Simon Property Group (NYSE: SPG) is a global leader in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company (Simon Property Group, NYSE: SPG). Their properties span across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales.

Two months ago Simon Property Group bought Taubman, made a bet that top-tier malls, which are the most profitable malls won’t go out of style. Taubman owns about two dozen high end properties, including Beverly Center in Los Angeles and The Mall at Short Hills in Short Hills, New Jersey.

Earlier this week, Simon Property Group, Inc. announced that they were terminating their merger agreement with Taubman Centers. Simon believes Taubman Centers didn’t take the necessary steps to mitigate the impacts of COVID-19, including, but not limited reducing their operating expenses and capital expenditure. Needless to say, Taubman Centers plans on fighting the agreement termination with Simon Property.

Gap CFO Katrina O'Connell said in its first-quarter conference call on Thursday it's "knee deep with all the landlords today." The executive said it's "very hard" to offer any timeline, although it's looking for ways to "partners with our landlords to come out with a better profitability for the company."

Simon is taking Gap to court as the retailer failed to pay its rent for April, May and June, according to WSJ. Simon is also requesting the court force Gap to pay its attorney fees and other expenses.

Simon said in the complaint the requirement that Gap and its entities "timely pay rent due under the leases has not been excused."

Simon properties had 412 Gap and its other branded stores, making it one of the mall owner's top store tenants aside from department stores.

About one month ago, J.C Penney filed for bankruptcy. Part of the restructuring involves closing 30% of the over 800 stores. It was reported that Amazon was in talks with JCPenney to buy some of their stores to use as distribution outlets. But Simon Property isn’t giving up on JC Penney just yet.

Simon Property has 63 J.C. Penney stores on their property. Private-equity firm Sycamore Partners is interested in buying J.C. Penney. Sycamore currently discussing a joint bid with Simon Property and Brookfield.

Since the reopening of the economy, the mall REITS have been on fire. Rightfully so right, as I'm sure Cheesecake has been pleasantly surprised by the traffic of people coming to eat at their restaurants. But for every success story, their is a at least one failure story. But I think for every success story, their will be many failure type stories in the coming months. For those companies that took loans, how are they going to repay those longs if demand doesn't get back to pre-COVID-19 levels. It can't right, due to social distancing mandates.

The coronavirus is spiking in more than a dozen states and hospitals are filling up again. Yet several governors have no plans to reimpose shutdown measures or pause reopenings at this time. But what if they have no choice if things become unmanageable?

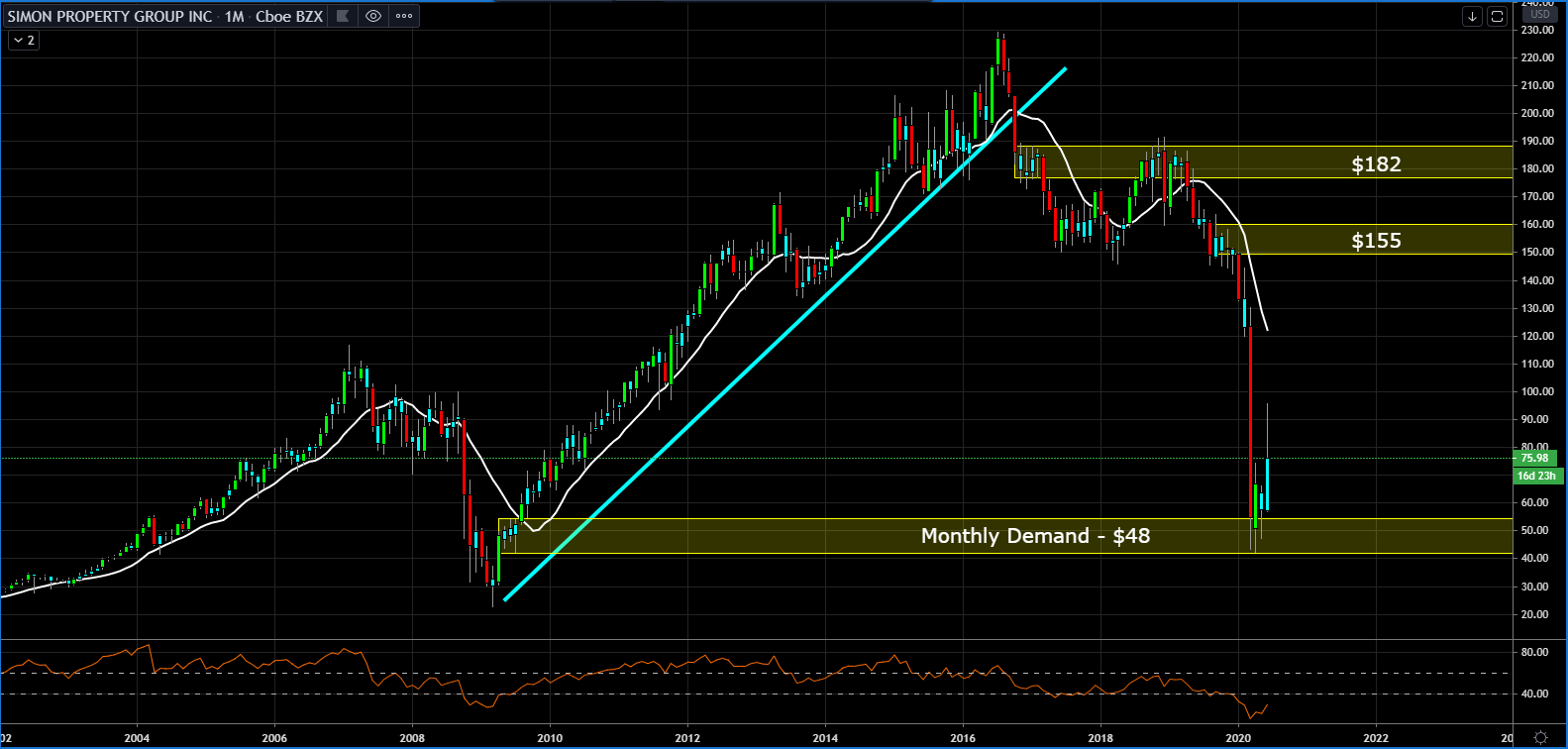

Despite price bouncing off of the monthly demand at $48, I personally think the bounce will be short lived as I have a bias that there is a large groups of people in the country that have put there guards down. Case in point, I just had to have a conversation with my son who told me he was going to visit a friend at her apartment and that he and the friend didn't have the visit. Because most aren't taking the approach as if they do have the virus, I think Simon Property will re-test the lows at some point.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance