What is the Bitcoin Halving ?

The Bitcoin network operates on a technology known as blockchain, or blockchain. The process of creating a new Bitcoin is called mining, and is done by miners, those responsible for verifying and adding the next block to the block chain. Each block contains all the latest Bitcoin transfers and in effect Bitcoin is sent from wallet to wallet around the world in a distributed and secure manner.

The block crossing event actually determines the rewards that Bitcoin miners receive from each block (in the Bitcoin blockchain, remember?). The event takes place on average once every four years - depending on the rate of mining, and the rewards paid to miners are cut in half, hence the name.

How many Bitcoin coins are mined daily, as of today? And how much after crossing the block?

The blockchain chain is the heartbeat behind Bitcoin. Every ten minutes, on average, a new block is added, after the miners are verified.

To date, miners' remuneration from each block is 12.5 Bitcoin coins, or 1,800 coins daily. The numbers were determined according to Bitcoin's protocol as early as 2008. After crossing, the rewards will be cut in half, ie 6.25 Bitcoin for each block, or 900 per day.

How many block-crossing events have been in Bitcoin history so far?

The Bitcoin first block, known as Genesis Block, was mined on January 3, 2009. Because cross-country events take place on average every four years, so far there have been two such events: the first occurred on November 28, 2012. The second in July 9, 2016.

Will block block events be held in Bitcoin forever?

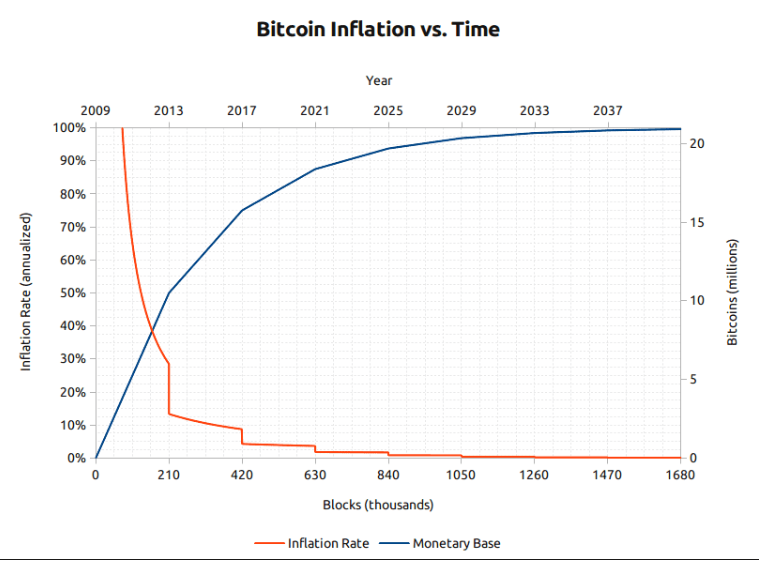

The answer is no. Every crossover event goes down the pace at which new Bitcoin coins are “born”. As we know, once there are 21 million Bitcoin coins production will stop completely. According to forecasts, the latest Bitcoin will be created around the year 2140. Hence no block-crossing events will take place thereafter.

Will the Bitcoin price rise or fall following the crossover event?

The crossover event means deflation in Bitcoin currencies. In other words, reducing the supply makes Bitcoin more rare (the opposite of inflation). Today there is no country currency with a deflation mechanism like Bitcoin. The upcoming crossover event will reduce the inflation rate from 3.65% to 1.8%.

And what about the price? Of course there is a great expectation of price increases after the previous crossover events of 2012 and 2016, most notably the meteoric surge in subsequent years - the 2013 Bitcoin bubble and the most famous bubble in 2017. Will history repeat itself? No one promises, only time will tell.

Is the block crossing event dangerous for miners? Could they stop following him?

On the one hand, miners will receive less Bitcoin for mining efforts, but mining viability will be determined by the price of Bitcoin at that time. If the price is significantly lower than the cost of mining, some may not be able to meet the losses and have to stop mining Bitcoin.

Is it dangerous? The fewer miners, the lesser mining is and the other miners who continue to mined will benefit more. The downside is that if it hits the miners, it will affect the smaller miners more and so the mining giants will survive, such as Bitmine, and mining efforts will be shared among a number of individual huge entities.

There is also a dreaded scenario where a "reactor war" could occur that could result in a massive reduction in the price of bitcoin (a short-term hit but a gain for the winners of the long-term war).

After all 21 million Bitcoin, what will the miners earn?

Bitcoin miners, besides mining rewards, also earn transfer fees from every Bitcoin shipment. If Satoshi's vision is fulfilled, by 2140, when the latest Bitcoin is expected to be recognized, the profit from remittance commissions will justify continuing mining operations.

"Once a predetermined number of currencies goes into circulation, the remuneration will be completely transferred to a transfer fee from any transaction and thus completely free of inflation." The quote was taken from the Bitcoin White Paper (Whitepaper) written in 2008 by Satoshi Nakamoto.

Bitcoin halving - Detailed explanation

According to the Bitcoin protocol, a total of 21 million Bitcoin will be issued by about 2140. The issuance of new currencies is gradually reduced over time with the idea of providing great liquidity at first to generate an incentive when the currency value and demand for it is relatively low.

At the beginning of the road, approximately 50 coins were issued in each block and in 210,000 blocks (approximately 4 years) the number of issued coins was cut in half. The Bitcoin IPO process is done through the mining operation where independent miners around the world compete against each other for the reward of the block that issues new Bitcoin to the approved winners' pockets.

The mining process requires electricity to find the solution to a mathematical puzzle and the first miner to solve the puzzle releases a block which is actually another page in the Bitcoin log ("blockchain") and includes logging and approval of network operations. When the miner publishes the block to the Bitcoin network, all other miners check the integrity and correctness of the operations listed therein and immediately move on to the competition for the reward of the next block.

The mining process serves two main purposes. The first goal is to verify the integrity of the network's operations in accordance with protocol and network security against malicious or illegal actions. The second objective is to issue the currencies while maintaining a well-known and predetermined inflation rate.

The cross is actually part of a sophisticated IPO mechanism that deflates a deflationary monetary system where, like gold, there is a relationship between currency rarity, its mining difficulty, its traded value and market demand relative to supply. Every 10 minutes new coins are issued that join the Bitcoin cycle that already exceeds 18 million coins and the issue rate is known and predetermined. On January 3, 2009, the first block was issued containing about 50 coins. From then until 21 million Bitcoin will be issued, the rewards for miners will be cut in half every four years or so, a total of 32 crossing events.

The first crossover event happened on November 28, 2012, at which time Bitcoin traded in the $ 12.25 area. This event reduced the Bitcoin supply from 50 to 25, but did not immediately affect the traded value. However, a few months later, price increases began and the currency's trading value first crossed the $ 1,000 threshold. All this until the famous breakthrough came to Mount Gox, which was then Bitcoin's largest trading platform and its collapse took the value of Bitcoin down and continued to wander around the hundreds of dollars for months and years.

The second crossover event occurred on July 9, 2016 and lowered the miners' rewards from 25 bitcoin per block to 12.5 bitcoin every ten minutes. Bitcoin then traded around $ 674 and most of us remember what happened several months after, in the 2017 bubble, which caused it to cross the $ 20,000 threshold before crashing back to $ 3000.

I recognize a pattern here? It is difficult to know and correlation can be assumed rather than causal. But, it's worth remembering that the next cross-country event is already around the corner. This week, in block number 630,000, miners' compensation will be cut from 12.5 to 6.25, a significant reduction in supply that will make Bitcoin's rarity in markets ever felt.