Vitalik Buterin, the co-founder of Ethereum, addressed the pressing issue of decentralization loss with the transition to Proof of Stake (PoS) during a recent event in China, ETHTaipei 2024. He introduced the "Rainbow Staking" framework as a potential solution to reconcile the staking needs and prevent the risk of centralizing block validation tasks among a few stakeholders.

Buterin emphasized the importance of safeguarding Ethereum's independence by freeing the blockchain from excessive centralization in the ETH staking offering, often dominated by major exchanges like Coinbase and Binance. Despite refraining from accusing these entities of conspiring against Ethereum, Buterin highlighted the need to address their significant influence in the transaction validation process.

He expressed concern over the reliance on intermediaries like Coinbase and Binance, which concentrate the power of block validation in the hands of a few large stakeholders, undermining decentralization.

Another challenge to Ethereum's decentralization is the practice of "liquid staking," allowing stakeholders to use staked tokens for other investments, potentially leading to dangerous concentrations of influence. Notably, Lido Finance, a major provider of liquid staking, controls over 30% of the transaction validation process on Ethereum, raising concerns about its monopolistic potential.

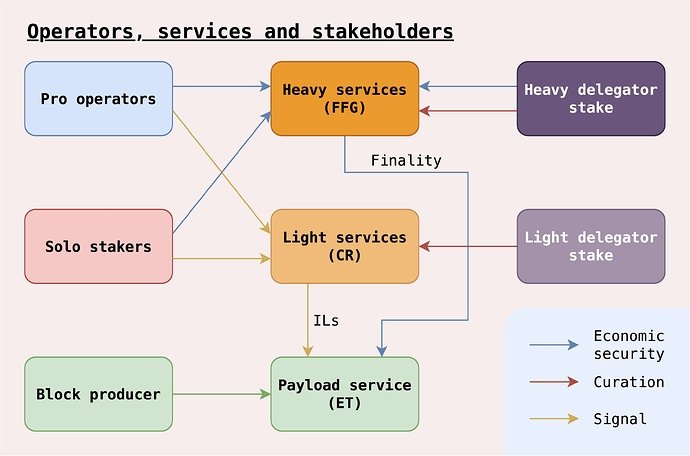

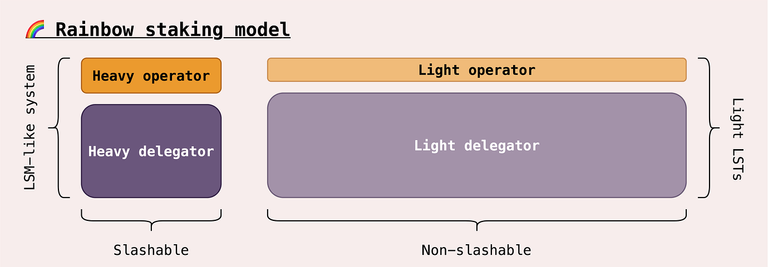

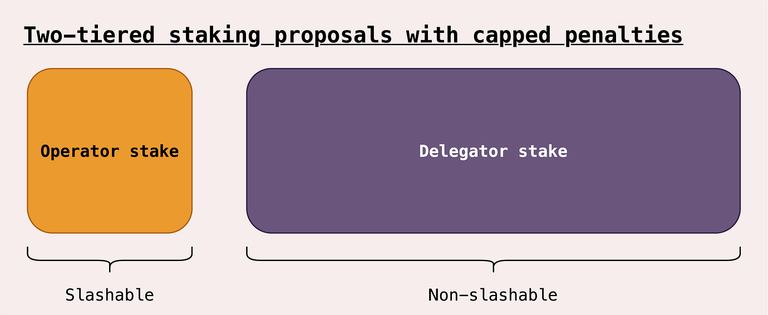

The "Rainbow Staking" model proposed by Ethereum developers aims to address these challenges by allowing isolated yet professional staking providers to access differentiated levels of staking based on their needs. By distinguishing between heavy and light services, the framework can identify operators subject to penalties for improper conduct and those exempt from countermeasures, thereby tailoring weights and measures according to each user's contribution type.

This approach enables the Rainbow Staking system to differentiate between various layers of contributors, identifying both capital providers and service operators. Ultimately, it offers a means to distinguish between those investing to protect the network and those dynamically engaged in validating individual blocks, thereby promoting decentralization within Ethereum's ecosystem.

!discovery 20

This post was shared and voted inside the discord by the curators team of discovery-it

Join our Community and follow our Curation Trail

Discovery-it is also a Witness, vote for us here

Delegate to us for passive income. Check our 80% fee-back Program