Blockchain101 an explainer series.

- Today I will explain what wrapped tokens are, why they are needed and what they are used for in cryptocurrency, and more specifically decentralized finance.

Background

- Ethereum is a blockchain, and every token created or minted on this blockchain is an Ethereum token.

- Ether is a token created or minted on the Ethereum blockchain, so it is an Ethereum token.

- Dai is a token created or minted on the Ethereum blockchain, so it is an Ethereum token.

- ‘USDC is a token, created or minted on the Ethereum block chain, so it is an Ethereum token.

- So every token created or minted on the Ethereum blockchain is an Ethereum token.

- Ethereum tokens which are not Ether are called ERC-20 tokens.

- A place you go to wrap your tokens is sometimes called a Bridge

- Your original asset is held on the Bridge in a place called a Vault.

- Keywords: Ethereum, ETH, ERC-20, wrapped tokens, cryptocurrency, blockchain, asset, wrapper, Ether, bridge & vault.

#

source

What are wrapped tokens

- They are tokens created or minted on blockchain A, which represent the value of a token from blockchain B.

- So a wrapped tokens on Ethereum, is a token, created or minted on the Ethereum blockchain, which represent the value of another token on another blockchain.

- On the Ethereum blockchain this type of Ethereum token is called an ERC-20.

- On Binance Smart Chain blockchain this type of token is called a BEP-20.

- So for example: a wrapped Bitcoin token on the Ethereum blockchain, is a token created or minted on the Ethereum blockchain, usually represented as WBTC.

- WBTC is an Ethereum token, but it represents the value of a token from another blockchain, in this case, the Bitcoin blockchain, and specifically a Bitcoin token, on the Ethereum blockchain. It is a ERC-20 token.

- Keywords: #Wrapped token, #blockchain, #asset, #WBTC, #ERC-20, #BEP-20, WBTC, Ethereum & Bitcoin

Why do we need wrapped tokens?

- First, only Ethereum tokens can be used on the Ethereum blockchain.

- So if an investor who wants to invest the value represented by their cash money or the value represented by their cryptocurrency, in a project on the Ethereum blockchain, the value of that capitol investment must be represented by an Ethereum token.

- ‘All investment in projects on the Ethereum blockchain must be in the form of Ethereum tokens, usually ERC-20 tokens.

- This can be accomplished in many ways, but the two most common are purchase/exchange or wrapping.

- Keywords:Ethereum, Ethereum tokens, ERC-20, wrapped tokens, cryptocurrency, blockchain, purchase, Bitcoin, exchange or wrap.

Purchase/Exchange

- You send your cash money or fiat to a centralized exchange and trade it for Ethereum tokens like Ether, Dai or USDC.

- ‘You send your Bitcoin, or Hive to an exchange and trade it for Ether, Dai or USDC.

- This Ether, Dai or USDC now represents the value of your cash money or fiat currency on the Ethereum blockchain.

- Now you can use those Ethereum tokens to invest the value of your money in DeFi projects on Ethereum like the MakerDao or the Uniswap decentralized exchange.

Further explanation- optional reading:

- If you have 1000 dollars USD and trade it for 1000 Ethereum tokens called USDC, each of which represents the value of one US Dollar on Ethereum, then you would receive 1000 USDC tokens.

- ‘However if the price of Ether was 1000 US Dollars, and you used your 1000 US Dollars to buy Ether instead of USDC, then you would get only one Ether. And that one Ether would represent the value of your 1000 US Dollars on the Ethereum blockchain.

Wrapped tokens

- You can trade or exchange your Bitcoin, Hive or Leo for a wrapped versions of these tokens on Ethereum. These wrapped versions are Ethereum tokens created or minted on the Ethereum blockchain specifically to represent the value of your other cryptocurrency on the Ethereum blockchain.

- So one Hive would be traded for one Wrapped Hive. This new token is an Ethereum token created or minted on the Ethereum blockchain to represent the value of one Hive token on the Ethereum blockchain.

- The same can be done for Bitcoin. A Ethereum token is created or minted on the Ethereum blockchain to represent the value of one Bitcoin on the Ethereum blockchain, and this new token would be called Wrapped Bitcoin.

Further explanation- optional reading:

- When Leofinance creator @khaleelkazi wanted to help Leofinance investors invest the value of their Leo tokens on Uniswap, a DeFi project on the Ethereum blockchain, he created or minted an Ethereum token, which represented the value of one Leo token on the Ethereum blockchain. These tokens became known as Wrapped Leo, which was subsequently know as WLEO.

Critical Security Aspect

- I address this last, but it is not the least important.

- A critical aspect of using wrapped tokens is that your original token, whose value you invest on the Ethereum blockchain is the asset that gives your Wrapped Token value and it must be stored safely, or your wrapped token becomes worthless.

- And you must trust that you will be able to get it back.

- Think of the Wrapped Token as a Promise to Pay. or what Americans call an IOU meaning I owe you.

- A Wrapped Bitcoin is a Promise to Pay you one real Bitcoin.

- So that real Bitcoin must be safely stored.

- ‘This means you must trust the place you take your Bitcoin, Hive or Leo to, to wrap your token, hold your Bitcoin, Hive or Leo safely and to give it back to you in exchange for the wrapped version when you want it back.

- ‘This is one reason there is only one or two places investors use to wrap their Bitcoin, because they are sure they can get their Bitcoin back.

- ‘This also the reason that the places which wrap tokens get hacked, because they are like banks.

- So you need to trust the token wrapper not only to be honest, but also to know how to keep your tokens safe.

Last Words

- I hope this post has brought you greater understanding of the term wrapped tokens.

- And I hope this knowledge will help you feel safer investing your hard earned cash or tokens in DeFi projects.

- If you have questions, please put them in the comments below.

- And if you liked this article please follow me for more content like this.

@shortsegments

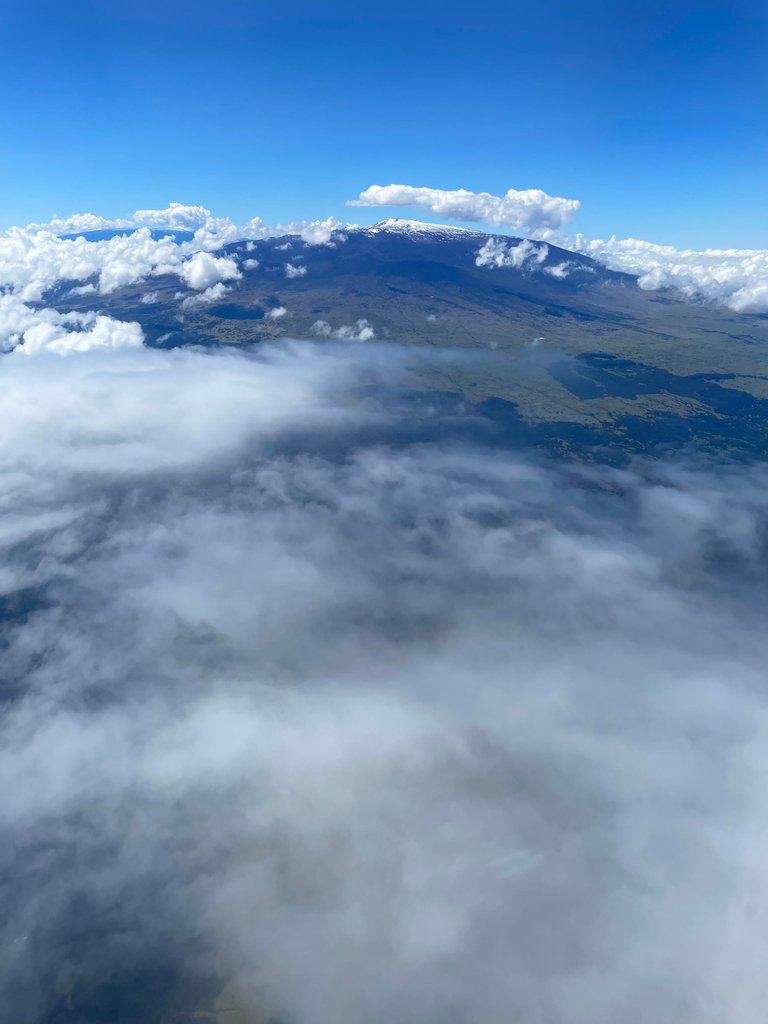

Studying cryptocurrency is like viewing the peak of a mountain rising through the clouds, a beautiful, and majestic creation. But we only fully appreciate it when we are able to view it from sea level to the top.

The Peak

The mountain

Posted Using LeoFinance Beta

LEOGLOSSARY Links are in Yellow in the above article

What is a wrapped token?

Binance Article written on Jan 19, 2021 and Updated on Nov 16, 2022.

The TLDR:

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thank you.

The rewards earned on this comment will go directly to the people( @shortsegments ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.