Photograph: Richard Slater, Taken 7th November 2022; the Revolut brandmark remains the property of Revolut Ltd

For British crypto enthusiasts, it's been a week of opposites so far. On the one hand, Santander has stated that it will not allow retail users to send money to Cryptocurrency exchanges. With this statement, Santander is a central high-street bank here in the UK and is joining the ranks of banks claiming cryptocurrency is a vector that bad actors use to commit fraud.

On the other side, Neo-bank Revolut expands its crypto offering, allowing spending from crypto balances. While Revolut doesn't make for a great "exchange" because they don't allow you to deposit or withdraw crypto, only buy and sell it.

Fraud, Bad Actors and Attack Vectors

In the UK, banks are regulated by both the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). As with any regulator, they put demands on banks in the form of regulations to protect retail consumers.

As you can imagine, a big part of the regulation is the implementation of ways to control risk, one of those risks being a fraud. Fraud is a big deal for confidence in retail banks, representing about a billion pounds annually. I'm willing to bet that only a tiny fraction of this is malicious actors compromising accounts. An even smaller proportion is the use of Cryptocurrency Exchanges as a way of moving money away from the customer's account.

A bad actor may compromise your phone, use a SIM-swapping attack, or hold a wrench over you until you transfer money to a cryptocurrency of their choice, but that's not their only option. Banning transfers to crypto exchanges is, at best, a knee-jerk response and, at worst, a conflict of interest.

Revolut, on the other hand, doesn't seem to have any problems sending money to and from cryptocurrency exchanges.

Conflict of Interest

Central Banks represent a conflict of interest in crypto; all of their power and control is vested in instruments of fiat currency. In the future, this control would extend to Central Bank Digital Currencies (CBDCs). This incentivises central banks to push back against decentralised cryptocurrency as their direct competitor to their CBDCs.

This is a big problem for the incumbent financial services system, as a conflict of interest could again undermine trust, similar to the 2008 crash.

Better Ways of Reducing Fraud

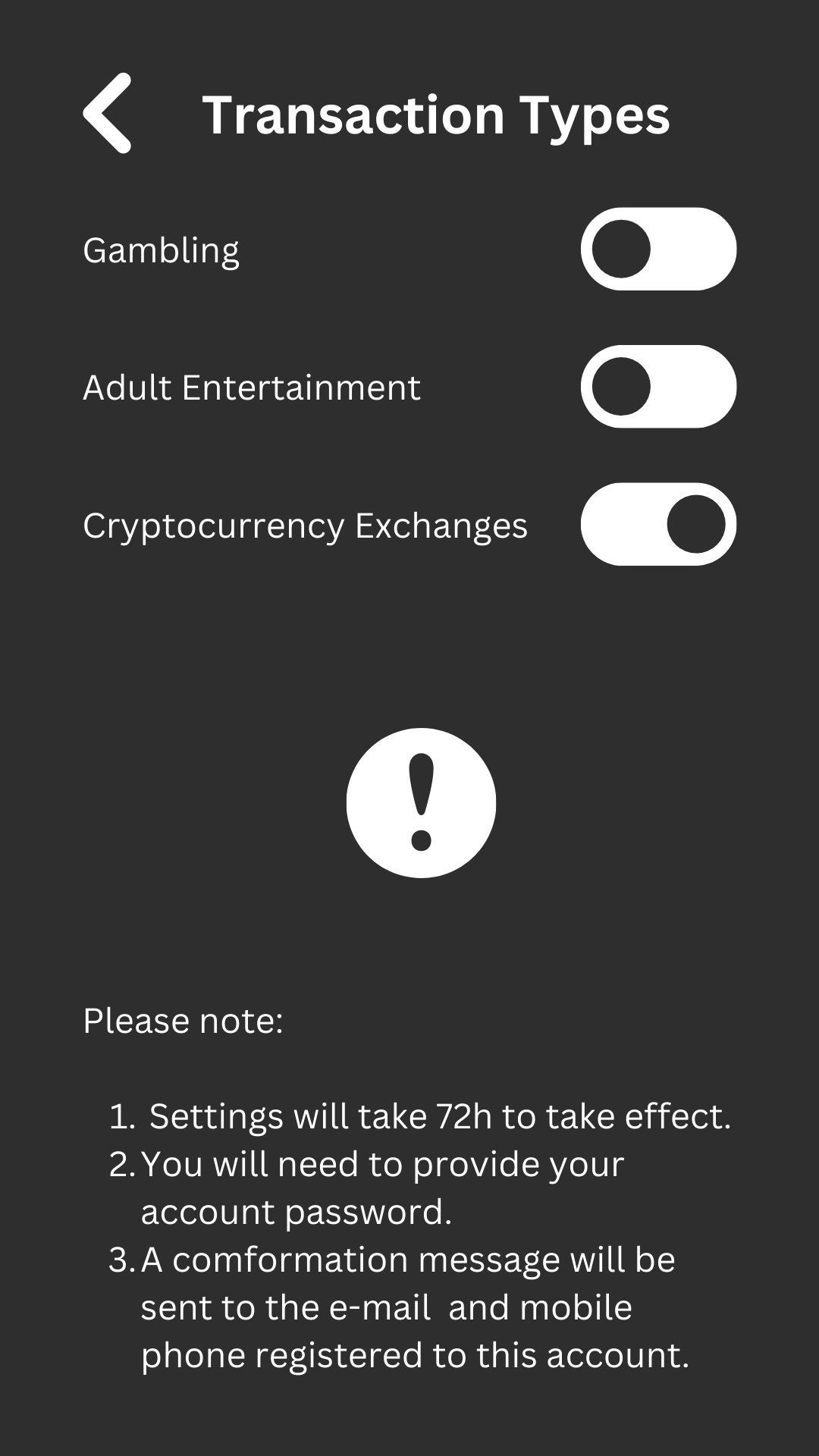

As daft as it may sound, there is a simple way to reduce the risk of fraud with a simple checkbox:

What's crazy is that several UK banks already offer the top two options. The way this should work is to require additional factors to change the settings, for example:

- It will take 72 hours before the change takes effect.

- Second factors will be required to change the setting, i.e. security key, password, and one-time code.

- Changes will be detailed in an e-mail to the account holder, giving them ample time to reverse the change.

This is a much more crypto-positive approach to risk mitigation. It remains to be seen how bullish our newest Prime Minister, Rishi Sunak, really is and whether he will have the support to make his vision of the UK becoming a crypto asset hub a reality.

Posted Using LeoFinance Beta

Hi @richardslater,

Thank you for participating in the #teamuk curated tag. We have upvoted your quality content.

For more information visit our discord https://discord.gg/8CVx2Am