Ethereum ETF Booms

Exciting news for Ethereum holders as the Grayscale Mini Ethereum ETF experienced a USD 5.2 million inflow. This move by institutional investors leads market confidence in Cryptocurrencies as an alternative investment option and lifts their legitimacy amongst other more traditional investment options.

The investment into the Grayscale Mini Ethereum ETF is part of a larger investment pattern noticed across the sector and recent data indicates that BlackRock's ETHA contributed USD 276.2 million while Fidelity’s FETH recorded USD 27.5 million. This brings the total Ethereum ETF investment to USD 307.8 million. At the current Ethereum price of USD 2,805 at time of writing. This is around 111,250 ETH purchased seeing the price of ETH rise.

Ethereum Price See's uptick

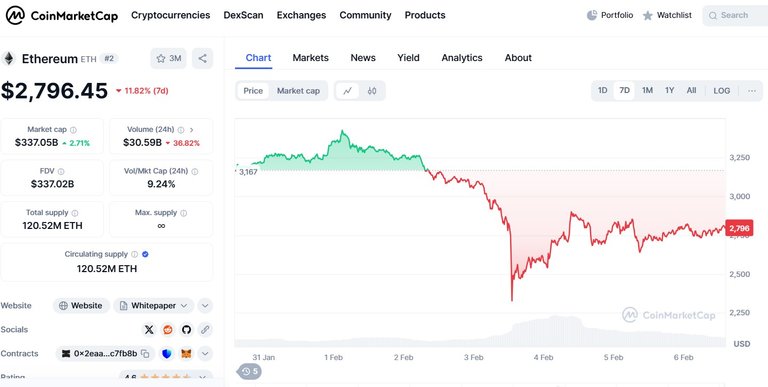

The investment has caused an impact on Ethereum's market performance seeing Ethereum's price reached USD 3,120 which is a 2.5% increase from the previous trading day. Trading volume also saw a significant rise with 12.4 million ETH traded which is about 15% rise from the prior day's volume of 10.8 million ETH.

This rise in both price and volume can be directly linked to the ETF investments indicating a strong market response to institutional investments in Ethereum.

The number of active Ethereum addresses increased by 8% to 650,000 showing a growing netwoek. The total value locked (TVL) in Ethereum based decentralized finance (DeFi) protocols rose by 5% to USD 85 billion which shows growing confidence in Ethereum's ecosystem.

Technical indicators also point toward a bullish outlook for Ethereum. The Relative Strength Index (RSI) was at 68 which may indicate that Ethereum is approaching overbought territory and could see a market correction. The Moving Average Convergence Divergence (MACD) displayed a bullish crossover with the MACD line crossing above the signal line.

Ethereum's price has been trading above its 50 day moving average of USD 2,950 which confirms the bullish trend.

Ethereum Stability

Ethereum has continued to be a main player in the sector retaining the 2nd spot just behind Bitcoin and seems positioned to maintain it's place while there is market movement with other cryptocurrency. Ethereum remains a gold standard Digital Asset.

image sources provided supplemented by Canva Pro subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services

Posted Using INLEO