About SYMM

With the ability to invest at multiple levels, safely store funds, and incorporate into how managed cryptocurrency investment funds, Symmetry Fund (SYMM) offers investors an opportunity to gain exposure to the cryptocurrency market without the hassle of personal trading. itself Part of the Ethereal blockchain (ETH), SYMM is a smart contract that complies with ERC20. The fund pays a monthly dividend in ET. With its conservative structure and approach, SYMM executes its trade and investment with a long-term and balanced vision of growth. https://symmetry.fund/

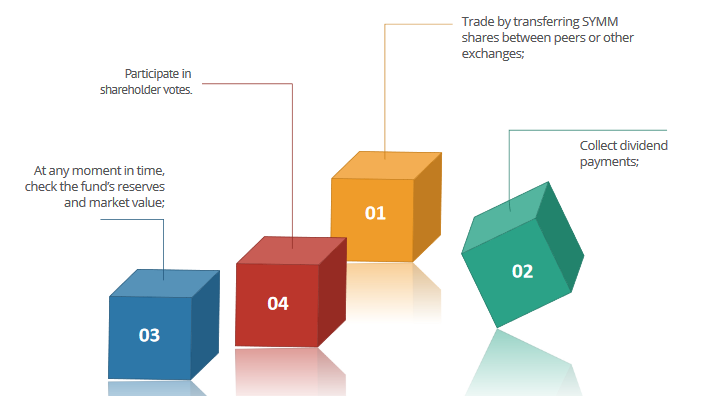

The capital funds will be used for trading in various cryptocurrencies and the percentage of funds to be allocated for each currency will be determined by analyzing certain currency and signal risks. A single section in the investment fund is a SYMM token. The investment funds trade and invest in ICO and cryptocurrencies including Bitcoin, Ethereum, Ripple, Dash and Litecoin. Shareholders will have the ability to trade their tokens with peers based on market prices. This will allow the shareholders to cash in on the flow because the value of funds increases over time, along with receiving monthly ETH dividends.

A fundamental element of the SYMM risk mitigation strategy is to hold capital in fiat currency (USD / EUR) when funds are not traded. While this may mean that the funds are not exposed when a large price spike occurs between the crypts in the crucial, it also means the funds are not exposed when volatile moves to the negative side occur. This makes funding exposure to blockchain assets to a minimum and ensures a steady and measurable growth path for the fund.

As the initial ICO moves into the trading phase, and the fund becomes more established, SYMM will investigate further opportunities to expand funding and provide investors with investments for all risk appetites.

Technology

As a technology company, SYMM offers an opportunity for individuals to gain exposure to the cryptocurrency market without the complexities of managing their own trade and related technologies. Embedded in ETH block, SYMM is a token corresponding to ERC20.

It is embedded in blocking ETH as a smart contract. Other SYMM financial functions will also be supported by blockchain contracts including ICO management, dividend payments, transparency actions, and voting.

There are several smart contracts that will operate throughout the different phases of SYMM funds from the ICO phase to the trading phase. This contract handles various parts of the fund. For example, when an investor buys a SYMM share in exchange for a token in the ICO phase, the contract will take action of supplying SYMM shares in exchange for tokens.

Future of SYMM

The base currency and other trading partners will be launched by SYMM as the funds become more established and the initial ICO trading phase has matured.

The purpose of SYMM is to be able to provide various levels of risk to investors so that there is a solution for any investor interested in having exposure to cryptographic. As we launch new investment opportunities, and expand our funding, SYMM will investigate how investors can offer special offers and benefits for new offers.

Symmetry Fund (SYMM) ICO

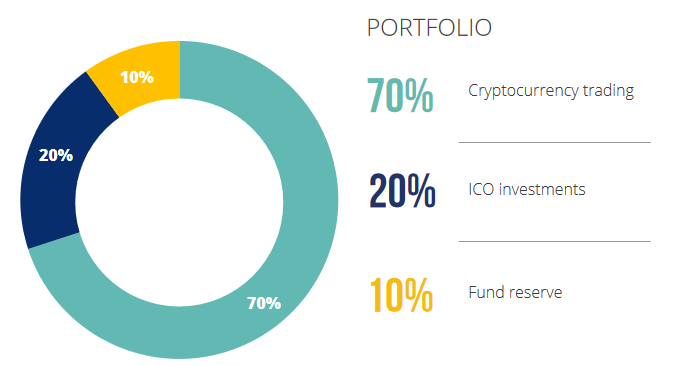

An unlimited number of SYMM estimates will be released at the SYMM Initial Offering Offer (ICM). ICO will be open for a period of 60 days at a rate of 0.1 ETH per SYMM. A SYMM token will represent a share of the funds. From ICO, most of the funds raised will be used for trading purposes. A small portion of the collected funds (up to 10%) will be held by a reserve fund and careful administration. Reseating these funds is part of the SYMM risk mitigation measures. An unlimited number of SYMM estimates will be available for purchase at a rate of 0.1 ETH per SYMM during ICO. By sending Ethereum to ICO smart contract address, investor will be able to purchase SYMM token. After sending the ETH to the address, the investor account will be credited with the corresponding amount of SYMM shares.

Trading Phase

After ICO successfully closed and funds withdrawn from ICO, the trading phase will begin. The trading phase will continue indefinitely with changes in trading activities such as traded pairs and the allocation of funds may be selected by shareholders.

At the start of trading phase, the value of SYMM capital will be from 90% of capital in ICO. This capital will be converted into fiat currency and quoted in USD.

Risk Management in Trade

Risks will be managed proactively by SYMM. A key strategy that SYMM will use to reduce risk is to store the capital of SYMM in fiat currency if not involved in trading. SYMM funds will only be stored in cryptographic during trading.

Holding funds in fiat currency means the value of funds will experience consistent growth without constant exposure to cryptococcal fluctuations, often volatile.

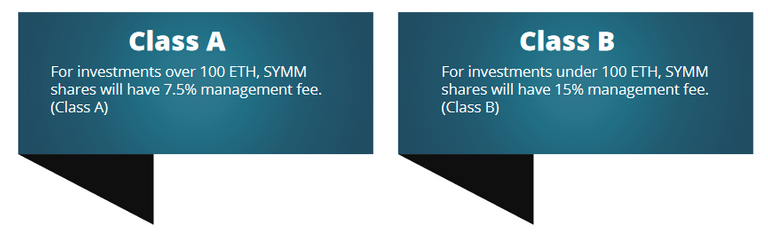

There will be 2 classes of stock:

Moving from ICO to the Trading Phase

ICO will be closed manually at the end of 60 days. This can be closed by the nominated administrator account. After the closing of ICO, funds will be withdrawn from the contract and exchanged for other currencies. To ensure that SYMM has no adverse impact on the market to be traded, withdrawals from the ICO phase will be completed within a few days or weeks. Withdrawals will be settled on different exchanges to reduce potential market impact.

Summary of ICO SYMM

One SYMM share equals one ERC-20 compliant token.

The ICO duration is 60 days from 30 November 2017 to 30 January 2018 ..

During ICO, 1 SYMM share will be charged at 0.1 ETH.

ICO Soft Cap is 3,000 ETH.

No Hard Cap for ICO.

Trading in BTC, LTC, DASH, ET and XRP will be made using 70% of the fund’s capital.

20% of the funds will invest in potentially high ICO. SYMM will secure deep discounts (up to 50%)

ICO which has not been released for public sale.

10% of the funds will be held by the funds in the reserve to ensure that the entire fund is never exposed at all times.

50% monthly trading profit will be paid dividends to investors every month. Dividends will be paid in ET.

50% monthly trading profit will be held for compounding growth.

To reduce risk and ensure the stability of the value of funds, SYMM funds will be held in USD and EUR.

Risk mitigation strategies will be undertaken.

Management fees will not be charged if there is no profit.

Under the scenario of symmetry and projected funds, the estimated annual ROI for the SYMM investor is estimated at more than 50%.

All shareholders will have the opportunity to vote on major fund decisions, which further encourage trust and sparency between the fund and its shareholders.

All transactions performed by SYMM will be specified in the relevant exchanges.

Funds held by SYMM will be subject to an external audit each month.

The balance of the account and the value of the SYMM funds will be reported to the stockholders on a daily basis.

Until SYMM is listed on the main exchange, all shareholders will have the ability to sell their investments for instant liquidity

The specific signal risk for each cryptocurrency will also be used to determine the allocation of funds and the risk of equilibrium.

This is similar to the way a mutual fund balances risk on non-cryptocurrency funds. Additional risk mitigation

Strategies to be implemented include:

With significant capital investment expected for SYMM, this could mean that the value of funds is sufficient to influence

the market direction To reduce the risk of SYMM funds affecting the marketing direction, the fund will

spread its trade in many exchanges. This will prevent market demand from decreasing or rising

beyond its natural rate due to SYMM trading activity.

To keep funds below a tolerable level of risk, margins can be used so that less funds are exposed at that time of

trading. With a trading strategy designed for some day-to-day, methodical and conservative picks

approach will support long-term growth of the value of funds and return of investors.

At the launch of the trading phase, SYMM will exchange a selection of pairs believed to hold significant

data on Analyzing this data, along with a conservative approach to funding will allow reliable risk and low risk of

trading to be executed Over time, expansion to different crypts may occur based on growth funds

and risk analysis. Expansion of funds to other cryptocurrencies and markets will be incorporated into the shareholders

vote. Shareholder votes will be made through smart contracts in blockchain.

Dividends

When SYMM generates a monthly profit, dividends will be paid to shareholders at ETH through a smart 3

day contract each month. Dividends will soon be available to SYMM investors when payment is made

to dividend contract Investors can then withdraw funds when they choose.

Profits are determined by subtracting the appropriate amount of funds at the end of the previous month

from what was valuable at the beginning of this month, minus management costs if applicable.

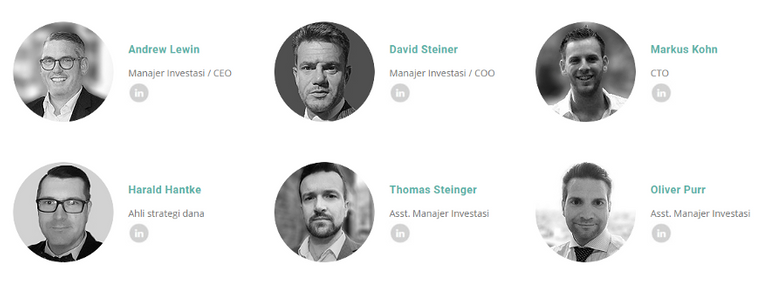

Team

Visit these links for more info

WEB https://symmetry.fund/

WHITEPAPER https://symmetry.fund/wp-content/uploads/2017/11/Whitepaper.pdf

ANN https://bitcointalk.org/index.php?topic=2641669.0

Author

Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1242198

ETH: 0xfe4A4DA8DE5565e76392b79615375dDf6C504d11

Free vote for you! Yay!