We take a look at two strategies the market-making DEXBot offers.

Liquidity is the key to a healthy market. It means there are enough buyers and sellers so that when you want to make your trade, it's available at just the right time and at your price!

It’s the lifeblood of markets.

Without it, markets would be dead. Liquidity is like the blood that has to flow through the body in order for prices to work properly and sustain life.

This post is for everyone holding PPY or interested in trading strategies, increasing their asset holdings value, and market-making (entities who place both buy and sell offers across the big-ask spread and profit from the difference). So let’s explore this DEXBot!

DEXBot Overview

You can think of DEXBot as a ‘super charger’. It is an open-source, simple-to-use trading bot for profiting 27/7 as a ‘market-maker while boosting the liquidity in the DEX.

A high-frequency bot that does market making can be used to boost liquidity. However, if the bot is only being utilized by a few people then it won't have much of an effect on increasing trading activity in general. Instead, it’ll just serve as an individual trader's tool for profiting off other traders who may not know about its existence or usefulness.

So, in order to make sure there's enough liquidity, it becomes necessary that DEXBot is widely used because of its effect on supercharging the market as a whole!

DEXBot solves three major challenges for investors and traders: Boosting liquidity for people closer to market rate Helping automate price discovery Giving automated money (asset) making opportunity market making.

Originally created by a Bitshares community project, DEXBot was unfortunately abandoned due to funding being cut off by Bitshares Worker Proposal System. Until recently, it had been left untouched for ages. For the first time in years, Gph.ai has updated it and made it possible for users to utilize this advanced trading bot. Now people can use this tool again to start market-making on Gph.ai, a fork of Bitshares that launched recently.

DEXBot advantages

DEXBot is free to use, open-source, and customizable. It’s available for Windows, OSX, and Linus and is on Github.

The Market-making bot is a market maker and not a taker. It adds orders to the books. Its goal in the markets, rather than taking liquidity, is to provide liquidity by placing orders with other bots on different exchanges which can help increase competition between buyers/sellers thus narrowing spreads before they happen naturally. This massively increases competition. Users of DEXBot profit in the process.

Typically, no one would start a bot to increase competition. But because of the nature of DEXBot, everyone using the DEXBot gets an upper hand over those who aren’t using it.

**DEXBot limitations **

As it stands, there’s a major challenge with the DEXBot. It’s limited to Gph.ai. However, it’s possible to enable it to work with Peerplays DEX. Additionally, it could be extended to other DEX networks too. But for that to happen, additional development will be required. It’s unclear if Gph.ai would be willing to go in that direction.

**Understanding liquidity **

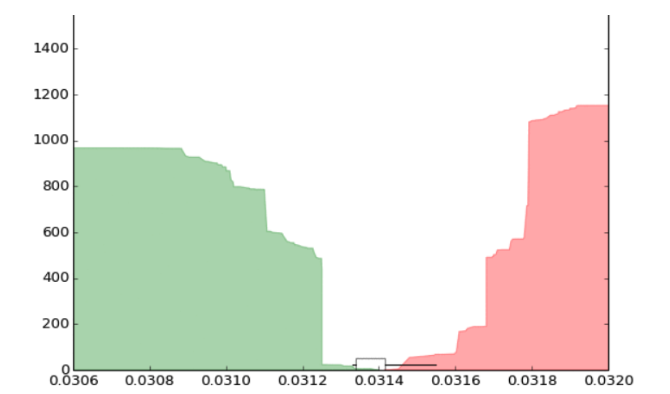

Think of the prices in the market as ‘V-shaped.’ On one side you have very little liquidity at the market price, and on the other side, you have the same price. In the middle, lies the depth of the market. But with a ‘busy order book’, the ‘V’ would be inversed. Thus, most of the liquidity would be at the market price.

DEXBot Trading Strategies

DEXBot has two closely-guarded marketing-making strategies that can be customized for any exchange built on top of vanilla Graphene.

- Relative Orders: This is a short-term strategy for traders who enjoy monitoring the charts and adapting to the changing conditions of the markets. This strategy places orders below the center price and a sell order above the center price. The markets must be in a ‘calm seas’ state, i.e. low volatility. Relative Orders strategy profits from spreads and goes with the classic ‘buy low and sell high.’ If markets are volatile, spreads are going to be huge and will leave no room for profit. That’s why it works best with less volatile cryptocurrencies. When the market starts going sideways and you have this strategy turned on, you may be positioned perfectly to capitalize on the oscillating market. The DEXBot manages and refills the order books continuously as the orders are placed. Buying low and selling high.

- **Staggered Orders: **This strategy places large amounts of buy and sell orders to fill up the order books. You choose the range you want to cover in terms of prices as well as the increments between the prices. Additionally, you also set the base and quote requirements. The DEXBot can provide market depth and make more solid trades.

The strategy closes profitable positions at break-even or with profit, but never in the red. As such, it spreads those earnings across all orders on behalf of its users as they trade successfully over time - increasing profitability through reinvestment from previous successful trades. This strategy is a long-term strategy, thriving on volatility. For example, let’s say you are a market maker who has set up this strategy. You have staggered orders for EOS and people coming to buy from you will get the best possible price available on their order then immediately receive worse prices as they go through each level of supply in sequence until all is sold out or blocked by other customers ahead of time - that's what we call "staggered buys." This adds new liquidity entering into the order books.

Conclusion

DEXBot is a free crypto trading bot that offers liquidity and two market-making strategies.

Having this DEXBot setup can offer a lot of value for PPY holders. They could potentially increase their holdings in whatever target asset they are looking to accumulate. Of course, there are many factors involved like the traded pair, timeframe, and strategy you choose to go with.

As the old saying goes, "without blood there can be no life." The same is true for markets. Liquidity keeps them moving and alive. DEXBot represents a good opportunity to profit and pump liquidity into a market. A ‘super charger.’

Everyone should know that GPH.ai will be removing the peerplays coin, please see the announcement, https://steemit.com/rudex/@rudex/ppy-and-wls-delisting-announcement

DEXBot works great on XBTS Cross-Chain Dex and BitShares blockchain. And it was created on BitShares! All our traders use this tool and earn money even when they sleep.

Original https://github.com/Codaone/DEXBot/wiki

The Open Source Market Making Bot with access to multiple cryptocurrencies for the BitShares DEX

Telegram group https://t.me/DEXBOTbts