This week has tested my patience and as a result I've been glued to charts, tracking the Trump tariff saga and its effects on crypto markets. As I noted in my SPS technical analysis blog last Friday, Trump's latest tariff threats came right after BTC hit all-time highs, only to see it crash to $104k and ETH slide below $2.5k. ETH makes up 80% of my DeFi portfolio, and for most of the week, my two ETH CLP positions were out of range. Normally, I'd rebalance after 48 hours, but I held off, wanting to see how the latest tariff mess plays out. For nearly five days, I got zero yields from 80% of my portfolio. Finally, the positions crept back in range the last two days.

ETH's price action looks to be in consolidation mode now. For most of the week, it held above $2.6k and then broke down on the daily chart. If it continues this trend, $2.3k is a key support level I am watching. If it holds, we might see a bounce, but a drop below could signal more trouble. SOL, sitting at $155 after touching $180 just two weeks ago, looks shaky too, testing resistance around $152. The whole market could tank, especially with tariff uncertainty and S&P 500 volatility adding pressure. The market outlook looks very cautious and uncertain.

Overall DeFi Portfolio

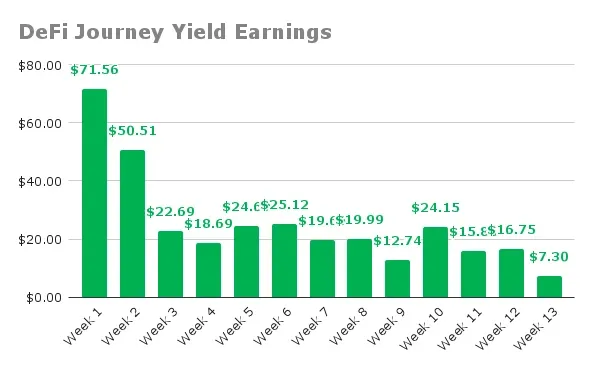

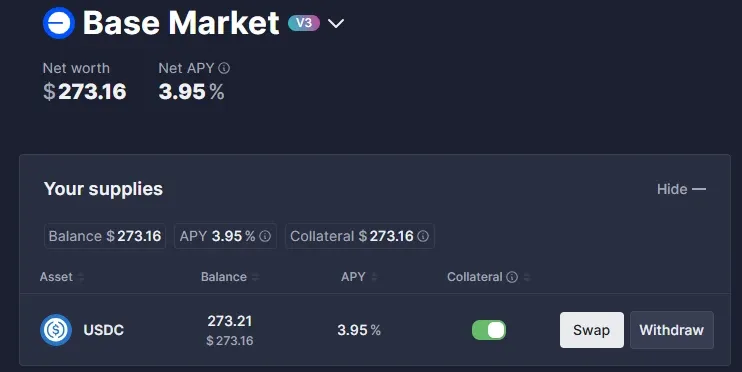

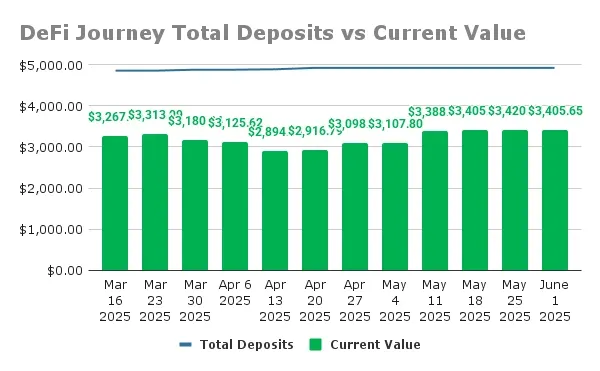

From a DeFi portfolio, my harvested yields crashed to $7.30, the lowest since I started this journey. With 80% of my positions out of range for five days, it's no surprise, but at least the last two days brought some yields. I added another $5.71 of this week's yield to my Aave USDC vault, pushing it to $273.16. The vault's yield sits at 3.95%, a solid spot to park funds while I wait out the tariff drama. Total deposits remain unchanged at $4928.71 and the total portfolio has slightly dipped to $3405.65.

CLP - WETH/USDC (0.04%) - Base

This CLP position stayed out of range most of the week and when ETH dipped below $2.5k. I harvested $1.36, bringing total rewards to $195.34. The deposit is $1663.40, with the current value at $1003.85, yielding a 35.41% APR.

- In-Range: ✅

- Range Setup: $1202.37 - $2545.32 (75% wide)

- Rewards Farmed This Week: $1.36

- Total Rewards: $195.34

- Total Deposits: $1663.40

- Current Value: $1003.85

- Yearly APR: 35.41%

- Price Difference (Inc. Fees): -$464.21 (-27.91%)

CLP - ETH/USDT (0.05%) - PancakeSwap, Binance Smart Chain

ETH's drop kept this position out of range until the last couple days. I harvested $1.72, pushing total rewards to $217.14. The deposit remains $2213.00, with the current value at $1343.17, offering a 29.63% APR.

- In-Range: ✅

- Range Setup: $1204.29 - $2546.84 (75% wide)

- Rewards Farmed This Week: $1.72

- Total Rewards: $217.14

- Total Deposits: $2213.00

- Current Value: $1343.17

- Yearly APR: 29.63%

- Price Difference (Inc. Fees): -$652.69 (-29.49%)

CLP - SOL/USDC (0.04%) - Orca, Solana

I harvested $4.22, with total rewards now at $120.00. The deposit is $896.20, and the current value is $785.47, yielding a 48.29% APR.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $4.22

- Total Rewards: $120.00

- Total Deposits: $896.20

- Current Value: $785.47

- Yearly APR: 48.29%

- Price Difference (Inc. Fees): $9.27 (+1.03%)

AAVE USDC Position

My Aave vault now holds $273.16 after adding $5.71 this week. With a 3.95% yield, it's a safe haven while we wait to see the tariff impacts. I'll likely keep these funds parked for at least another month, especially with the July 9 deadline looming. I can redeploy quickly if the market shifts.

Concluding Thoughts

This week's $7.30 yield is a worst yield since I have started this journey, but with 80% of my positions idle for five days, it's not shocking. I'm holding off on rebalancing my positions, waiting to see how the tariff saga plays out, especially with the July 9 delay in just over 5 weeks. For now, I'll keep stacking yields in my Aave vault, staying liquid until BTC, ETH, or SOL give me a clear signal to move. Just have to remain patience and be ready if the market turns.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO