Two nights ago, I downloaded the Ark Invest Big Ideas 2025. I forgot the reason why I missed the same report in 2024. The first time I stumbled on Ark Invest Big Ideas was in 2023. I wrote about it in my series of articles about Digital Assets Vision 2030.

In that article, I utilized two graphs showing the positive prospects for digital assets. Among diverse types of digital assets, NFTs are recognized as receiving much attention. Moreover, it was considered good that in the NFT space, speculation in gaming has been replaced by a focus on art, collectibles, and utility.

Overview of Ark Invest’s 10 Big Ideas for 2025

Two years later, I am writing now a follow-up post about the findings of Ark Invest when it comes to innovative ideas in 2025. In the table of contents, you will see 10 of these big ideas for this year, and they include the following:

AI Agents

Bitcoin

Stablecoins

Scaling Blockchains

Robotaxis

Autonomous Logistics

Energy

Robotics

Reusable Rockets

Multiomics

AI Agents is now trending even here on Hive. For the past several weeks, I have been encountering Hivians, especially coming from the InLeo community, publishing articles about this topic. Bitcoin appears old news to many, particularly to those who have been in the crypto space during the early years. The other six big ideas, especially multiomics, appear strange to me. Though I like robotics, perhaps because of watching films on Netflix like “Better Than Us,” I am impressed by the potential of the utility of robots in improving our lives. However, my interest is more in stablecoins and scaling blockchains.

The Role of Smart Contracts in Scaling Blockchains

In this post, I would like to start with scaling blockchains. The researchers committed 14 pages of the report for this specific topic. Browsing the report, you will not be surprised if much attention is given to Ethereum and Solana.

Reflecting on the report, the more I understand these two prominent blockchains, the more I appreciate what we have here on Hive. It is as if Hive is nonexistent to the researchers of Ark Invest.

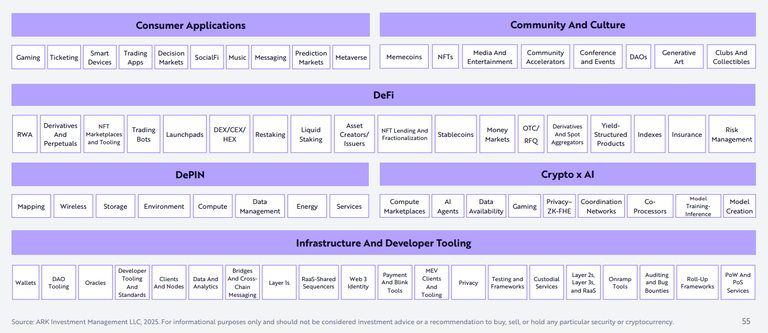

Discussing scaling blockchains, the first sub-topic discussed is about smart contracts. The growing complexity of the digital asset space has been recognized. Addressing this situation, smart contracts play a significant role that driving innovation in other fields or sectors, such as applications like GameFi and SocialFi, derivatives, and other decentralized networks related to wireless connectivity and energy storage.

I find the table below very impressive, showing such a growth in the use of smart contracts in the increasing number of spaces. I find DeFi most notable due to the 18 existing categories under it. I don’t even know what a HEX is. I only heard about DEX and CEX. DePIN too is something new for me. Under Crypto x AI, AI Agents are still a new topic for me. I have zero knowledge of what Privacy-ZX-FHE is.

And so, the above table shows the expanding role of smart contracts in various industries within the digital asset space. Within Hive, the first time I read about smart contracts was October 23, 2023, when @vsc.network introduced the idea of bringing it to Hive. Since then, it was only two days ago that I read about its most recent update. @edicted published an article where he shared about the potential of VSC interoperability on the Hive network. For him, this will reduce onboarding difficulty and will benefit Hive, resulting from the increasing number of users. Smart contracts play a significant role in such interoperability, and @vsc_eco is confident that Hive will “become the ultimate hub for interoperability” (Source).

Ethereum vs. Solana: The Race for Scalability

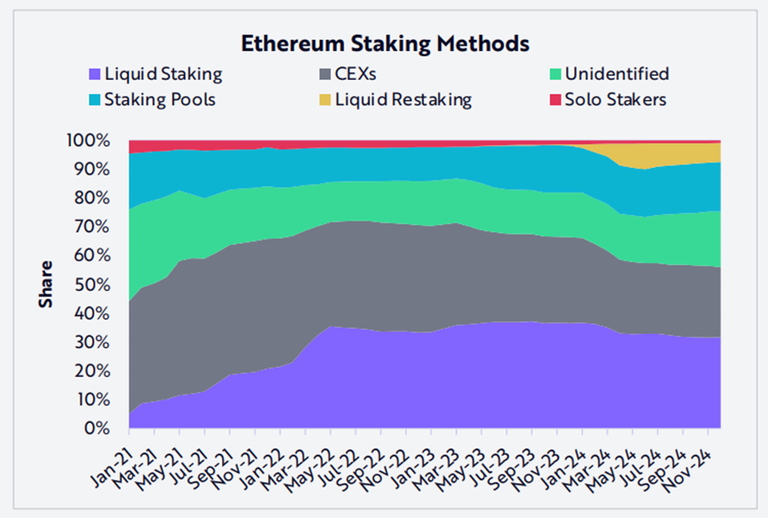

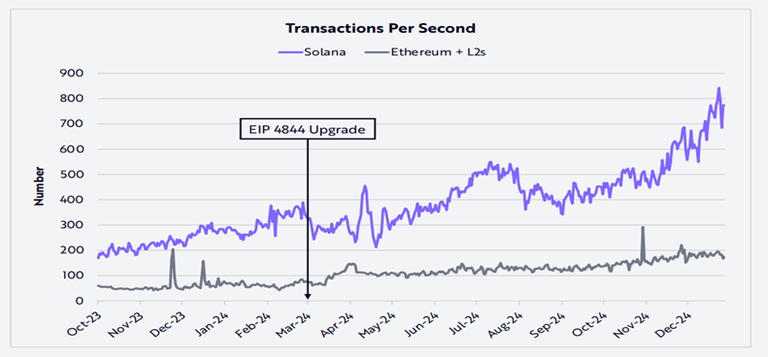

As already mentioned, the Ark Invest team gave special attention to Ethereum and Solana when it comes to scaling blockchains. The emphasis is on the reduction of fees and greater efficiency. We are told that due to EIP 4844, Ethereum’s most significant technical upgrade, the transaction fee has been cut by 10x from $0.50 down to $0.05. As a result of such a big drop in transaction cost, users have been migrating from the base layer to layer 2s and have captured an 85% share of daily active addresses transacting on the Ethereum ecosystem. In 2024, Ethereum was able to scale daily transactions from 3 million to 15 million, a 400% increase made possible by Layer 2 activity. However, despite migration to layer 2, we are told that “institutions, high-value users, and whales are” still settling their transactions primarily on the base layer. Furthermore, as for the preferred strategies to generate yield on Ethereum, liquid staking and re-staking remain the favorites.

Nevertheless, despite the success of Ethereum’s technical upgrade, Solana still surpassed it in at least two ways. When it comes to transactions per second (TPS), the success of the latter is credited to the use of “more expensive hardware requirements and parallel transaction processing.”

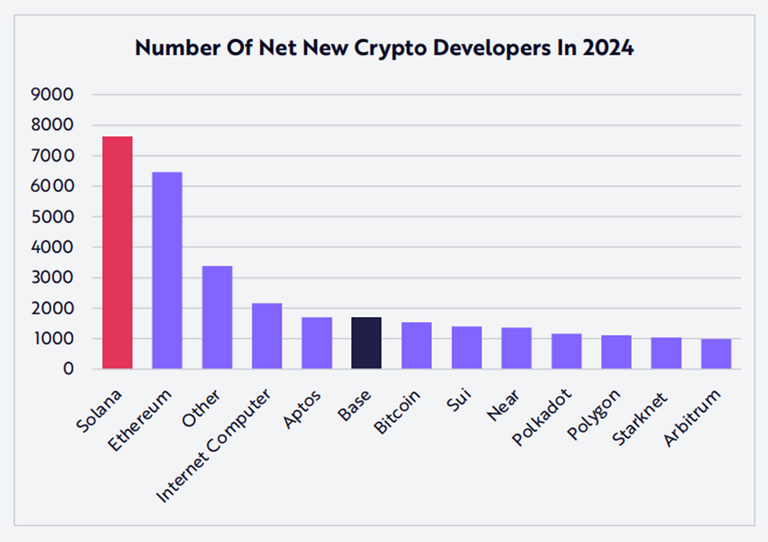

Another area where Solana overtook Ethereum is in the number of new crypto developers. “Of the 39,139 new crypto developers in 2024, Solana led the way with 7,625, surpassing Ethereum Mainnet.”

As a Hivian, what insights can we glean from the above report? As mentioned, lower fees and greater efficiency play a significant part in the increase of network transactions and the number of crypto developers in both Ethereum and Solana.

Hive’s Feeless Transactions: An Overlooked Advantage

I suspect that the feeless transaction happening on the Hive network is virtually invisible in the eyes of the majority in the crypto space. Even though it is a remarkable quality of the Hive network, several reasons have been repeatedly identified by the Hivians themselves.

The tension between focus on value creation and marketing. Some would say that marketing will automatically happen if the network just focuses on value creation. It is good that we now see a few doing their best to market Hive, and we just witnessed recently how HIVE has been listed on crypto exchanges. Even though the exposure is still minimal, any organic growth is something to be celebrated.

Another reason is that HIVE isn’t designed for speculation. Traders looking for quick gains find our token disappointing, for we focus too much on creating content on a decentralized platform.

Still another reason perhaps is the unfamiliarity of many about resource credits. It is the norm that for anyone to transact on the chain, one must pay a gas fee. Big chains popularized this practice. The idea of feeless transactions is too good to be true.

I think the most popular obstacle is the onboarding process. I encountered it several times when attempting to onboard my colleagues and my students. It is good that a Hivian like @gadrian has a better way to create Hive accounts.

Perhaps more reasons can be elaborated, such as limited exchange presence and defi integration, Hive's association with social media instead of a blockchain that can power Web3 applications, and the emphasis on building the internal ecosystem that results in an introverted community.

Can VSC’s Smart Contracts Improve Hive’s Efficiency?

How about the long-awaited launch of VSC’s interoperability? Does the VSC smart contract aiming to improve interoperability among chains also help improve Hive's efficiency?

I understand that both InLeo and VSC are doing their best to connect Hive to more ecosystems. If Hive can interact with other blockchains effortlessly, that would be great. In the game of scaling, I heard of the importance of sidechains. RCs work great for now. Is the chain really ready in case a huge number of users flood the network?

I think that’s all for now. I still know little about VSC and sidechains. It is better to see them in actual operation so we can test them. The earlier they are launched, the better for our chain.

Grace and peace!

Posted Using INLEO

it's just a matter of having some account creation tickets, which most medium/bigger accounts have. It is unfortunate that the regular onboarding methods still fail.

Oh, so that's the key. I wonder how much HP is needed to have those account creation tickets.

You should have enough. Last I checked, you needed all the RCs of a new dolphin (5500-6000 HP) to claim one ticket. I claim them automatically. You can do that too, if you have enough max RCs (and you should). The easiest way to do it automatically is to check the option on Hive Keychain -> User operations -> Automated tasks -> Claim accounts.

Ok thank you for the info. I will try.

There should be an easy onboarding method, like user password and email and that's it, like a normal social, otherwise it will be hard to get web2 people... You had a lot of troubles onboarding students

They follow the same procedure, and a few work, but others fail. I wonder what's the cause.

With the way the market is really volatile, I really think I will prefer investing in stablecoins much more than bitcoin

That will be a good decision.