Something I’ve been thinking about for a while is the strength of art as an investible asset class versus stocks and crypto in the ‘macro’ environment of 2023 (bear market, potential recession?, negative sentiment, etc) and also how ‘art as an investment’ is being disrupted by NFTs.

Disclaimer

I am just a random guy on the internet who thinks a lot about crypto, NFTs, traditional investments, alternative investments, money, finance, etc. I nerd out on all these things. I wrote this post because (as I said) it’s something I’ve been thinking about for a while and I wanted to synthesise all my thoughts around the topic of art and NFTs to help myself and if it’s at all useful to anyone reading this, then that’s great too.

All my ‘investments’ in crypto and NFTs have been with small amounts of ‘fiat’ here and there (what I sometimes refer to as coffee and beer money) and small amounts of liquidity I have inside crypto (eg staking rewards). Crypto and NFTs are risky. You should (in my opinion) never invest more than you can afford to lose. This is not financial advice. Do you own research.

Art as an asset class

I’ve always thought the term ‘asset class’ sounds very sexy. I feel very smart when I use it in a sentence (a bit like zeitgeist). Art (fine art) usually gets bundled in to the broader alternative investments bucket alongside collectibles, classic cars, wine, whisky, equity crowdfunding, sometimes even crypto and real estate - basically anything that’s not stocks, bonds or cash. In my own framework of thinking about investing, diversification, portfolio allocation, etc I think about art as a separate asset class.

What makes art a great investment?

- Outperformance vs traditional metrics - “Contemporary art has outperformed the S&P for the past 25 years” Scott Lynn, Masterworks CEO (source). Note - I mention Masterworks quite a bit in this post but this is not a sponsored post and I am not affiliated with them in any way, I just think they have a cool product and they have some fantastic content on art and collectible investing on their website.

- Diversification - non-correlated asset, therefore performs well when other assets traditionally perform poorly.

- High-net-worth (HNW) and ultra-high-net-worth (UHNW) investors are overweight art vs everyone else - (this research from Art Basel and UBS has some good insights) - when you know, you know. I think they know (and what they don’t want you to know) is that art is a superior store of value 👀.

- ’Passion investing’ - apparently this is a thing? Sounds cheesy but what it means is that by investing in art you get to hold something you’re passionate about and that looks good (in your eyes) - at least that’s the dream. In recessions and bear markets, investors can feel a bit down and art can go some way towards healing these doldrums. Card collecting and things like LEGO, wine and whisky would also fall into this category. It also means that if you’re investing in these things with the view of making money you need to take a view on what you think will be culturally relevant years and decades into the future. Folks that are passionate about something tend to have an edge over everyone else.

![]()

Masterworks

Masterworks buys art by ‘blue-chip’ artists (Picasso, Basquiat, Jeff Koons, etc) and then ‘wraps’ them as securities and sells ‘shares’ in these artworks to non-accredited investors. There are a few other similar platforms that I have briefly researched over the years but Masterworks have been the most successful in the ‘fractional’ blue-chip art market. I love the idea of owning a piece (literally) of art that I love that I would never be able to afford myself. I have not personally invested into any art on the Masterworks platform because I believe that I should both love the art and think that it’s a great investment.

![]()

A few times I’ve looked at their offerings and had FOMO and almost invested before asking myself the question, ‘Do I really love this?’ and the answer has always been no.

What I don’t like about Masterworks is their management fees - 1.5% annually and 20% of the profits when the work is sold to a buyer. Art storage is expensive (a problem you don’t have with digital art - more on that later) so it’s understandable and there’s obviously the cost to run the business (they have a big team of researchers). Masterworks have clearly made inroads in terms of making art more accessible as an investment and for folks who appreciate fine art but NFTs are coming to disrupt them (in my opinion).

NFTs aka ‘Memes as an asset class’

The first popular use-case for NFTs was PFPs (profile pictures - see Cryptopunks, Bored Apes, Coolcats, etc) - they were done to death. Then the narrative switched to utlility - ‘I don’t care about the art. Where’s the utility?’. But now we’re deep in this NFT bear market and most of the noise has died down art has become the utility (at least in my circles - more on cognitive bias to come) - just not art as PFPs.

Eventually the idea of NFTs as a thing will seem cringe and the many different use-cases will be the thing and NFTs will just be the ‘rails’.

Ownership of culturally relevant digital assets is disrupting traditional art. Digital assets have the potential to reach large audiences quickly. Items that are affordable today may be a stretch in future if they follow the path of traditional art.

Music and books have been disrupted. It’s inevitable that art is next. I am not saying traditional IRL art as an investment class is dead or will die soon but I think digital art is already the default form of art collection for zoomers. Platforms such as manifold have been absolute game-changers for artists and collectors.

Oh, and zoomers love memes - “While traditional mediums dominated in terms of value in 2021, 11% of HNW collectors’ spending was on digital art. A small number of young collectors spent significant amounts on digital art, with 5% of Gen Z and 4% of millennial collectors having spent over $1 million.” (source)

In addition, NFTs vs traditional art are -

- more accessible - there are less middle-men, less snobbery, storing the art is not as much of an issue as physical art.

- better for artists (see less middle men)

- less likely to be fraudulent - blockchains enable traceability and immutability

- more liquid (popular marketplaces enabled by cryptocurrency)

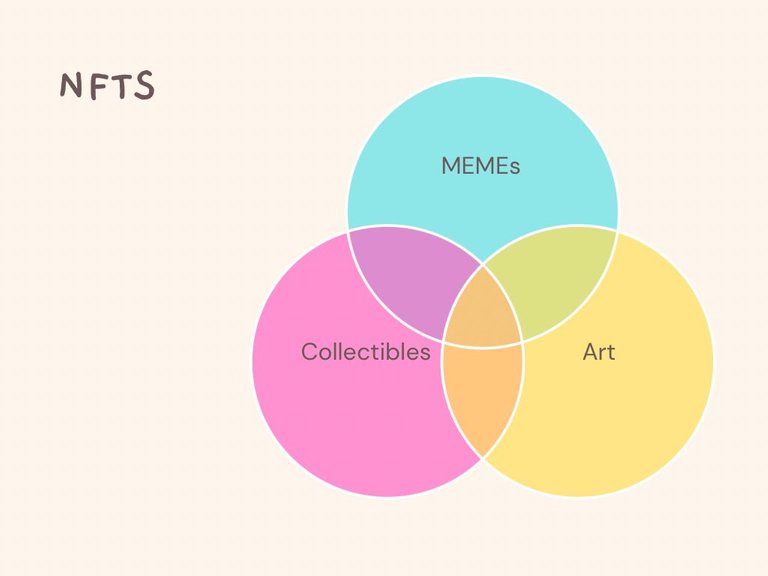

I made this graphic (in Canva) in early 2022 when I first started exploring the idea about how NFTs have an edge over traditional art.

Who doesn’t love a Venn diagram, let alone a three-way? This is the lens through which I try to look at (art) NFTs -

- Art - do I love the aesthetic?

- Collectibility - what is the supply? (obviously affects price)

- Memes - is the piece culturally relevant? Is there some on-point satirical reference that dates it to a specific cultural event? - there were plenty of those in 2022!!!

Example - Gascat by Kristy Glas

I love the art style - a lot of people wouldn’t, art is a subjective and personal experience but Kristy Glas does have a loyal band of followers and collectors. Just 100 people can own this NFT. The first mint was in October 2021, peak NFT bull market time meaning high gas. Gas cat was horrified!

Shout out to a few other artists I follow who I think also tick all these boxes - darkfarms, vstrvl, nick/niftyjutsu, manic distopia, none32x32, CB Singh, Kero.

Conviction

I have a number of high-conviction ideas that I believe will play out over the long-term. These include electrification and renewable energy, plant-based meats disrupting the animal meat market, carbon credits to take their place in diversified portfolios as a major ‘asset class’ (I said it again - BOOM!), the rise of crypto and crypto-adjacent platforms (main convictions - Ethereum and urbit, the Cosmos ecosystem). For the mid-term, during these ‘dull and dreary’ times I see memes as an asset class (aka NFTs) as a great place to speculate with beer and coffee money - they spark joy, they are culturally relevant and they are the preferred medium for art for zoomers. As Tina would say, There is no alternative.

Cognitive bias

To close, I just wanted to acknowledge that my thesis is of course heavily influenced by my own cognitive biases. In ‘researching’ this post of course I’ve tried to find information supporting my own beliefs. I am happy to accept feedback for any counter-theses. I always feel much better having read a wide range of counter-arguments. Although it’s not hard to find negative content related to NFTs, to date I haven’t found anything to persuade me to change my mind. The other issue is that algorithms on social media timelines really like to push content out to you that thinks you will like and I’m already following lots of dank digital artists on twitter so a lot of my views are reinforced every time I scroll through my timeline.