Today although majority of cryptocurrency was in the red as overall markets is bearish there were a couple of tokens in the green. One of them is none other than Luna.

The immediate question to those unfamiliar with the Terra chain would be asking why is this? For LUNAtics we know why and its pretty simple to explain. Today we take a look over as to the potential causes of Luna price rising even in the face of a bear market.

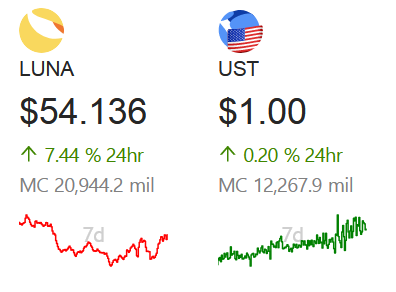

Luna and UST

One is a stable coin, UST, and the other is the mechanics of supply and demand of minting and burning UST, in that of Luna.

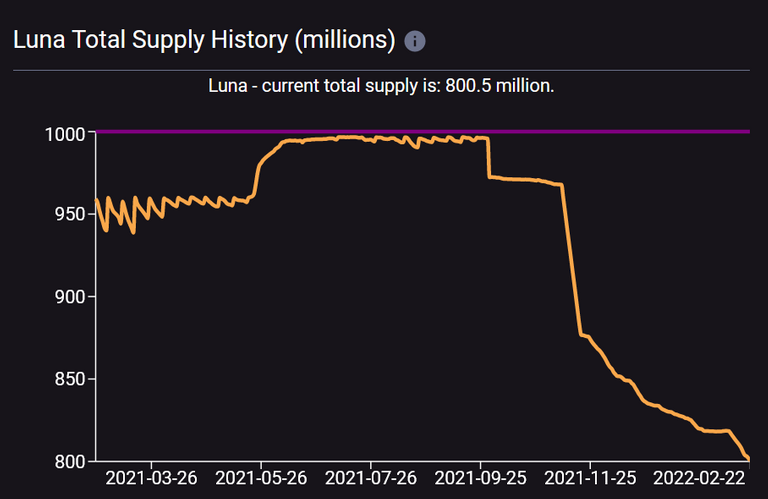

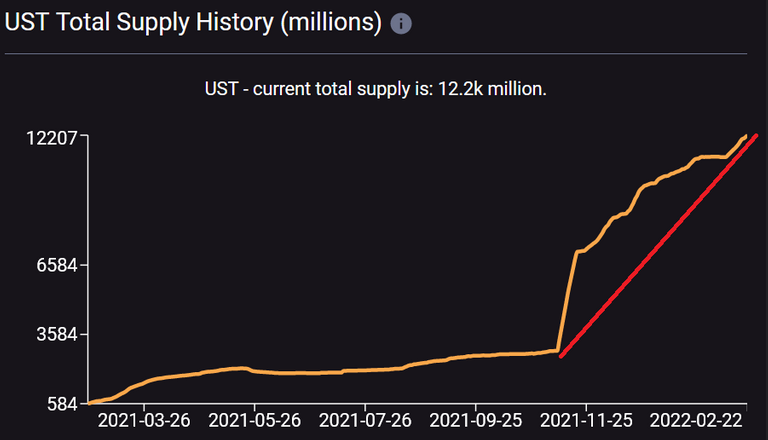

In order to create UST the token LUNA will need to be burned. For the past year the amount of total LUNA has reduced from the original start of 1 billion down to barely over 800 million. The reduction of LUNA is inverse to that of UST. As less LUNA is in circulation there is more UST in circulation.

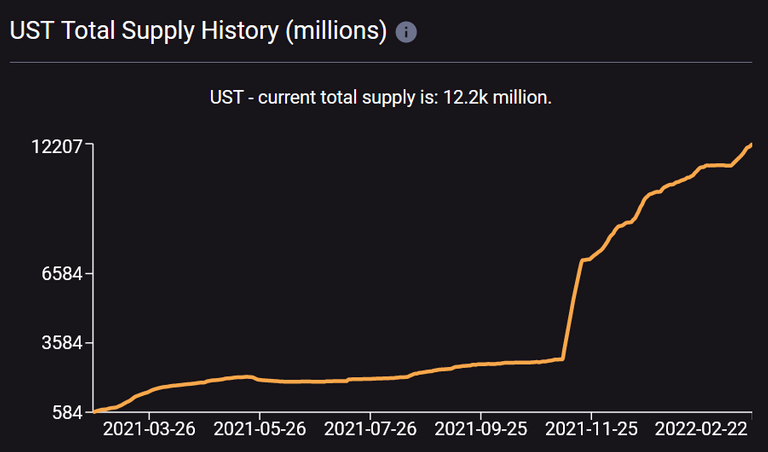

Chart above is showing the past year increase of UST in circulation. It is an exact inverse of that of the LUNA token. This is the correlation between the two native tokens on Terra blockchain.

Demand of Stable Tokens

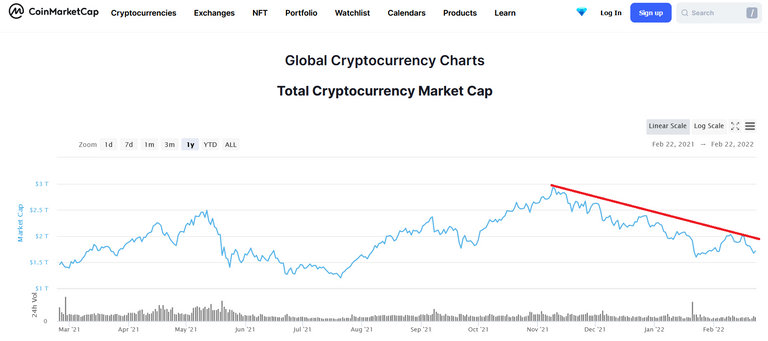

In bear markets investors tend to sell assets and hold stable tokens. UST is an algorithm stable coin and over the past few months has seen its demand explode. This is exactly around the same time the overall cryptocurrency market started to fall in November of 2021.

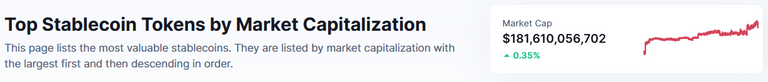

The faith in investors in UST is making the demand increase. There are also protocols that is making UST a very attractive stable coin to invest in, such as Anchor protocol, that provides up to 20% APY yield just for putting UST into the protocol. With the demand of stable coin to increase in bear markets it is also true in bull markets. Stable coin market cap has rose to a market cap nearly $200 billion.

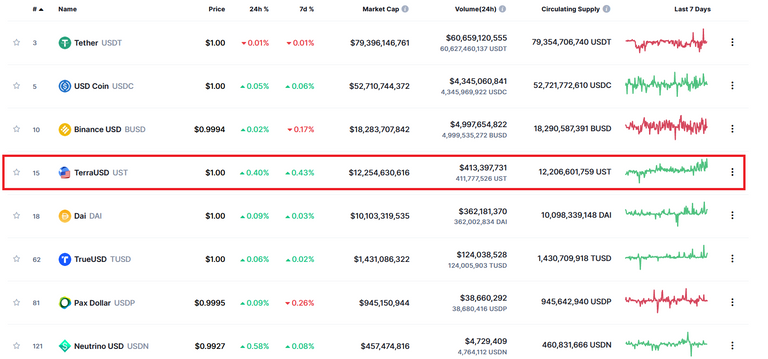

Tether and USDC hold 3rd and 5th largest market cap in cryptocurrency via coinmarketcap is proof that stable coins have a high demand moving forward. UST is the fourth highest in market cap and has surpassed DAI not so long ago. Now in 15th overall rank in market cap UST is eyeing on taking over BUSD stable coin.

Conclusions

LUNAtics staking and buying LUNA have good reason to do so and today even in a bear market it is proof. We can only imagine how much higher in prices LUNA can go if the cryptocurrency market is bullish.

The mechanics of LUNA and UST is making LUNA a deflationary token. The token started out with a supply of 1 billion and since then has almost had 20% of all its entire supply removed in replace for the UST that is has rose to over $12 billion in market cap.

UST pegged to the US dollar through an algorithm makes it not necessarily a security. In addition Terra has disclosed that UST is decentralized as there is no way for the asset to ever be locked or black listed. It is not like other stable coins such as Tether's UST and Circle's USDC. The latter coins are created by an entity hence is centralized. This overall has lead to more users adopting to UST in lieu of other top stable coins.

Demand for UST rising in both bull and bear market will make LUNA even more scarce. Are you invested in LUNA yet? If not you should take a deeper look at it now more than ever.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Actully super interesting. This really is the first time we are seeing it happen on such a scale with the availability of stable coins now. It's playing out the same way as the stock market. Things start to look iffy they back out and move into more stable assets. The ties that LUNA has with it all and how that's playing out is crazy wild but makes sense when you start breaking it down.

Posted Using LeoFinance Beta

The results from the break down is so easy to understand is why I like the Terra chain. There is a lot of potential moving forward especially with stable coins.

Great article. Yes, the beauty of the Terra ecosystem is that the increased use of the UST stablecoin actually directly helps the price of LUNA, by making LUNA drastically more scarce, LUNA has had a deflationary trend for a while now, I mean look at that incredible reduction in the LUNA supply chart!

The nocoiners who want nothing to do with speculating can use the Terra side and use any number of the ecosystem's stablecoins, and the more they use their stablecoins, the more LUNA gets two benefits: reduced supply + greater staking rewards!

Everybody wins. LUNA and Haven Protocol (they use the same mint & burn system with a few small changes + with the added benefit of Monero privacy tech) are the FUTURE!

Posted Using LeoFinance Beta

Don't forget the Cosmos IBC linking with Terra makes it truly solid. I only found out about Cosmos a little over a couple months ago. Talk about me being slow !LOL !PIZZA !LUV

@mawit07(4/10) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

lolztoken.com

Mountain Dooby Doo

Credit: reddit

@anarchistpreneur, I sent you an $LOLZ on behalf of @mawit07

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (2/10)

I am still learning about the specifics of the IBC, but essentially it allows you to interact with other Cosmos SDK-based blockchains NATIVELY, right? Like On OSMO chain for example, from what I can tell, it seems like you can actually send REAL coins from LUNA that are not wrapped, is that right? Or is it just a lower risk form of wrapping? As it stands right now, bridges for other chains are basically 2 chains that are not designed to work with each other just kinda communicating via a rough tool that is practically held together by tape, I hear that bridges often have a lot of risk. So I am assuming the advantage of Cosmos' ecosystem of chains has the advantage of being much safer.

Posted Using LeoFinance Beta

Thank you for the tips btw!

Posted Using LeoFinance Beta

I gave you a follow and re-blog, looking forward to more great content.

cheers,

Stealthbomber (Anarchistpreneur)

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

!LUV !WINE !PIZZA

Congratulations, @logicforce You Successfully Shared 0.100 WINEX With @mawit07.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/1 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.400

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

@logicforce(1/4) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

!LUV !PIZZA !WINE back

Congratulations, @mawit07 You Successfully Shared 0.200 WINEX With @logicforce.

You Earned 0.200 WINEX As Curation Reward.

You Utilized 2/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.400

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

@mawit07(3/10) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

PIZZA Holders sent $PIZZA tips in this post's comments:

logicforce tipped mawit07 (x1)

@mawit07(3/5) tipped @anarchistpreneur (x1)

Learn more at https://hive.pizza.