The king on the throne has always been cash when it comes to transactions, it is the most preferred option especially from a seller’s standpoint and one of its main advantages is a fast and instant settlement. It's also universal.

However, with the prevailing market conditions and rising inflations, cash is currently taking a severe beating and its value is depreciating quickly like an ice block placed in a warm room. If I stood in a warm room (say 45 Degrees Celsius) and hold an ice block on my hand, how long will it take for it to melt? Probably less than a minute.

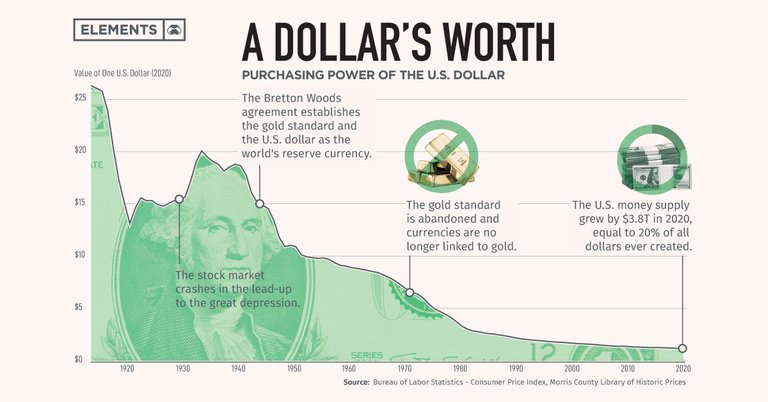

The purchasing power of the USD for almost over a century. Notice the steady decline since 1970?

That’s the reason why every time you go to buy something again after just a few months, you discover that the price has almost doubled. Why? Because the ice is melting, the currency is losing its strength.

Seen from that perspective, it’s obvious that you have to get rid of the ice block as soon as possible because holding it is a bad idea.

It Depends

So cash is not always kinging especially this current times we live in because it can’t hold its value. The question then becomes what is holding its value? If you look around, there isn’t much to find.Both stocks and crypto are down, precious metals and real estate are also down. You see red everywhere. Like Khal said in a previous post of his; we’re not only in a crypto bear market, we’re in a global bear market. Almost everything is down.

This then begs another question, if almost everything is down and cash been the most preferred means of transaction, can’t you leverage cash to purchase assets at their current low prices? We all know that being liquid gives us an added advantage on the negotiation table.

It is said that profit is made not when you sell but when you buy. How much profit will you be making if you buy assets at a discounted price? Potentially a lot!

Many people don’t venture further along this direction. They scream cash is not king and try converting all their cash. I think that’s an incorrect way of looking at things especially from a long term perspective.

You won’t find people like Warren Buffet getting rid of their cash reserves. Rather they will be liquidating some of their assets in order to have more cash so that they can go on a shopping spree. Why not? Everything is on sale.

Conclusion

Cash is not always king but it is still king. And the more you have of it, the higher your chances are of profiting from undervalued assets some years down the line.I know the markets look horrible right now but that’s just the cycle were in. Eventually, it will rebound and we will see new All Time Highs. So don’t let FUDsters make you forget the big picture. Now is actually an opportunity to build your wealth portfolio. Think long term.

Thanks For Reading!

Profile: Young Kedar

Recent Posts;

● Web 3.0 Makes You A Business

● The Significance Of The Learn2Earn Model

● Living The Dream TOO Early

● Developing Financial Integrity

Minnow Support : @cryptothesis

Posted Using LeoFinance Beta

Congratulations @young-kedar! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 30 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

- It is said that profit is made not when you sell but when you buy. How much profit will you be making if you buy assets at a discounted price? Potentially a lot!

I agree that profit is made when bought. The key is to buy any asset at the right time and have the discipline to hold the asset until the right time to sell. Focusing on assets that pay dividends will encourage the investor to hold the asset through the ups and downs of the market. Rental property; dividend stocks; crypto with airdrops and liquidity pools are assets that encourage long term holds. And a shout out to @cryptothesis for pointing me to your articles. Keep up the excellent posts!

Rightly said! You have to buy and hodl the profit generating asset(s). That's the right incentive to keep hodling it through thick and thin.

Thank you for the support! I appreciate it :)