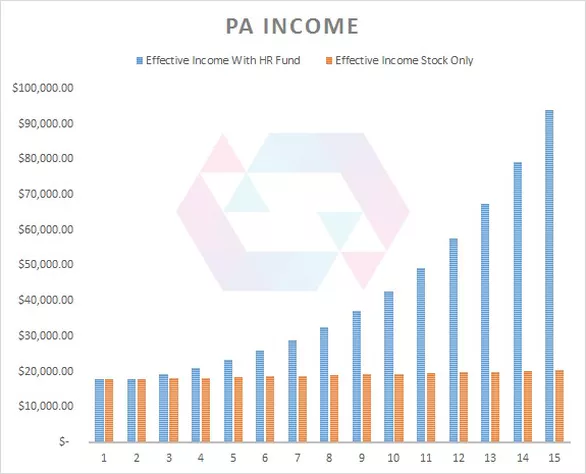

Continuing this blog series with another diversification case study, today we are looking at how to yield stronger dividends by implementing a high-risk, high-return product like Countinghouse’s algorithmic strategy. Some investors prefer income from stock dividends over ROI gained from more liquid market returns, but by including an active product in your portfolio of mainly passive products like stocks, you can significantly increase overall profit and become a more successful income investor. Income investors seek to grow dividend income over time, and by following a very similar diversification strategy as already discussed in our previous blogs, acceleration of that dividend return can occur. See Figure One for a visual example of the divergence of per annum income between the two strategies.

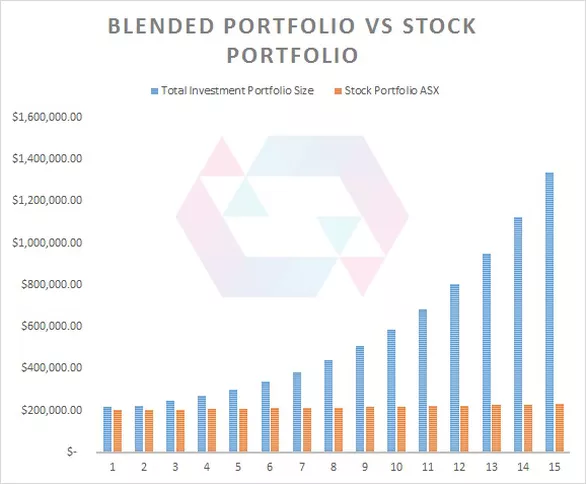

Figure One: Showing the ROI divergence between stocks-only/passive income and diversification into a high-return/active product.

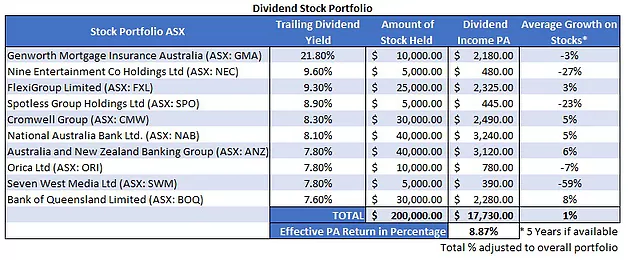

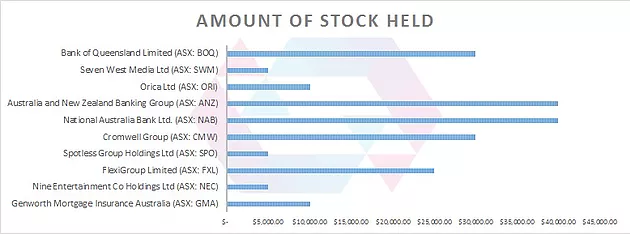

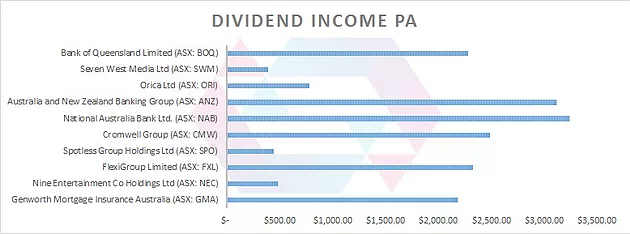

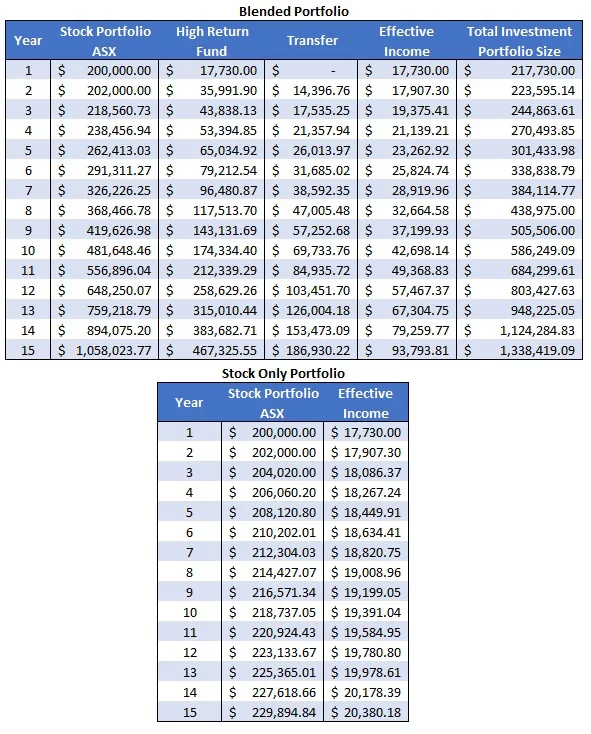

This above outcome is achieved though the following example investor. An investor has a stock portfolio valued at $200,000 with an effective PA return of 8.87%, or a little over $17,000 (See Table One, Figure Two and Figure Three). This investor then uses this first year of dividend return to invest into a high-risk, high-return fund and draws down 40% of that fund-generated profit the next year and re-invests that into their stock portfolio (Table Two). This serves to grow both PA income (Figure One) as well as total net value of this investor’s stock portfolio (Figure Four).

Table One: Example stock portfolio

Figure Two: Example stock portfolio, stock held.

Figure Three: Example stock portfolio, dividend income per annum

Table Two: Showing increased effective income with blended risk porfolio

Figure Four: Bringing it all together. A visual representation of the blended risk portfolio significantly outperforming the passive-only portfolio.

This implementation of an active high-risk, high-return fund into your passive, stocks-driven dividend income stream can serve to drastically bolster your dividend income ROI, and is yet another example of the allure and necessity of well-informed diversification methodology. In next week’s blog, we will be discussing a very similar diversification strategy that yields more frequent dividend drawdown, hence a more frequent increase in income.

Valuable information about strategies.Thanks.

Counting House is deep mathematical principles, combined with expertise in human and market psychology in order to bolster their investment portfolio and deliver market-beating returns

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

Very useful post. Thanks.