This is not a blueprint of how Supply (Support) and Demand(Resistance) should be traded, rather it is just a summary of how I trade using the given strategy. It may therefore need a bit of tweaking on your end in the event you need it to work with your style of trading.

I trade cryptocurrency with 100x leverage or 100:1 with the best spreads on the internet with low fees..perfect for usa clients, they use bitfinex charts and prices.

http://www.jafx.com/?link_id=awrtd19880&referral_id=0077500

These Strategies will work fine for bitmex contracts as well

https://www.bitmex.com/register/Ar7CYb

I have broken the Post into 4 main chapters (of the sort):

- Identifying support and resistance zones.

- Plotting zones after identifying them.

- How I trade the Supply Demand strategy.

- Simulator and Live examples of trades taken using the above strategy.

SUPPLY AND DEMAND MADE EASY

By @ArkBTC

- IDENTIFYING SUPPLY & DEMAND ZONES:

Before I get into how to identify these zones, let’s shed light on what Supply and Demand is all about, and I shall give an example to make it easier to understand.

Definition:

Let us take a country in the tropics, say England for example. A certain company sells heaters and air conditioners. In the summer, the majority if not everyone will be out looking for air conditioners because of the heat in that season and hence the prices will escalate. (Demand has exceeded supply >> Price of commodity goes up)

Similarly, come winter, the Demand for the heaters will cause its price to go up (Same reasoning as before), and since the demand for the air conditioners will have gone down in the winter, (Supply exceeding demand), then its price will end up going down.

Therefore, I will term Supply and Demand as “The amount of commodity/ service available and the desire of buyers for it, considered as a factor regulating its price” (S/O to @Spraxx_fx’s pdf)

Supply- How much the market can offer.

Demand- How much a product/service is desired by the buyers.

With all that in mind, let’s now get into identifying these zones.

There are 4 types of structures that form the foundation in this Strategy, 2 of which are continuation patterns and the other two are reversal patterns i.e.

Drop Base Drop, Drop Base Rally, Rally Base Rally and Rally Base Drop.

Below are their illustrations on a forex chart;

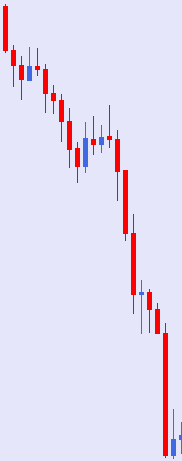

Drop Base Drop (DBD) - Continuation

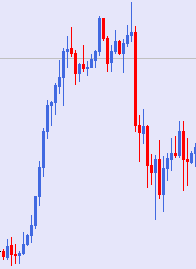

Drop Base Reversal (DBR)- Reversal

Rally Base Rally (RBR)- Continuation

Rally Base Drop (RBD) - Reversal

Go back to your charts, scroll through and try identify these structures.

DBD- Continuation

DBR- Reversal

RBR- Continuation

RBD- Reversal

PLOTTING OF ZONES:

Okay so you have gone back to your charts and have noticed that price actually forms such structures day in day out, and so what next?

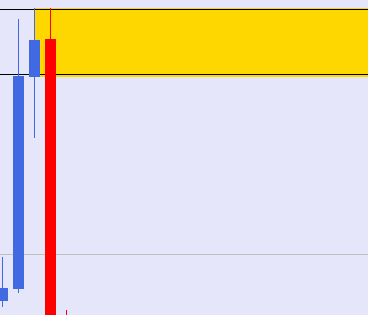

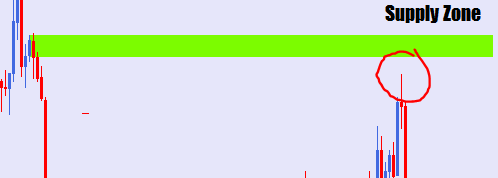

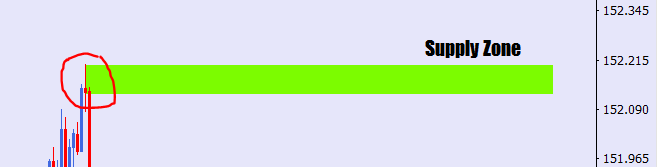

We shall therefore start this off with SUPPLY zones. These zones are plotted using the last bullish candle where a reversal of a bullish trend, or a continuation of a bearish trend has occurred (RBD or DBD).

Since these are zones where the market makers look for premium prices for entries on sells, it needs the highest possible spike to sell high, and thus will be drawn using the selected candle body to the upper wick i.e.

(Body to Upper Wick.)

As for DEMAND zones,

It’s basically the opposite. They are plotted using the last bearish candle where a reversal of a bearish trend occurred, or a continuation of a bullish trend (DBR or RBR).

For this zone, we cover the body of the wick down to the bottom wick as shown below;

(Body to Lower Wick.)

To note:

- In my own view, this method of plotting zones is not entirely a blueprint, such that in some cases you can be forced to draw a supply zone using a bearish candle rather than the bullish candle, and as so for the demand zones. Below are 2 examples;

- Also, as you go ahead in drawing these zones, be sure to look left, especially since this strategy works best with fresh zones as to be discussed later.

TRADING THE STRATEGY:

You now know how to identify and plot zones, but what next? Do you just sit behind your computer and draw every supply and demand zone that you can find and hope to sell supply and buy demand? HELL NO!

This is where the whole idea of fresh zones comes in handy. A Fresh Zone basically refers to “a zone that hasn’t been tested before.” Simple as that.

How then do I pin point the fresh zones from the NOT SO FRESH ones???

Well I learnt this simple method from my bro @ottraders

You could do either of the two:

Open the chart that you want to trade, say UJ, and then as per the current market price, draw a horizontal line and from there look left to look for zones that are close to the price, and that they aren’t broken (will have a video for this in the event it doesn’t make sense)

You could alternatively identify the prevailing trend and then plotting zones where the price may retrace for a liquidity grab before a trend continuation.

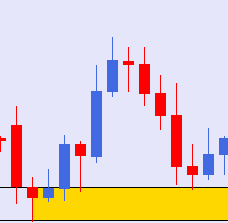

Check the given example:

(Note that I used the second method on drawing these zones.)

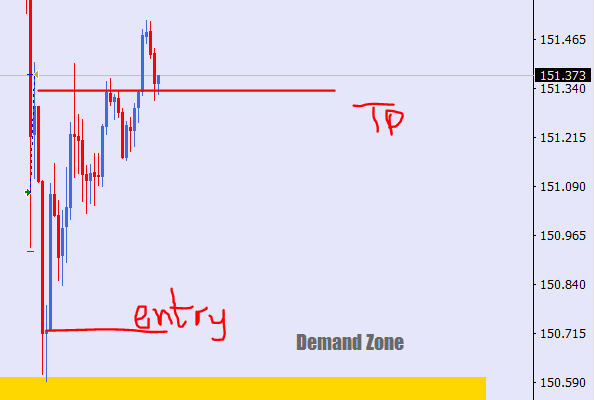

Once you have plotted that zone, you will have either of two ways to trade it;

i) Anticipating a rejection of the plotted zone

For example, you would wait for the rejection, and then sell on the confirmation of a candle close below the zone. This strategy is basically for the respecting of a zone.

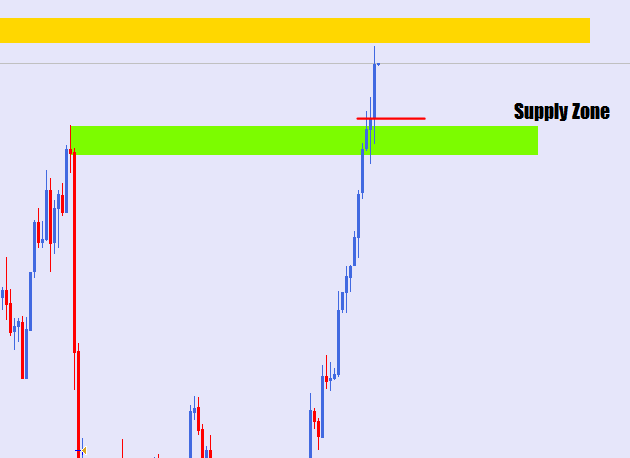

ii) Anticipating a break of the plotted zone

In the above example on UJ being on a rally and getting to a supply zone, we can wait on the break of the zone (candle close above supply) of which the TP would be at the next supply zone.

That’s basically it.

Buying demand and selling supply FAM!

What about what my confirms? Easy there. All the confirmation you need is a candle close.

Using the same example of UJ, the price is on a rally to a major supply zone. What the candle close basically means is waiting for how the price reacts in that zone. If we have a bearish candle closing below our zone, that will be a confirmation of a rejection and thus sells should ping, and for a close above the zone will mean taking buys to the next zone.

With any trades using this strategy, do note that the stop loss needs to be above/below the zone depending on how the market sets up and how you make your entries. Apply proper money management as well as good R:R ratio.

I use this strategy with one Timeframe at a time as I find that it suits me better that way. However, it is still possible to work it out by marrying the timeframes. (Check out Spraxx’s PDF)

Enough about all that theory now, below are screenshots of a short simulator session I did purposefully for this pdf, as well as trades I have taken using the strategy.

All analysis is on the screenshot.

Trade: success.

Things I have come to notice, (I’m subject to correction)

I came to realize that most if not all the time, price cannot break 2 consecutive zones at a go. This means that in the event a demand zone is broken, you can take buys on the next zone without confirms. (Don’t hold me accountable if it doesn’t work out for you. Thoroughly back test it.)

Example below:

Broke the first zone>>waited for it to get to the next zone>> BAM!!!

And the trade hit TP easily.Price will not always get to your zone. Instead, it might miss your zone by a few pips and then reverse, but worry not. Opportunities will always be there. Example below:

Don’t beat yourself up if you miss an opportunity, price in most cases does a retest of a zone before progressing to hit the tp. So you can make your entries on the retest. It also allows you time to assess how the market is setting up.

SUMMARY:Supply zones- body to upper wick (bullish candle)

Demand zones- body to lower wick (bearish candle)

Supply/ Demand market structures- RBR, RBD, DBR and DBD.

Entries confirmation? Candle close above or below projected zone, with the SL being a few pips on the opposite side of the point of entry and the TP being a few pips near the next zone.

Ways to trade SD- Rejection of a supply (sells) and demand zone (buys)

- A break of a zone as the price rallies or drops to the next zone.

TO NOTE:

Once a zone is broken, it changes and becomes the opposite, just as in support and resistance i.e. a broken supply zone will turn to a demand zone and vice versa.

I will cover how institutions make their trades, both entries and their profit taking on my next post so stay tuned.

I trade cryptocurrency with 100x leverage or 100:, Forex, Stocks, Indices, And commodities 500x or 500:1 with the best spreads on the internet with low fees..perfect for usa clients, they use bitfinex charts and prices.

It is very well explained step by step