The recent events surrounding UST and LUNA are getting everyone's attention. This is making waves while having some fear that the entire industry is at risk. To me, this is just a test in resiliency. Quite frankly, if cryptocurrency cannot handle this, it deserves to go away.

Since HBD, like UST, is an algorithmic backed stablecoin, people want to draw parallels between the two. This usually ends with people concluding the same thing could happen to HBD. While we can never say definitively what will happen, we can analyze the different features in place.

In this article we will highlight some of the characteristics that set the two apart.

Simply put, what is hindering Hive's growth, along with HBD, is also defending both coins.

Shutting Down The Chain

One of the biggest problems with Terra is very little was on there. With Hive, we have a host of projects and applications. Development teams spent countless hours along with money creating their projects. They are not so inclined to have them shut down.

The Luna Foundation shut down the blockchain yesterday. This shows the danger in centralization. Anyone who built on that blockchain would have been out of luck.

With Hive, that is not possible. While the consensus witnesses could agree, there are others who are running the software. As long as they do that, Hive keeps going. One of the reasons to conclude this is many who are running nodes are also behind projects. To shut the blockchain down means turning off, to some degree, their project.

Go through the Witness list and see if you can associate the on-chain projects teams with the node operators.

HIVE-HBD Conversion Mechanism

One of the key features is the conversion mechanism whereby the stablecoin can be created utilizing the base token. On Terra, UST was generated by converting LUNA. The same is true on Hive with HBD being created from it.

However, that is where things end. With Terra, there were no precautions in place. On Hive, we see a number of them.

Before getting to that, we have to start with the core token. To be frank, HIVE is a pain in the rear to acquire. We all know that. So the starting point of acquiring a ton of HIVE is difficult.

LUNA was much easier to acquire, for reasons that were unnoticed until recently. This is where it all begins. Thus, if the core token is held in massive amounts, one can begin the attack.

Pre-Mine

This is something harped upon by many on Hive. However, it is one of the most valid points out there.

While there is no certainty with UST, it does look like the attack was carried out by getting a hold of massive amounts of LUNA from a pre-mine or Founder's stake. This handed someone the LUNA in some type of OTC deal. The key to this is that it does not drive the price up.

Hive no longer has a pre-mine that can be used against it. In fact, it is in the Decentralized Hive Fund protecting the blockchain.

Conversion From HIVE-HBD

The process starts by acquiring a lot of the stablecoin via the conversion mechanism. With Terra, this was done without penalty. On Hive, there is a 5% fee on each conversion.

This means that anyone staging an attack is going to take a 5% hit right off the bat. While this still might be worthwhile if the numbers are large enough, we can see how this is a bit of a deterrent.

So even if someone acquires the HIVE, something they will have to buy on the open market, driving up the price, they take an immediate hit when converting it to HBD.

3.5 Day Conversion Time

If our nefarious one still wants to carry on, opting for the 5% fee, there is another roadblock. The conversion time is only a few seconds, putting the HBD in the attacker's wallet. There is a catch though, it is only 50% of the total. The other 50% has a delay of 3.5 days before it is issued.

Here is another defense mechanism that is a hindrance to growth. We know the 5% conversion fees turns people away. Equally as damaging, from an expansion perspective, is the 3.5 wait time. There are too many variables for traders to deal with over that time. It is rather unappealing.

We know this by the lack of liquidity with HBD. However, from a security standpoint, this is a major difference maker between the Terra system. If the person wants to get the full amount of HBD, that is a 3.5 day wait time, with 50% being exposed to market conditions. Since the price paid is the average over that time, one's payout will likely change.

HBD Stabilizer

On the internal exchange we have the HBD Stabilizer operating. This goes in and buys HBD or HIVE depending upon the price. It does so using funds allocated from the DHF, proceeds that are returned.

Looking at the transaction activity in the wallet, we can see it receives 6,573 HBD every hour. Throughout the day it is filling orders, providing liquidity in an effort to hold the peg.

During this entire market crash, the internal market, for the most part, maintained the peg. That means, at any time, people could trade HBD for HIVE and get near $1. This differed from the price feeds picked up based upon activity on external exchanges. As we see, the amount of HBD available along with volume is minimal, creating a misrepresentation of the price movements overall.

HBD Liquidity

In addition to getting a hold of HIVE, it is even more difficult to get HBD on the open market. The HBD Stabilizer is potentially putting out roughly 150K HBD per day. This typically carries a 1% premium off the best price. Here we see another deterrent, albeit not an onerous one.

Going through the linked post above, we see that only Upbit and Bittrex offer HBD. The first is unavailable to those outside South Korea. As for Bittrex, it has no volume. So neither of this is really an option for most.

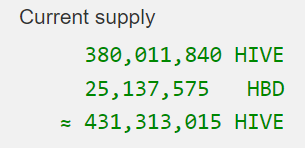

There is a reason why liquidity on these exchanges is tight. Let us look at the HBD float taken from Hiveblocks:

There are 25 million HBD in total. However, we see that the DHF has more than 16 million locked up. This means the total amount available is 9 million.

We also have 2.2 million on Upbit, which is an exclusionary exchange.

There is also another roughly 3 million locked in Savings and not immediately available. So now we are down to about 3.8 million HBD out there.

As we can see, getting a hold of HBD is even more difficult than HIVE.

pHBD

The pHBD-USDC liquidity pool on Polycub was set up to help alleviate this issue. The question, is that becoming a point of vulnerability? Could someone use that as an attack vector?

We are seeing the pool growing. In this instance, it is possible for someone to go in and buy up all the pHBD. At the moment, that is just shy of 200K HBD. Now we are talking about a decent sized honeypot for what is out there.

There is only one problem. The pHBD account maintains enough liquidity to conduct its daily transactions. With the excess, it is put into Savings.

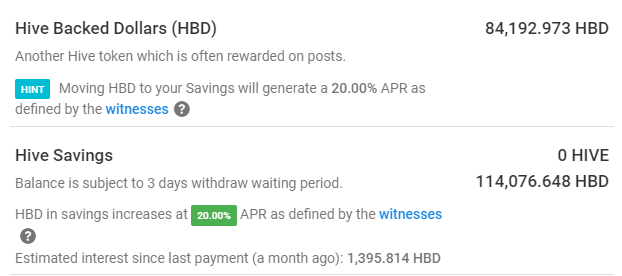

Here is what the account looks like:

Thus, our attacker could spent $198K purchasing all the pHBD. However, when going to bridge, only 84K would immediately end up as HBD. The rest would have to wait until the team moved the rest of HBD from Savings. Here is another 3 day wait in the process.

Of course, if there was a known attack, the team might opt to hold off on doing that, sensing that something is amiss.

Haircut

This might be the most powerful of defenses there is. It is also logical.

With a stablecoin of this sort, the redemption is a certain amount of the native coin for each stablecoin. At present, HBD can be converted to $1 worth of HIVE.

Here is where the situation on Terra completely fell apart. Logic would say that for this to be a valid system, there needs to be a spread in the market cap of the native token and that of the stablecoin. If not, there no way to back it up.

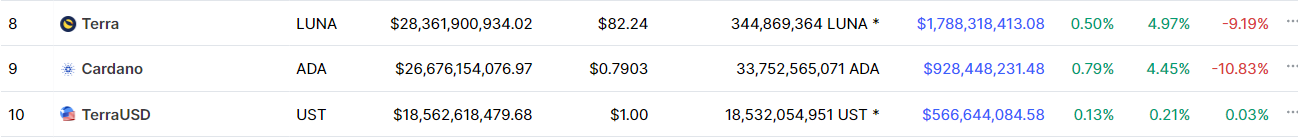

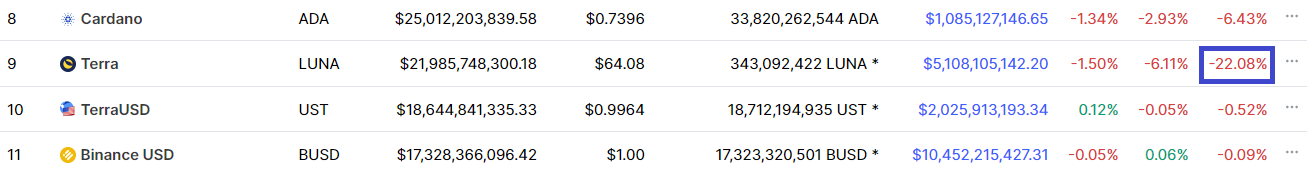

With UST, the market caps were fairly close. Here we can see from the historical data on Coinmarketcap.com what things looked like.

On May 1st we see the spread:

On May 8th, notice how it tightened:

The key is to stop this before it begins. With Hive, there is a haircut rule meaning that when the percentage of HBD (by marketcap) reaches a certain percentage of HIVE, then the blockchain stops producing the HBD. Thus, there is an initial limitation to the amount of HBD that can be out there based upon the total marketcap of HIVE.

At present this is 10% but it is being increased to 30% in the next hard fork.

Thus, getting to this point is impossible with continued creation of HBD. Long before the ratio achieved the level of LUNA-UST, the blockchain would stop generating HBD.

It is important to learn from the plight of others. Fortunately for Hive, there are security measures in place to protect the chain. Could there be more? Certainly. In fact, we need to keep analyzing ways to make things more secure.

One of the defenses is the lack of liquidity. This will hopefully change over time. The key with this is to, as the supply is expanding, develop a host of uses cases. The reality is that LUNA's main use case was to generate UST. There was little else.

With HIVE and HBD, we have the opportunity to build value (different from price) which makes it necessary to hold the token. This is the true defense of coins like these.

In closing, we are in a strong position. While many are upset about the lack of rapid growth in token value, situations like these teach us how valuable security is. Sometimes the best approach is the more methodical one.

There will come a time, if building continues, where Hive will be tested. This means we best prepare for it. By having a defensive foundation in place, we have the opportunity to add more.

It is obviously something the Luna Foundation completely overlooked (or didn't care about).

Either way, it would be very difficult to do something similar to HBD as was done to UST. A big part of that is they are not on the same scale with each other. If HBD does achieve that status, we will need a lot more defenses in place.

Sometimes having time is the best defense of all.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Always well researched and informative.

Thanks for laying this out clearly.

These points should be put out loud and clear to those thinking about wasting their time making money attacking this chain.

This info being out there is the first deterrent.

Nice work task!

Watching the nefarious types step in thinking they have an edge, only to discover they've fucked themselves while everyone saw; pure gold in the humor department. I've always liked that particular feature of this chain and would prefer nobody knew about the security here so I at least have something to watch since there's nothing really on TV anymore.

Yep. I think you are hitting upon a key point. There is no ideal solution. The big thing is to put in enough stuff to simply deter the behavior. Make it so that if someone does try it, it is so costly and such a pain in the ass they move onto other targets.

At least until we get to where size become an advantage that makes it tough to target.

Posted Using LeoFinance Beta

Hive's haircut rule is much more robust than similar mechanisms on Terra. It was possible for Terra to print trillions of LUNA for people trying to convert UST. The same would not be possible with Hive. Terra did have a speed bump in how it does conversions a little bit similar to the haircut rule, but for some reason in the last few days they decided to essentially remove it. I guess it was a hail mary to restore the peg, but it turned out instead to accelerate the crash to zero.

We'll never know, but it isn't impossible that if they had left things alone with the speed bump in place, it might have recovered (I'd say unlikely, but not impossible). If nothing else it would have slowed down the collapse and allowed more time to implement a better fix or negotiate with investors for a work out (which was tried but the negotiations didn't succeed as things played out, perhaps because the situation was so rapidly deteriorating).

It is always interesting to see what projects do when things get rough. That is the true test.

Sadly for them, they either didnt have enough precautions in place or they made the wrong decisions (or both).

Either way, something for us to look at and try to learn from.

Posted Using LeoFinance Beta

Its good for me to read this article because I am putting so much faith in the HBD.

I am looking to fund my retirement and this article left me knowing that I need to learn more about what I am investing is.

If the price if HIVE keeps dropping and HBD stops being printed, what happens to our HBD that is in savings. Does it still grow?

Also

Let's say that we reach mass adoption of HBD and merchants start receiving payment in HBD. If all merchants wanted to cash out their HBD daily, how limited would our economy be? 3.8 Million?

Or is 3.8 Million the cap of how much HBD we could buy if we wanted to?

Posted Using LeoFinance Beta

You should be cautious betting too much if any of your retirement on any sort of blockchain or blockchain asset or token. They're all experimental.

I agree.

I am gambling on the blockchain, but also diversifying in real life.

Being in the US, California specifically, things look very dire with the traditional model, so a little experimentation is necessary.

Thank you for pointing it out.

Before luna i read a dozens of tweets about "HBD is risk free"...

So I'm not the "bad guy" all the time :D

I think many of us understand that crypto is still wild and anything can happen.

Anyone who tells you any investment is risk free is just being silly - nothing is "risk free" even the money I invested in buying seeds for my garden is a "risk" investment.

HBD is not risk free. There are risks with it. It is, however, low risk.

The biggest risks are the blockchain stops along with the ending of the backing of HBD by HIVE. Obviously the second is being discussed and worked on. As for the first, each has to access on his/her own.

Posted Using LeoFinance Beta

DAI = king algo coin. Nothing comes close to it. HBD should become a DAI version

One thing I like about the haircut is that it tells people HBD is not risk free. You are being explicitly told that you are taking risk. If HIVE fails to hold enough value, there is no nonsense about how printing trillions of HIVE is going to save you.

Of course, you do need to understand what you're buying, and it isn't necessarily clearly explained all the time.

That's not the only risk, but once you have one explicit risk, it isn't claiming to be risk free.

Any real reason why not remove HBD and make a DAI out of it? DAO could easy pay in hive connected to $ value of hive.

I think this would scale better to some higher level

I'm not even sold on DAI being better in any useful way. For one thing, a lot of its collateral is USDC (used to be the majority, but less than that now). What's the point of that?

Until you show me a collateralized stablecoin with only on-chain assets as collateral demonstrating clear superiority l don't see the point in a major revamp. This has been done before, of course. DAI originally did that, but didn't perform that well, leading to the current situation. BitUSD was the first I think.

It would dilute ur hive holdings as ppl converted into hbd if the price got super low. However there are several fail safes in place prior to this happening. Worst case dilutions happen and HBD and hive trade together. when the token trades back above a dollar, hive and hbd will trade differently again.

The amount of things to at need to go wrong at the same time for this is 3 fail safes and a market crash so huge that it would dwarf any in history and would cost the attackers so much more money than the hassle and the value of the attack that it wouldn’t be worth it.

Then after all that the blockchain would still just recover and carry on, with a little dilution of hive tokens at worst.

Also if it was an attack the witnesses could take evasive manoeuvres if they saw huge amounts of hbd being converted to hive during the 3.5 day conversion period

I'm looking forward to seeing how you aim to fund your retirement, it's going to be exciting. Might even motivate me. God bless HBD.

Posted Using LeoFinance Beta

I am aiming to accumulate 1,000,000 HBD over 29 years using the magic of compound interest.

I then plan to live off that interest.

I understand that there will be inflation and other issues to deal with, but I see a road and I am following it until there is no other way.

When I did the math, I needed to start with 100 HBD and grow it by 50 HBD per month.

I started with over 700 to cushion me, and I need to earn 50 HBD more so I don't have to transfer any fiat in.

This does not include my HIVE Power or any of my other investments on the blockchain.

This is HBD in action and I hope to be an example.

Posted Using LeoFinance Beta

Remember that the 20% can be changed at any moment by the witness so it would be good to have a plan B

But this is a solid strategy in my opinion and similar to my own.

Posted Using LeoFinance Beta

Well, HBD is plan B.

Hive Power is Plan A.

Leofinance is sometimes plan C but sometimes plan B

Splinterlands is plan D,

Then there's spinvest and rising star.

The plan is set but we have to continually check in to make sure that things are still working as we hoped.

I will enjoy the 20% while it lasts.

Posted Using LeoFinance Beta

Yes, my plans are similar!

I think we wont regret it

Posted Using LeoFinance Beta

Yes it can be changed at any time. However, from the position we are standing in now, it would be crazy to alter that.

Plus we should get some time locked vaults in the next hard fork (not the upcoming one but the one after that).

If we do that, then we can have a lot of things open to us.

Posted Using LeoFinance Beta

Time locked vaults - like even bigger APR for HODling long term?

Posted Using LeoFinance Beta

Depends upon what the witnesses decide. Yes it will have to be larger than just having it in savings. Hard to tell how they would adjust that.

Posted Using LeoFinance Beta

Well in 29 years, it's absolutely possible. It feels really overwhelming when I think of it. Wow, what a goal. Good luck with it.

Posted using LeoFinance Mobile

Yes, with 20% you only need 50 HBD per month.

Very do-able here on the blockchain.

Posted Using LeoFinance Beta

Am actually going to bookmark this, it is an evergreen article to read and re-read.

We are onto a beauty story here!

Posted Using LeoFinance Beta

Yes.

Hard to say but it would have to be a lot more than that if you are claiming "mass adoption". To reach that point, HBD would have to be in the billions.

But we are a long way from that at this point. We have to build more of the foundation. It is being worked upon.

On focus has to be on accumulating more HP and having the stake grow there. Plus with some new application developments, we should be able to onboard some more people, requiring HP for RCs.

Posted Using LeoFinance Beta

So I'm trying to colonize mars while the people are still trying to land on the moon...

The numbers from your article seemed surprisingly small. Reminds me what a gamble it is - but at 20% interest rate, its a gamble worth taking.

By what I am understanding, if we want to grow the HBD the way it needs to grow, we might see some extremely magical things (like doubling, or splitting) happen in our wallets.

Posted Using LeoFinance Beta

Great article as usual! Crazy to see how the HIVE blockchain does not get more credit for this and much more developing. Truly undervalued IMO and why I am restarting my accumulation!

We don't get credit because its so detailed.

You can't give credit unless you understand it.

I agree, it is undervalued.

My next target is 20,000 HP. I remember when my first target was 60!

Posted Using LeoFinance Beta

Keep growing you stack. That is vital.

And once you reach it, the next level will be 25K HP.

Posted Using LeoFinance Beta

The longer I'm here the less impressive "double dolphin" becomes.

I wonder how much of a game changer the buy with a credit card option is.

I know I want to buy irregardless of the price just to try the new feature.

Posted Using LeoFinance Beta

There are a lot of things that we were baffled by in the past yet we find out they are incredible. The foresight with some of this stuff is amazing.

We are in a strong position. Of course, that does not mean we relax. Now is the time to keep pushing things forward.

Posted Using LeoFinance Beta

At these numbers user wise, its so easy for us to double.

We should have a "bring a friend" challenge.

If your friend posts 5 articles and 100 comments within the first month you both get a bonus.

Posted Using LeoFinance Beta

Like everything, that will get manipulated and/or botted.

Posted Using LeoFinance Beta

I forget that in 2022 people don't have friends

Posted Using LeoFinance Beta

Yes, the closing of the blockchain means that someone has a control button). What do you think may follow the closure of the blockchain and how long can the shareholder be kept in the dark about further steps, or complete and irreversible bankruptcy?

Posted Using LeoFinance Beta

Yes, it looks like the truth), but there is always a meager chance for the ideology of the creator of the project. although this chance is too small. remains to believe in miracles.

Posted Using LeoFinance Beta

I dont know how the business structure is set up so I cant speak to shareholders.

The token holders are pretty much screwed. It is looking like a total loss might be in the cards.

This is why many feel it is a rug pull. Bankruptcy of the foundation might be part of the plan.

Posted Using LeoFinance Beta

One risk factor seems to be that the coin used for backing the stablecoin is subject to hype cycles and doom and gloom cycles. When in a hype cycle, its price can go up tremendously, which allows for creating a vast amount of the stablecoin. Then, when the doom and gloom cycle comes, the coin's price goes down a lot, and it's not able to back the stablecoin anymore.

The haircut rule on Hive is one big way that we can protect against this. If lots of HBD is created when Hive's price is high, and then doom and gloom times come and Hive's price is low, there wouldn't be enough Hive to back all the HBD. System collapse would happen unless HBD creation stops, which it will as soon as we reach the haircut. So, a lesson for us is perhaps to be careful about how much we want to raise the haircut. 10% seems pretty safe.

As you are saying, use cases are the most important thing. It might be that we don't need to increase the haircut rule, we just need to create more use cases, and the use cases will take care of both utilizing HBD and locking up Hive, which would result in increasing Hive's price, thus allowing more HBD to be created. A kind of a very safe way to grow.

Use cases cause holding if for not other reason than necessity. That is where value comes in.

So with HBD (as well as HIVE), we need to keep building out the use cases and having reasons for people to have it in their wallet.

One key with HBD is payment. Another is to have more options for liquidity and bonding. A third is to generate enough money to actually make it a true investment/funding mechanism.

Posted Using LeoFinance Beta

I have no idea if LUNA can even recover from this mess anymore, Seems to me like we just lost a competitor completely.

I personally think if HBD ended up being around 20-30 million liquid supply by the end of the year (not including DHF) that we'd be growing at a decent pace.

Slow and steady is always best.

Communities I run: Gridcoin (GRC)(PeakD) / Gridcoin (GRC) (hive.blog)| Fish Keepers (PeakD) / Fish Keepers (hive.blog)

Check out my gaming stream on VIMM.TV | Vote for me as a Hive witness! )

I think you are right although I am not sure we even have that. The key is going to be how many use cases do we have for HBD by the end of the year?

That will give people incentive to get a hold of HBD. A 20% APR is one use case but, as we saw with Terra, doesnt do much long term.

We need commercialization.

Posted Using LeoFinance Beta

Another one bites the dust.

Posted Using LeoFinance Beta

It is either you hangout out having coffee or drinks at some favorite spot with the developers for learning about Hive or you are putting enormous amount of time to research these things and put it as simple as possible for the community to digest.

From reading this, it tells me every little mechanics on Hive plays vital role(s), tamper with any and the chain's defense weakens.

The more we tighten up our defense mechanism the better.

Posted Using LeoFinance Beta

Nah I dont have out with anyone. You should know by now @joetunex, I am a jerk, nobody wants to hang out with me.

That said, I get it from reading what is written in the posts along with getting into the comments. A lot of knowledge there.

Posted Using LeoFinance Beta

Well done task, you are obviously putting lots of effort.

Posted Using LeoFinance Beta

It's so reassuring to know all this about Hive. And not having a pre-mine is also like a guarantee !

Posted using LeoFinance Mobile

It does remove a major point of vulnerability.

Few can say that.

Posted Using LeoFinance Beta

Very informative and timely too. It's good to know that Hive is less prone to suffer what killed LUNA

Posted Using LeoFinance Beta

Less prone but not totally invulnerable.

We have to keep the discussion going and doing what we can to defend the chain.

Posted Using LeoFinance Beta

Other excellent pieces of information, that need to be shared as much as possible in those interesting times! Thanks for this. Hopefully it will have enough convincing power off chain...

Thanks for the article! Today I was actually asking about what makes HBD different from UST, no answers yet, but no need to cos this answers all my questions.

That is what I was trying to do.

Posted Using LeoFinance Beta

After all these precautions, as a last line of safety, I believe the hive community would be able to do a big short squeeze, gamestop style, if someone tries to attack us.

We will never sell!

Kisses !BEER & Hugs 😘🍻🤗

That is tough considering the type of money that could be tossed at it if HBD becomes a serious threat.

Hard to compete with the likes of Blackrock.

Posted Using LeoFinance Beta

Sorry, out of BEER, please retry later...

Nice hive Blockchain was built to defend itself, anyone trying to short hive like luna will end up hurting himself, too many factors to be considered

There are some mechanisms in place.

We will see what else is developed.

Posted Using LeoFinance Beta

I guess as we develop as a blockchain, we'd keep taking precautionary measures against these kinds of attack. As you said, it'll get to a time when we'll be tested.

Posted Using LeoFinance Beta

Yep and Hive is known for standing up to a fight. This is how we were born so we know that if attacked, we will start swinging.

Posted Using LeoFinance Beta

This was a really great post! I like the way you laid it out and detailed it very well. As you said, many of us have probably been asking ourselves the same question over the last couple of days and this answers many of those questions. Well done!

Posted Using LeoFinance Beta

It seemed to get on the minds of some.

Posted Using LeoFinance Beta

This article is good as always ,it clear my doubt and open my eyes to see more reason why hbd if different from other stable coins , measurement as been put In place , thanks to the team

It concerns me how much Hive changes. Abandoning the 10% rule in favor of a 30% rule makes me feel less confident in HBD. The ability to change the rules has proven too tempting for witnesses. Shortened power-down time, and they already increased the 10% limit by excluding the DHF. The Hive dollar is already half way to adding haircuts right now. It might be a good idea to get out of stables while things are down, and buy up Hive or Rune or whatever.

Yea, I wonder if 30% is too high of a limit.

I remember hearing block trades talk about it on the Cryptomaniacs Podcast and it made sense back then but after this thing with Luna I'm not sure

Posted Using LeoFinance Beta

The haircut rule is about more than just limiting how much HBD gets created. Even more importantly, it limits how much Hive can be created, regardless of how much HBD exists.

With a 30% haircut rate, at most 30% more Hive can be created, regardless of Hive's price variations.

A 30% expansion of the supply of Hive wouldn't crush the price (if you think about it, Hive was designed with a base initial inflation rate of around 8%).

The haircut rule is an extremely powerful protection against a death spiral like the one that happened on LUNA and 30% is still probably overly conservative, but I think it is best to play on the safe side of such things.

Ah, it makes sense again!

Thanks for the explanation.

Posted Using LeoFinance Beta

Can adjust it every (or every other) hard fork if needed. Work our way up the scale.

Posted Using LeoFinance Beta

The last weeks happenings have made me less confident about a 20-30% haircut

So you feel that Hive got it all right the first time and should not adapt?

I find this a highly unlikely scenario.

Posted Using LeoFinance Beta

Great explanation.. I was wondering what would stop that from happening here.. #QuestionsAnswered

I don't think it is around defences it was more that UST was expanding too fast without the market to fill it. This enabled someone with a lot of money to dump UST and cause a depeg while also shorting Bitcoin. It caused a catastrophic melt down. But no doubt as always there would be plenty of winners over the next few weeks. Sad all that Luna cash is gone to someone else, wonder who ended up with the majority of it all.

Market cap of ust compared to Luna should have been minuscule. They didn’t even have this basic control in place.

Correct and then the bots kicked in and kept arbitrage which blew out Luna mint.

The OTC deal, reportedly, is also a problem.

Posted Using LeoFinance Beta

Well yup, they purchased a heap of Bitcoin with UST then the person that they bought the Bitcoin off had UST and naturally they were going to dump it for more Bitcoin. They got a premium price for it.

So when they dumped their UST to buy Bitcoin they tried to find large liquidity pools to get the cash from. Then bang. Network failure.

Posted Using LeoFinance Beta

On Splinterlands, one can buy credits with HBD, but not DEC or SPS. Maybe that use case for HBD can be added, if they don't have some legal constraints against that (because no stable coins are listed on their new pages to buy these tokens directly from their interface).

Ragnarok will provide another sink for HBD.

So, more non-yield-generating types of use cases are being developed for HBD.

Posted Using LeoFinance Beta

There are some forming. We will see some LPs from Cubfinance. Hivelist is starting to focus upon HBD and pHBD.

So we are seeing the green sprouts of it.

Posted Using LeoFinance Beta

I didn't know about it. HBD should start to be supported alongside HIVE (or on its own) by more businesses on Hive.

Posted Using LeoFinance Beta

I bought credits with Dec just yesterday

That was a smart move since DEC went below the peg. :) I assume it was valued at the peg, right?

I was saying one cannot buy DEC or SPS with HBD in the game interface (can do so on HE, but indirectly). That would be another sink for HBD. It is important to develop an economy around HBD, not only around HIVE.

Posted Using LeoFinance Beta

i had my questions, and now i understood most of the answers, at least the ones i did not know. we were talking about this yesterday on discord.

Just wondering, but wouldn't the HBD in savings still generate HBD regardless? I don't think it's programmed to dish out Hive? I guess author payments can be converted into Hive without any issues though.

Posted Using LeoFinance Beta

Yes HBD is Savings does get paid out in HBD. The posts will be all in liquid HIVE (except for the HP part).

Posted Using LeoFinance Beta

It took a bit of thinking but I do understand your points and am now much happier to continue with Hive than I was before I read your post. Thank you for the reassurances and lesson.

Posted Using LeoFinance Beta

There are some smart people around here who live and sleep security.

So they are continually looking at these things. People like theycallmedan is always game theorying everything.

Then you have Arcange who is obsessive about security.

Posted Using LeoFinance Beta

I've seen their stuff and they definitely reassure me

Yeah, that's what I was thinking when I was analyzing the LUNA fall. They didn't have time, so they made every possible mistake, it seems to me.

Thanks for the article, I understand the Hive-HBD mechanism more now. It's reassuring and it's really important!

!CTP

The fact that I dont think they cared to begin with made it highly vulnerable.

I would guess they didnt take the time to map out any security measures.

Posted Using LeoFinance Beta

It is true that one of the major defenses is HBD, and as you get older this may change.

But as you say, more protection mechanisms will also be created as the chain grows, since to maintain trust measures must be taken against malicious attackers.

Thank you task for such an excellent article, it helped me to appreciate the chain and those who work to develop it better.

Posted Using LeoFinance Beta

I posted another one carrying an idea. Worthy of discussion.

We need to see what options are out there for this.

Posted Using LeoFinance Beta

Thank you for explaining this in such a common and kind vocabulary. It's hard for e to understand a lot of articles that I read about crypto because I just lose the focus, my brain is much more artistic than numerical, but I really try to understand how the crypto market works; and I have a lot of interest in dominating how Hive works.

From my almost no knowledge on the hard crypto topic, I really can agree with you in the fact that Hive has a great development in its projects. And about all you explained about the HBD and Hive, I really could follow you, and understand what you said.

Anyway, I'll re-read this. I think your post is excellent even for beginners to understand where they are, and how Hive operates.

Thak you!! Have a good day!

Well it is a rather advanced topic for Hive. There are many other basics for newer people to understand.

However, getting exposed to different things is always good.

Posted Using LeoFinance Beta

Always come to check on what Taskmaster is saying when I don't understand something going on on the HIVE Blockchain.

Like two typos but all corrected now. This is vital information! If you didn't get it then read it again. Good post!

No problem. It is always good to have another set of eyes on it.

All that was corrected.

Posted Using LeoFinance Beta

This is a real nice overview of the mechanisms. Thanks for summarizing it so clearly! From every incident the other projects learn. When the steem drama happened everybody learned a valuable lesson. Today with the whole Luna issue, other projects learn. It’s great to see that for hive-hbd there are plenty of safety measures. But indeed as uou said there will be possibilities to further work on security.

Either way, the Hive project looks really solid and I’m quite confident to be involved in this one :-)

Posted using LeoFinance Mobile

These are conversations that need to take place.

Posted Using LeoFinance Beta

Your posts are real kickstarters for these ;)

Posted using LeoFinance Mobile

feeling much better about our little corner of the crypto-verse after seeing how others are imploding at the first sign of turbulent markets :)

You bring up a valid point. If a project is not able to withstand the bear market and some attacks, what good is it.

When the idea goes out, we find out who is truly wearing a bathing suit...and who is bareassed in the wind.

Posted Using LeoFinance Beta

Hive and HBD always best to compair other crypto. I know hive will change my life

It is changing the lives of many already.

Posted Using LeoFinance Beta

Yeah but HBD can destabilize also. I see no difference only some different parameters.

( i only look at quality at the stablecoin)

If on Haircut limit and market drop 50%, HBD token loss 50% in value.

will someone convert here? probably not.

Hold?

market drop more? Who bails out? Nobody. A same result like luna with the difference it doesn't damage that much underlining asset.

The underlying asset ( hive) gets shredded on a slow and long drop

Our Attack vector is hive price. If we have for example 1 Billion HBD and Hive is at 10$ + ( increased HC limit to 25%).

Or 40$, what you like more. If price drop 50% at this point HBD is dead. Trust is gone. And a death spiral because of lost trust would also start.

Where is here any difference?

It is completely different from LUNA, it's not a matter of parameters.

With a 30% haircut ratio, it is only possible to add 30% to the supply of Hive, no matter what price Hive drops too, because the haircut causes the peg to break. So you can't generate a death spiral.

We predicted and patched the flaw that crushed Luna many years ago.

In super short, if hive price falls who pays the debt?

The HBD holder.

How can this scale in the volatile crypto tech space?

The HBD holder assumes the risk of a peg break in the event of a catastrophic fall in the price of Hive, assuming they don't exit their position before the haircut rule kicks in. But investors in HBD can monitor the risk level (i.e. how close HBD is to the haircut ratio and how much they think Hive may drop in price) and make an informed investment decision.

And it's not like a collateral-based system doesn't imply the exact same risk, unless the collateral is the same as the underlying stable coin.

And even if it is, then you have third party risk. For example, say someone is promising to back to a USD stable coin with real dollars (ala Tether). What happens if those dollars disappear?

All investments have risks of one sort or another. Personally, in the crypto space, I think HBD is one of the safer places to invest for predictable returns and I've taken advantage of it several times in the past (currently I think Hive is more attractive at current price, however).

For now 20% are sustainable.

For now haircut is fine.

For now everything is ok.

Is only the scaling problem that adds an unpredictable factor in. At some Scale Reputation risk will become the same as HBD would drop to zero.

Social and finance need a as much as the possible secure backbone. Because Social alone is a big topic.

And Stablecoin alone too.

One can break the other in many ways and open a death spiral caused of other reasons ( bad press).

That are problems on bigger scale.

For now 1M HBD would be absorbed. I think even 10M in a medium to bad market with time if someone would go full degen.

But 100M to Billions?

Maybe you get downvoted for calling people satanic pedophiles x)

Well, also downvoting people who answers your questions doesn't seem like very produtive way of going around things xD @world-travel-pro

Great to know our funds are safe in the Hive Ecosystem due to these defenses in place. Thank you so much Task for this wonderful aggregation of all of them in one place. A huge shoutout to @dalz for providing us with the numbers and giving more clarity on how all of this works. It's complicated but interesting and most importantly necessary for security reasons.

Screw the death spiral!

Posted Using LeoFinance Beta

@dalz provides a terrific service by delving into the numbers and keeping up updated on different areas that are important to the chain.

And yes, we are safer but not completely safe. There are always points of vulnerabilities. We just have to work on shoring them up.

Posted Using LeoFinance Beta

So you want to take away a defense 😂(only joking)

Personally I don't mind the 5% fee, or 3.5 day wait. It's all part of the way things were set up to make Hive safer, as well as building with the future in mind. Security is rarely free.

As shown by UST, liquidity comes so that is one area you have to prepare.

One area that wont change is that Hive could always be a bit of a challenge to get a hold of in large numbers. This helps to reduce the point of vulnerability.

Posted Using LeoFinance Beta

I think if anyone really started working to acquire a huge amount of Hive or HBD, it would put the community on high alert. A call out to hold onto your Hive could be done to rally the troops.

!PIZZA

This is one of your best articles so far. I was thinking of writing about the mechanics that make HBD superior and more secure than UST. It is a pleasure to see that you have written it already.

Terra has proven that they were never a proper decentralized project now with their shutting down. I remember @jacobgadikian saying he could not shut down BLURT after it launched even when he wanted to. That is true decentralization.

I had some faith left in Terra. It has gone down the drain after shutting down the blockchain. I'm open to trading LUNA and UST for quick profits/speculation. Long term investing on the other hand is simply out of question.

!PIZZA

!LUV

Posted Using LeoFinance Beta

@vimukthi(1/1) gave you LUV. H-E tools | discord | community | <>< daily

H-E tools | discord | community | <>< daily

There is little out there that is truly decentralized. We see the same with distribution.

So we have to build upon those which fit the description. Hive is doing a solid job.

Posted Using LeoFinance Beta

Unfortunately, I realised the true value of HBD later, in fact I was moving almost everything to HBD from UST.

I am sorry for the hit you took.

Glad you know about it now. With activity on Hive, you will be able to fill up your HBD holding.

Posted Using LeoFinance Beta

thanks for the good explanation! Now my faith in HBD saving has grown a lot.

I am glad but that does not mean we are in the clear. There are still discussions we must have and people looking at protecting even more.

This should be an ongoing process.

Posted Using LeoFinance Beta

Very valuable information there. Inspired me to stack and stake Hive!

Posted Using LeoFinance Beta

Nice. Helped solidify some of my understanding. One of the only good things about this death spiral for LUNA is maybe other algo stablecoins will look and learn (HBD especially). I feel we are already ahead of where they were and more prudent in general.

However, any algorithmic stablecoin has a majority of it's risked baked in by the fact that it is an algorithmic stablecoin :-)

Designing algorithms for any eventuality is near impossible, especially when you involve greedy humans who are extremely creative in finding ways to make some money. No one can design a foolproof safe, but you can design one that is so hard to crack that most safecrackers give up :-) Then you only have to worry about the genius, obsessed safecracker and track that person like a hawk.

Bad analogies aside HBD can and should use this as an opportunity to reassess and shore up defenses.

Posted Using LeoFinance Beta

No different than most other things. In the end, it all comes down to use case.

While financialization is often focused upon, the ones that will stand up are going to be those that have enormous use cases.

After all Soros brought the British Pound to its knees too.

Posted Using LeoFinance Beta

HBD roadblocks and mechanics put in place to ensure its survival adds trust in this relatively limited supply stablecoin. While there is always a risk, I feel safe with HBD compared to other options.

Posted Using LeoFinance Beta

It is impossible to eliminate all points of vulnerabilities. However, we can make it very difficult to pull something off.

Attackers often are all about the "low hanging fruit". Make it too tough and they will move onto something else easier.

Posted Using LeoFinance Beta

It's great to know all these info from here. It's so comforting to learn how HBD has been built. My respect to the devs behind these measures and everyone who took part during its building. That explains its strength even during these challenging times. And I believe the developments don't stop there and we will see more. Hive is humongous and I'd like to believe that it isn't easy to take it down.

Posted Using LeoFinance Beta

They do keep going an expanding. That is what is key. Builders are what make winning projects.

Posted Using LeoFinance Beta

That indeed is what makes the projects keep going, the continuing expansion, innovation.

Posted Using LeoFinance Beta

I think as you already mentioned, the major problem LUNA has is limited use cases. That alone places Hive waaaaaaay ahead and drastically reduces the risk of us having the same fate.

I had no idea the absence of a lot of liquid HBD was protecting the system. That's a new lesson learned.

I also don't understand what an algorithm stablecoin means.

Posted using LeoFinance Mobile

It means that the coin is not backed by a Treasury holding of 1:1 in an asset like the USD. The backing of HIVE is done via the coding. It is not asset backed.

If you understand that the risk is a lot of HBD being acquired and then converted to a ton of HIVE, which is what happened with LUNA/UST, that will cause a massive expansion of HIVE which would crash the price. Of course, that kills the peg.

Posted Using LeoFinance Beta

I was also made to understand that Luna didn't have the kind of staking abilities as Hive does with HP.

Posted using LeoFinance Mobile

This was a fantastic article. I encourage others to sound react to it in posts and link to it so it will rank well in google because there will be a lot of people looking it up as they learn about the success of hive during this crash. This is a great resource. I would actually edit the title to just say "How Is HBD Different than Terra Luna?". (Keywords in the front of the title is rule 1 in SEO)

Posted Using LeoFinance Beta

This is what a defense should look like, predicting and countering where attacks would come from.

The sole aim is to keep building and standing tall when the time comes and fulfilling our duty when the trust is given.

To whom much is given much is expected.

It is good to plan ahead.

Posted Using LeoFinance Beta

Thank you for this I was snooping around a bit getting some answers but this clears up a lot of the questions I had about the stable coin HBD and how it's different from UST.

Posted Using LeoFinance Beta

There are parameters in place with it.

We are now seeing how security is always an issue.

Posted Using LeoFinance Beta

The world NEEDS to see this. Then, just maybe, Hive will get the attention it deserves.

This is without a doubt some top notch work, everyone needs to see this, people in Hive and outside of it. 💰

Sorry, out of BEER, please retry later...

~~~ embed:1525149130871513088 twitter metadata:M3NwZWFrb25saW5lfHxodHRwczovL3R3aXR0ZXIuY29tLzNzcGVha29ubGluZS9zdGF0dXMvMTUyNTE0OTEzMDg3MTUxMzA4OHw= ~~~

~~~ embed:1525199160110198784 twitter metadata:YWphbmFrdV9iYWVrfHxodHRwczovL3R3aXR0ZXIuY29tL2FqYW5ha3VfYmFlay9zdGF0dXMvMTUyNTE5OTE2MDExMDE5ODc4NHw= ~~~

~~~ embed:1525246554034118662 twitter metadata:S2VubnlDcmFuZXx8aHR0cHM6Ly90d2l0dGVyLmNvbS9LZW5ueUNyYW5lL3N0YXR1cy8xNTI1MjQ2NTU0MDM0MTE4NjYyfA== ~~~

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

PIZZA Holders sent $PIZZA tips in this post's comments:

vimukthi tipped taskmaster4450 (x1)

@honeysaver(2/15) tipped @taskmaster4450 (x1)

wrestlingdesires tipped taskmaster4450le (x1)

Join us in Discord!