KEY FACT: The United States Commodity Futures Trading Commission (CFTC) has cleared the way for options on spot Bitcoin exchange-traded funds (ETFs) by announcing it will not interfere with their clearing, following prior approval from the SEC. These options will be cleared and settled by the Options Clearing Corporation (OCC), which is expected to act swiftly in facilitating their listing. Analysts anticipate significant impacts on Bitcoin’s market liquidity and dynamics, with options providing investors with new tools for exposure management.

Image Source: CFTC

Bitcoin ETF Options Pass 'second hurdle' with CFTC clearance

The United States Commodity Futures Trading Commission (CFTC) has issued a notice that effectively clears the path for the launch of options on spot Bitcoin exchange-traded funds (ETFs). The CFTC's Division of Clearing and Risk (DCR) released a press statement on November 16, indicating that the commission no longer has a role in clearing these options. The statement clarified that the listing of spot Bitcoin ETF options "does not implicate" the CFTC's jurisdiction, as these options are cleared and settled by the Options Clearing Corporation (OCC), which serves as the sole issuer of all equity options.

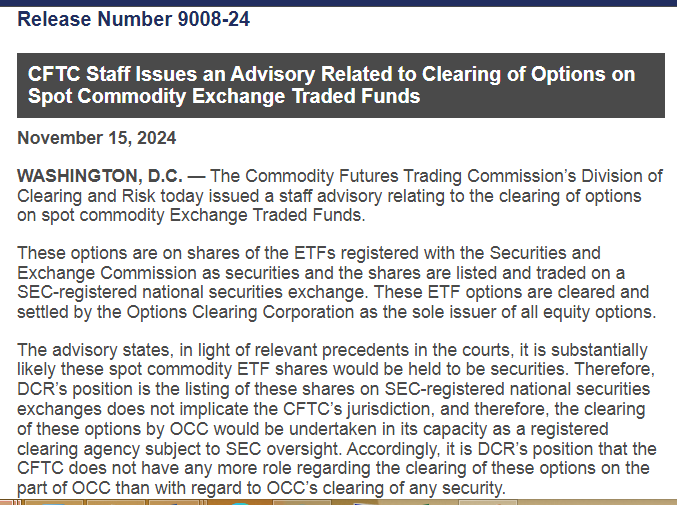

The Commodity Futures Trading Commission’s Division of Clearing and Risk today issued a staff advisory relating to the clearing of options on spot commodity Exchange Traded Funds...

These options are on shares of the ETFs registered with the Securities and Exchange Commission as securities and the shares are listed and traded on a SEC-registered national securities exchange. These ETF options are cleared and settled by the Options Clearing Corporation as the sole issuer of all equity options. Source

The statement "Release Number 9008-24" indicates that these spot commodity ETF shares would be held as securities, thus clarifying CFTC’s role in listing these shares on SEC-registered national securities exchanges. This announcement follows the U.S. Securities and Exchange Commission's (SEC) earlier approval of applications from the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (CBOE) to list options for spot Bitcoin ETFs. With the CFTC stepping back, the focus now shifts to the OCC, which is expected to act promptly in facilitating the listing of these options soon.

Industry experts and analysts are optimistic about the potential impact of this development on Bitcoin's market dynamics. Nick Forster, founder of Derive, highlighted the significant influence that large-scale options trading can have on market movements. He referenced past instances where substantial options activity led to notable shifts in market indices, suggesting that similar dynamics could occur with Bitcoin, given its fixed supply.

Image Source: CFTC

On his part, ETF analyst Eric Balchunas described the CFTC's notice as the "second hurdle" that needed to be cleared for the introduction of spot Bitcoin ETF options. He anticipates that the OCC will proceed swiftly, potentially leading to the listing of these options shortly. Similarly, James Seyffart, another ETF analyst, expressed enthusiasm about the development, indicating that the process is moving forward as expected.

The introduction of options on spot Bitcoin ETFs is expected to enhance the liquidity of Bitcoin markets and provide investors with additional tools for managing exposure to the cryptocurrency. This development could be seen as a significant step toward the maturation of Bitcoin as an asset class, its evolution as a mainstream financial asset, and offering more sophisticated financial instruments to a broader range of investors.

As the industry awaits the OCC's final approval, the anticipation surrounding the launch of these options continues to build. Market participants are closely monitoring the situation, with the potential it holds to influence Bitcoin's market behaviour and attract increased participation from both institutional and retail traders.

In summary, the CFTC's recent notice has removed a significant regulatory barrier, thus, making the launch of options on spot Bitcoin ETFs closer to fruition. With the SEC's prior approval and the OCC's anticipated action, the financial industry is poised to witness the debut of these options, marking a notable milestone in the evolution of Bitcoin-related financial products.

The Commodity Futures Trading Commission is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures, swaps, and certain kinds of options.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha

This is a welcome development, looking at it, the, if this is given a more proven attention to that allows for it actualisation then, it would bring cryptocurrency, expecially Bitcoin, and other crypto marketing to its place. Thanks for the article well informative.