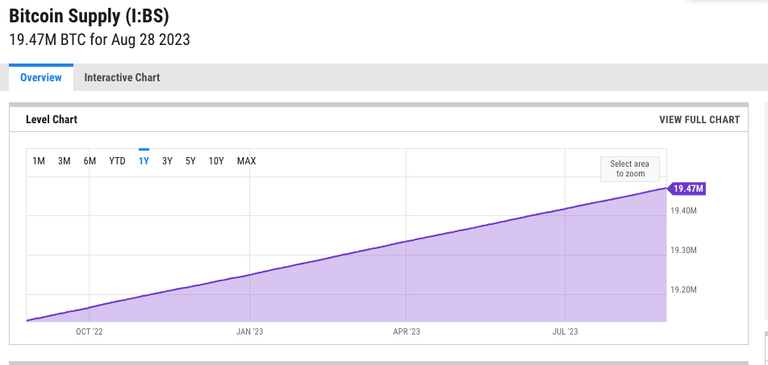

The Bitcoin Supply currently stands at just over 19M BTC, and given the 21 MAX that's most of it already minted, there's not a lot more to come.

And given that some of that BTC is lost forever that restricts the current and total available supply even more.

It really doesn't take that much demand for BTC to soak up significant chunks of that supply, and if a significant percentage is voluntarily locked in people's or institution's wallets, that means restricted supply for sale which means a higher price, all other things being equal.

What follows are just a few thought experiments in what scenarios would soak up what percentage of the BTC supply..

There were 62.5 million individuals worth over $1M in 2021.

Around another 300M adults have wealth of between $100 000 and $1M.

If just 10% of these very wealthy people on planted earth wanted to be 1 coiners and hold 1 BTC just for the status that would suck up just > 6M BTC, or one third of the supply

There are 1000 companies worth over $1BN

If the average company wanted to hold just 1% of their value in BTC then that would mean $10M worth of BTC per company at current prices.

That would mean 385 BTC per company at current prices (just < $26K)

or almost 4M BTC held at the institutional level on average, or around 1/5th of the total BTC supply.

Combine the above together and we've got 10M BTC voluntarily locked... more than half the total supply already!

- The world's average adult will be worth $100 000 by 2024.

- 5BN * 10% = 500M,

- So if 10% of the world's population wanted BTC to hold for the lolz then that would mean 0.036 BTC on average for that 10% of the population.

That's not a lot of BTC for everyone, or at least it doesn't sound like a lot.

And all it then takes is for some of those people to aspire to hold 0.1 BTC or even 1 BTC and the price could go mental, I mean if competition kicks in high six figure sums for BTC are not out of the question, not at all!

At current prices that would mean 10% of the population being prepared to hold $10K of their wealth in BTC.

IF that were the case that could tip things, with 10% holding and seeing that portion of their wealth outperform other assets, crazy pring-tings might happen!

Caveats...

The big one is what people's sell-price triggers are... being a 0.1 coiner or a 1 coiner might not feel that attractive to a 100% profit .

And then there's the ickle issue of what the broader system can do to influence the value of BTC.... if people can't get it out to FIAT, that's probably most of the institutional demand down the drain, and a lot of ordinary demand down the drain too.

However if it remains relatively easy to offramp BTC (which may seem ironic, but it's not), and hodl and buy-in fomo coincide I'm of the opinion that CRAZY things could happen to the BTC next bull run, I mean if it hits $100K it could go several times higher in a very short space of time!

This is just based on the scarcity of the asset and the fact that people are sheople.

BITCOIN math does not lie, in my opinion it is only a matter of time before it develops. That's why accumulating everything we can is so important now.

I'm with you!

Those are some interesting numbers! Also, I bet that we have at least 2-3 million (if not even more) BTC in "lost wallets", where people lost their private keys... And that number can just grow in the future as chances of "finding" the keys are close to zero!

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

Yes true I had a feeling that was about the amount lost giving a real max supply of around 18M - and there's not much new BTC being produced now!

The problem with that experiment is implying people will always want to have 1 coin for status, that was the same argument for NFTs, that people would want to have them for status, and while some still do it didn't prevent it from crashing and even bankrupting some people.

But as for me, yes, I would like to have 1 full Bitcoin and hold it forever for status hahahaha

I dunno I think BTC is different to NFTs. The later are just mostly shit! BTC has the kudos!

Same here im pissed bc my solo was rolliong over for 2 months when btc hit the low was ready to buy 5-6 btc lol

Currently there is what $800bn or more saved in Bitcoin. When it starts going up and people see their $ value decreasing, they either have to join BTC or become poorer. There is still time to get in on BTC at these prices, it is like getting in at the beginning of the housing boom. Let's goooo!

I know it certainly feels like a limited opportunity to get in at these prices!

Now that the etfs are here soon retirement plans add those to mandatory holdings in mutual funds and every worker buys them I bet BlackRock is thinking about this one reason I own there stock is they usually win.

I think all depends on the trust of BTC.

Yes I guess that's the key, doesn't take too many people percentage wise to trust it!

Buscando estrategia para ganar dinero??'

This is really interesting thanks for the update.

There’s going to be hype once bitcoin reaches its 21M limit. And i have a strong hunch that once news of this is out there will be a huge pump in price.

When it gets in a mutual fund in a big 401k letting all the ppl buy it with no choice and no one selling in retirement etc will be a huge demand shock and rip that thing to ne heihts