(these ones will be a slightly different posts from the usual HPUD ones I do, but for some time I wanted to, hopefully, shed some more light into how to use or read the information visible from diesel pools on Hive Engine side-chain)

Understanding Liquidity Pools on Hive Engine

A Hive Engine based Series you might want to call a Guide 😜

For this particular "guide", I will use my preferred front end, https://beeswap.dcity.io for most examples and https://tribaldex.com for some of the other features present in Hive Engine.

Although I am using these as examples, there are other around that could provide you similar or near quality of such information. And I will make examples from my ATX token and respective pool (although most of this will apply to any other token/pool).

Since I wish these post series to be as effective as possible, for the ones not yet familiar with liquidity pools, here it is a summary of all the posts in this series:

InTo Basics

- 🤯 What is a Liquidity Pool?

- 📊 Adding, Removing and Swapping

The Real Deal

- 🤑 What do Liquidity Providers Win?

The Importance of Understanding

- 😎 The Depth of Liquidity Pools APR's

- 🤫 Options and Strategies

Made with lots of ❤️ from @atexoras.witness, @forykw and its dark soul @forkyishere

(Disclaimer - these topics might need corrections over time, so please take that into consideration, and I would encourage U to contribute if you wish/can)

🤑 What do Liquidity Providers Win?

On Hive Engine, liquidity providers can win "fees" (0.25%) or "rewards". And in this topic, I am not going to drill in depth about the price changes that can happen, resulting for example from the ratio of the pool changing back and forward (from people swapping). One would have to account for that price changes as anyone would via the normal trading market.

Price Slippage, Price Impact and "fees"

When swaps occur in a pool, there is a percentage (0.25%), of the total achieved swap ratio, that is taken from the swapped amount and distributed among ALL liquidity providers, equally to their pool share. This fee percentage will be taken from the swapped amount is determined, which can vary depending other (concurrent) swaps happening at the same time or/including people adding/removing liquidity.

Yes, in here you have to consider that there could be multiple things happening in a very small amount of time, therefore pools have mechanisms to protect the swap, in case something unpredictable happens. To that protection, we call slippage. A percentage you agree to support in price difference, when all these things happen against what is being calculated at the time you wish to swap tokens.

In addition, because you are swapping on side for the other, an adjustment of the ratio is needed, that we call "Price impact" (which includes your selected slippage), and will be higher the more volume you want to swap, and depending on the amount of liquidity present in the pool.

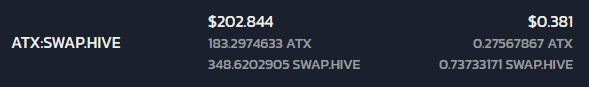

You can consult (at https://tribaldex.com/dieselpools/positions) how much of these "fees" you have already won, for your participation as liquidity provider, in each respective pool you have or were part of. Here is an example of myself for the ATX:SWAP.HIVE pool.

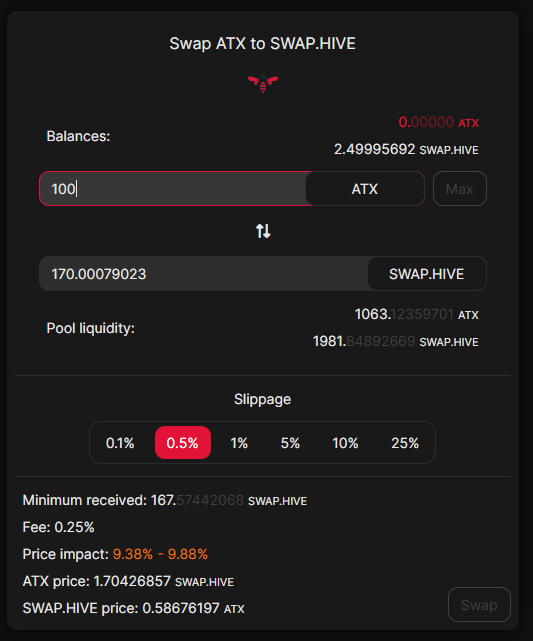

Taking as example the ATX:SWAP.HIVE pool again, if I would like to swap 100 ATX into SWAP.HIVE, in following example, the price impact would be from 9.38 to 9.88% (using 0.5% slippage). This is because the pool has only around 1063 ATX tokens, which causes a high price change (what I previously called ratio) and more slippage for the effort of swapping a large volume.

This means that if after broadcasting my swap request, the pool can't guarantee the max of the price impact (for example, if someone removed a lot of liquidity, which would increase the price impact), your swap will fail in order to protect the pool and your swap.

Also, notice that previously we had ~1.86 SWAP.HIVE per each ATX token, and if we would like to swap these 100 ATX, then we would effectively be swapping them at a lower ratio of ~1.70 SWAP.HIVE per ATX.

Rewards

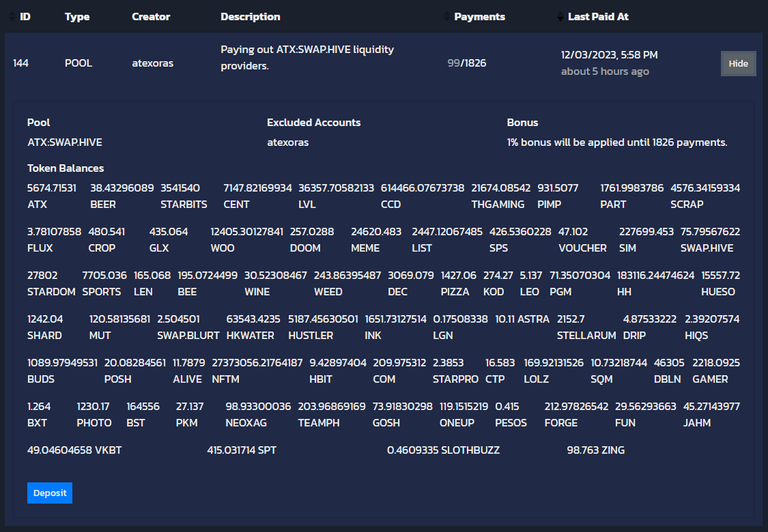

These are currently possible via Hive Engine contracts that allow you to create what's called a "distribution". These need to be applied either to pools or fixed to specific accounts (you can specify a list). It costs 100 BEE to create a distribution and you need to specify a couple things before launching it (for the pools specifically):

- length (for how long it will run) expressed by the Number of Payments (one per day)

- bonus shares (how many shares extra do people that are in the pool will win over time in percentage to their own shares), or Bonus Percentage. You can also specify a different (shorter) length for this one (usually to incentivize staying in the pool for early adopters).

In the case of the ATX:SWAP.HIVE pool, I have set the distribution to 5 years (1826 days) and the bonus curve (with 1% bonus daily) to apply to the same extent.

The bonus works the following way. Lets imagine you enter on the first day with 100 ATX (and equivalent SWAP.HIVE), and this is equivalent to 100 shares in the total participation of the pool. Then with 1% daily bonus, it means that if no one would add or remove liquidity to/from the pool, after 10 days, you would have 110 shares.

Obviously everyone else in the pool would gain the same percentage. But, newcomers would enter at the previous equivalent share count, without bonus.

After a distribution is created for a pool, one will need to add tokens into it. ANYONE can add tokens to ANY distribution on pools. Which makes a nice method of marketing and spread methodology of tokennomics. With room for many strategies.

From the tribaldex UI distribution menu, select your desired pool pair, then click "details" and at the bottom left you will see the deposit button. After clicking on it, a new popped menu will appear and there you can select all the tokens and respective quantities you wish to deposit in the distribution.

Note that the deposit is final and you will not be able to revert the process. So, make sure that you are doing what you want.

Then, its simple... every day, for each liquidity provider participant, the respective share in the pool will be awarded an equivalent portion of the rewards in that distribution, up to the total Number of Payments defined in the pool.

Nice write up I am slowly getting my head around it all. !LOL Zing seems to be another good one at the moment too.

!PIZZA

!ALIVE

yep, very good tokenomics and very nice one to compare the ways of balancing where the tokens are.

Also appeals to everyone skills, time and perception of risks.

!PIMP

You must be killin' it out here!

@forykw just slapped you with 1.000 PIMP, @new.things.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/2 possible people today.

Read about some PIMP Shit or Look for the PIMP District

@forykw! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ new.things. (6/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

lolztoken.com

A lite house.

Credit: reddit

@forykw, I sent you an $LOLZ on behalf of new.things

(5/10)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

Nice write up. I run the GLD coin and provide the coin for the liquidity pool. You mentioned distributions and rewards pool which I looked into but won't do.

Don't suppose you have any experience with NFT mining on coins. I've seen it as available but for the BEE cost and not much write up its hard to want to do.

😉

I can put that one in my bucket list for next year.

But yes, you can have NFTs mining yes. You will need to enable delegation and staking, and then you enable NFTs to mine. There are a couple examples already using that.

Great description of it all. Great for newbies! Reblogging so that people can start their Hive DeFi hustle!

Once complete (the 3rd part being released soon), then my idea is to go grab some people, show them how they can win some free tokens and test out these... while potentially winning some stuff.

That would be good

It is very important to know about all these things and here we can earn a good month a good profit every month by making an investment so all such projects are available here first we need to research.

Anything you found new? Or that you didn't knew exactly about...

I think the hive engine is down nowadays because for many days I have been trying to sell or buy a token in the hive engine it's not working 😕

I am pretty sure its not down... But let's go through what exactly you are trying to do.

Can you share some pictures or describe what you are expecting to happen? And I can help you.

$PIZZA slices delivered:

@new.things(2/10) tipped @forykw