First published on Twitter: https://twitter.com/blockTVBee

❖ Let's Start with Some Education ❖

➤ About BTC Futures Currently

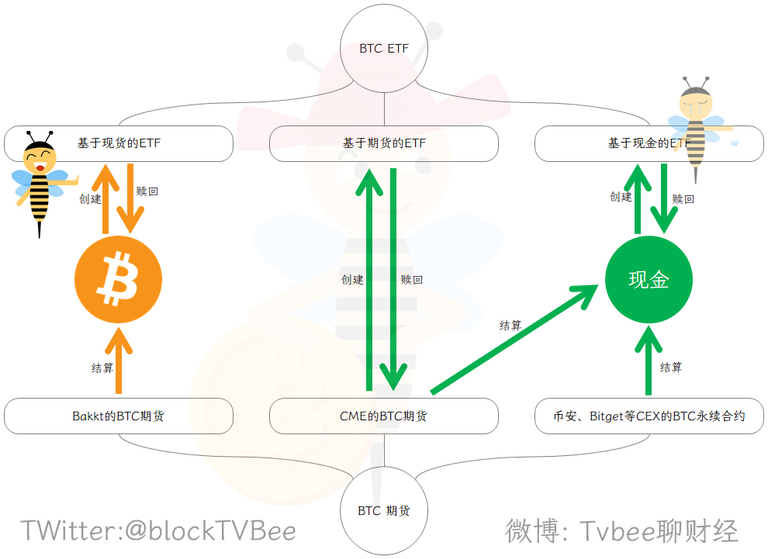

There are 3 main types of BTC futures:

The first type: Perpetual futures on platforms like Binance and OKEx.

The second type: CME (Chicago Mercantile Exchange) BTC futures, which are cash-settled, so apart from having a settlement period, they are quite similar to the first type.

The third type: BAKKT's BTC futures, which are settled in spot BTC.

➤ About BTC Futures ETFs

Most BTC futures ETFs are based on CME's BTC futures.

➤ About ETFs

ETF (Exchange Traded Fund) is a fund that trades on stock exchanges.

An ETF can be created based on a basket of assets or a single type of asset. These corresponding baskets or single assets can be referred to as the underlying or base assets.

ETF represents a part of the ownership of the underlying assets. This means that ETF products support redemption, i.e., exchanging ETFs back for an equivalent value of the underlying assets.

Therefore, ETF products cannot be issued out of thin air. Issuers need to hold an equivalent value of the underlying assets to issue ETFs.

❖ 3 Types of BTC ETFs ❖

➤ ETFs Based on BTC Spot

Many people think BTC spot ETFs are a positive development, and this view is correct.

However, some people think, "Spot ETFs and futures ETFs are different. Futures ETFs can be approved, but spot ETFs haven't been approved due to regulatory reasons. So, when BTC spot ETFs are approved, it indicates regulatory recognition for BTC, which is good for BTC." This view isn’t incorrect, but it's not complete.

Institutions like BlackRock issuing spot ETFs could be the most substantial positive development in BTC's history.

Because issuing ETF products requires holding an equivalent value of the underlying assets. Issuing BTC spot ETFs requires holding an equivalent value of BTC spot. Therefore:

BTC Spot ETF Market = BTC Spot Market

This means that large global financial institutions like BlackRock are likely to attract new BTC investors. These investors haven't participated in the existing crypto market and are more accustomed to, or restricted by regulatory conditions, to only purchase institutionally issued ETF products. The greater the market demand for BTC spot ETFs, the more BTC spot the institutions will need to hold.

Thus, large financial institutions issuing BTC spot ETFs can bring incremental capital and a broader international market to BTC spot.

The BTC spot ETF market in Hong Kong can also expand the Asian market for BTC.

➤ ETFs Based on BTC Futures

Currently, several financial institutions have issued BTC futures ETF products. However, these BTC futures ETF products are based on CME's BTC futures, which are cash-settled. Therefore, the BTC futures ETF market does not bring incremental capital to the BTC spot market.

➤ ETFs Based on Cash

Cash-based BTC ETFs are issued by institutions holding cash, and redemption is done in cash. Naturally, they do not bring capital flow to the BTC spot market.

BTC现货ETF有何不同——一图带你看懂3种BTC ETF&3种BTC期货

❖先来科普❖

➤关于BTC期货

目前主流的BTC期货包括3种:

第一种:币安、欧易等平台的永续期货。

第二种:CME(芝商所)的BTC期货,是使用现金结算的,所以它其实除了有结算周期以外,其他的和第一种差不多。

第三种:BAKTT的BTC期货,这种BTC期货是用现货结算的。

➤关于BTC期货ETF

目前,绝大部分BTC期货ETF是基于CME的BTC期货。

➤关于ETF

ETF(Exchange Traded Fund),交易所交易基金。

ETF可以基于一篮子资产或某一种资产创建,这些相应的一篮子资产或某种资产我们可以称其为基础资产或底层资产。

ETF代表着基础资产的所有权的一部分。这意味着ETF产品支持赎回,即把ETF换回等值的基础资产。

因此,ETF产品不能凭空发行。发行者需要持有等值的基础资产,方可发行ETF。

❖3种BTC ETF❖

➤基于BTC现货的ETF

很多小伙伴认为BTC现货ETF是利好,这个观点正确。

但是,有些小伙伴的理解是:“现货ETF和期货ETF不同,期货ETF可以通过,但现货ETF通过一直没通过是因为监管原因,所以当BTC现货ETF通过以后,说明BTC在监管上得到了认可,因此利好BTC”。这个观点不能说不对,只能说不够。

贝莱德等机构的现货ETF可能是BTC史上最大的实质性利好。

因为发行ETF产品,需要持有等值的基础资产。发行BTC现货ETF,需要持有等值的BTC现货。所以:

BTC现货ETF市场 = BTC 现货市场

也就是说,像贝莱德这种全球型大规模金融机构,很可能会有新的BTC投资者,这些投资者没有参与现有的加密市场,他们更习惯、或者受监管等条件的限制,只能购买机构发行的ETF产品。市场对BTC现货ETF的需求越大,机构就需要持有越多的BTC现货。

所以,大型金融机构发行BTC现货ETF产品,可以为BTC现货带来增量资金和更广阔的国际市场。

香港的BTC现货ETF市场,同样可以为BTC扩大亚洲市场。

➤基于BTC期货的ETF

目前,多家金融机构发行了BTC期货ETF产品,但是这些BTC期货ETF产品是基于CME的BTC期货,而CME的BTC期货是使用现金结算的。所以BTC期货ETF市场,不能给BTC现货市场带来增量资金。

➤基于现金的BTC ETF

基于现金的BTC,发行机构持有现金去发行BTC ETF,赎回时赎回现金。自然不会给BTC现货市场带来资金流。