I always try to follow this quote by Elon Musk - ' You should take the approach that you're wrong. Your goal is to be less wrong.'

After the recent crypto crash, I have been thinking about creating an emergency fund. But do we really need to have an emergency fund? What's the purpose of this fund? I have researched a little to find the answer. This article will share what I have found as the answers.

Purpose of Emergency Fund

The short answer is the fund for an emergency. This is how I tried to write in the exams. Lol!

It is mainly for the events where we need money quickly. For example - you just remembered that you need to withdraw cash for an emergency from an ATM. You didn't plan that before the expense. In that case, an emergency fund will come forward as an angel! You may lose your job; any accident could happen; Your house could burn down(I don't want that); for these types of emergencies, you may need extra funds to survive.

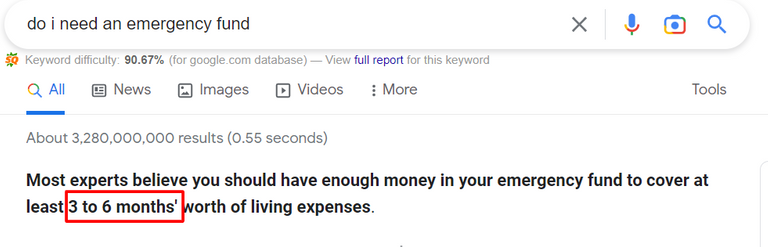

I asked this question to Google and found out that most people suggest having an emergency fund for at least 3 to 6 months. Why not one month or five years? Because that's reasonable if you save money to survive for 3-6 months.

If you just keep for one month, the amount will be so tiny, and you will panic if you run out of money. And if you save too much, like 2-3 years, then you will lose out on a lot of opportunity costs. Therefore, 3-6 months isn't too much or too little, just the right amount. For example - if you lose your job, it will give you enough time to stop crying and find a job within a few months. Or, maybe you got into an accident. It will provide you with enough time to recover and continue to work as Clark Kent, aka Superman!

Downside!

Now you know what an emergency fund is. Now let's have a look into some downsides.

First, opportunity cost! If you know how to invest your money, like you are Warren Buffet or something, you are losing out on a lot of potential returns.

Let's say your emergency fund is 10,000 dollars. If you invested that money on HBD savings, you might get a potential return like 12% Apr. So instead of keeping ten thousand dollars idle, you can actually earn $1,200 interest by just staking. The amount will be higher every year if you compound!

Suppose you invested your emergency fund in Bitcoin back in 2012! Today, you would have been another Jeff Bezos... with hair! Of course, there's a risk too. Your crypto or stock price can go down, and you may lose part of your emergency fund! I am just talking about the opportunity cost of the emergency fund.

The second downside, while our emergency fund is sitting there in the bank, earning like 5% interest from a so-called high-interest savings account(!), it loses value to inflation. It will eat up your money!

Let's say you have worked 20 years, and you have 500k dollars. Assume that the average inflation rate is 1.5% per year. After 25 years, 500k dollars will be only left with around 344k Dollars. Where did the money go? The inflation ate it! Just yesterday, I wrote an article about it!

But even after all these downsides, an emergency fund is really needed to help you, specially for any urgent case. Even after opportunity cost or inflation, this fund has a great purpose! Think like a football team manager. You have 11 players on the field, but you always keep some reserve players. If any player falls in injury, you can use a player from reserve!

My Plan!

Personally, if you ask me, I don't want to keep a big emergency fund.

The first reason is my expenses are low! I have calculated that my living expenses, along with my other costs, are pretty low. I live in a country where we don't need to expense a lot on spending average lifestyle. But it varies from country to country. There are some countries where people have to pay more taxes, and living costs are so high. So, plan your emergency fund accordingly.

Secondly, I have many income sources. I run a travel agent. And as a part-time freelancer, I do various contract-based jobs. And you can already guess, I trade crypto and earn a few bucks from Hive. So, if I lose any income source, hopefully, I can cover from another source. I am not saying my income is so good, but enough to keep a small emergency fund! So, diversification is essential. Try to find out various sources of revenue.

Thirdly, I have health insurance so that If any uncertain incident happens, insurance can cover my costs. So, at least I don't need extra funds for health issues.

And finally, I have a good amount of money in crypto. I can sell any tokens in case of an emergency. I am also earning a good amount by staking some of my cryptocurrencies. I can liquidate my staking profit in case of emergency.

Also, I can use my credit card in case of an emergency. My card gives me one month to pay back without penalty, so this could be a good option. However, I don't recommend this to people who can't use a credit card like a debit card.

So, that's my plan about the emergency fund. But you don't need to listen to me, and just plan accordingly to your income, expenses, and lifestyle. Though I don't want to keep big funds for urgent matters, I felt terrible when I didn't have enough money to buy the dip after the crash on BTC!

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Now this info is pretty useful!

Gracias! 🙏

Another useful piece of information