This is a very short post to share my opinion: I expect BTC to reach new ATH today, on the 19th Oct 2021, when NYSE begins trading the ETF I posted about recently.

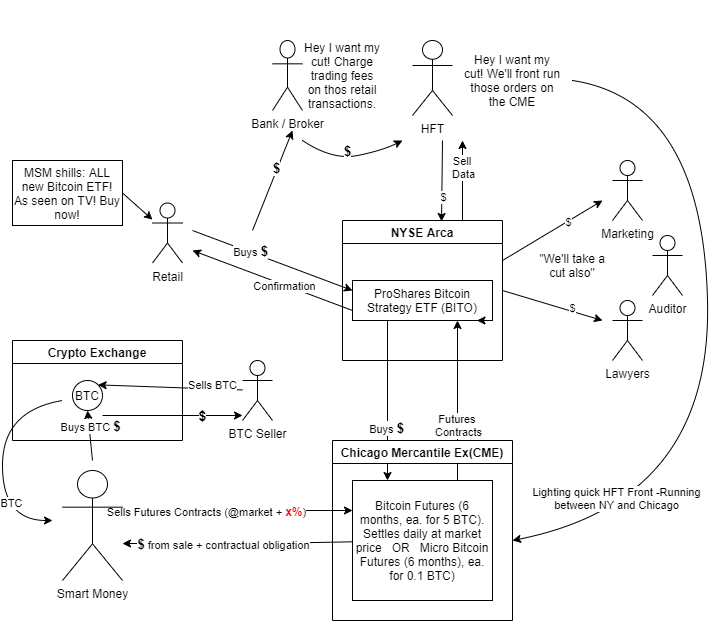

I've drawn this diagram to illustrate the money flow. I've taken liberties to add a few actors here and there. Isn't it funny that we have ETFs in NY and Futures in Chicago? Perfect for the HFT boys to front-run orders!

In the diagram, begin at the top left, with the MSM shilling the ETF to retail. The smart money captures a profit illustrated with the red +X% which is the premium they charge on the sale of the futures contract.

What they do with the money is anyone's guess but Raoul Pal argued that they could buy the underlying (Bitcoin) and at the end of the day (I suppose) sell that BTC and buy the opposite futures to liquidate their positions. So they make risk free profits. But you can let you imagination wild as to what else they can do with leverage and with the HFT crew. But I could be wrong! Maybe it will be sell the news and they'll short it aggressively. But that's unlikely. There's more money to be drained from retail and they know it. The vortex of futures, options and ETFs should match perfectly with a rise to 200K+ USD by year end.

Posted Using LeoFinance Beta

Fantastic and simple explanation

This is what we are looking for "Continuous progress"

Posted Using LeoFinance Beta

Thank you! It came off the press yesterday on my computer. I was just trying to figure out the money flowed.

Posted Using LeoFinance Beta

See image from post on Noise.cash

Posted Using LeoFinance Beta