“The stock market is a device for transferring money from the impatient to the patient” – said Warren Buffett. Those people who panicked in December – or in November, January – missed a very nice first semester this year. The last six months were heaven for most investors.

Two-digit yields

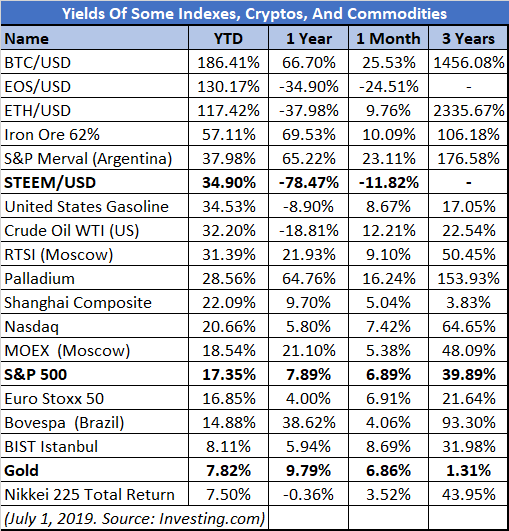

The “year-to-date” yields of almost all stock market indices are positive, and many show two-digit gains. The very commonly used S&P 500 American index of larger capitalization companies made 17.35 percent. The Nasdaq Composite technology stocks index, 20.66. Some stock exchanges in developing economies – Moscow, Shanghai – even much more, see the table.

But careful: The jump in stock prices in Argentina is more a product of the high inflation. “The inflation rate in Argentina was recorded at 57.30 percent in May of 2019” – wrote Tradingeconomics.

Why commodities?

Gold received a lot of attention after a ten percent surge in some weeks (see here and here). In reality, it was one of the least profitable commodities. Iron ore, crude oil, palladium or gasoline yielded 3-4 times more. I think I should broaden the list of my investment targets, pay more attention to less-known commodities and its producers. (The other question is if there are adequate ETN-s, certificates or other instruments to make the trade.)

After the G20-summit in Japan last weekend, today gold is falling heavily and stock prices are jumping. This is understandable because now there is less need for safe shelters like precious metals. Another reason is, the dollar also began to strengthen. (A US-China trade agreement could mean more economic growth, and that means, less US rate cuts. Higher interest rates mean stronger dollar and weaker gold, mostly.)

Are cryptos the best?

In the top places of the yield list, you see the main cryptos: the BTC/USD almost tripled, the EOS/USD, and the ETH/USD also more than doubled. The poor Steem “only” surged 35 percent this year. Not bad, but considering the large falls before, it could be much better.

I know many people here will say: “Do you see? Cryptos are much better! Don’t waste your time with old-fashioned stocks and commodities.” They are not obviously right. Cryptos may have rallied much more this year than other assets, but they also fell much more before, in last year.

Stay diversified

Cryptos have more yield, perhaps, but also much more risk. You shouldn’t put all your savings in the same asset class. For centuries, stocks have been proven to be profitable investments in the long term.

And in the second half of the year? Something makes me believe it will be another golden semester. Donald Trump wants to win the next elections, and surely don’t want to trigger a recession. He must make an agreement with China, sooner or later. Donald also boasts that he is creating a good stock market atmosphere. He attributes to himself the glory. He needs shares to surge again.

Doves and more doves

The Federal Reserve is more dovish, again, supporting lower rates, cuts. The bear market or at least greater correction in December showed the Fed also wants higher or stable stock prices. (The Fed stopped the rate hike cycle and began to talk about rate cuts. With this rhetoric it stopped the stock price falls, also.) The “Powell put” can work: If the stock market is experiencing heavy turmoil, the Fed will take measures:

A Fed put is defined as: The confidence of Wall Street that the Fed will lower interest rates and print money to support the market until economic strength will be strong enough to carry stocks higher. (Source

Never-ending expansion?

The European ECB is also more dovish than before, low and negative rates can stay indefinitely. Many people are saying stock prices are too high, overvalued, and are afraid of a longer bear market. But the markets, sometimes, are making very surprising things. Another couple of years of a continuous bull market, after this long one to 2019 from 2009, could be the biggest surprise.

But of course, the trees do not grow to the sky.

(Photo: Pixabay.com)

There's some useful insight here, thank you.

You just planted 0.10 tree(s)!

Thanks to @ucukertz

We have planted already

7853.98 trees

out of 1,000,000

Let's save and restore Abongphen Highland Forest

in Cameroonian village Kedjom-Keku!

Plant trees with @treeplanter and get paid for it!

My Steem Power = 24244.09

Thanks a lot!

@martin.mikes coordinator of @kedjom-keku

The key to safe investment is to diversify. Diversification helps you to enjoy the benefits of different investment but without the risk of failure of any one of the sources.

One method to diversify is by investing in Index funds. This helps you by adding more diversity to your portfolio. Check out Libertypool Blockchain Index (https://libertypool.com/) for more information.

Thank you, I'm interested in different crypto-related indexes.

See Bitcoin make a comeback congrats to the holders of bitcoin

Less gold and more shares and cryptos. Good recommendations for those of us who do not understand much about the issue of investments. Thank you!

Congratulations @deathcross! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPYou got a 87.26% upvote from @brupvoter courtesy of @deathcross!

Congratulations @deathcross!

Your post was mentioned in the Steem Hit Parade in the following category: