THIS IS NOT FINANCIAL ADIVCE! As you probably know...

Click here for the annual report that I'll be discussing.

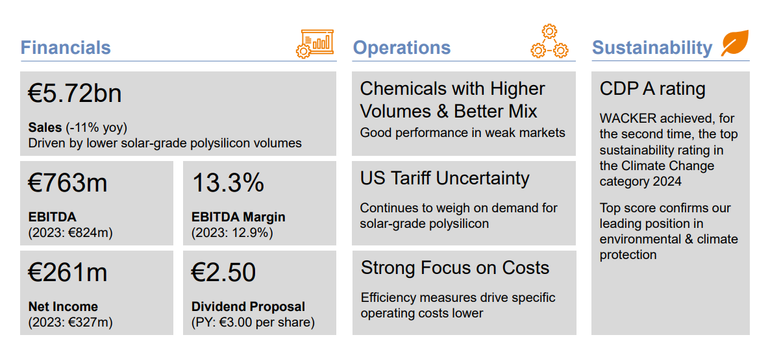

Wacker Chemie AG had a terrible year 2024 – if it wasn’t a cyclical stock. For a cyclical stock, it was actually a good year, as it was the bottoming out for this cycle (I hope). -39% in the stock price is still quite terrible. As it was my first big cyclical investment, I started buying too early (around 120 €), but kept buying and dropped my buy-in to 85€ in total. It could have been worse, but also a lot better, as the stock bottomed out at 60€. I bought my last share at 65€, and had a limit buy set for 59€.

Why Wacker Chemie?

First, forward thinking. The R&D is focused on future technology, enabling Wacker to produce the shovels for autonomous driving, hydrogen fuels, CCS, mRNA, and others. 180 Mio. € goes into R&D every year, right now there are around 350 different research projects ongoing. The focus is on enhancing the current polysicilons, especially the purity, as we are in a semiconductor cycle at the moment – and the same will be used for solar panels as well, which are in a low cycle at the moment.

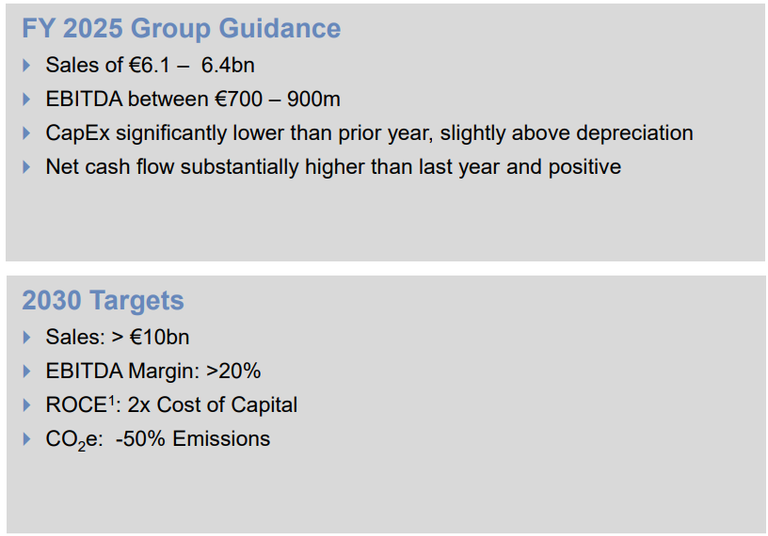

Also, they are focusing on profitability. As you can see in the picture above, even in a horrible year they were able to get a higher EBITDA margin. That gives them more advantage for the future, too - 2030 they want to be at 20% EBITDA, against 13,3% now.

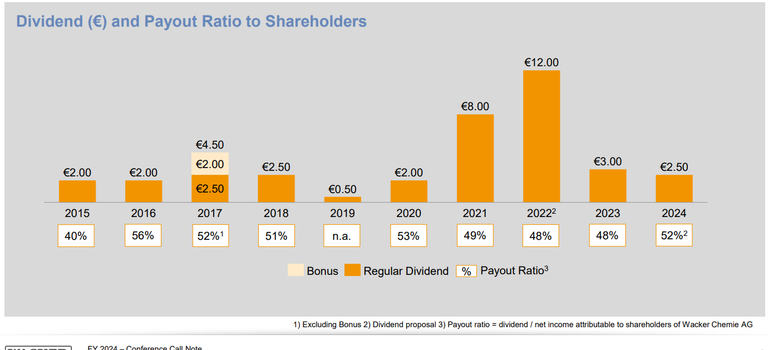

Second, Wacker Chemie runs a fluctual dividend policy. They maintain the dividend at around 50% of the net income. As a cyclical stock, that means that the dividend fluctuates as well – a concept not seen kindly in the US, but as always, it has its advantages. Wacker will always have enough cash to carry out expansions and investments on whatever is necessary to stay successful.

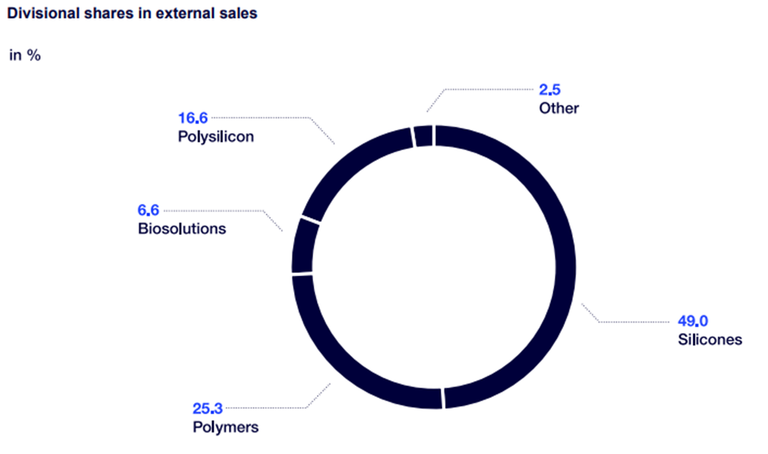

Third, competitive position. Wacker is number one in producing polymers and polysilicone for semiconductor applications, and second for silicones (behind the mighty DOW Chemicals). Being a market leader is a difficult spot, but also gives some advantages, especially when being able to build that leading position through innovation – and the R&D is seeing to that.

Fourth, segmentation. Even a cyclical company tries to compensate. At Wacker, that is the case through the segmentation into 4 main categories. Until now, Silicones is still the most important one, with 49% of sales, but it’s expected to stay stable while especially BioSolutions will grow rapidly. Due to the downturn in solar energy, Polysilicone is actually down, so when that cycle bottoms out, it will even out more. It's not as beautiful as Microsoft, but hey, it's a German industrial - for that, they're doing a good job.

Fifth, 51% of the stock is owned by the founding family, and only 33% are free float. Dr. Wacker, one of the heirs, is basically the head of every important committee of the company. Him and his family having a majority stake in the company gives the stock some stability and shows that they have the highest motivation in keeping the company in good shape.

Lastly, mid term goals are on track. In 2030, Wacker expects to reach an income of 10 billion Euros. That is a growth of 60% (5,7 billion 2024) over a span of 5 years so pretty nice for an industrial. EBITDA is supposed to be at least 20% (13% in 2024), that would be 2 billion Euros in 2030 – against 760 million in 2024. More than a double up. Is that normal? Yes. For cyclical industrial stocks, that is actually pretty normal. They’re not steady growers, but run up and down all the time. To invest in them either means to buy low and forget about them for the rest of one’s life, or to try to time the market a little – not as in short term trading, but more of a 5 year span.

What’s not going good right now.

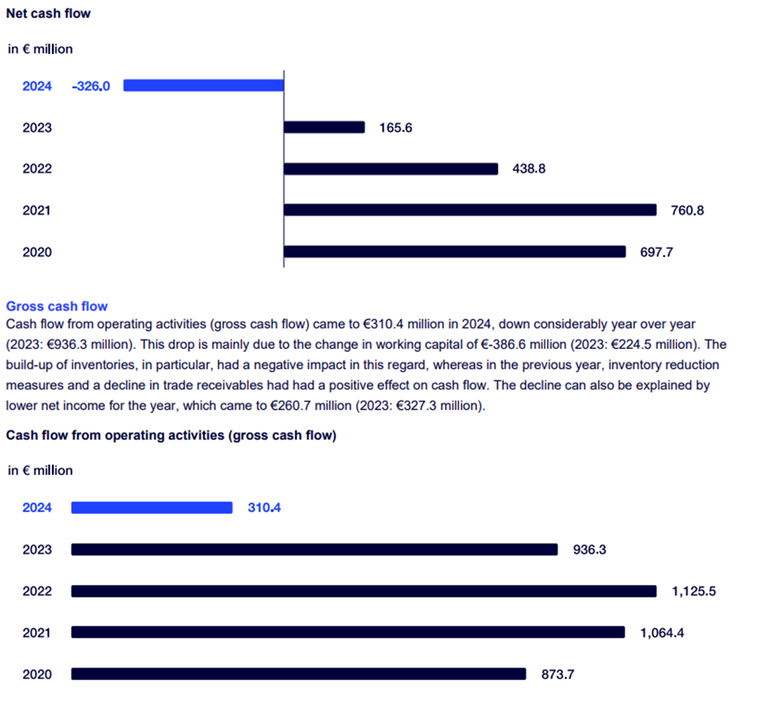

Cash flow is negative – yes, it’s a cyclical company, but their goal was to be able to finance all their expenditures with their current incomes. That not being the case is a sign for things not being as controlled as hoped. BUT - as you can see above, they expect positive Cash Flow again in 2025.

Debt

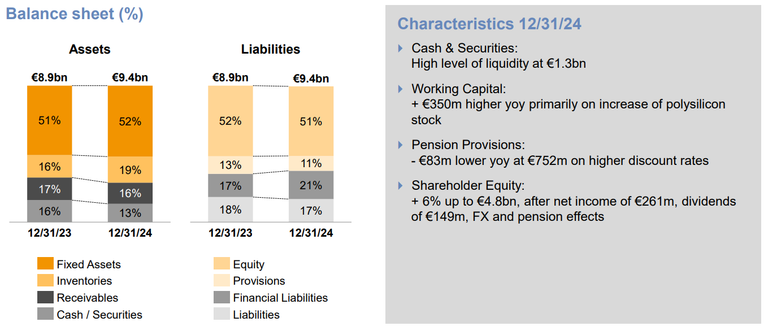

4,57 billion Euros is quite a chunk, considering that the EBITDA is only 750 Million. Liquidity is at 1,25 billion Euros, so not that bad, and for an industrial actually quite good. Still, financing liabilities have increased from 17% of total balance sheet to almost 21%. It is to hope that the company will use the excess cash in the upward-cycle to reduce that debt – or to buy back shares, but that is not a big thing for German industrials.

Inventory has gone up 3%, while receivables and cash/securities have gone dwon a little. That has to change, too, but hopefully will with rising sales and orders.

Net Income vs. EBITDA

Ebitda margin of 20% sounds really good – but that is not the net income. In 2024, EBITDA was 760 Million, but Net Income was only 260 Million. That’s only 34% of the EBITDA. So, a 20% EBITDA margin means a 6,8 % net income margin. That does not look too good.

What if it’s not the bottom?

Honestly, that would be not cool. But Wacker Chemie is a staple in German industry, and there is a 500 billion euros support package coming towards the German industry – of which 20% are going towards “green” projects, and Wacker has a lot of stakes in those, too.

EXCEL! It rocks for everything.

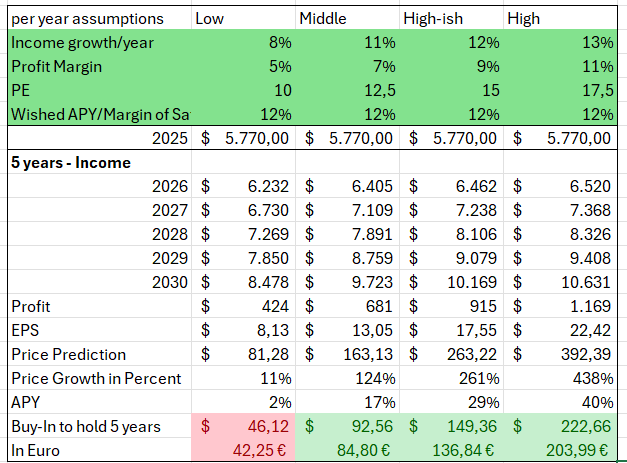

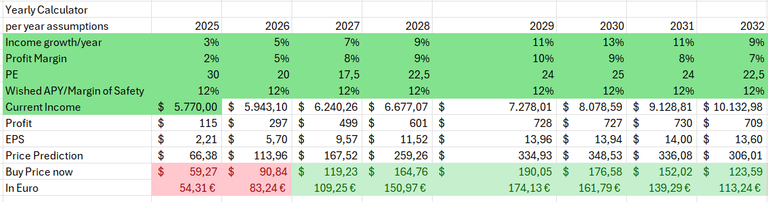

Info: The Net Income Margin is currently at 5%. As that is supposed to be the bottom and the DA part of EBITDA is supposed to go down, it should go up, so I used the 5% as a low case (that is taking into account that the Net Income is supposed to go down in 2025).

The PE is incredibly hard with Wacker. Right now it is around 30, but in a great year it can go down to 5 - it fluctuates a lot. So I tried to take that into account, too - if you have other suggestions, please let me know, I love to play with those numbers.

Here are my calculations based on 2024 and the mid-term expectations for 2030. I think reality will land somewhere between my middle and my high-ish case, giving a decent and probably outperforming return over the next 5 years. Reaching 160-200€ is nothing new for Wacker Chemie, so it’s not too much wishful thinking. The high case of reaching 390€ by 2030 might be a little out there, though. I'd probably start setting Stop-Loss at 170€ when the price hits 200€. Maybe even earlier, just to be sure. Like 120€ when it hits 160€.

Conclusion

Wacker Chemie AG is still a little risky. It could go incredibly strong in 2025 or 2026 - or it could still linger around. I don't see much risk with the Trump-Tarifs, as I expect those to be short term, until the rest of the world learns how to handle the new US-Administration.

What I am pretty certain is that we reached the bottom, and that it will go up from here. How fast - that's the question. I'll probably hold for 3-5 years and see what happens. I think reaching 150€ is easy, and hopefully 200-225€.

Help me!

So, this is my style of analyzing stocks. If you have tips, comments and remarks, feel free to post them! I’m always eager to learn. I'm not a pro in this whole thing, and might even get some terms wrong, so please feel free to correct me so I can learn. For example, I still struggle with all those EBITDA, EBIT, and Net Income sometimes - I tried to be very thorough in this one, but if there's a mistake, please point it out! Thank you!

And Thank you for reading :-)

The rewards earned on this comment will go directly to the people( @uwelang ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Business environment looks in turmoil like I have never seen before in a period of approximate peace.

Assure to be cautious is a key factor in the current situation of trade and assets acquisition.

Thanks

Always cautious! It's my first time doing cyclical investment, so it adds some risk to it :-) But I'm confident that I'm on the right path - can't be worse than my 2022 experience :-D

Do you really want to wait until 2030 to see if these shares are still worth it?

Yes, of course, that's the idea of investing. I'll wait and see if my hypothesis works out.

@beelzael, I paid out 0.150 HIVE and 0.035 HBD to reward 1 comments in this discussion thread.