My Foray Into Conventional Investment Wisdom

Reading @hitmeasap’s post on "How Often Should You Buy And Sell Crypto" got me thinking about investment strategies usually employed when buying investment assets and the theoretical underpinning of that approach.

In conventional thinking crypto assets are regarded as very volatile and therefore riskier assets. Simply put, volatility equals risk. And higher volatility equals higher risk.

The 2 Rules of Conventional Investment Wisdom

The first rule of conventional investment wisdom is to diversify your holdings in assets considered risky. Preferably in assets that are not, or better even negatively, correlated. This is the rationale behind the founding of hedge funds. In the past that is. Way back when. Now hedge funds are rarely, if ever, hedged.

The second rule of conventional investment wisdom is to not invest in risky assets all in one go. It is considered prudent to use a system called “dollar cost averaging” to enter into the desired position.

Is Crypto Really Riskier Than Traditional Investments?

In this article we will look at the first rule of conventional investment wisdom. A second article will address the dollar cost averaging approach to buying risky assets.

A picture is worth more than a thousand two thousand (inflation!) words. This is also true for investment decisions.

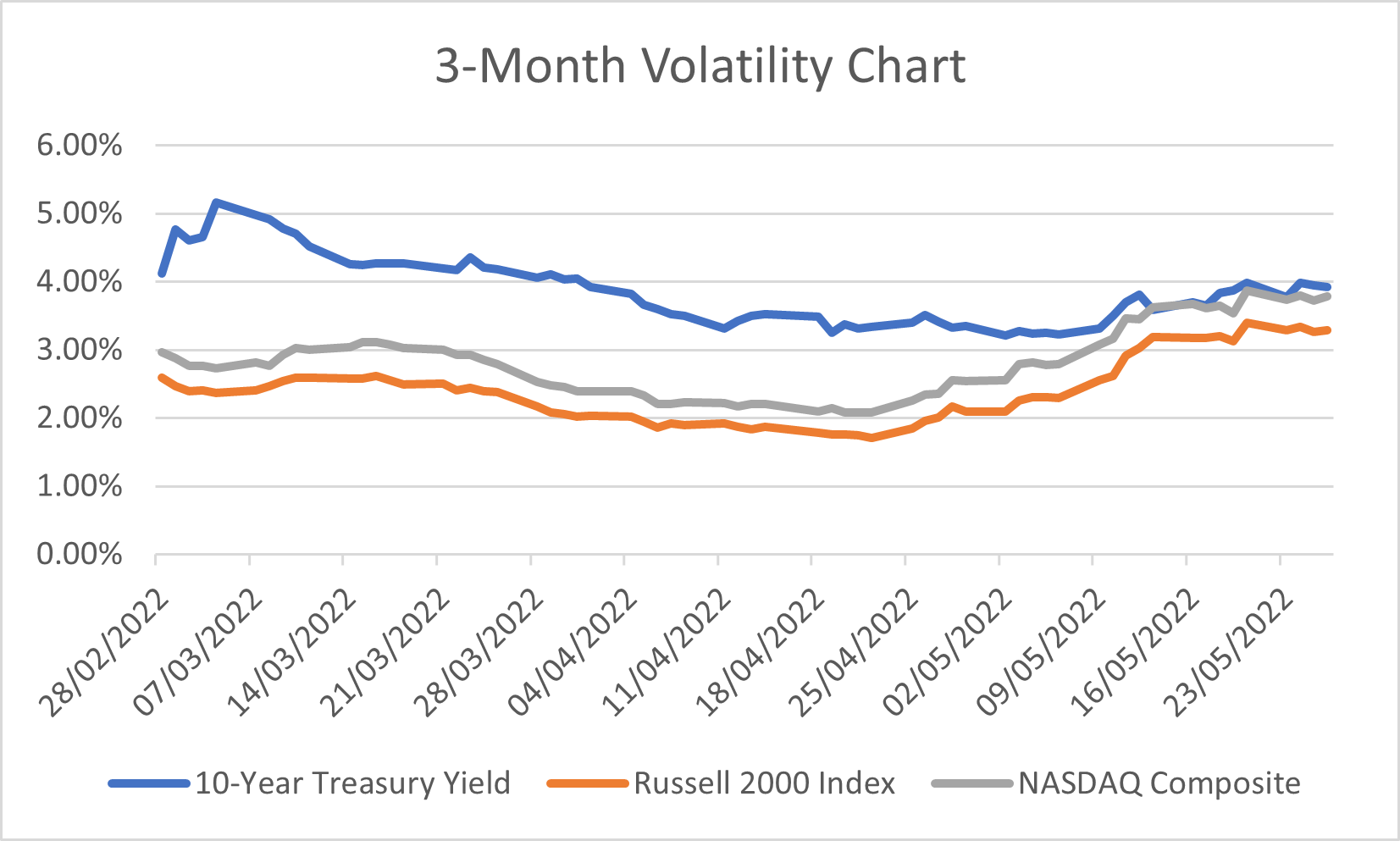

Let's simply look at a few charts. These charts compare the volatility in two different but very traditional asset classes. Equities are represented by the Russell 2000 index and the NASDAQ Composite.

Both equity indexes are considered “risky” in that the NASDAQ Composite represents primarily technology companies. And technology companies are considered a more speculative investment than more traditional companies.

The Russell 2000 index represents the smallest 2,000 companies in the Russell 3000 index. And as such is considered speculative. Because "everyone knows" that smaller companies represent a riskier proposition than more established and thus bigger companies!

To take the role of the traditional safe asset, I look at the volatility of the 10-Year Treasury Yield. The “safest” asset there is in conventional investment thinking!

And then we will compare these charts to the same ones for the largest cryptocurrency, BTC.

We will measure volatility by using a well-established investment indicator (and one readily accepted by the investment community), the average true range (ATR), smoothed over a 20-day period. We will convert the ATR into a percentage figure, ATR%, to allow a one-to-one comparison amongst the asset classes.

I could have used more complicated measures, but the maths involved is really not worth the extra accuracy.

The Evidence

Let’s start with the 3-month volatility comparison.

{All data used in these charts is sourced from Yahoo Finance and manipulated using Excel.}

Conventional investment wisdom has once again been shown to be at least iffy. The asset typically regarded as the "safest", the 10-Year Treasury Bond, appears to be the most volatile! And thus, the riskiest!

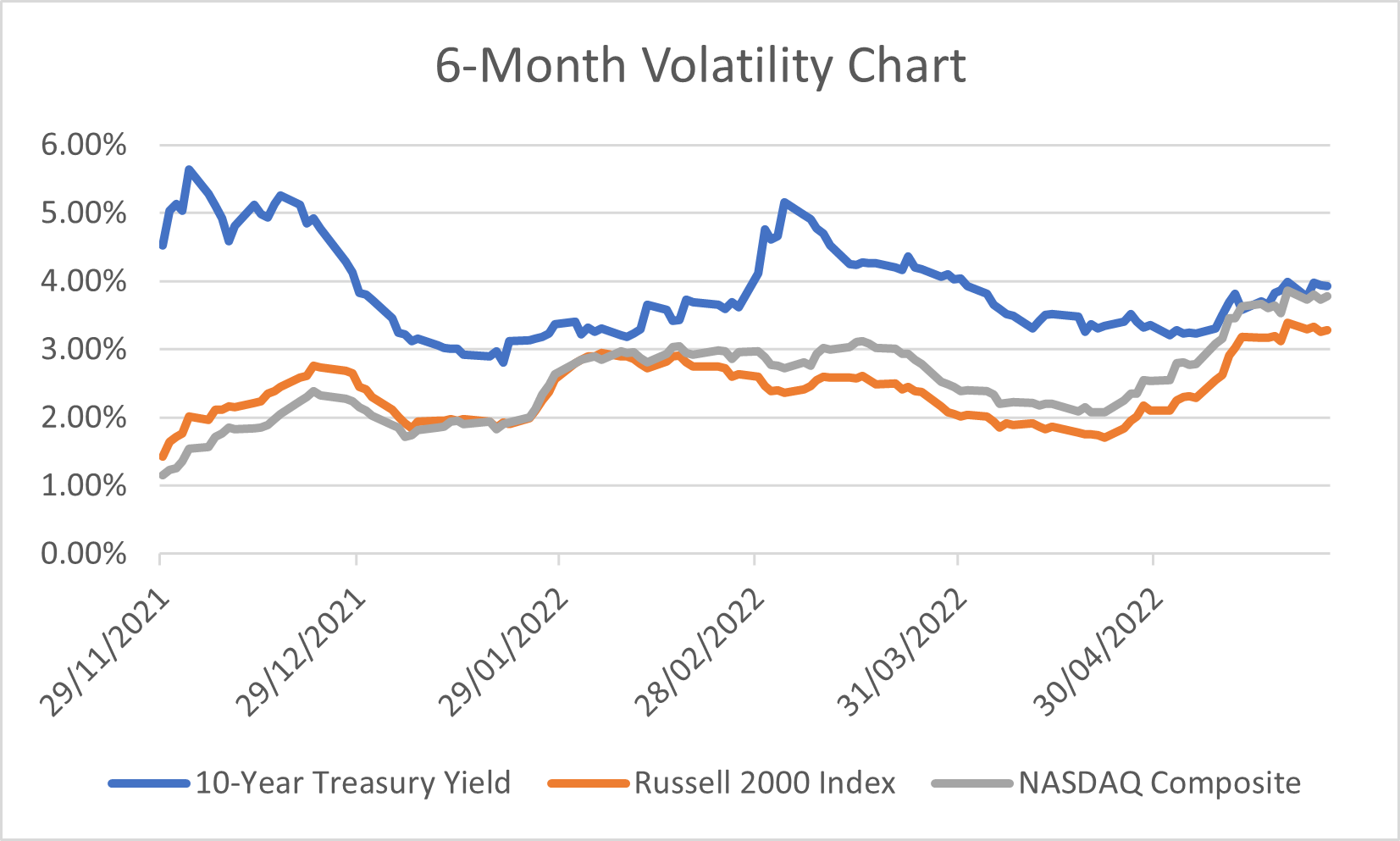

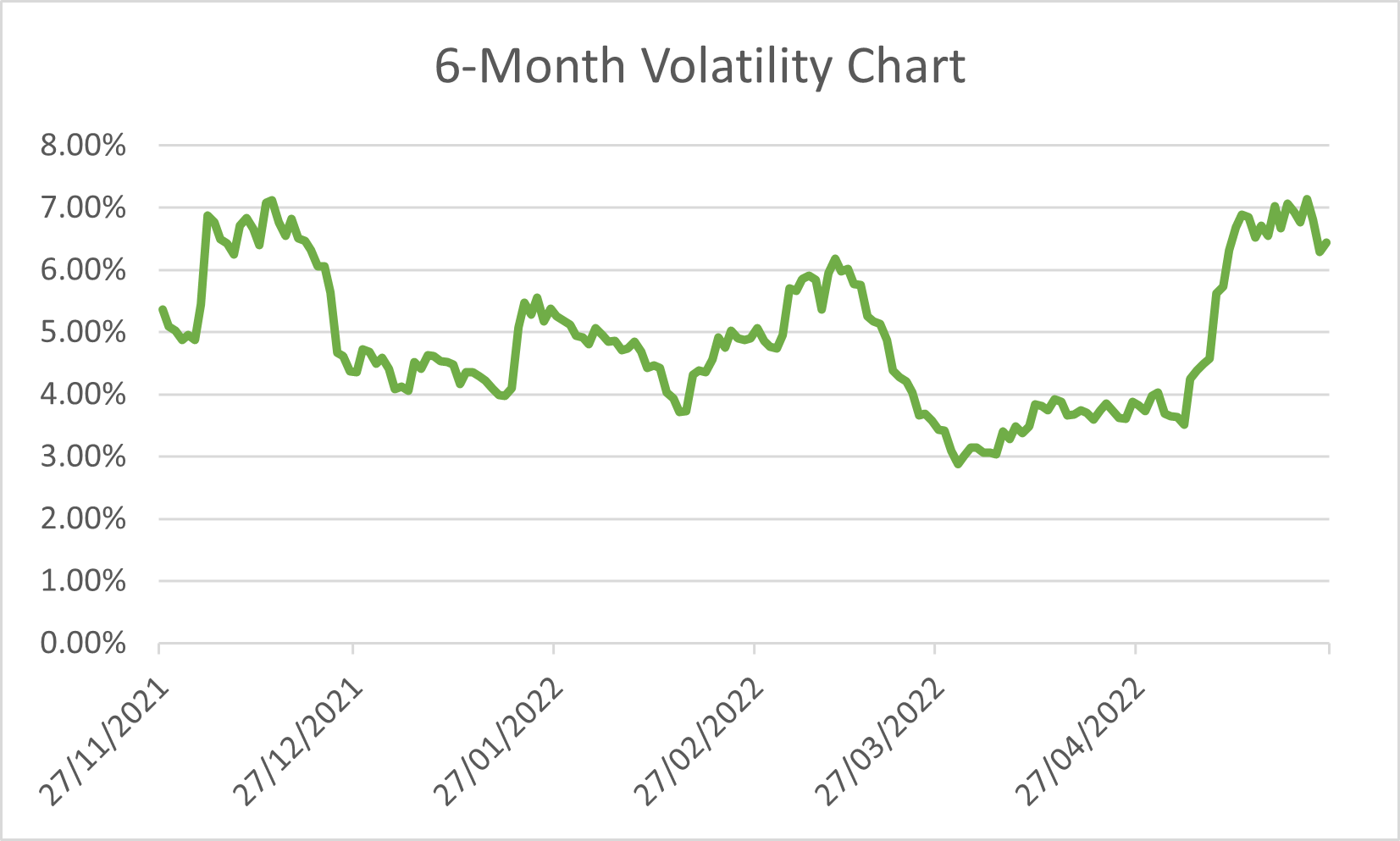

How about the 6-month period?

Same story.

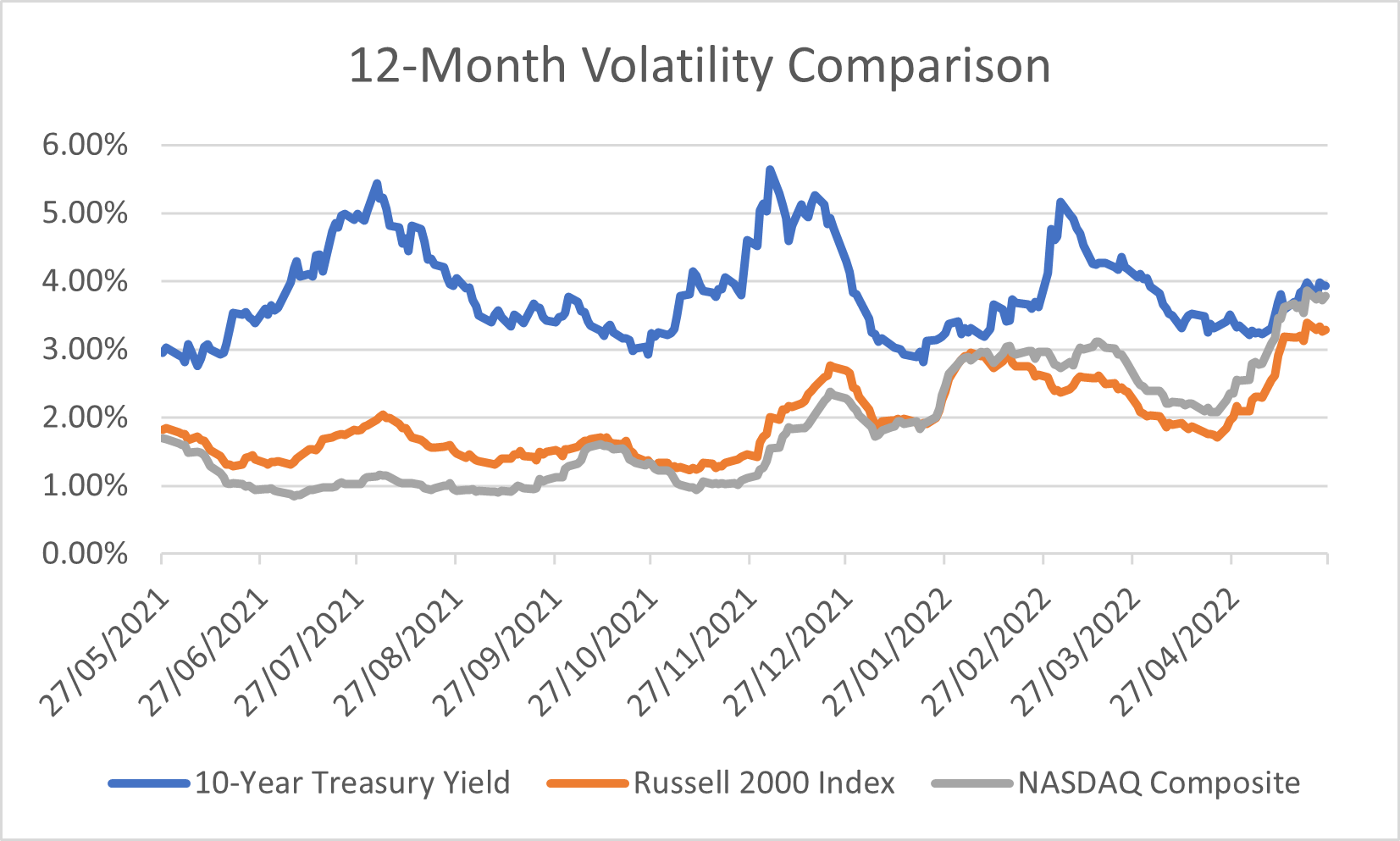

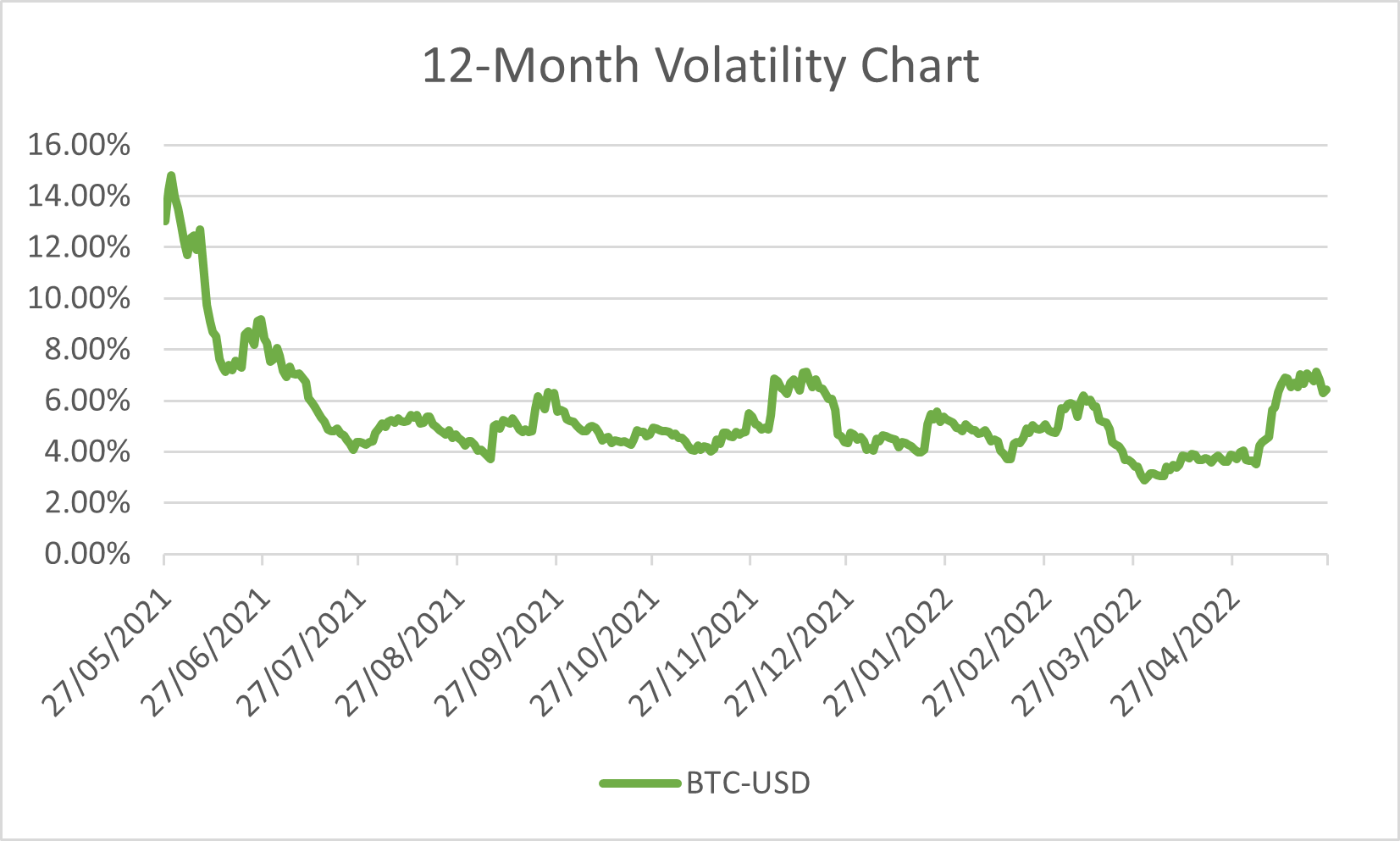

How about the 12-month period?

Even over this period the “safest” asset is the most volatile and thus the riskiest. According to conventional investment wisdom at least.

Does Crypto Deserve the “Risky” Label?

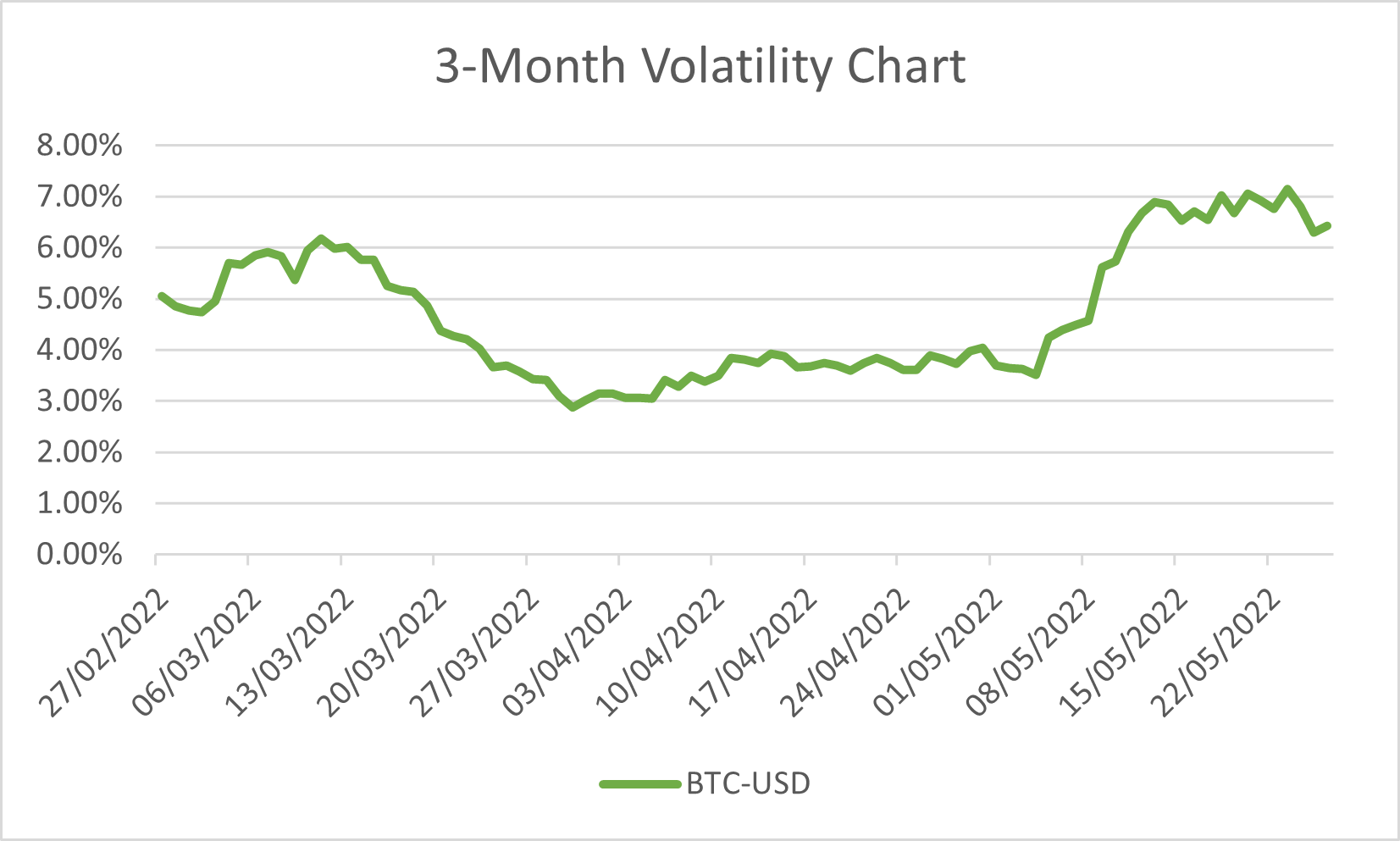

Let’s now look at the equivalent charts for the oldest and most valuable crypto asset, BTC. What follows are the same 3 charts for BTC.

The reason I am not putting BTC into the same charts as the traditional assets is simple. Crypto trades 24 hours a day, 7 days a week. No breaks. Traditional assets are traded Monday to Friday with weekends and public holidays off. That makes a direct one-to-one comparison difficult without impacting the data.

First, 3-month volatility.

In this chart you can clearly see the significant increase in volatility in the crypto market in early May 2022 caused by the collapse of LUNA and UST.

Followed by the 6-month volatility.

And finally the 12-month volatility chart.

For now, the absolute level of volatility is still higher in BTC than in the other asset classes. The gap is narrowing though.

And despite the recent upheavals in crypto, simply looking at the volatility charts it is quite obvious that the increase in volatility is well within the normal range.

The Future of Risk in Crypto

Looking at the longer term chart you can see that BTC has actually become less volatile over the last 12 months. The traditional asset classes of equities and bonds on the other hand have increased in volatility.

In lots of ways this represents the maturing of BTC as an accepted asset class and the uncertainties surrounding the traditional asset classes of fixed income and equity. It is likely that volatility will converge towards that of the more conventional asset classes. Certainly, as measured by the NASDAQ Composite.

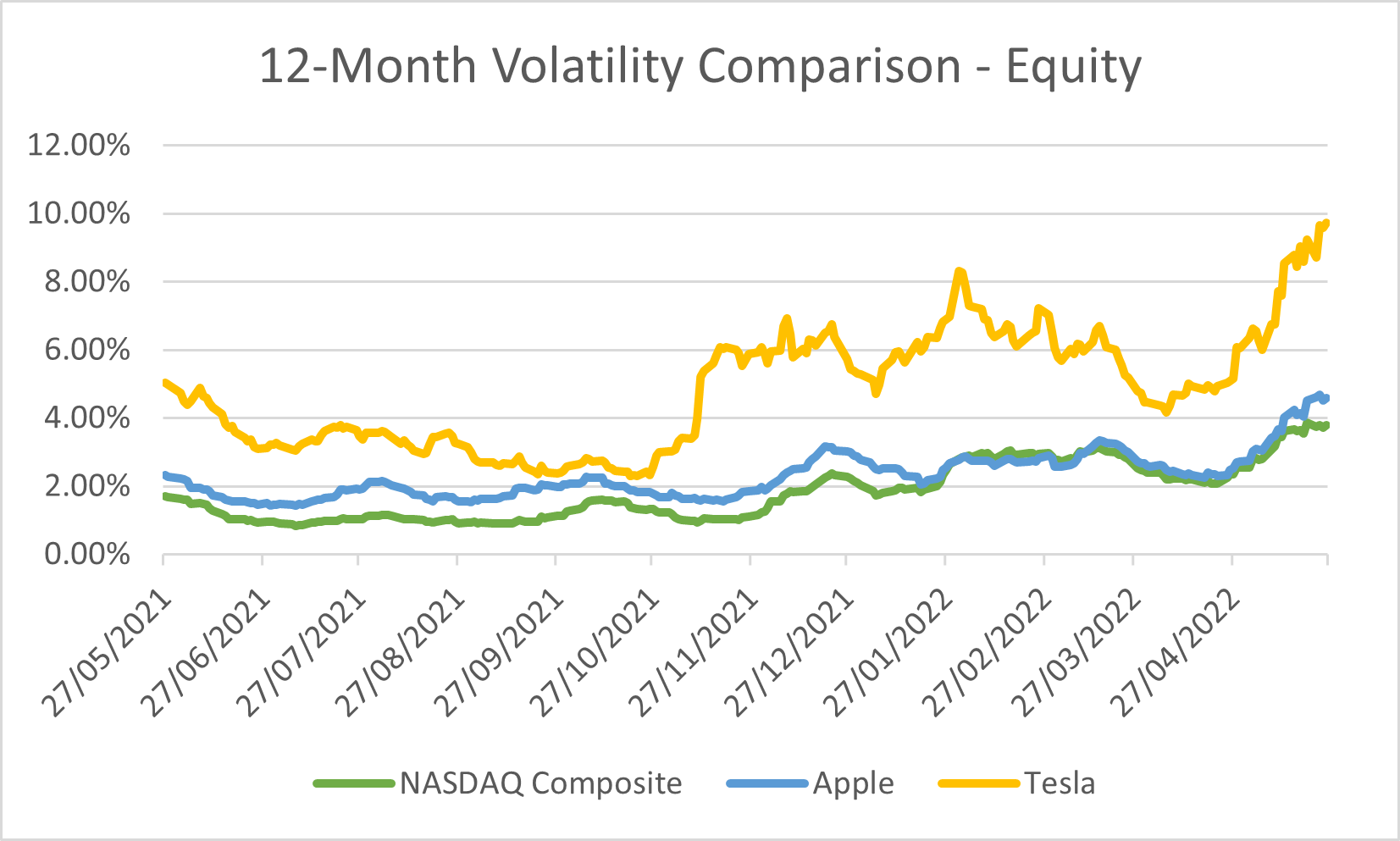

To sum it all up, I want to offer one more chart. This looks at the 12-month volatility comparison of the NASDAQ Composite with two of the investment community's darlings. Apple and Tesla.

This clearly shows that the volatility in Tesla is significantly higher than Apple, which appears to be an excellent proxy for the volatility in the NASDAQ Composite index.

And wouldn't you know it? Tesla's absolute volatility levels are more than 50% higher (9.72% vs 6.43%) than BTC's!

The take-away from this should be a confirmation of what you already should be aware of.

Know what you own, also known as "Do your own research". Be it a traditional stock like Apple. A racier speculative stock like Tesla. Or the bellwether of crypto, BTC. Or anything else.

We will look at dollar cost averaging as an investment strategy in the next article.

Posted Using LeoFinance Beta

Great post. Very good coverage of the BTC volatility.

Every investment is a risk, it is all about how many riskier assets you can keep in your portfolio is the question. Nice post.

Posted Using LeoFinance Beta

How did Warren Buffet, or was it Charlie Munger, put it? Put all your eggs in one basket. And then watch that basket!

Posted Using LeoFinance Beta

Thank you for all the helpful visuals. !BBH

Posted Using LeoFinance Beta

Many people understand charts better than tables or words. I'm glad I used them!

Posted Using LeoFinance Beta

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

Congratulations @rpren! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 300 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

In my opinion, no I don't believe that crypto is really any more risky than traditional investments. If you do your homework and don't invest any more than you can afford to lose you should be fine either way. Jumping in and out of investments can cause problems too.

Common sense, as in anything else, is key.

!CTP

Posted Using LeoFinance Beta

I think everyone should decipher how far they want to go before investing. Instead of jumping in and out as a result of market speculations.

Posted Using LeoFinance Beta

It is about managing your risk, high risk has high rewards but that does not means you just blindly invest in any high risk stock or crypto. Most of them will go down badly, but if u know how to research and select huge potential projects, you can quite easily make profit from it.

Posted Using LeoFinance Beta

It's all a gamble - to call one investment safe and another risky is silly. It's all risky, but with the risk comes the reward! And of course some investments are "safer" than others.

Posted Using LeoFinance Beta