The European Central Bank (ECB) has been making moves recently, and it’s worth taking a look at the latest developments.

So, the ECB has reduced interest rates to 3.25%! “

Really, we’re talking about interest rates again?you might say. YES! The ECB seems to be doing quite well in managing inflation and rates, even gaining an edge over the FED.

INTEREST RATES

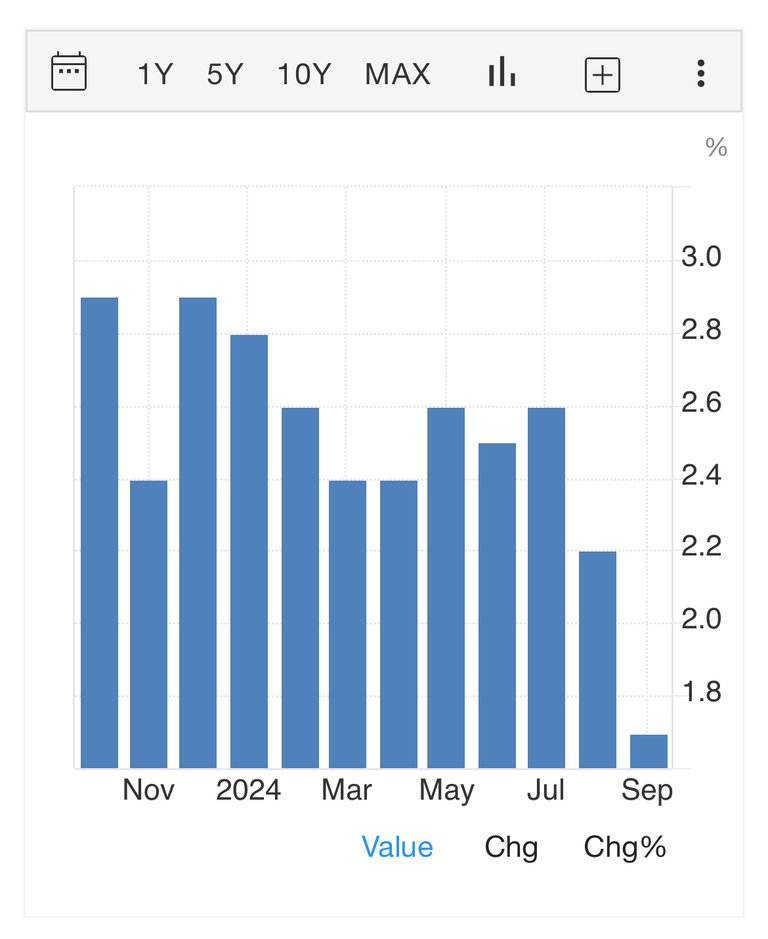

Markets had largely anticipated this cut because policymakers had hinted in their statements that this decision was coming. The inflation risks have significantly decreased, and economic growth in the eurozone has been a bit weak lately. The ECB confirmed this in a statement after the meeting, saying that “disinflation is on track.” Specifically, inflation fell below the 2% target for the first time in three years, reaching 1.8% in September. Therefore, the ECB proceeded with a 25-basis-point (0.25%) cut, marking the third reduction this year. As expected, markets responded positively.

It’s also notable that this is the first time since 2011 that the ECB has cut rates in two consecutive meetings.

Why not a bigger cut?For those wondering, ECB President Christine Lagarde explained that the decision to cut by 25 basis points was the only one discussed, avoiding the more aggressive 50-basis-point cut that the FED favored in the U.S. in September.

Up until the ECB’s last meeting in September, markets had expected only one more rate cut this year. However, recent developments have led to expectations of two more cuts, with the first one happening yesterday.

At the same time, concerns about eurozone growth are rising, as the ECB downgraded its 2024 growth forecast to 0.8%, from a previous 0.9%. Growth will likely remain in positive territory, but it may start to improve gradually, as the rate cut will give the economy the boost it needs.

INVESTING

Is it time to start investing in European stocks? If you ask me no! The only market you should invest is the US Europe sick at this point and I don’t believe that things will get better soon !

Posted Using InLeo Alpha