KEY FACTS: Illinois has introduced House Bill 1844 (HB1844), proposing the establishment of a state-managed Bitcoin strategic reserve, requiring the state treasury to hold Bitcoin for at least five years before potential conversion or use. The bill, currently under review by the Rules Committee, is the latest among U.S. states, following Arizona, Texas, and Oklahoma, to integrate Bitcoin into financial reserves as a hedge against inflation. Supporters view it as a step toward financial innovation, while critics raise concerns about Bitcoin’s volatility and practicality. If passed, Illinois’ decision could set a precedent for state-level cryptocurrency adoption in public finance.

Source: Illinois.gov

Illinois Proposes Strategic Bitcoin Reserve with a 5-year Hodl Strategy

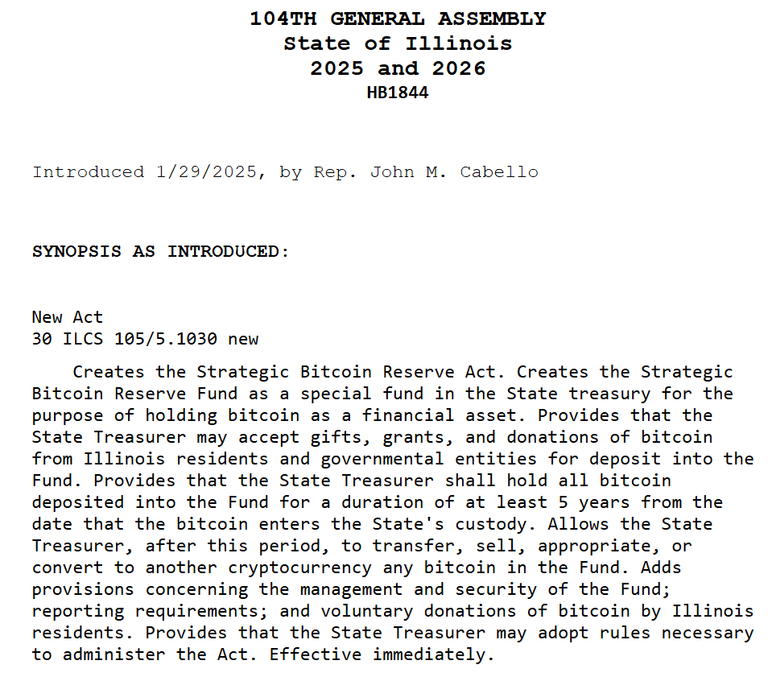

Illinois State has introduced House Bill 1844 (HB1844), proposing the creation of a special fund within the state treasury dedicated to holding Bitcoin as a financial asset. The strategic Bitcoin reserve is to be state-managed by the state treasury. The bill was introduced by State Representative John Cabello, during the 104th General Assembly on January 29, 2025. With the bill, Illinois becomes the latest U.S. state to integrate cryptocurrency into its financial frameworks.

104TH GENERAL ASSEMBLY

State of Illinois

2025 and 2026

HB1844

Introduced 1/29/2025, by Rep. John M. Cabello

SYNOPSIS AS INTRODUCED:

New Act

30 ILCS 105/5.1030 new

Creates the Strategic Bitcoin Reserve Act. Creates the Strategic Bitcoin Reserve Fund as a special fund in the State treasury for the purpose of holding bitcoin as a financial asset.

Source

A crucial aspect of the bill is its stipulation that the state treasurer must retain all Bitcoin deposits for a minimum of five years from the date of acquisition. After this period, the treasury is authorized to transfer, sell, convert to other cryptocurrencies, or utilize Bitcoin for other appropriate purposes.

As of January 29, 2025, HB1844 has been referred to the Rules Committee for further deliberation. This step is crucial as the committee will establish the final regulatory details before the bill proceeds to a full legislative vote. The outcome will determine whether Illinois adopts Bitcoin as a strategic financial asset.

Screenshot of HB1844 bill. Source: Ilga.gov

Illinois is not alone in this endeavor. Several other U.S. states have proposed or enacted legislation to incorporate Bitcoin into their financial reserves. The Arizona Senate recently advanced legislation permitting public funds and pensions to invest in Bitcoin. In Texas, Lieutenant Governor Dan Patrick announced legislative priorities for 2025, including a proposal to establish a Texas Bitcoin Reserve. Similarly, in Oklahoma, representative Cody Maynard introduced House Bill 1203, known as the Strategic Bitcoin Reserve Act on January 15, 2025. This bill aims to allow Oklahoma’s pension funds and state savings accounts to allocate a portion of their assets to Bitcoin as a hedge against inflation.

The movement to establish Bitcoin reserves at the state level is in line with national discussions about cryptocurrency's role in government finance. Proponents argue that Bitcoin, with its decentralized nature and capped supply, offers a hedge against inflation and currency debasement. Mouloukou Sanoh, co-founder and CEO of MANSA, a decentralized payment network, views Illinois' initiative as a "step in the right direction" for Bitcoin adoption in the U.S. He noted that the decision "aligns with President Donald Trump’s broader vision of creating a Bitcoin reserve."

However, the adoption of Bitcoin as a strategic reserve is not without controversy. Critics highlight concerns over Bitcoin's volatility, lack of intrinsic value, and susceptibility to cyberattacks. Lesetja Kganyago, governor of the South African Reserve Bank, questioned the merits of such a decision, pointing to South Africa’s focus on central bank digital currencies (CBDCs) and blockchain utility over Bitcoin’s use as a store of value. He remarked,

"There is a history to gold. There was once a gold standard. Currencies were pegged to gold. But if we now use Bitcoin, what about platinum, what about coal? Why don’t we hold strategic beef reserves, mutton reserves, or apple reserves? Why Bitcoin?"

As HB1844 progresses through the legislative process, it will be closely watched by policymakers, financial experts, and the cryptocurrency community. Illinois' decision could set a precedent for how state governments perceive and utilize digital assets in their financial strategies. The outcome of Illinois' HB1844 will not only impact the state's financial future but could also influence national discourse on the role of cryptocurrencies in public finance.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO