First published on Twitter: https://twitter.com/blockTVBee

❖ Perspective 1: Seeking Value in Change ❖

➤ From a Cyclical Perspective

BTC spent the entire year of 2023 experiencing a minor bull run, similar to the first half of 2019. After peaking in June 2019, it fell back and bottomed out in December 2019 (excluding the "312" black swan event for now).

Since the approval of the ETF on January 10, 2024, BTC has only experienced a pullback for 14 days.

Additionally, altcoins saw some increases in February and March of 2023, and again in November and December. Combined, they had an uptrend for about 3-4 months. Thus, when BTC initially fell from $48,000, most altcoins didn't follow. However, as BTC continued to decline, altcoins began to pull back.

➤ From a Price Perspective

At the end of 2018, BTC was around $3,200, and its 2019 peak was about $13,500, an increase of $10,300. The bottom in December 2019 was around $6,500, a pullback of $7,000, which is about a 68% decline (=$6,500/$10,300).

In this cycle, the low was about $15,500, with a high of around $48,500. The current pullback low is around $38,500, a decline of about 30% (=(48,500-38,500)/(48,500-15,500)). This is less than half of the previous round.

Of course, this year won't be like 2020. Emotionally, BTC's faith is increasing, and financially, ETFs will bring long-term capital inflows.

The influence of faith and ETFs means BTC's bottom won't be too low, but we can't confirm if it's the bottom yet. From a cyclical perspective, there might still be time for further decline or fluctuation.

❖ Perspective 2: Macro ❖

From a macro perspective, the current situation is very similar to the second half of 2019. There are two similarities:

First is the interest rate—both involve stopping rate hikes and not yet starting rate cuts.

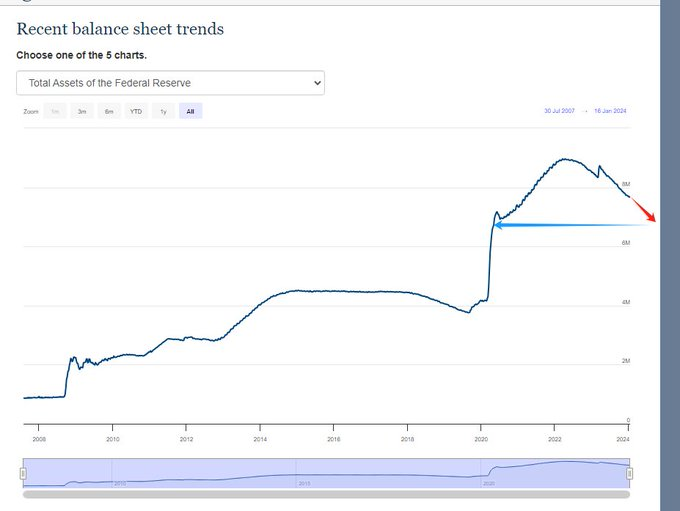

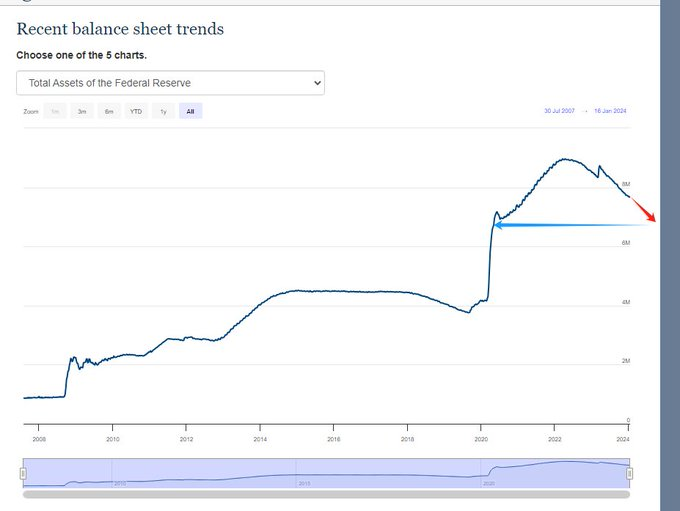

Second is balance sheet reduction—continuing the process.

However, note a significant difference. At the end of 2018, it was clearly indicated that balance sheet reduction would stop in the second half of 2019, marking the end of the tightening cycle. But currently, we don’t know when the reduction can stop.

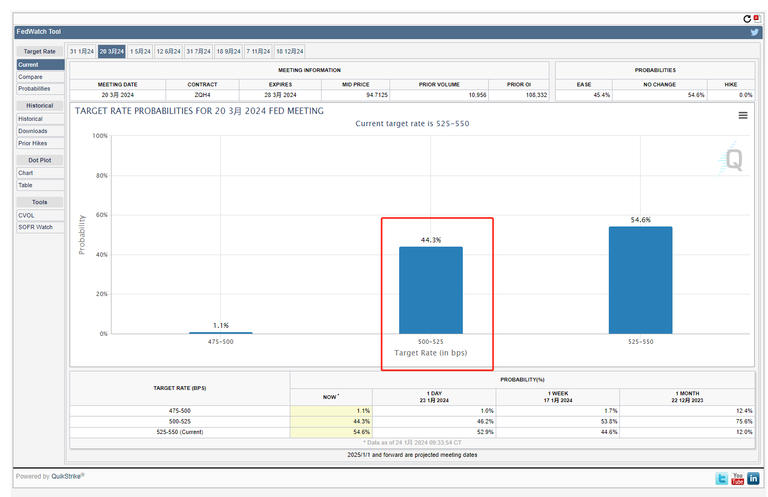

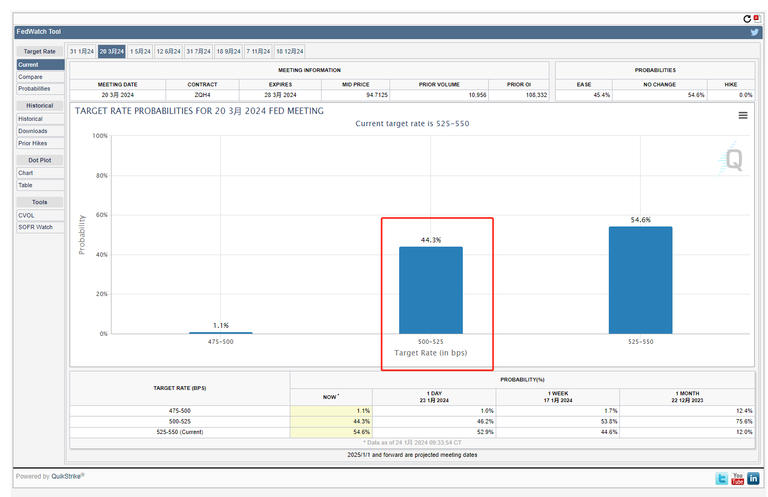

The Federal Reserve's interest rate decision on February 1st is unlikely to include a rate cut, but it might reveal some signals, like when to stop reducing the balance sheet. Additionally, the minutes of the January meeting will be published in February. These two dates could potentially shatter the expectations of a rate cut in March. About a month ago, the probability of a rate cut in March was 80%, but it is currently 44.3%.

Considering the Chinese New Year's impact on market expectations, the outlook for February might not be optimistic.

❖ Perspective 3: Halving ❖

Halving is generally positive, as explained in another article by Xiao Mi Feng, so I won't elaborate further.

In 2016, there were declines before and after the halving.

Before the 2020 halving, the market was already in a downward trend before the "312" crash. There wasn't a significant increase after the halving either.

Halving means a reduction in production, and we can view this from the perspective of BTC producers, i.e., miners. After the halving, their earnings decrease, and it's likely that BTC will enter a bull market. Therefore, miners might want to increase their mining power by purchasing more mining equipment. The motivation to liquidate assets around the halving could be to buy new mining power.

But this cycle is slightly different. The inscription system has increased miners' earnings, so their willingness to sell BTC might be less than before.

❖ Opinion ❖

➤ Medium Term

Xiao Mi Feng believes that 2024 (mainly the first three quarters) might see a squeezing and converging market trend.

Simply put, two points:

The low won't be too low

The high won't be too high

The low won't be too low, influenced by faith, ETFs, and inscriptions, which should be understandable without further explanation.

The high won't be too high, mainly due to the macroeconomic environment. In a high-interest and balance sheet reduction environment, market liquidity is limited.

Looking at just the halving expectation or macroeconomic impact might be one-sided. The 2024 market trend is likely a combination of the halving cycle and interest rate cut cycle.

➤ Short Term

BTC is indeed not expensive now, but from a point and cycle perspective, we can't be 100% sure of the bottom.

The macro outlook in February (denial of the March rate cut expectation), Chinese New Year liquidation, and pre-halving are all unfavorable factors for February's market.

Next, we should pay attention to the Federal Reserve meeting in March, as it will introduce a new dot plot, providing further predictions on the timing of rate cuts.

From February to March, watch for a confirmed time to stop the balance sheet reduction. Stopping the reduction means the end of the tightening phase.

➤ About Black Swans

A black swan event is not guaranteed.

One expectation for a black swan is that a crisis erupts at the beginning of rate cuts after a period of high interest rates, as historically seen with the 2000 Internet bubble and the 2008 subprime crisis. This cycle's peak in rate hikes is similar to 2006, and if rate cuts start in September as previously indicated in the dot plot, it would mark one year of high interest, similar to 2007.

However, the extent of balance sheet expansion this time is significant, and even with another 8 months of reduction, it would still be at a relatively loose level.

But a significant decline at the start of rate cuts is likely, not necessarily after, but possibly before, due to market expectations.

Of course, Xiao Mi Feng will leave some room for black swan events, as unexpected as they may be.

Additionally, altcoins are not entirely in sync with Bitcoin's rises and falls, so phased investing seems rational.

➤ About Bottom-Fishing

Xiao Mi Feng believes there might be two opportunities to bottom-fish:

There might be a decline around the halving, combined with the fading expectation of a March rate cut.

There might be a decline around the time of rate cuts. History shows that the U.S. stock market often falls during rate cuts (Xiao Mi Feng's subjective interpretation is that the market speculates on expectations before the rate cut, driving up stock prices, then liquidates to repay high-interest loans, and re-borrows when rates fall). This expectation seems to be a consensus among some, so be cautious of a potential drop when rates are cut.

We are currently on the path to the first opportunity.

好久不写行情了,最近行情波动明显,想聊一聊这个话题。

❖角度1:刻舟求贱❖

➤从周期角度

BTC大约用2023全年经历2019年上半年的小牛行情。2019年6月触顶后回落,2019年12月触底(312有黑天鹅,暂不考虑)。

2024年1月10月ETF通过至今,BTC仅回调了14天。

此外,山寨在2023年2-3月有一部分上涨,11-12月上涨。加一起至多有3-4个月上涨。所以BTC最初从$48000回落,山寨大部分没有跟跌。但BTC继续下行时,山寨开始回调。

➤从币价角度

2018年底BTC约$3200,2019年高点约$13500,上涨了$10300。2019年12月底部约$6500,回调了$7000,回调幅度约68%(=6500/10300)。

本轮,低点约$15500,高点约$48500,暂时回调低点约$38500,回调幅度约30%(=(48500-38500)/(48500-15500))。还不到上一轮的一半。

当然,今年不可能和2020年一样,从情绪上,BTC信仰在增加,从资金上,ETF在长期会带来资金流入。

信仰和ETF影响,BTC底部不会太低,但现在还不能确认是底啊。从周期上看,有可能还有继续下行或震荡的时间。

❖角度2:宏观❖

从宏观上看,现在非常像2019年下半年。有两个相似之处:

一是利率——都是停止加息、降息尚未启动。

二是缩表——缩表仍然在继续。

但是,注意,有一个截然不同之处。2018年底,已经明确表示在2019年下半年会停止缩表。也就是紧缩周期已经明确了结束的时间。但目前,我们不知道何时可以停止缩表。

2月1日美联储利率决议,降息是不可能的,但可能会透露一些信号。比如何时停止缩表。此外1月的会议纪要会在2月公布,这两个时间点有可能会粉碎3月降息的预期。约1个月前,3月降息的预期概率是80%,目前为44.3%。

加上春节的节日变现预期,2月的行情可能不太乐观。

❖角度3:减半❖

减半是利好,小蜜蜂的另一篇文章里有解读,不多说了。

2016年,减半前后,分别出现一波下跌。

2020年减半前,312暴跌前已经是下跌趋势。减半以后也没有明显的大涨。

减半是产量减半,我们可以从BTC生产者,也就是矿工的角度出发。减半以后收益减少,并且大概率BTC会迎来大牛。所以矿工有意愿增加挖矿算力,购买更多的矿机。所减半前后变现的动机,很可能是用来购买新算力。

但本轮略有不同,铭文让矿工的收益增加,矿工卖币的意愿可能以往更小。

❖观点❖

➤中期

小蜜蜂认为2024(主要是前3季度)可能是夹逼震荡行情,或者收敛行情。

说白了就两句话:

下也不会太低

上也不会太高

下不会太低,信仰、ETF、铭文的影响,应该都懂、不多说。

上不会太高,主要还是受宏观环境影响,高息缩表环境下,市场的流动性是有限的。

单看减半预期或宏观影响可能都是片面的。2024的行情,应该是减半周期和降息周期的影响叠加。

➤短期

现在的BTC的确不贵了,但是从点位和周期上都不能100%确认底部。

2月的宏观面(3月降息的预期被否定)、春节变现、减半前,这些都是2月行情的不利因素。

接下来要关注3月美联储大会,因为会推出新的点阵图,对降息的具体时间会有进一步的预测。

2-3月关注美联储停止确定停止缩表的时间,停止缩表意味着紧缩彻底结束。

➤关于黑天鹅

不一定会有黑天鹅。

黑天鹅的一个预期是,高息持续后降息初期爆发危机有历史记录,2000年的互联网泡沫、2008年的次贷危机都是在高息持续后降息初期爆发的。本轮加息的高点刚好和2006年差不多,如果像上次点阵图显示的9月降息,刚好高息持续1年,和2007年一样。

但是本轮扩表的幅度实在很大,就算再缩表8个月,也还是处于一个较宽松的水平。

但是,降息初下跌较大概率会出现,不一定是降息后,也可能是降息前,因为预期影响,市场可能会提前做出表现。

当然,小蜜蜂会给黑天鹅留一点仓位,说好的天鹅,当然意外情况。

另外,山寨现在并不完全同步大饼的涨跌,分批建仓是比较理性的。

➤关于抄底

小蜜蜂认为可能会有两次抄底的机会:

减半前后可能会有下跌,加上3月降息预期的消退。

降息前后可能会有下跌。因为历史显示降息时美股往往会下跌。(小蜜蜂的主观理解这个逻辑是,降息前炒预期把股价拉高然后出货还上高息的贷款,然后等利率降下来再贷出来。)并且这个预期似乎在一部分人中已形成共识,那么降息下跌一波还是要小心。

我们现在应该处于第1个机会的路上。