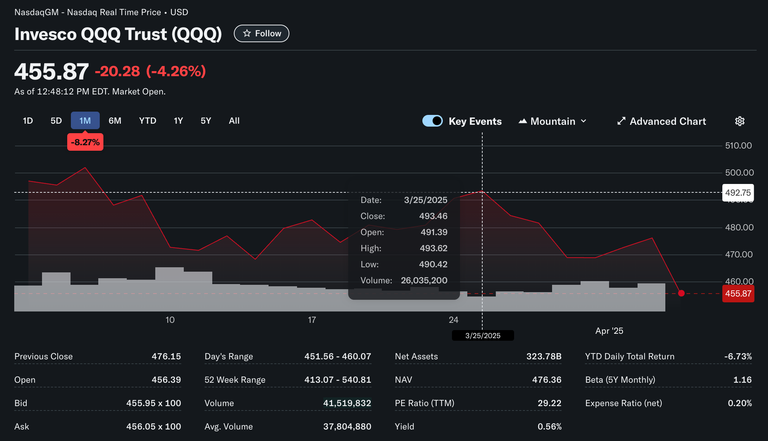

My plan was to roll forward some put positions, hedging against what looked like an increasingly fragile market narrative. But I didn’t pull the trigger.

The market’s behavior lately has felt incredibly binary—sharp swings up and down with little warning. That type of action makes it tough to build conviction unless you’re staring at the market 24/7, which I’m not. I’ve also been trying to stay disciplined, avoiding the trap of attempting to time every move. So, I waited.

Unfortunately, the timing of my decision didn’t work out. The drop came. Volatility spiked. And the hedge I had been contemplating would’ve played out exactly as I envisioned. It was a miss, plain and simple.

But not a loss.

Because what this experience really gave me was confidence—not in my ability to perfectly time the market, but in my ability to read it. The signals were there. My thesis was sound. I journaled my reasoning before the move even happened, which now serves as a confirmation that my framework is sharpening. That’s an invaluable win for the long game.

More importantly, this reinforced the importance of thoughtful preparation. Even though I didn’t act this time, I was in the right headspace. And when the next opportunity arises—because there’s always another—I’ll be better positioned to act with clarity and conviction.

Going forward, I’m leaning into more activity in the options space—not with reckless frequency, but with targeted, purposeful moves. There’s a lot of uncertainty still brewing under the surface, and where there’s uncertainty, there’s potential. Whether it's hedging downside or taking advantage of mispriced risk, I’ll be ready.

Sometimes, missing the shot is what makes you realize your aim isn’t that far off.

Discord: @newageinv

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities and services that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

My go to exchange is Coinbase; get bonuses for signing up!

The future of the internet is here with Unstoppable Domains! Sign up for your own crypto domain and see mine in construction at newageinv.crypto!

Always open to donations!

ETH: newageinv.eth

BTC/LTC/MATIC: newageinv.crypto

Disclosure: Please note that for the creation of these blog posts, I have utilized the assistance of ChatGPT, an AI language model developed by OpenAI. While I provide the initial idea and concept, the draft generated by ChatGPT serves as a foundation that I then refine to match my writing style and ensure that the content reflects my own opinions and perspectives. The use of ChatGPT has been instrumental in streamlining the content creation process, while maintaining the authenticity and originality of my voice.

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.