So this has been a long time coming

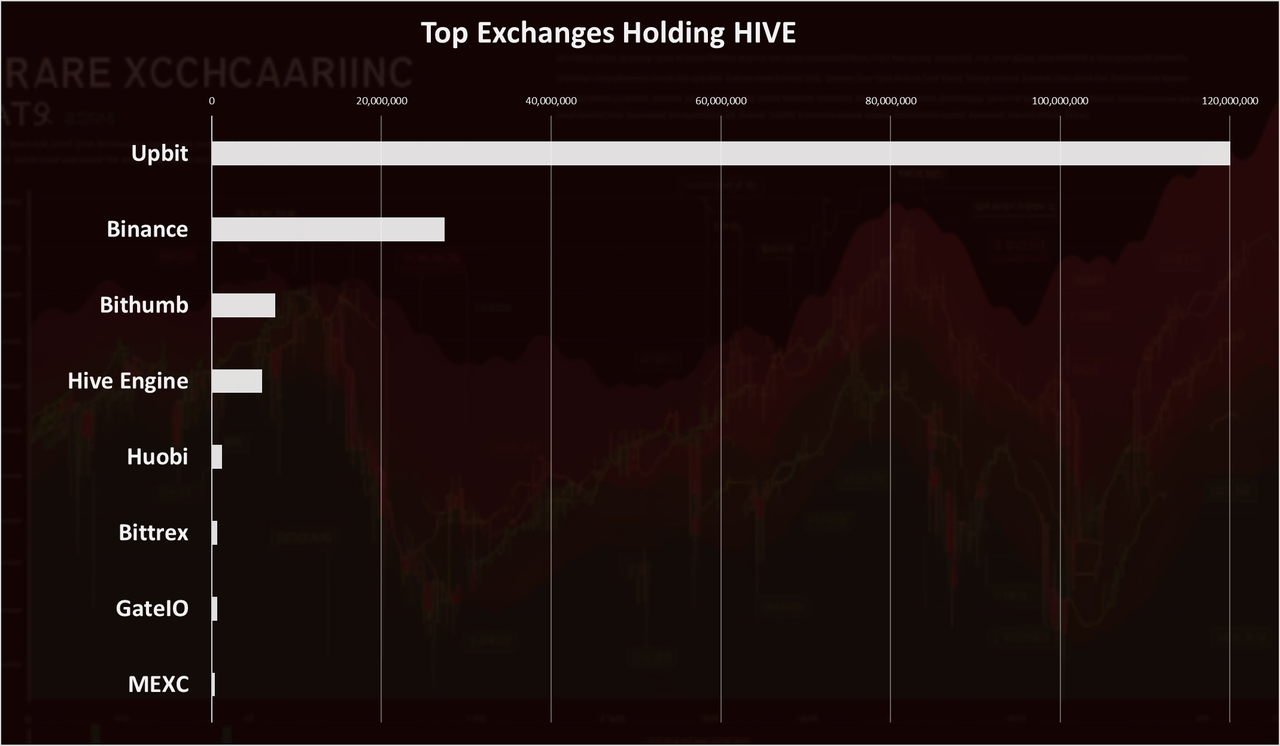

For years I have looked at Upbit's impact on Hive. The main reason of course is the immense amount of Hive this exchange holds. It is now at 29% of total supply! See this chart by @dalz for comparison:

And the alarming trend is that in just a half a year Upbit's supply increased by 20M Hive. We should look very closely at what's going on here imo. A main reason would be the potential attack opportunity this exchange could have on the network by holding >50% of the supply (of course this could be far less with other potential wallets being part of the attack). Luckily we have somewhat mitigated this risk by having implemented a 30 day voting restriction of newly powered up Hive. But it wouldn't prevent such an attack (especially if Hive wouldn't be powered up all in one go).

~2% arbitrage opportunity for insiders

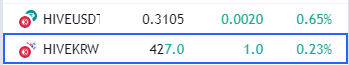

I have been looking at Hive's price on Upbit as well as Binance (which has the second highest supply) and there is a striking arbitrage opportunity available almost all of the time. The price on Upbit is often 1 cent higher there which corresponds to around a 2%+ difference in price. There are at least 2 reasons for why this arbitrage opportunity exists: Upbit is only available to S. Korans and there is not a direct arbitrage route (it requires conversion from KRW to $ and v.v.). But even so, it seems strange why this wouldn't be taken advantage of most of the time since 2%+ is a big difference.

Here we see Hive being traded on Binance for ~31 cents and around 32 cents on Upbit:

Upbit moves Hive to cold wallet in 2023

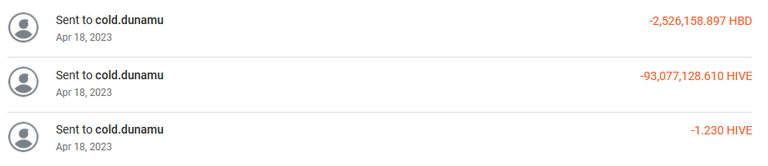

This was a big development last year. We can see that @upbitsteem (which is now inactive) moved 93M+ Hive to its cold wallet storage @cold.dunamu in 2023 (imagine if they had made a typo):

Nobody of course can confirm that the keys to that wallet are only secured offline, and it doesn't feel great having one wallet hold that much Hive. Since then the amount has grown to a staggering ~115M Hive...

Transferring these funds has caused a very obvious signal in the charts. It took me this long to make this connection, but the insanely big volume candles for Hive on Upbit ceased in exactly April of 2023 (when these funds were moved) (some of these had over 2B! in weekly volume):

The cold wallet now stores around 115M in Hive and if Upbit as a whole has around 121M, this would suggest that there are only around 6M on the exchange as of this moment. This would explain why the big volume candles stopped exactly at the time of transfer.

But there is a much more significant implication of this for me. It means that Upbit likely itself was responsible for the massive pump and dump schemes we saw until April of last year. Only Upbit would have been able to pull this off and I guess it shouldn't be really surprising since an exchange always tries to extract money from its customers.

Some of these pump and dumps had over 100% price increases and over 50% price decreases as can be seen in the highlights here (notice how the volatility stopped after April 2023):

Conclusion

The mystery who was behind these huge pump and dumps until 2023 has been at least solved for me. It was Upbit all along (which should have been obvious) and they did this since they must have made big profits along the way. The big question here is: why stop with this scheme? What triggered Upbit to move most of its Hive to a cold wallet, thereby lacking the supply needed to execute these P&Ds? My only guess at this moment is that there might have been some new regulation regarding the safety of customer's funds. What I am also wondering is if they really only used their funds in this scheme? It would have been easy to use customer's funds as long as they could buy it back...

Ultimately I actually feel that this could be a good development for Hive's price. While we will lack the crazy pumps (and dumps) in the future, price should become much more stable along the way. With organic growth this would also mean that price should go up on average.

Check out the Love The Clouds Community if you share the love for clouds!

Interesting... In addition to possible attacks, I am sure that there will be massive market manipulation from Upbit, especially in the coming months with the advent of the bullrun. Does Upbit require KYC?

@tipu curate

Upvoted 👌 (Mana: 47/57) Liquid rewards.

yes, and a S. Korean passport...

Intriguing point of view. One more thing to consider and pay attention to, from now on...

Just some extra info, fresh from the coinmarketcap oven, ordered by Volume in the last 24 hours.

Binance still has better liquidity score.

I am sure there are several auto-trading bots on Hive that move massive amount of Hive backwards and forwards from one dex to another, trying to take advantage of the price fluctuations among them.

I think the reason for that is that on Upbit they do not have fractions of KRW in the order book. This would result in higher slippage

Right. It also seems to have the interesting effect of creating and keeping the highest price among them?

There's a 30 day voting restriction of newly powered up hive? This I did not know. Of course, at my level, it means little.

Nice sleuthing!

The restriction is only for voting in governance, witness...

Ah. Thank you.

How much they have on cold and hot wallet have nothing to do with the exhange active balance ... its just funds managment... tokens in the exchange are just a numbers in their database and become acctual tokens when someone is asking to withrdaw... the balance in the hot wallet is usualy enought to have for daily operations and if needed they will transfer from cold to hot in big batches

thanks for clarifying (although I am not sure why they would call this a cold wallet- I think markymark or so also posted something back then about an actual cold wallet; however looking at the trxs it's clear that this account is rather liquid). Anyhow, I don't think it can be a coincidence that the volume and volatility stop exactly in April with this move of funds. It's very suggestive to me (at the least) that Upbit has been manipulating the market until that time and that they cannot use their funds in this way anymore (with all the exchange shenanigans it's also quite likely that they did use cusotmer's funds imo.) If you have a different idea, I am all ears :)

Hive still so young and small that this kind of things happen, it is a bit worrying but is there really something that anyone can do about it? I guess the restrictions for voting and other measures might be enough for any kind of attack, I think devs already got this into account after the Steem situation back in the day

Great post thanks for info :))

It can be like that, when there is so much holding on top of an exchange, if the selling pressure is high, the price can come down, but now the bull market has started, we will see more investors coming into the project and now. We will see the price increase.

Yay! 🤗

Your content has been boosted with Ecency Points, by @sacra97.

Use Ecency daily to boost your growth on platform!

Congratulations @tobetada! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 92000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: