Week 33 - Aug 14 - Investment Moves

- US markets as of 11 am (EST)

- Aug 14 Options Trades - Part 1

- Aug 14 Options Trades - Part 2

- On Holding - a new player?

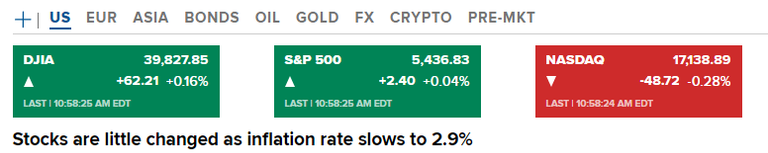

US markets as of 11 am (EST)

Here are the US markets as of 11 am.

The market has switched between RED/GREEN so far today. US inflation appears to be tamed and a soft landing is possible. If so, the markets might continue their bullish trend going into the US Elections.

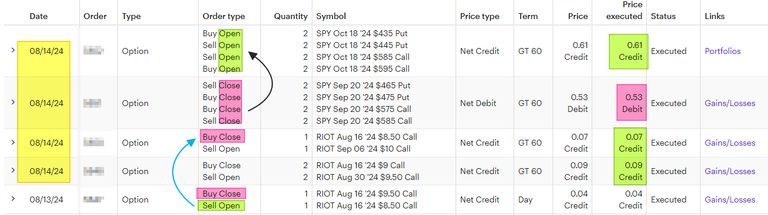

Aug 14 Options Trades - Part 1

- Closed Sep 20 Iron Condor for $53 each.

- Open Oct 18 Iron Condor for $61 each.

Call: $10 higher on strike price.

Put: $30 lower on strike price. - Rolled Aug 16 Covered call on RIOT into Sept 6 for $7.

The prior day, I added risk by lowering the strike price and got a $4 premium.

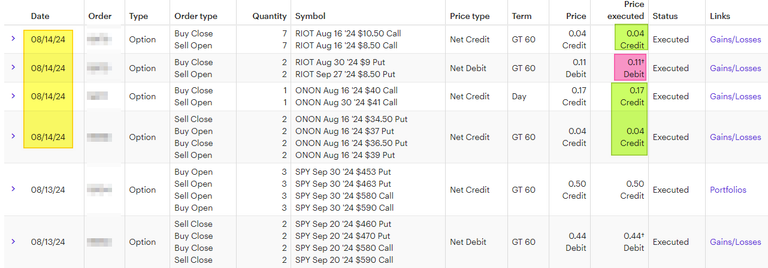

Aug 14 Options Trades - Part 2

- Rolled 7 Riot covered calls down in strike price for more risk. I got $4 each.

- Rolled 2 Riot Cash secured put down and out for $11 debit each (cost me money to reduce some risk).

- Rolled 1 ONON covered call up and out for $17.

- Rolled 2 CSP (Cash Secured Put) up in strike price for $4 each. These will expire in 2 days and I try to get a bit more "cash" from the time decay by adding risk into the trade.

- Prior Day (Aug 13) Closed the Iron condor and opened a new one.

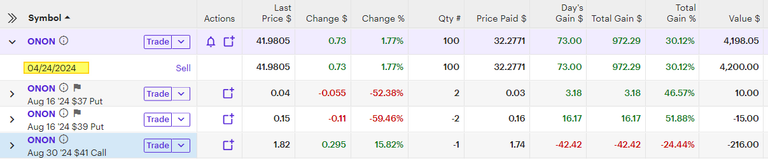

On Holding - a new player?

I got into ON Holding in April, before the Paris Olympics. It was a good move since the stock has been up over 30% since then. However, I later learned that one of the FOOL services recommended ON Holding (a paid subscription service).

What is my thinking on this position?

https://finance.yahoo.com/m/165cefbc-ef8e-3b53-9c16-8f1dcb26bb13/on-running-revenue-growth.html

I don't own Nike, but I have owned Skechers U.S.A. for a few years now. On Holding is bigger (by market cap) than Skechers and Under Armor. This means that either On Holding is lacking in marketing or the market that in serves is a smaller niche market. Some folks who follow tennis might know On Holding due to the company's history. One of the reasons I decided to invest is to pick an unknown brand and try to ride the wave before it becomes a big player in the industry.

On Holding is looking to expand other lines of business outside of sneakers, which is a common pattern in the industry. They are growing their presence in China (and other Asia markets). All the moves that On Holding is making are having a positive effect on the bottom line. Growth is there and it appears they are on track to continue this pattern for the next few years.

I will continue to use options around my ONON stock. I will use both Covered Call and CSP to try to reduce some of the risk of market volatility and adjust my options positions as needed.

OT:

Do you like the investment content I create? It's all free!!

Do you want to earn money by liking posts and commenting on others' content? If so, sign up using my referral link.

https://inleo.io/signup?referral=solving-chaos

Then you can send out referral links to your friends.

Have a profitable day.

Posted Using InLeo Alpha