Do you recognize this guy?

Source

Of course you do. It is Peter Schiff, noted gold bug and Bitcoin hater. He is also an uber-inflationist. This guy, along with the likes of Jim Rickards, have been touting inflation for decades. Of course, the reason, according to them, is all the "money printing" by the Central Banks is going to kick off hyper-inflation.

The question is always when?

Do not worry. It is going to happen any day now. Just give it time. The Fed is "printing money" so it will happen.

This is their rhetoric and, sadly, many believe it. Money printing does not lead to inflation in the USD. That was proven over the last 40 years. Forgetting much of that time, where the US ran growing deficits, just look at the 2010s when Central Banks "printed" $23 trillion.

You would think that was enough to really set things afire.

The other day I wrote a post detailing how the Fed could not win in their battle for inflation. In it I outlined what the Fed was facing and why.

In the comments, I got this reply from @ew-and-patterns.

On the surface, this all sounds really bad. So let's us parse through it to see what is really taking place.

In other words, let us truly find out what is "Beyond Stupid".

CPI

The first assertion is about the validity of CPI. In fact, two of points relate to that.

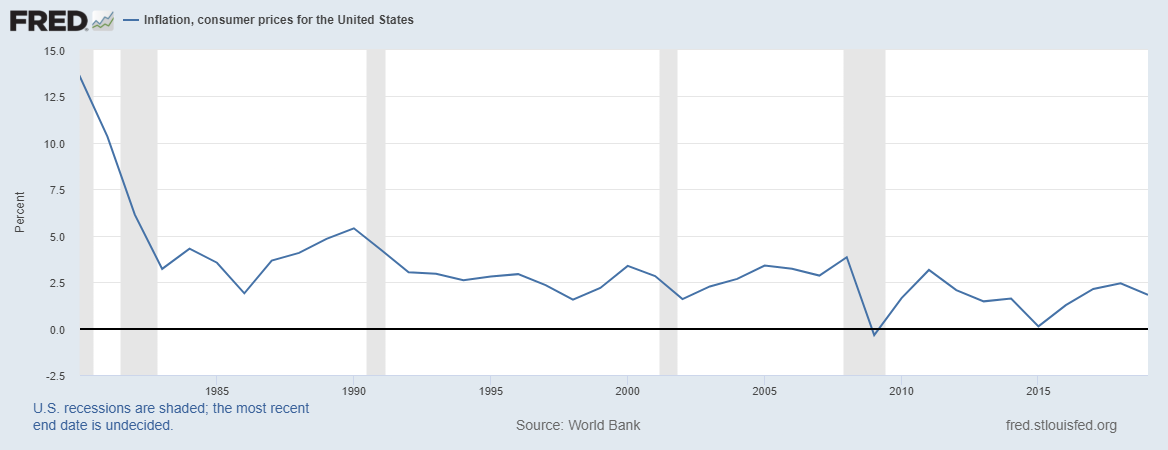

To truly frame it, we have to look at the two charts from that post which it most likely pertains to.

First, we have a graph that applies to the United States.

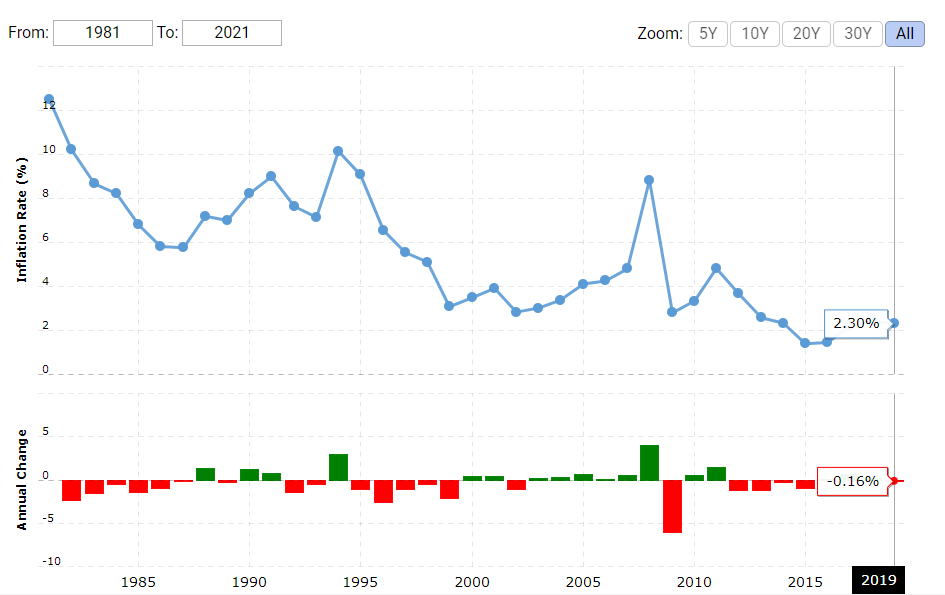

Next we have one that reflects the same thing on a global scale.

Now let's look at the first statement:

CPI data is fabricated and the goods chosen for a "nmormal consumer" are ridiculous.

So here we encounter the first tactic. A statement yet where is the proof. Simply because someone says something is fabricated does that make it true? Not necessarily. It also does not make it untrue either.

Yet we just have a statement about a widely following metric.

Of course, it is not the only one; more on that in a moment. However, even if we believe the raw numbers are way of, made up if you will, the trend is hard to deny. Let us presume those numbers are off by an order of 2x, and they CPI rate is double what they claim, that would not negate the trend.

Hell, have fun, triple or quadruple the percentage. The result is the same.

But perhaps we can't believe that because it is a state put out by governments and Central Banks.

Another Metric

looking only at CPI data for inflation measuring (even if you believe the bullshit numbers) is beyond stupid.

Agreed. Looking at inflation based solely on this metric is "Beyond Stupid". So is there something else that is out there which could apply?

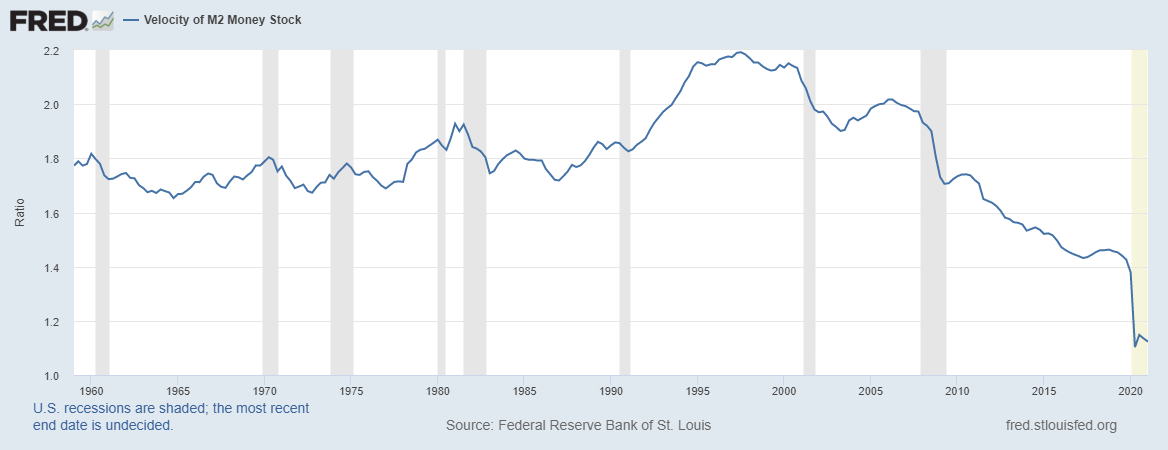

Fortunately, we have something. For inflation to take place, money has to flow through the system. If money is stalled, it cannot take place, especially at the hyper-inflation level.

.png)

source

As we can see the velocity of money, which means the number of times one unit of a currency (in this case a dollar) travels through the system in a certain period of time, has not fared well. For the past 30 years, the VOM has slowed to an outright crawl.

Of course, the lockdown of the global economy as a result of COVID sent things flying off a cliff. The pace got to one.

This is done on a quarterly basis.

The problem is that in spite of all the "money printing" but the Fed and other Central Bank as well as the Biden Bucks, things are not looking so hot.

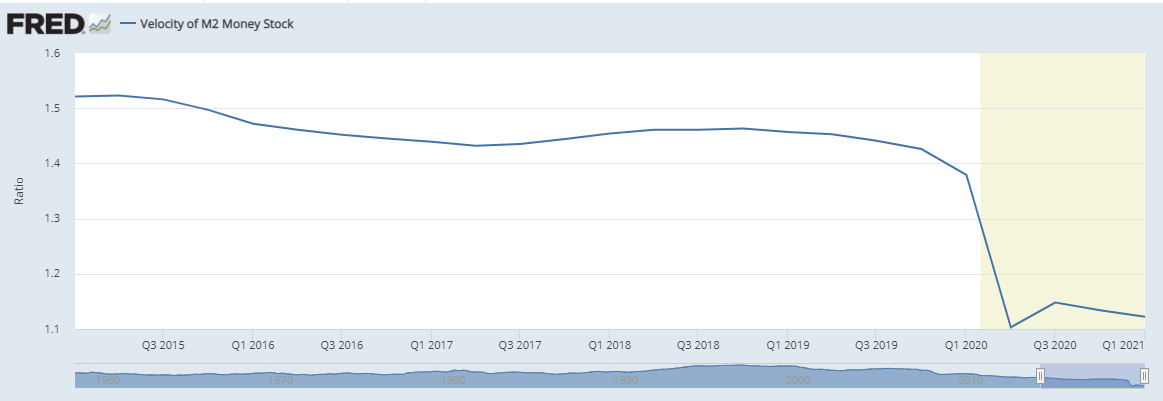

Here is the same chart blown up to show the last few quarters.

There was a jump during the 3rd quarter after a devastating 2nd quarter. Yet, despite all the easing, the trend resumed. It had a jump and now had two consecutive prints that were lower than the previous quarter.

Could this reverse? Sure. However, the long term trend is down, which is not inflationary.

This data supports the CPI in that the VOM is not pushing prices higher.

Do you really believe that asset price inflation and raw material inflation are irrelevant?

We will take this one in two parts.

Raw Materials

Do I consider raw material inflation irrelevant?

Not if it exists. The question is do we have that? Sure we see the media tout things such as lumber, iron ore, and steel, all of which ran to all-time highs. But where do we really stand.

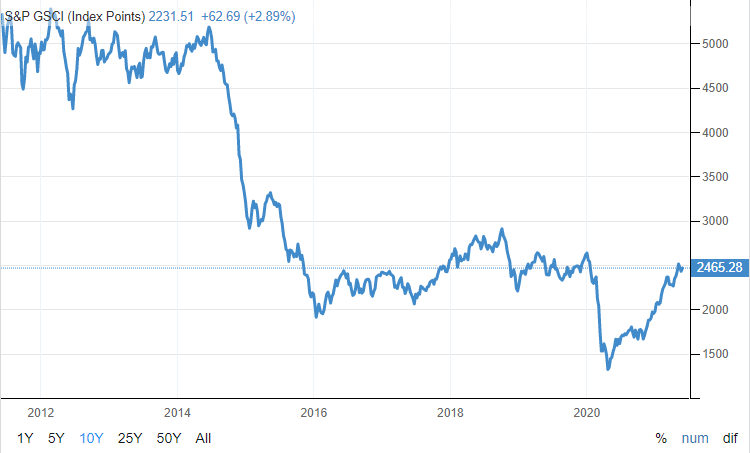

We start this analysis by looking at the Goldman Sachs Commodity Index (GCSI). From the website we get this:

The S&P GSCI is the first major investable commodity index. It is one of the most widely recognized benchmarks that is broad-based and production weighted to represent the global commodity market beta. The index is designed to be investable by including the most liquid commodity futures, and provides diversification with low correlations to other asset classes.

Here is what that chart looks like over the last year.

Well that looks pretty bad. Guess that is the case. Although this is a one year chart. How do things look over a 10 year time frame?

That provides a completely different picture. Notice how we are far below where we were in 2014 and by a significant margin. In act, we sill didnt reach the point we were at before COVID hit.

Let us step back even further.

Tells a completely different story. Even after the run up from the lows in April and May of 2020, we still are only at the level we were in the early 1990s. We saw a run up for about 19 years before having a more than a decade of price decline.

So no the increase in the price of material is not irrelevant; it is simply not happening across the board over the long term. And why is that?

With commodities, the higher prices are, the more incentive there is to drill, grow, chop down, or mine. As more companies enter the mix, supply increases. This is basic with commodities.

At the same time, technological advancement is taking place within agriculture, mining, and drilling. Over time, this produces more of whatever the commodity is for less money.

Here is the link to the site for this chart. You can pull up many different commodities from agriculture to energy to precious metals. If you do that, you will find that most are at a pricing level of where they were 7-14 years ago.

Asset Pricing

This is one of those situations where people have to change the narrative.

Here is the deal: increasing value of assets is a good thing. That means wealth is growing. Does anyone really think the increase in one's portfolio is stocks is a bad thing? How about the value of your home?

In fact, when we look at home pricing, this is often confused to the nth degree.

Almost 2/3 of Americans "own" their home. Well they don't rally own then because 9 out of 10 are financed. This means there is a mortgage against the property.

Of course, here is where the lunacy begins. If the value of the home increases, that means the equity goes up. That makes the asset worth more to the owner as compared to before. But here is a major question: what happens to the mortgage payment? Unless it is some type of variable mortgage, it stays the same. Hence, we see the homeowner is actually coming out ahead in this instance.

And this is a situation we see taking place right now.

The challenge with assets is they tend to go up and down. So the narrative that inflation is evident by looking at the stock market or housing is misguided because they can pop at any moment. In fact, it is likely we see a correction in housing within the next 12-18 months since we have a bull run that is already over a decade long.

Does that mean that nothing is more expensive? Of course not. There are many things have that gone up of late although we have to keep it in perspective. Much of what we are seeing, the inflation print that the Fed is getting, is due to a supply chain disruption. When the global economy is shut down, we end up with shortages. This drives prices up.

Here is a copy of the Fed's statement from last month.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world (emphasis added). Amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement (emphasis added). Inflation has risen, largely reflecting transitory factors.

Giving Timelines

The biggest problem with this discussion is those who take the other side of this argument never give any specifics. They just blurt out accusations and say "we are going to get (hyper)inflation". No timeline. Nothing.

As we can see here, we are seeing prices move up over the recent term in both commodities and the CPI. The Fed finally is getting some inflation. I bet they are very happy.

The problem is that they know it is short-lived. Supply chains eventually do reverse. This inflation is not caused by monetary policy but rather economic disruptions that obliterated productivity. Over time, that will turn around.

How long will it take?

That is hard to say but I stated in the past I would not be surprised to see the commodity bull rage into 2023 and maybe even 2024. That sector usually takes about 18-24 months to reverse the supply equation. Thus, we could see the charts where the prices go higher.

After that, expect a typical commodity reversal. If that does not happen by 2024, then look for technology to really kick into overdrive as high prices pull in a lot of new innovators. That will obliterate things by the middle of the decade.

As for the Velocity of Money, it might improve to where it was before COVID, to about 1.4 or so. Even with that, it will still be down from historical norms by a wide margin. The money is not flowing through the system like it us to. The Fed backed themselves into such a corner, there is a liquidity crisis.

Maybe in another post I will delve into why there is not enough dollars out there, which is causing the Fed to fail in all their attempts at stimulating things.

For now, do not buy into inflationism. It is taking on the aura of a cult or a religion at this point.

Any bouts we see will be offset within a couple of years. Deflation is still something the Fed is battling and, quite frankly, are losing against.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Great article! Have you read the book The Truth About Inflation by Paul Donovan? Worth it!

This is so freakin good especially since just the other day I was starting to dig into inflation and trying to better understand it. Everyone's running around screaming inflation but I haven't really seen it happen besides on some products but that's really just supply/demand at the moment which will cycle out here in about a year or less.

I tend to like to look into stuff more and get the details and facts instead of just jumping on board with what other people are screaming. More times than not it's the opposite of what they are yelling lol

Posted Using LeoFinance Beta

Alarmists are rarely right.

Inflation is an interesting subject because so many mix it up completely. The simply fact is an expanding population with increasing wants and needs requires inflation. More money is required for investment, growth, and innovation. So while people are screaming about inflation, they are doing so on computers and other innovation that were produced by innovation, research, and entrepreneurship.

Where do they think the money came from?

The technological angle is as big a part of the equation as the economic these days. Of course, this is something that is vastly overlooked.

But I do have one question for you: if massive money printing leads to huge inflation, explain Japan. They have been printing for decades in a question to push things up and they cant. It still keeps collapsing.

Posted Using LeoFinance Beta

This is actually one of the reasons I teach my students to not be overly concerned about monopolists.

Two important things to keep in mind with respect to 'monopoly power' over a specific line of goods or services:

NOTE: Cheaper prices (and higher quality) over time due to constant innovation are, of course, a big part of the long-term deflationary trend @taskmaster4450le is pointing out in this post.

Monopolies are getting hit harder and quicker than ever before. What tends to happen is they hang onto an industry yet the industry, overall, changes. So while we can look at companies like Blockbuster and Kodak dominating their realms right up to the end, other distribution and technology cases made their realm obsolete.

Look for this in the healthcare industry as we see major innovation over the next decade. This is a field heavily protected by the institutions with the backing of the government. Yet, the technological progress will go around this, leaving many of them holding the bag.

Posted Using LeoFinance Beta

I don't know. If the velocity of money is down to 1, then that seems to me to mean that people are paying their debts and not spending money they don't have. When did that get to be a bad thing? Corporations are hoarding their cash because the economy is so effed up they need to build a cushion. You are a big proponent of the fact that technology and innovation will lead to an age of abundance. I guess I can't wrap my brain around why it's a "good" thing for our government to keep putting our country further and further into debt. We are now at a point where we have to print money just to pay the interest. How can encouraging people to put themselves into debt be a good thing for anyone (other than the banks)? To me, inflation will be a byproduct of this. If less goods are being sold but their is more paper money out there, prices will rise because it will no longer be about supply and demand of the products. Rather it will be about an overabundant supply of the currency. I don't know. I'm with @shortsegments. It makes my head hurt and I'm glad I'm in crypto. lol

Posted Using LeoFinance Beta

The velocity if money is slowing down basically due to the money being locked in the banking system that cannot be moved. When people understand that easing is really just swaps, then they begin to see what happens. All those deposits are tied up in the banking system and cannot move. Banks are then dealing with reserve instruments that they use to settle each days accounts. This is something that actually produces less money out there, further slowing the economy.

Yes credit card reduction is a good thing. However, loan reduction, overall, is not. Innovation comes from debt funding. If money is a tool of collaboration, then the economy is better served the more that is out there. In our system, which is debt based, that is the only way it gets into the economy. Someone, either individual, government, or company has to take a loan. Obviously the worst of the three is government since they tend to provide a crappy roi on anything they do.

While people complain about debt levels over the last 40 years, and they are huge, the fact is they do not complain about the largest advancement in human history. Look at all there is today compared to 50 years ago. How do you think all of that came about? Where did the money come from?

Posted Using LeoFinance Beta

I get that. The question is whether much of that advancement would have happened anyway if we had stayed on a gold-backed dollar. Maybe, maybe not. Either way, the point is moot now since we can't go back. In the meantime, it HAS led to the creation of crypto. There is a clearly defined need for an uninflatable asset/form of currency. Regardless of whether inflation is a net positive, as @edicted talks about, or not, the fact that bitcoin has gained the adoption it has world-wide speaks to it's relevance and value. There's a lot to be said for something that just is what it is with transparency and immutability as fundamental properties.

I don't know if it will ever replace anything as a currency but....it seems very likely to become a major leg in the world's financial structure.

Posted Using LeoFinance Beta

As an aside, the Federal Reserve is a private company and made over $320 BILLION in profits last year IIRC. They are the ones getting paid all the interest from our government. And whether you think they're backed into a corner or not, THEY put themselves there. And we all get to suffer for it. Obviously that is a very simplistic view, but facts are facts. They are in control of our monetary policy and their machinations over the last 50 years have definitely played a large role in why our country is in so much debt. And yet I'm sure they've probably profited in the hundreds of billions every year for at least the last 10 years if not longer. Doesn't that seem like a conflict of interest to you?

Posted Using LeoFinance Beta

Certainly they did that. The liquidity crisis in the USD is all the Fed's doing. And guess what, they will continue to make the problem worse. In fact, we are seeing on a weekly basis.

Ultimately, the Fed will crash the economy before they realize what is going on. So we know where the source of the problem is, at least on the surface. Deeper down, the real issue is a debt based monetary system which means that default is built it. There is not enough money out there to pay all the debts due to interest which starts ticking the second money is created.

Posted Using LeoFinance Beta

.

Well now we entered into a different discuss. You just went from inflation to the fate of society.

Actually what you spell out is plausible. In fact, that is the plan they are looking to enact. They showed their hand, whether out of arrogance or oversight, it is out there.

However, I disagree that will take place because the plan will fail. We are already seeing it. The entire COVID situation was meant to further enhance their tyranny. While their power base appears to have grown, it is being challenge. The vaccine thing is being rejected by large groups of people around the world. They are not having to offer lotteries to try and incentivize people to get a shot.

One of their big players, Bill Gates is starting to be attacked. Even the mainstream media, which is a part of the plot, is having to turn on him. At the same time Klaus Schwab is encountering resistance with his Great Reset that is taking place.

The other obstacle they have which they are not likely to overcome is the China situation. One of their main weapons is global warming and the idea that only a centralized, global government can fix this problem. Where they run into a problem is China is not playing along. They could give a crap. They are doing what is in their best interest which means getting as much energy as they can. They are building more coal plants than the rest of the world combined and showing no signs of slowing down. To become the largest economy, which they will probably do for a while, they will have to produce a lot of cheap energy. They know this.

Long before we get to the point where the full control apparatus is in place, they will face massive civil unrest. This is going to be much different than in the past when information was scarce and the financial resources were fully in their control. Each step down decentralized road makes their challenge a bit more difficult.

In the end, communistic/marxist systems never work.

Posted Using LeoFinance Beta

I would not expect hyper-inflation, but I think some sucker impacts.

More expensive daily basics. From food to energy.

Prices never go back, so long-term it will fuck everyone.

Hyper Inflation would be healthy because it would end up in a need of a new currency. More stable with better rules. But I'm sure there will come instruments to "save the currency".

500-year bonds or more retarded things :D

Posted Using LeoFinance Beta

If they want to protect the USD as the reserve currency, they should start issues out 50 or 100 year bonds. Get that debt out there contracted on a long term basis in USD terms.

Of course, the ECB is discussing perpetual bonds that never expire and only get paid interest, never pay back the principle. Hard to default on that.

Posted Using LeoFinance Beta

This makes my head hurt. But I think I will sleep better tonight, knowing I have crypto and the world won't end tomorrow, next week or even next month.

Posted Using LeoFinance Beta

Yep. This is why the price of gold has been relatively stable (in terms of how many ounces of gold are needed to buy a pair of work boots, a nice suit, a steak dinner, etc.) for quite a little while -- say a couple thousand years ...

Until innovation penetrates the mining of gold and creates a much greater supply.

There was a time when aluminum was the metal of the royals simply because, even though abundant, it was hard to extract from its ore form.

Posted Using LeoFinance Beta

That is so true

The CPI is a huge lie because they can manipulate things as they wish. What constitutes as actual inflation is really just a messed up number to fit their narratives.

Posted Using LeoFinance Beta

I don't understand how somebody could advocate for inflation, it just means you earn less if your wage doesn't increase accordingly

Posted Using LeoFinance Beta

Great guide and my believe and understanding after reading this ,is that it is going to be of help in managing inflation nation wide