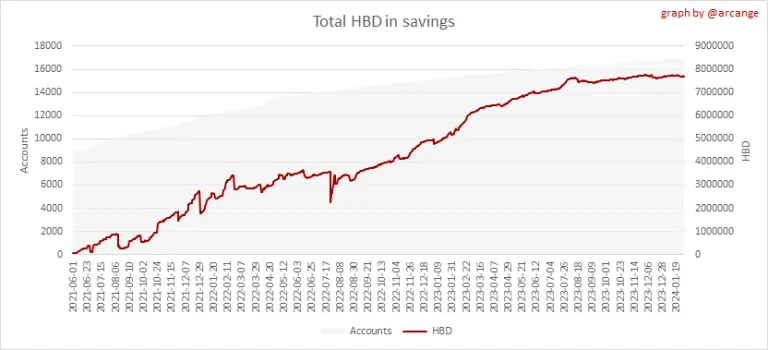

The 20% was to attract interest from outside investors, and it was kind of successful

The curve has flattened, and there's no marketing around it any more.

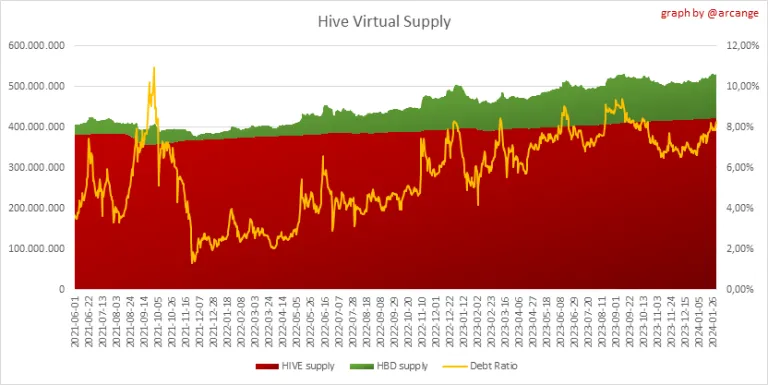

And what's more important, we're getting close to the debt limit. We just cannot sustain that growth of HBD supply, as long as HIVE price doesn't improve. We're already risking a HBD depeg if HIVE drops to somewhere around $0.20 now.

For these reasons, me and a lot of other witnesses have decided that the APR should slowly go down.

Thanks for your explanation... Just for my understanding, what's the debt limit? and...do you consider 8% of debt ratio a value which is indicating a problem here?

HBD is backed by HIVE. The debt limit prevents us from printing too much HBD, which would lead to a LUNA like death spiral.

I actually remembered older numbers, the last hard fork changed the percentages.

When the total amount of HBD in circulation exceeds 20% of HIVE market cap, the blockchain will stop printing HBD for rewards. At 30% and above, it won't honor the $1 peg with conversions any more.

Debt ratio is at 8%...30% is very far away still

True, the situation is way less dire than I thought. If we could get it marketed again it might make sense to keep it this high.