The tokenization of Real World Assets (RWA) is underway.

After the announcement of Robinhood tokenizing 200 stocks for European investors, eToro is looking to offer a similar service. These are going to be ERC-20 tokens, housed on Ethereum.

This is an interesting turn, one which could have profound implications on the world of DeFi.

Trading and investing platform eToro has announced plans to launch tokenized US stocks as ERC-20 tokens on the Ethereum blockchain.

Over the past couple years, there was a lot of speculation regarding the shift towards tokenizing RWA. So far, the progress is slow, with regulation in many areas impeding the progress.

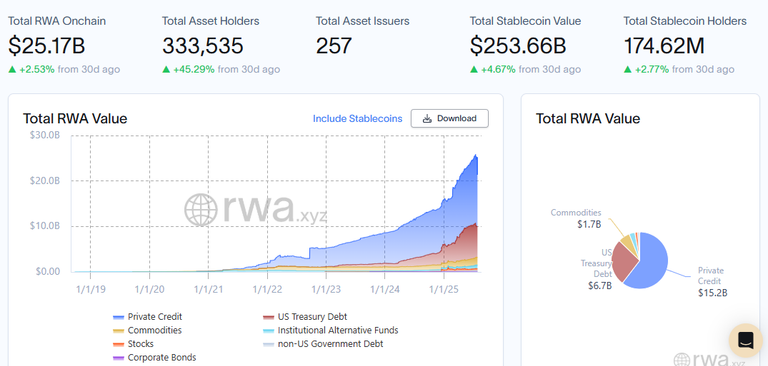

At present we are looking at roughly $25 billion according to rwa.xyz.

eToro Rolling Out 100 Stocks On Ethereum

The move by eToro will enable the stocks to be traded as blockchain assets, offering 24/5 service.

It is important to note, these are not traditional stocks in the sense they offer the same rights as stock ownership. There are no claims against the capital of the company and would not be included in any bankruptcy filings.

Essentially, these are derivatives of the stocks, akin to options. It does allow for the speculation on the movement of the asset, mirroring most markets.

What makes eToro's offering interesting is the tie to DeFi. Being ERC-20 tokens means that we could see the ability to trade on decentralized exchanges.

According to eToro, users will eventually be able to transfer tokenized stocks off the platform into self-custody or DeFi protocols. “Yes—that is 100% the objective here,” a spokesperson told Cointelegraph.

The move to self custody wallets is an enormous step. Once something is in a wallet like Metamask, the ability to swap using a variety of pools or assets expands greatly.

“Users can buy a tokenized stock on eToro, redeem it to the eToro wallet and from there to their own wallet, etc.—and then bring it back to eToro if they wish to.”

This would mean that stocks that are moved to an individual, self-custody wallet could then be transferred to another, which eventually could be routed back to eToro. The fact we are looking at the same protocol that is used for many tokens out there shows the interconnectedness of what is being designed.

A Growing Share of DeFi?

The industry is still in its infancy in many regards. That said, we are seeing the infrastructure being laid that will create the future financial system.

For the moment, we are dealing with the lead being taken by Wall Street. Each time we read an article, it mostly deals with a well known financial firm doing something with crypto. No longer is the innovation coming from the individual (or small) developers.

We are now in a period where Wall Street is taking over.

This might not sit well with crypto purists but all is not lost. Like eToro is showing, there are "hybrid" options that could be established, providing a bridge to something greater down the road.

In other words, even if things start from centralized traditional entities, this might help the DeFi world. After all, more assets equates to greater trading volumes, more staking, and increased TVL.

We are seeing more DeFi infrastructure built. This could be a complementary situation where both leverage each other for exponential gains.

Wall Street is going to focus upon building a system which has as much closed as possible. There will have to be outlets if they are using blockchains like Ethereum. That is the opportunity.

If the development of DeFi infrastructure keeps growing, the offerings by Wall Street in the tokenized realm could be integrated. This will help with volumes (and liquidity) on that platforms, providing enhanced utility.

It is a slow process in the near term. The next couple years will provide more insight as development and innovation takes place.

Posted Using INLEO

This post has been shared on Reddit by @dkkfrodo through the HivePosh initiative.

This can be a Thing for people Living under sanctioned countries that don't have access to wall street or the swift system.

Sadly we have to wait until that be avaible on DEFI.

Now, apparently that is not an option but imagine if they share the dividends of the stock with the owners of the ERC token in USDT or another stablecoin.

It's an exciting time for the gradual adoption of crypto amongst the masses...

Allowing self-custody is a bold move. Also, directly integrating with Ethereum and giving up the control that would come with running this on an owned L2 is likewise commendable.

That said, Etoro has mostly been crypto-friendly to the best of my knowledge, so It could be argued that there's an incentive to uphold that reputation.

!bbh

This is a good news to hear and it would help shape the future of crypto in the future

Ethereum price is growing, and this could be the reason why the coin price is going up.