Hey! 🙋♀️

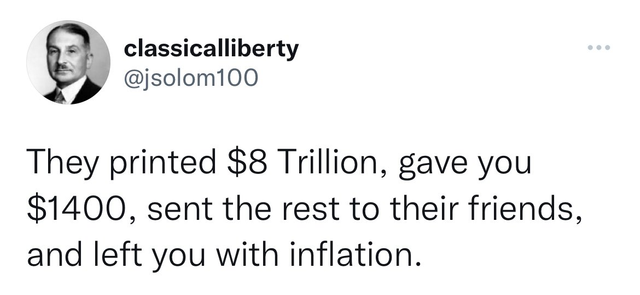

There was a story about printing too much money and helping people too much, but that's not entirely true. They say we have an inflation problem because we issued too much stimulus money and gave people so much money that they stopped working.

The majority of people weren't getting 'too much money', aside from the fact that supply chain disruptions were the main reason.

usually looks like this:

Source: ~~~ embed:1607192362870095874?s=20&t=tPdCdXKXFqdmyTnINWp3GQ twitter metadata:Vml2ZWs0cmVhbF98fGh0dHBzOi8vdHdpdHRlci5jb20vVml2ZWs0cmVhbF8vc3RhdHVzLzE2MDcxOTIzNjI4NzAwOTU4NzR8 ~~~

No one got rich on those checks.

Your fat cat companion who didn't need it at all got rich while we got peanuts. Now they are trying to hold us accountable for the problem.Will it help reduce the price of all these things?!

Fight with Inflation!

Inflation is one of the most pressing economic issues of our time, and one that needs to be addressed. Inflation is defined as a rise in the general price level of goods and services, and it can have a significant negative impact on individuals, businesses, and the economy as a whole. When inflation occurs, it erodes the purchasing power of money, meaning that it takes more money to buy the same goods and services. This can be especially difficult for people on fixed incomes, as their incomes remain the same while the prices of goods and services rise. It can also lead to a decrease in investment, as investors are less likely to put money into the economy when they know their money will be worth less over time. Fortunately, there are steps that can be taken to counter the effects of inflation. One of the most important is investing in assets that can protect against inflation. These include stocks, real estate, and commodities. Investing in these assets can help protect your wealth from being eroded by inflation, as the returns on these investments can be higher than the rate of inflation.

It is also important to save money, and to spend it wisely. By saving money, you can ensure that you have a cushion in case the prices of goods and services increase. You should also look for ways to save money on everyday items, such as cutting back on energy costs or shopping for the best deals.

There are several strategies to help fight inflation. One is to use fiscal policy, which involves the government increasing taxes or decreasing spending to reduce the amount of money in circulation. Another is to use monetary policy, which involves the central bank increasing or decreasing the money supply to control the rate of inflation. In addition, it is important to ensure that money invested to fight inflation is used wisely. This means that investors should look for investments that have the potential to provide a real return in the face of inflation, such as bonds, stocks, and real estate. It is also important to diversify investments to reduce risk.

Finally, it is important to remember that fighting inflation takes time and patience. It is important to take a long-term view and to realize that inflation is a natural process that will eventually be reversed. With the right strategies and a long-term view, we can fight inflation and make sure that money invested to fight inflation is put wisely.

Inflation can have serious negative effects on individuals, businesses, and the economy as a whole. However, by investing in assets that can protect against inflation, saving money, and staying informed, you can fight against the effects of inflation and protect your wealth.

Have a good day dear :)

Posted Using LeoFinance Beta