During the last Bullrun Ethereum seemed unstoppable. Afterall, at its core, its a concept that anyone new to crypto can quickly come to understand and see the value in. The new layer of the internet.

In this blog, I present some of the key reasons why I believe Ethereum will outperform the 2020-2021 bullrun.

The last bullrun was the dawn of web3, and along with it came: Smart Contracts, DeFi and NFTs. These narratives became the three catalyst behind a parabolic rise in the price of ETH and other altcoins.

Then it began the descent.

The Tyranny of Ethereum mainnet

Aside from macro economic factors, like rising interest rates and the end of quantitative easing by the Federal Reserve, Ethereum found itself ill prepared for the amount of volume it saw during the 2020-2021 Bullrun. The chain simply wasn't built for the scale of users and assets that were being traded.

This often led to a clogged (or very busy) network, with a slowed pace for confirming transactions. On Ethereum, the user that pays the most in gas typically gets their transaction confirmed before others. When the Ethereum network is busy, users end up in a gas bidding war to get their transaction processed before the scores of other users (or apps / smart contracts) trying to do the same.

It's all because of Gas

It wasn't long before it became appearent to everyone in DeFi that, each time the token would pump, so too would the cost of transactions on the network. This has become a topic that will live with us always, so long as we use Ethereum. Because of gas. The new tax on everything You needed to have the mindset of "it takes money to make money", or you're else you were likely left sitting on the sideline, waiting for lower gas fees and missing the some of the best gains in DeFi -- while they lasted.

The Panda is used to visualize the Ethereum Merge

The New Ethereum

The good thing about blockchain is that crypto never sleeps. Devs keep on deving, and the roadmap never ends.

Since the 2021 bullrun, Ethereum has undergone 2 massive upgrades, and more are on the way. First, there was The Merge, the upgrade that took Ethereum from proof-of-work (POW) to proof-of-stake (POS), and reduced the networks energy consumption by 99.95%. The second massive upgrade was the Shanghai (Shapella) upgrade, which allowed for ETH staked by validators to be withdrawn.

With Ethereum now a POS, and EIP-1559 running (which started before the merge), immediately after the merge there was significant drop off in the supply of Ethereum being minted versus how much Ethereum was being burned. That means, for the most part, Ethereum is now a deflationary token, with more tokens being destroyed than created.

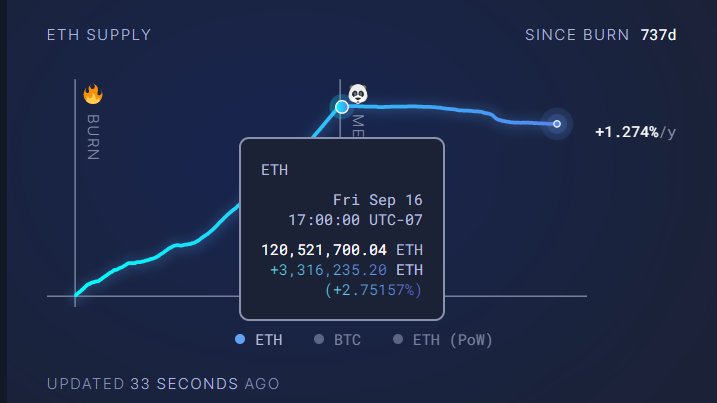

Graph of Ethereum POS burn rate

Above is the actually burn rate of Ethereum since The Merge. As of today (333 days since The Merge), there has been a total of 913,379 Ethereum burnded, which is a supply change of -302,086. The supply of ETH is currently increasing by an annual rate of just 1.27%

The image below features a simulation (the white line) you can run on UltraSound.money to see what the inflation rate of Ethereum would be had it stayed a proof-of-work chain.

Graph of Ethereum burn rate with POW simulation

The thing that can't be denied about Ethereum is that the core team consistently deliver. It might take a bit longer than expected to build and get just right, but in the end, they deliver. I don't know about you, but for me, if that's the case, and it's just a huge decentralized organization with some of the smartest mathematicians and computer programmers on the planet -- that's like betting against Apple right after the launch of the iPod (in 2001).

Chart of Apple stock price.

In conclusion

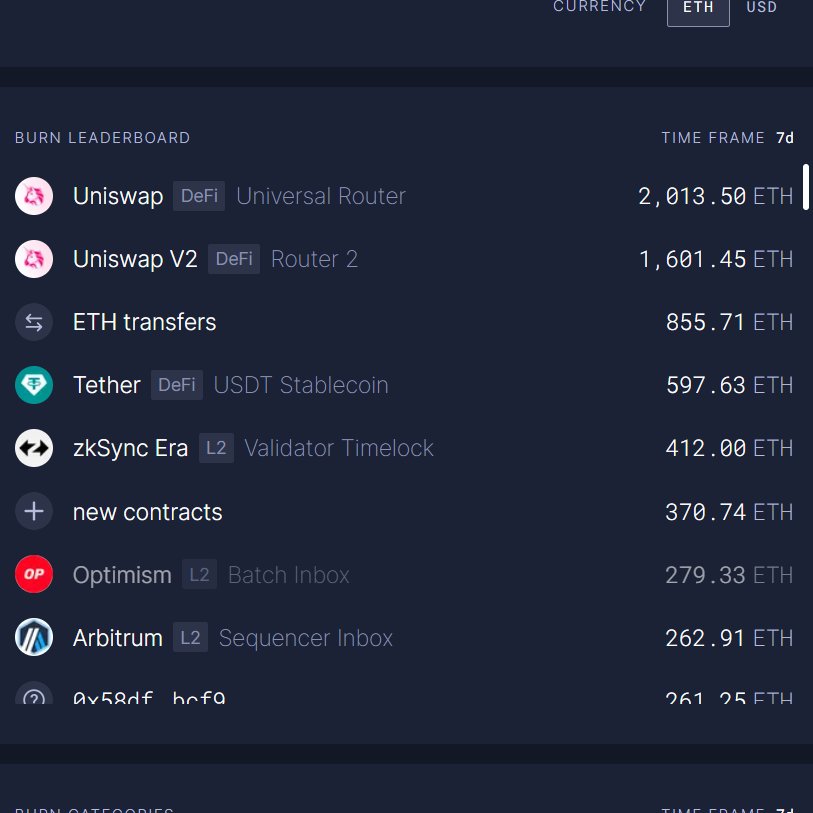

With Ethereum now deflationary, and continuing to scale and onboard new users, the majority of users in web3 will be pushed off of mainnet onto layer 2s (L2s).

Here's why that's actually bullish for Ethereum.

Users on L2s have their transactions batched and confirmed at once, instead of clogging the network with many individual requests. Layer 2 networks like Arbitrum, Optimisim, and Polygon zkEVM, which help scale Ethereum while still utilizing its security, will make up the majority of transaction happening on mainnet.

In time, I imagine Ethereum mainnet will become a layer of 1s and 0s, governed and transacted on primarily by immutable code and DAO voting. All of which is still bullish for the entire network and allows for it to endless scale, while only passing on a fraction of the cost to users, who inherently benefit as the network sees more activity.

Thanks for reading! If you enjoyed reading this, consider sharing and discussing this topic with others. You can also find MMG on X (formerly Twitter), or join the community on Discord, where we share all of our HIVE blogs.

Posted Using LeoFinance Alpha