In this post, I will be calculating the yield on my curation rewards for HIVE using analytics on PeakD. If you have been following my earlier posts, I have been calculating the yields from curation (both manual and via delegation) on various tokens such as SPT and ONEUP.

To ensure that the time period is decent enough to be representative, I have decided to calculate for the month of November. While searching for data, I came across some data points under "My Analytics" under PeakD.com.

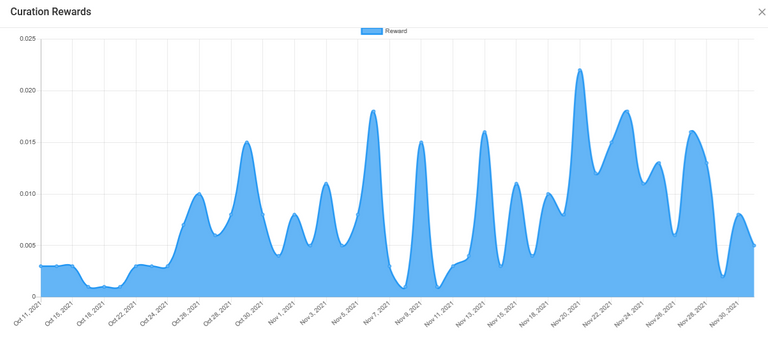

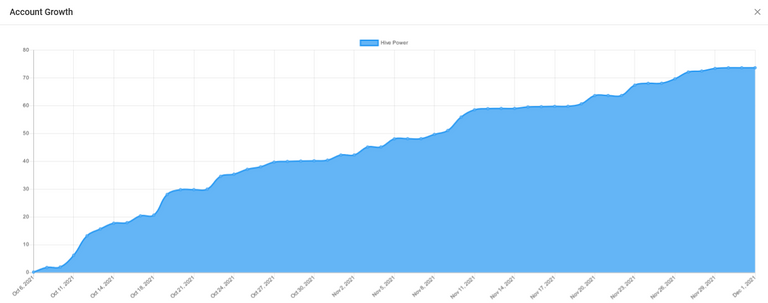

The two charts below show my Curation Rewards (in USD) and Account Growth based on the Hive Power.

The next step would be to tabulate the data to derive:

- My average Hive Power during the month of November (because there is less HP at the start the month and more at the end of the month, which could affect the Vote Value and subsequently Curation Rewards)

- My total Curation Rewards for the month of November

| November | Hive Power (in Hive) | Curation Reward (in USD) |

|---|---|---|

| 1 | 42.2 | 0.008 |

| 2 | 42.2 | 0.005 |

| 3 | 45.1 | 0.011 |

| 4 | 45.1 | 0.005 |

| 5 | 48 | 0.008 |

| 6 | 48.1 | 0.018 |

| 7 | 48.1 | 0.003 |

| 8 | 49.6 | 0.001 |

| 9 | 51 | 0.015 |

| 10 | 55.9 | 0.001 |

| 11 | 58.5 | 0.003 |

| 12 | 58.9 | 0.004 |

| 13 | 59 | 0.016 |

| 14 | 59 | 0.003 |

| 15 | 59.5 | 0.011 |

| 16 | 59.6 | 0 |

| 17 | 59.7 | 0.004 |

| 18 | 59.8 | 0.01 |

| 19 | 60.6 | 0.008 |

| 20 | 63.6 | 0.022 |

| 21 | 63.6 | 0.012 |

| 22 | 63.6 | 0.015 |

| 23 | 67.4 | 0.018 |

| 24 | 68 | 0.011 |

| 25 | 68 | 0.013 |

| 26 | 69.6 | 0.006 |

| 27 | 72.1 | 0.016 |

| 28 | 72.4 | 0.013 |

| 29 | 73.4 | 0.002 |

| 30 | 73.6 | 0.008 |

| Total | 58.8 (average) | 0.270 |

The next step is tricky, because I would need to convert the Curation Rewards into Hive and the price of Hive was very volatile in the month of November.

After much thought, I have presented it based on various price points using CoinMarketCap's data because it is difficult to pick a "correct" price for Hive.

| Scenario | Curation Reward (in USD) | Curation Reward (in Hive) | Annualised Yield |

|---|---|---|---|

| Using start of month's price of 0.81 (as of 1 Nov) | 0.27 | 0.33 | 6.9% |

| Using end of month's price of 2.67 (as of 30 Nov) | 0.27 | 0.10 | 2.1% |

| Using the average of start and end of the month, i.e. 1.74 | 0.27 | 0.16 | 3.2% |

| Using the highest price of 2.92 (as of 29 Nov) | 0.27 | 0.09 | 1.9% |

| Using the lowest price of 0.80 (as of 10 Nov) | 0.27 | 0.34 | 7.0% |

In summary, the annualised yield ranged from 1.9% to 7.0% depending which price of Hive was used. Even though it might seem that the higher the price of Hive, the lower the yield, do note that (1) the price appreciation will be reflected in your wallet value if you are still holding the Hive tokens (i.e. did not sell them) and (2) your future Vote Value and Curation Rewards will increase too.

Finally, I would like to reiterate that these curation rewards were based on my own manual curation and it can differ from user to user, but I hope it gives some insights about yields on the Hive token.

As always, thanks for reading and have a pleasant day ahead! :)

It's nice to see your account grow and I can tell you that once you have 100 Hive Power, the curation rewards start to become more interesting. You can probably expect about 9.5% APR on curation at that point. At the moment you are around 5% because of the dust effect on Hive. I like to use Hivestats.io tool to check my return on curation.

Thanks for stopping by! Will take a closer look when I get to 100 Hive Power hehe. Yes, HiveStats is quite an useful tool as well. I saw some numbers over there but I wanted to do a manual calculation personally to verify and understand how those numbers are derived. 🙂

Congratulations @relf87! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 2750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: