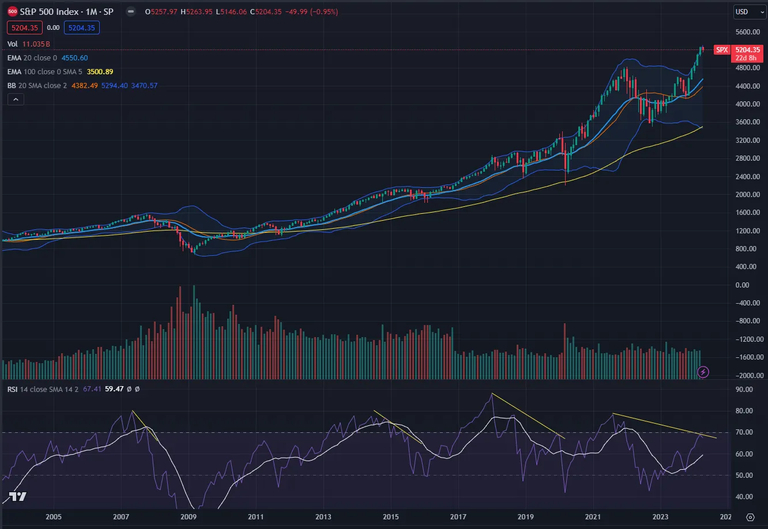

S&P 500 2021-2014

At present, the S&P 500 index is at All-time Highs. It also happens to be above that key level of 70 in the Relative Strength Index. When we pan out, we can see that a divergence is forming in the RSI of the S&P 500 from the last time it hit an All-time High in 2021.

S&P 500 2005-2024

Something to also be aware of is that New All-time High’s that have coincided with RSI readings of over 70 on this chart typically mean the index is at or near a top and a reversal in trend is about to take place. It played out in 2021. The same may be playing out right now in 2024. What’s more worrisome is if this reversal happens sooner than later, that would mean the recent move to All-time High’s was weaker than its’ predecessor. This translates into a weak move that might be completely erased in any subsequent weakness.

Don’t Miss Your Chance At BITCOIN!!! 💰💰💰

I’m giving away $25 in Bitcoin to up to 4 free subscribers on May 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe to enter: anarchistinvestor.substack.com

Or better yet…Become a paid subscriber to get a chance at $100 IN BITCOIN and:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

Discretionary Spending vs. Consumer Staples

The United States is a “consumer-driven economy”. In short, this means that the United States economy is the largest buyer of the world’s goods. That’s also why the US dollar is the world reserve currency. Many market watchers use the direction of the ratio between Discretionary Goods purchases and Consumer Staples goods purchases to determine the health of the US consumer based on how big money investors are putting their money to work in these types of stocks. Discretionary spending are luxuries like cars, vacations, entertainment, and fast food. Consumer staples are items like groceries, paper products, personal hygiene, etc. If investors are sensing a weakening US consumer, they buy stock in the latter and not the former.

The ratio fell just prior to the top in the Casino in 2021. What followed was the strong sell-off throughout 2022. The ratio broke its’ downward trend in 2023 which coincided with the market rally that has gotten us to where we are today. In the last couple weeks, that upward trend is beginning to break down. The lower support line for this ratio has been violated. What follows may be another downward move in risk which means downward movement in the stock market.

Plan of Action

No one ever lost money by taking a profit. If you have a large portion of your net worth in the Wall Street Casino, now might be a good time to pull some of it out and preserve it. If you’ve wanted to rotate into other investments, this is also an opportunity for that rebalancing. Getting a little more liquid and waiting for investments to go on sale is also a great strategy.

If you add in the rise in Gold recently, it just feels like something negative is coming for the traditional investment markets. Add in the rising number of these under reported divergences and you get a really good justification for locking in some of your profits.

I Have Squandered So Much Money

It's only a waste if I don't learn from it.

THE ANARCHIST INVESTOR

APR 09, 2024

I was the child of a police officer and a laboratory scientist. My parents worked hard and our lives were what you would expect of an average, middle class American family. There were times when I was younger that our family of four lived paycheck to paycheck. In fact, many financial setbacks compounded the financial difficulties. It wasn’t until several years after my mother went back to work and both she and my father received a couple promotions that we had some breathing room. I can remember the years where I wanted for luxuries but we couldn’t afford them. In fact, I think my parents were once alerted to my tall tales about luxury vacations while I was at school by one of my elementary teachers. It may have been those times juxtaposed with the relative fortune of my teenage years that caused my financial overzealousness in my young adult life.

Gambling

My formidable years never saw me forget what it was like to be the “poor kid in class”. That being said, it was a Christian private school my parents worked their asses off to send me to up until fifth grade when it became too expensive and I also imagine it would’ve been unfair to send my younger brother to public school if I had stayed enrolled. It’s a head start I don’t think many get and I don’t think I could ever repay.

Much of my 20’s and 30’s has been steeped in gambling. Often, I didn’t even know that’s what I was doing. I feel like I was attempting to leverage the financial progress my parents had made in their lives as a launching pad into so much more. Somewhere I also felt like I owed it to them. Unfortunately, it was done without intention and calculation. The irony was that it started off with day-trading dotcom stocks while I was in school for engineering. I was someone learning how to be extremely exact and calculating while investing in companies that had millions of page views and no earnings. At the time, if you were making $100-$200 a day trading Pets.com then you were a genius and everyone else who was buying boring old oil stocks or gold and silver were going to ‘stay poor’ or they ‘weren’t going to make it’.

The day trading fervor gave way to online poker. Sites like Party Poker and Ultimate Bet gave me the opportunity to match statistical wits with players from around the world. It also gave me an opportunity to make (or lose) large sums in a short period of time. The action was intoxicating. The largest hand I ever played I lost $7,000 and I had a 95% chance of winning before the final card fell.

In "Confessions of a Winning Poker Player," Jack King said, "Few players recall big pots they have won, strange as it seems, but every player can remember with remarkable accuracy the outstanding tough beats of his career." It seems true to me, cause walking in here, I can hardly remember how I built my bankroll, but I can't stop thinking of how I lost it. - Mike McDermott (Rounders)

My overall financial health wasn’t trending upward. I never learned risk management or bankroll management. This was also prior to smartphone applications that could help you with those. I think I tried to keep a spreadsheet once but the moment my bankroll dipped I stopped updating it.

I read a dozen books about game theory, statistics, and player tells. I could read players’ hands based on how they played extremely well. What I couldn’t do was manage the emotions and finances associated with long periods of time where I played well but still lost.

At the same time I was building up a mountain of student loan debt. Something I am just now getting out from underneath. Yet another failure of managing risk. Never once did I put down on paper the debt needed to graduate and compared it to my expected lifetime earnings in that field. If I had, the trajectory of my life might have been completely different. However, the Universe only provides us with events in our lives that we can handle, if we choose to.

When I finally did go to school for a finance degree (MBA), I began my career in the financial industry. I began in banking as a teller and eventually worked my way up to Branch Manager at the ripe old age of 27. However, something kept pulling me back to ‘the action’. I spent time during this period on and off as a proprietary trader. The firm I worked for took a deposit of cash from me and levered me up. This meant I could by 30 X my cash balance in stock at any one moment in time. I was day trading again. The issue I was still facing was risk management. My cash balance got eaten up mostly by churn. Churn is the term for when you trade back and forth a lot but don’t really make any money while the trading fees eat away at your cash. My big wins were offset by lots of little losses. Quite often I was cutting off the wins too early and poor entry points meant my losers more often than not moved in my direction after I had already gotten out after a little bit of pain.

Throughout a lot of my life, I have also gambled gambled. It started with poker but it came to also include games with ridiculously lopsided odds against my success like craps. There are many anecdotes about a famous poker player, David “Chip” Reese, who was incredible at 7-card stud. Stud games allow you to do a lot of card counting and number crunching because you get to see a lot of the cards in play. He was so good at it that Doyle Brunson tapped Chip Reese to write about 7-card stud in his Best Selling book ‘Super Systems’. I believe Chip once said that he would win millions playing 7-card stud only to lose it to the casino playing craps. He would then head back to the poker table and start the process all over again. I am in no way comparable to Chip Reese in poker talent. But we do share a similar story. Skill enough to make money but poor Risk Management.

Risk Management

I was given an incredible opportunity when a head hunter called me one day and offered me a spot at an Insurance & Risk Management firm near my house. The pay wasn’t amazing to start but the upside was incredible. I took to it like a fish to water. It matched my ability to memorize information along with my gift of gab and sales experience. In addition, it gave me the opportunity to work with business owners who are masters at managing risk. I would argue that risk management is the single biggest skill set needed in any business venture. You can have the most innovative products and amazing marketing plan but without risk management, it will all come crumbling down.

I was also paired with a mentor that taught me more than I can ever explain. If there is such a thing as risk management when it comes to relationships, this guy was the Lao Tzu of the practice. His book of business was centered in the public sector (ie - government). I watched and sometimes helped him dance around land mines on a regular basis like a freaking ballerina. His mentorship and the nature of the job helped me understand how misdirected I had been in my financial career. It also helped me value mostly conservative financial practices with some small outsized bets that could pay off huge.

What I Have Learned

I have always been chasing the return without thinking about what I was risking in the process. If I gave you the option of flipping a coin that had equal opportunity to win a Ferrari or lose every dollar to your name or just handing you a used Honda Civic…would you choose to flip the coin or would you take the old Civic? My younger self would’ve flipped the coin, lost every dollar, rebuilt some money, and then flipped it again only to lose everything and restart the process all over. My present day self is thinking about how much I can flip that Civic for.

I have also learned that I ALWAYS need to ask myself, “What if I’m completely wrong?” This practice is imperative because it helps you anticipate how to pivot out of a bad situation. In many cases, you can put the safeguards in place ahead of time, just in case. Some of the best investors in the world find a way to make money even when they’re wrong.

If every thrill seeking gamble I engaged in would’ve been tempered with an ounce of risk management, I wouldn’t have involved myself in most of it. And the few that I would have, the returns would’ve been massive.

Top 5 Reasons You Need a Side Hustle

And why.

THE ANARCHIST INVESTOR

APR 10, 2024

If you are an entrepreneur as your full-time gig, this article may not apply to you and it’ll be clear once we get to the end. If you aren’t an entrepreneur as your main gig, this article is for you. There is a wide range of reasons why working part-time alongside your full-time gig is worth it. Let’s dive in.

1. Extra Money

This one’s pretty self-explanatory. Extra money in your pocket is going to help you in many ways. The best ways would be to reinvest it back into your side hustle or other investments like crypto, precious metals, real estate, etc. My side hustle is what you’re reading right now. However, my full-time work is actually multiple side hustles. They also include woodworking/furniture flipping, passive crypto mining, and eventually real estate investment.

Extra money can also help with unforeseen expenses or simply to lessen the sting recently of inflation in the items you purchase every day.

2. Diversification of Cash Flow

My writings and investing philosophy focus a lot on risk management. Part of risk management in investing has to do with ‘not putting all your eggs in one basket’. This means diversification of investment which also means diversification of cash flow. If you have a single source of cash coming into your portfolio, you’re at risk of losing that cash flow and thus taking a huge step backward in your financial prosperity. Generating cash flow from two or more sources means any one source can fall off and you’re lessening the impact that would have on your daily life and ultimately your long-term financial goals. The biggest cautionary tale here is 40 hour a week workers that lose their job during economic downturns and now all they have is unemployment. One or multiple side hustles solves for that.

3. Complimentary Business

Your side hustle can enhance your main job or vice versa. One of the people I met that had this nailed was someone who worked in the public sector. His day job was in the financial area of towns/counties. He also developed an auditing/consulting side hustle that helped other public sector entities balance their books. He developed contacts while wearing either hat that then resulted in either more opportunities in his 9-5 gig and helped identify potential clients for the side gig.

Now I can’t stand publicly funded bureaucracies but in a world where they exist, this dude had it nailed. His side hustle benefited from his day job and vice versa.

I am searching for this right now. Passive crypto farming helps me write here and help my community of readers out. Researching for this newsletter also leads me to new, potential sources of passive crypto income. I haven’t yet figured out how woodworking dovetails into this all but I’m certain there will be some crossover :).

4. Family Bonding and Teaching

I am looking to get into garage sale flipping with my son and his friend. They love video games and it would be a huge opportunity to help them create a collection while also building a skill set that could make them money for their whole lives. Side hustles can include your significant other, kids, and even extended family. It can be a bonding exercise that brings everyone together. I know of several couples that operate side hustles together and it has strengthened their relationships immeasurably. At the heart of it, building a family unit is a side hustle that pays you in love and spiritual fulfillment. Why not pair it with income generation as well?

5. Scalability

Entrepreneurs know this well. It’s their main job to scale a business or venture. The average worker has a full-time gig that essentially trades skill or time/labor for money. If this describes you, then you’re limited by how many hours there are in a day and/or your hourly rate. Positions within rigid corporate structures rarely yield opportunities for massive upside moves in compensation. Even then they’re capped at some amount.

A side hustle can scale. This means for no or only minimally additional work, the income potential can grow big time. You’re reading my scalable side hustle right now. Adding subscribers grows the potential income generated from this newsletter. It typically doesn’t require that I work dozens of extra hours to make that happen. This is juxtaposed to my other side hustles that are capped in their upside.

Corporations are able to leverage scalability to keep up with or outpace inflation. Workers are at a disadvantage in this area. Within the last 20 years, the internet and other technological advancements have made it possible for individuals to more easily create scalable businesses that give them the same protection and wealth production.

If you don’t currently have a side hustle but are looking to start, I would highly suggest reading a book entitled ‘The Other Eight Hours’ by Robert Pagliarini. It details how the eight hours for you that aren’t sleep or work are the most important time you can utilize every day.

##It's Not Just Inflation, It's a Housing Supply Shortage

Shelter costs are the remaining driver of prices in the economy.

THE ANARCHIST INVESTOR

APR 11, 2024

Printing money causes inflation because inflation is the erosion of value of currency when more of it is created without increases in the money/asset backing it. The US Dollar is backed by the productivity of the US economy. If productivity and business activity does not increase at the same pace that dollars are created, then you get dollars that are worth less today than they were yesterday. We have inflation every year that this happens, which is pretty much every year. Our goods and services get more expensive by an average of 2% annually as a result. However, there is an underlying factor that is at the heart of the current inflation crisis.

Supply Shocks

The market for goods and services is fairly efficient at rebalancing itself following large supply shocks like the one we had in 2020 and 2021. It has taken only a couple years to heal the supply chains that were damaged. Supply shocks can dramatically increase prices in a short period of time (just like 2020 and 2021). And for good reason. Increased prices reduce consumption but they also entice new entrants into the market to supply those goods and services which increases supply and eases or neutralizes the price increases through competition.

The global supply chains have almost all but healed from the disturbance that was 2020 and 2021. However, one area still remains in a constant state of supply shortage and that is housing.

The Constant Housing Supply Shortage

Let’s dispel this rumor right now. There isn’t a shortage of housing. Yes, I just used it as a section title but I’m trying to keep your attention. If I said there’s a housing supply misallocation you would probably fall asleep or go check twitter out of boredom. That being said, there is a housing supply misallocation. The places that have lots of low cost, available units are in places that people don’t want to live. The places that people want to live don’t have enough units available to drive prices lower. And let’s dispel another wives’ tale about mortgage rates. They almost don’t matter. What matters is the price and what your income prospects in the market where the real estate is located. Mortgage rates can affect the price but just because interest rates go up a couple percentage points doesn’t make a huge impact in a market with such a huge misallocation of supply. In fact, it probably supports prices as folks locked in to mortgages at lower rates aren’t looking to move and pickup the same loan at a higher cost. This further restricts the supply of homes on the market for purchase and exacerbates the supply-demand mismatch.

The poster child for this is Detroit. In the 1950’s and 60’s it was a thriving metropolitan area. Why? Because the U.S. automakers were going gangbusters. In fact the whole U.S. manufacturing industry was strong and non-auto manufacturers were thriving in Detroit as well. However, over the course of 60 years, those industries are now all but missing from Detroit and nothing has replaced them as of yet. The result? Thousands upon thousands of vacant homes that used to be occupied. There are so many that the city has to purchase the land and pay to knock them down. If you want an affordable home, move to Detroit. Just don’t expect to get a great job. And you also have to expect big tax bills because there isn’t enough of a working population to support the still bloated government in these areas (yet another deterrent to folks moving there).

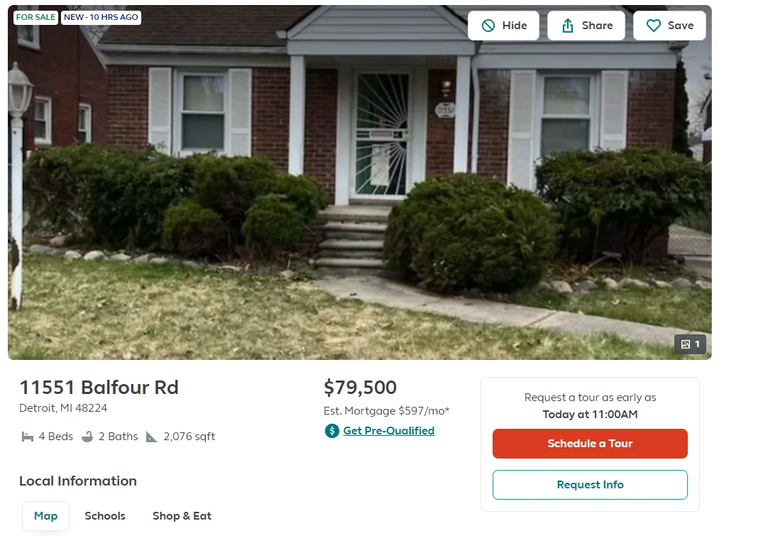

Here is a listing for a 4 bed, 2 bath, 2,000 square foot house in the Detroit area for $79,500

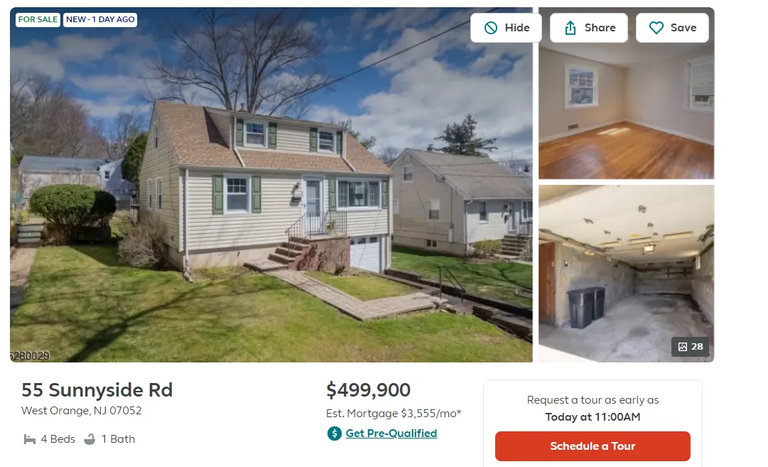

A slightly smaller home in West Orange, NJ has 4 beds, 1 bath, 1,500 square feet and is listed for more than 5 X the price at $499,900.

The functional difference between the two is negligible. It’s the location that matters. Remember the first three rules in Real Estate are Location, Location, Location.

Most real estate can’t move. Your t.v., couch, treadmill, food, etc can all move with you with only a small amount of aggravation. You can’t pick up a house and move it to another locale if the employment prospects are better in the new spot. This results in huge misallocations of housing; an asset that takes a long time and a high input cost to create more of.

Add on top of all of these issues the fact that local and state governments make the problem worse while telling you that they’re trying to help. Rent control for instance reduces the turnover of rental units which decreases the available rental units and drives prices up for all non-rent controlled units. It also causes developers to opt for high end projects as opposed to units that might be accessible to middle-income residents because those projects typically aren’t rent controlled and even if they were, most folks couldn’t afford the first year of rent. This means high density apartment buildings aren’t being built when they are in high demand but not very profitable.

Inflation is Mostly Shelter Cost Now

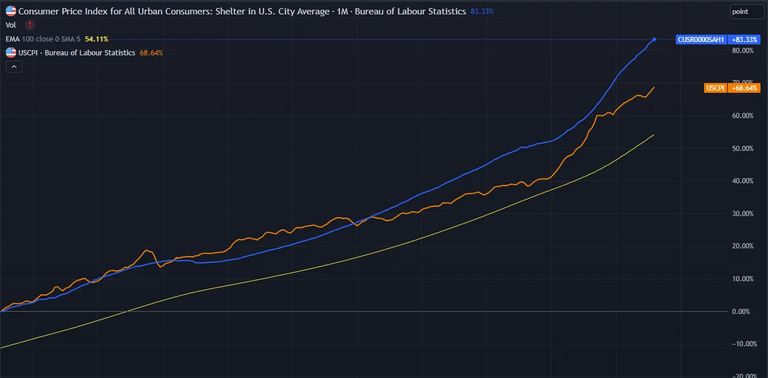

Here is a chart of the Consumer Price Index (orange) versus the Shelter cost component (blue).

In most every other component of the CPI, there have been ebbs and flows and ups and downs. The CPI has consistently marched higher. The main reason being the cost of housing. COVID caused the ‘Mass Migration’. Large amounts of people moved to different states and began working remotely. The real estate supply allocation was already out of whack. Now add on top of that a major rebalancing of where housing was desired and where it wasn’t. The regionalized housing market saw price drops or pauses in certain regions while others skyrocketed (and continue to go up even now). Another dynamic in Real Estate is price inelasticity. The prices can go up quickly if demand surges, but they typically fall a lot slower when the demand abates.

What is the Solution?

Unfortunately, the only near term solution to housing prices (and thus overall inflation) would be for job losses to pick up. Less jobs created and lower pay increases would result in less money available to chase after real estate in desirable markets where supply is very low. The Federal Reserve knows this and is waiting for the crack in the labor market to begin cutting rates. There will be a window of time where unemployment rises even while the Fed is cutting interest rates. This will be the final step down in price increases that gets the reported rate back to 2% annually. Maybe even below it depending on what that fallout looks like.

The longer term solution is up in the air. The first step is governments need to get out of the way and let the market resolve this supply issue for itself. Rent control and affordable housing regulations need to be rolled back. They have done more to hurt the situation than help. Local governments also need to take a hard look at their zoning regulations and understand they are probably part of the problem too.

Secondly, more property that can be ramped up and ramped down in terms of housing units is needed. This means on-demand units that can be added or removed to a region in a short period of time. This takes the form of tiny homes, mobile homes, modular living units that can be easily transported, etc. The Sioux tribe never had a problem with housing. They could take their teepee with them.

Finally, End the Federal Reserve. Mucking around with interest rates causes long-term supply issues for every industry. Over or under production is rampant when a small subset of academics thinks they can guide the ebb and flow of massive economies. Debasement of the currency has also created an environment where housing has to be purchased because holding cash isn’t a good investment (or at least it hasn’t been in the past). You have to put it to work somewhere and the most obvious places for the average worker are into the Stock Market and/or into a home. If there were a prolonged incentive to save, real estate buyers wouldn’t be in as big a hurry to get that down payment into a house or condo. They could do alright renting and earning a yield in a savings account.

Until these dynamics are sorted out, real estate will continue to be an incredible investment (not to mention the tax advantages). I currently use Ground Floor to do so and earn a yield because I’m not at the point where I can purchase a standalone property just yet.

What Should You Be Buying Right Now?

No, it's not what everyone's talking about.

THE ANARCHIST INVESTOR

APR 12, 2024

As a young boy I played a lot of baseball. First base and pitched but my favorite thing to do was hit. The most frustrating part of hitting is making solid contact and the ball goes right to a defender like a magnet. We used to call these at ‘em balls. As in you hit the ball right at ‘em. The cure for at ‘em balls is to hit them where they ain’t a la Willie Keeler, third baseman and outfielder for the New York Giants (yes there used to be a NY Giants team that played baseball and not football).

The average investor is guided by shiny objects. Which means they’re not an investor, they’re a gambler. When the crowd at the craps table is hooting and hollering, it entices more people to take notice and head on over. The same applies to investments that everyone is talking about. You don’t want to be FOMO’ing into what has already started to run up. You want to be looking for what everyone isn’t talking about.

What is Everyone Talking About?

Here is a short list of shiny rocks that everyone is focused on right now.

Gold

Silver

Bitcoin

Oil

The money is made in investments after you’ve bought. Usually some significant time after you’ve bought. Unloved or underappreciated assets don’t realize their potential over night. Sometimes it takes months or even years to realize their full potential and then exceed it due to the FOMO crowd. The time to make money in Bitcoin was at $20,000 in 2022. The time to make money in Gold and Silver was when they were $1,800 and $20 per ounce respectively in 2021 and 2022. The time to make money in Oil was when it was $70 per barrel 6-12 months ago or better yet $15 a barrel in early 2020.

If you don’t own any of these, I’m not saying stay away. A small purchase gets you into the game. However, anecdotes abound of individuals barreling into the gold and silver dealers when new all time highs are hit to buy for the first time ever. They get their few ounces at the high and then 6 months later the price is down 20%. They return to liquidate their meager stack at a loss and never return again. Don’t be like them. Hit ‘em where they ain’t.

What is Everyone Ignoring?

There are a few investments you should be looking at right now that don’t get a lot of attention or even none at all.

Cash

Yes the anti-dollar Anarchist Investor is telling you to have some cash. While I can’t stand how US currency is manipulated and constantly in a controlled demolition, some safety fund of US dollars is still a good investment and risk management practice. In fact, you have the opportunity right now to lock in some interest rates to outpace inflation right now. I don’t think this window will be open for much longer. If you can get your hands on a couple CD’s in a large GSIB bank that yield 4% APY at different maturities such as 6 months, 15 months, and 24 months with the ability to make 1 penalty-free withdrawal, you should consider this a great opportunity to realize some profits in your stock portfolio or other investments and lock in some yield while maintaining liquidity in a SHTF scenario.

Real Estate

No I do not think you should go out and purchase an investment property right now. That time will come in about 6-12 months. This is part of the reason cash is a good idea because you will have the funds on hand for a down payment. However, if you have no investment real estate (ie - not your primary residence), now is a great time to average in and get some yield on your cash again using Ground Floor. This is also advisable if you’re young and just starting to build an investment portfolio. Property prices are dropping in some regions and there will be purchasing opportunities in the near future with a continuing supply misallocation that will drive returns in many of those regions.

Uranium

I have written about Uranium in the past and I highly advise you take a look into that article here. Nuclear is the energy future of the world and uranium will be the oil in that future. Granted I also believe in holding some oil exposure as well. However, Uranium is the longer term investment that promises a lot of upside. I don’t advise Uranium being a huge portion of your portfolio but I do think buying in a little bit at a time now will pay off huge in the long run. Especially if you are in your 20’s or 30’s.

Crypto

Wait, you just said don’t FOMO into Bitcoin. And yes, I’m still sticking to that. Plus you can get a chance to win Bitcoin if you’re a free or paid subscriber here! There are other crypto investments you should be looking at to round out your crypto portfolio with the potential for outsized gains in the longer term. I won’t do a deep dive into these today but I will let you know what I’m looking at.

HIVE and HBD - Hive is a decentralized blockchain that helps you monetize your data and interaction on the chain. HBD are Hive Backed Dollars or a stable coin that you can stake for 20% APR at present in your HIVE wallet savings account. Learn more here: hive.io

Bitcoin Cash (BCH) - a alternative to Bitcoin that has the potential for faster transaction processing and lower fees to make it more scalable as a daily use currency (careful here as it has run up in sympathy with Bitcoin)

MOBILE token - the reward for using Helium Cellular and sharing your ping data to help them better map the network as they build it out. I don’t recommend dumping money into this. Passive crypto mining like this is a huge win and helps you monetize your own data. Other plays here are miners for FRY, HONEY, DIMO, and GEOD. I will write more in the future as those passive miners get delivered and setup by me.

**Keep in mind that I advocate value averaging meaning consistently purchasing investments but dialing up or dialing down those regular purchases based on if an investment is over or undervalued. I am dialing down my Bitcoin, Gold, Silver and Oil purchases so I can allocate more toward my investments in those items above.

Affiliate Links

Get $10 in free Bitcoin and start stacking today with Swan Bitcoin: https://www.swanbitcoin.com/anarchistinvestor

Automate your Gold & Silver Purchases with Vaulted:https://vaulted.blbvux.net/g1EGKX

Save/Make Money on your Cell Phone Plan with Helium MOBILE:https://my.hellohelium.com/ref/2FN2CHL

Channel Links

Matt-Archy on X: https://twitter.com/Matt_Archy

Ungovernable on X: https://twitter.com/UngovernPod

Ungovernable on YouTube: https://www.youtube.com/channel/UCL0qwtU4SZhCgpz6f4EMgzw

Ungovernable on Facebook: https://www.facebook.com/UngovernablePod

Ungovernable on Twitch:

Ungovernable on Rumble: https://rumble.com/c/c-5871264

Ungovernable on Odysee: https://odysee.com/@WhyLibertarian:f

Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation