As Russia's invasion of Ukraine continues, we are witnessing unprecedented sanctions against Russia to isolate it from the global financial system. Starting from banks and small companies to the whole implementation of the Swift sanctions, which is described as "an economic nuclear weapon." And while I appreciate all the ways and methods of trying to stop this war, I don't think economic sanctions are one of them. After all, these sanctions will only harm regular Russian people who, for the most part, have nothing to do with Putin's decisions.

Most Russians' eyes are heading to cryptocurrencies as a way of getting out of the falling Rouble and converting their hard-earned savings into a "safe haven".

Trading volumes between the rouble and cryptocurrencies have jumped to record levels during the last three weeks.

Alas, governments are no more ignorant of crypto. They know pretty well how crypto can bypass the traditional economic barres and grant people uncensored financial freedom. They are so worried about the potential use of crypto to evade sanctions and give the Russian government the effective ability to transfer money board without limits. This rose a new type of FUD that we weren't to expect before. One that could trigger a new wave of regulatory backlash against crypto. After all, no one would like to see a technology facilitating war and destruction. I even heard and read views that this war is going to bring the "crypto winter" we all hate.

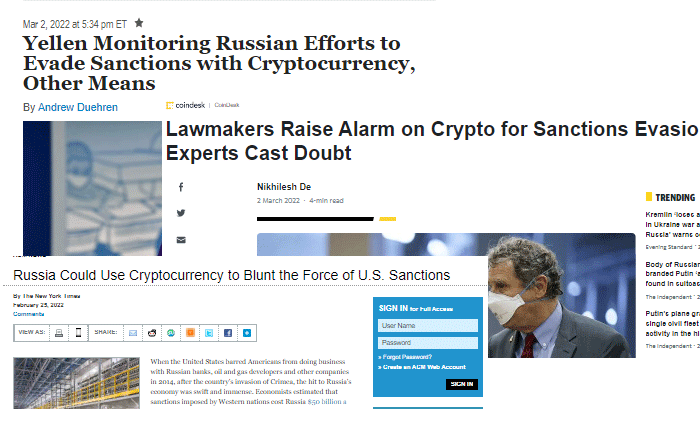

And if you've been following news for the last two weeks or so, then you certainly stumbled across many media headlines that go into throwing rumors about the potential of sanction evasion with crypto.

So, what gives? Can crypto really be used to bypass the economic sanctions? Are we on the verge of witnessing a new regulatory backlash? Is there any bear market lurking around the corner?

To put things into perspective, the first thing we need to do is to take a step back from the nonsense media headlines and the traditional political anti-crypto speeches.

What we should do is rationally analyze whether those concerns are justified?

Well, on the face of it, cryptocurrencies might seem effective means to bypass economic sanctions. They are permissionless, decentralized, and most importantly, don't belong to a single entity that can exclude a country from being able to use them.

Despite that though, I think using crypto to escape global economic sanctions on a large scale is just impossible.

In fact, there are features rooted in crypto that make it damn difficult to use not just for evading sanctions but also for any illegal activity in general...

Crypto is transparent:

Cryptocurrency is, for the most part, transparent and open-source with all transactions being recorded immutably and accessibly to anyone. The US and its allies can easily observe and have, in fact, done so to all Bitcoin wallets that have been tied to the Russian government, banks, or oil companies. That means any crypto sit in these wallets could practically be worthless as no one would be willing to buy it. Major crypto exchanges such as Binance, Kraken, and Coinbase promised they would block the accounts of any individuals on sanctions lists, the latter (Coinbase) has already blocked more than 25,000 Russian addressed

Even The US Financial Crimes Enforcement Network (FinCEN) admitted in its latest report regarding Russia and the conflict in Ukraine that cryptocurrency is not being used to circumvent sanctions.

According to FinCEN:

Although we have not seen widespread evasion of our sanctions using methods such as cryptocurrency, prompt reporting of suspicious activity contributes to our national security and our efforts to support Ukraine and its people source

To know that governments and authorities are finally aware that crypto can't be used for any illegal activity is interesting, to say the least.

Cryptocurrency is volatile:

Whether we like it or not, crypto is still damn volatile compared to traditional currencies. We lived in days where just a single comment or a piece of negative news was enough to crash markets. While I'm sure this is going to end in the medium-term future as crypto prevails and mass adoption becomes a reality, no one can deny the volatility of crypto markets at the present.

The reason why we always repeat the golden rule for any newcomer "only invest what you afford to lose" is that we all know how crazy crypto movements can be. This applies to retail investors and doubly so for companies and governments.

Most stable coins alternatives such as (USDT. USDC...) are heavily centralized, meaning any funds with those variants can easily be frozen.

So the question now: Is it really possible the Russian government or any close personalities would take the huge risk of keeping a big part of their money in crypto? I don't think so.

Final thoughts:

This war is a tragedy and things seem to be getting worse every day. I do hope that soon comes a peaceful solution for the sake of all those directly affected.

However, if there is anything good that this war brought is that it showed how generous and welcoming the crypto community really is. The Ukrainian government accepts donations with crypto and so far has raised more than 60 million dollars through it.

Here on Hive, there are several Ukrainians who are sharing their daily experiences and getting much support and sympathy from the community. Ukrainians trapped by bombs and missiles are effectively using cryptocurrency to protect their savings and get support. This shows how damn important cryptocurrency is in a time of conflict and strife. It is something that will have a positive mark on crypto's reputation in the future, and if you ask me, I believe that cryptocurrency will emerge from this conflict with a much stronger narrative.

What do you guys think about the potential use of crypto for "evading economic sanctions"? And how do think this would be seen in the eyes of regulators & governments?

I'm keen to learn your opinion and thoughts...

Publish0x

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @qsyal! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 14000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz: