Yesterday And Today we had some really significant decisions that we are used to watch , The Fed interest rate decisions and the Bank of England decision rate.

The Fed*

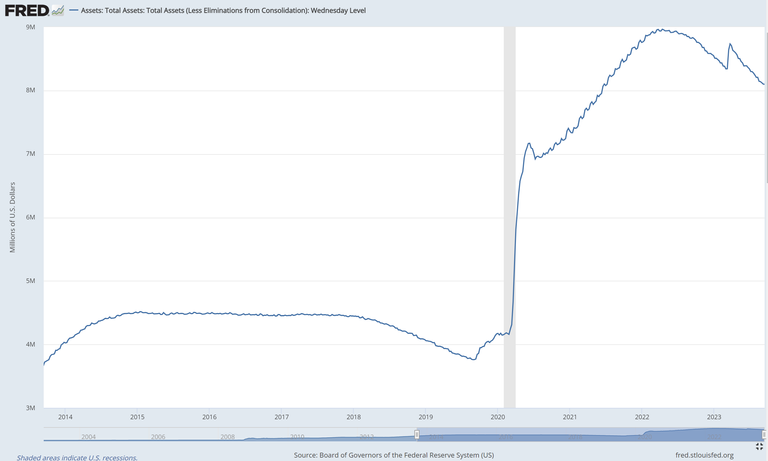

The consensus was that in this FOMC meeting, the Fed wouldn't increase their interest rates, and it was correct, as the rates remained the same at 5.25%-5.5%. Of course, what was even more significant and hinted to us what to expect was the Powell press conference later, which turned out to be a lot more hawkish than expected. Powell announced that the Fed would increase interest rates one more time this year, probably in the next FOMC meeting. In 2024, they will likely start cutting the rates later than expected, resulting in smaller rate cuts, without specifying the extent. What does this mean? It means that inflation is stickier than they initially believed and once again shows their determination to do whatever they can to reach their 2% target, especially now that their economy is performing better than expected. This gives them room to increase rates further, even if some banks fail. Right now, the rates have less impact on the crypto and stock markets. What will have more impact soon is the quantitative tightening that the Fed and other central banks are implementing. Look at the chart to see how many assets the Fed bought during the COVID pandemic and consider the bull market it ignited. Now, look at where we are in terms of selling those assets and how deep we are in the bear market. I believe that we have a lot more room to fall, especially in stocks.

*Bank Of England

The Bank of England made the same decision as the Fed and chose to keep the interest rates unchanged for this month at 5.5%. Regarding the BoE, I believe that the notion that their job is done is probably delusional. England has been hit really hard by inflation, leaving the EU, and, of course, dealing with their politicians who are not doing a particularly good job. So, I expect that they will increase their rates further, and not just once; they will likely have the highest interest rates in Europe when their job is truly done.

Posted Using LeoFinance Alpha

Posted Using LeoFinance Alpha

https://leofinance.io/threads/steemychicken1/re-steemychicken1-kdbv8bw1

The rewards earned on this comment will go directly to the people ( steemychicken1 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 140000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPUp and up the rates keep going! The rich will get richer, but those in debt will get poorer. I know they're trying to cool the economy down but at what point of continual rise does it all collapse?

The cracks are here but who knows maybe collapse is what they want