Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Hmm, another week in the books, and with the markets the way they are, we just keep chugging along and doing what we do. Prices rise and fall, but over time our set-up should work in the long run.

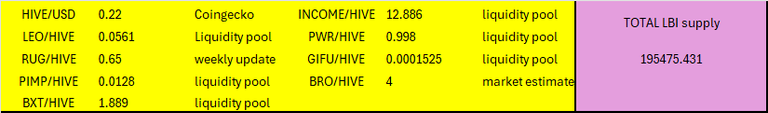

The cut off for these numbers was last night (for me) around 12 hours ago. HIVE has slipped further than this, under $0.20 currently. But for this report, here are the values at the time:

Here is last weeks report for comparison:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-35-week-ending-30-march-2025-972

@lbi-token wallet

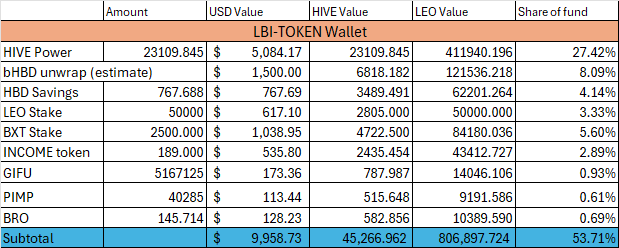

As the reshuffle continues, moving our LEO and some HBD over to the new @lbi-leo wallet, everything else remains fairly unchanged. No big price swings for our minor holdings here, with HIVE slipping and LEO up a bit compared to HIVE. BRO is struggling, and has dipped under 4, and GIFU is down a lot over recent weeks. These are only small positions for us, and we grow our tokens for these two via delegations. BXT has held up, and pays a decent dividend. Income drop from INCOME has been missing for the last few days, so I better start hassling @ecoinstant about that. There is one more week to go for the restructure for LEO, so once that is done this wallet will drop under 50% of our funds total assets.

@lbi-eds wallet

Steady around 19 - 20% of LBI assets, our EDS position just keeps doing its thing. 20 EDSI per week, plus a little EDSD on top and an income that creeps up week by week. No changes for this wallet on the horizon, it really is our set-and-forget position.

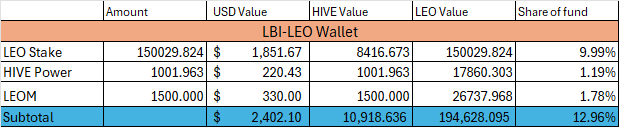

@lbi-leo wallet

Week three of setting this wallet up, and it's taking shape. We have resumed growing our LEO position, and will pick up some more LEOM and HP during this week. One thing I have let the LEO team know via a #feedback thread is that for some reason @leo.voter is missing our new delegation from here so far. Anyway, I'm sure that will kick in soon and this wallet will be full steam ahead.

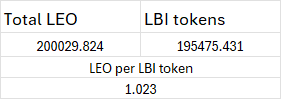

The LEO per LBI rate is still the same rounded off to 3 decimals. If I went to 5 decimals you could see the difference, with last week at 1.02314 and todays being 1.02329. Once the LEO wallet is fully set up, we should see this grow faster over time.

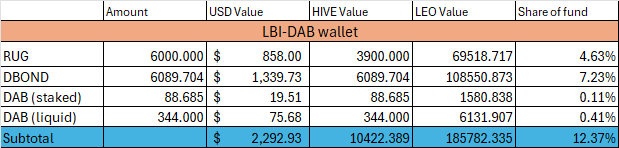

@lbi-dab wallet

13 DAB added for the week, which is pretty standard, making our current total 432.685. Picked up a few DBOND's to add to our collection, pushing us close to 6100. It'd be nice to see a recovery for RUG, but that is dependent on the crypto gods blessing us with some green, which doesn't seem to be happening at the moment. Anyway, we are looking years ahead, and this year is really a time to build our positions up for the future.

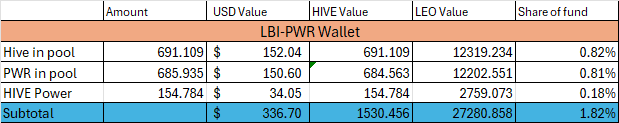

@lbi-pwr wallet

Added some funds in here again this week, to get us back towards our long term goals. The wallet still looks small compared to our others, but if you counted the 16,000 HP delegation from the @lbi-token wallet it would be a different story. Anyway, we need to keep building the liquidity pool position, and work on boosting this wallets owned HP so that we can slowly move the main wallets delegations to grow other things. Overall, solid progress this week in that regard, with the wallet worth 150 HIVE more than last week.

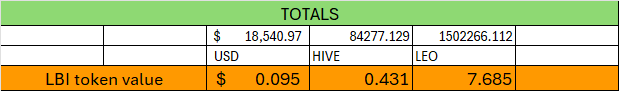

TOTALS

Sad to see the fund back down to $18500 - feels like we have gotten no where. I know that is not the case, we have set a lot up for years to come, but I'd be lying if I said it didn't disappoint me seeing these numbers. It is what it is, and things have gotten worse since the report cutoff time.

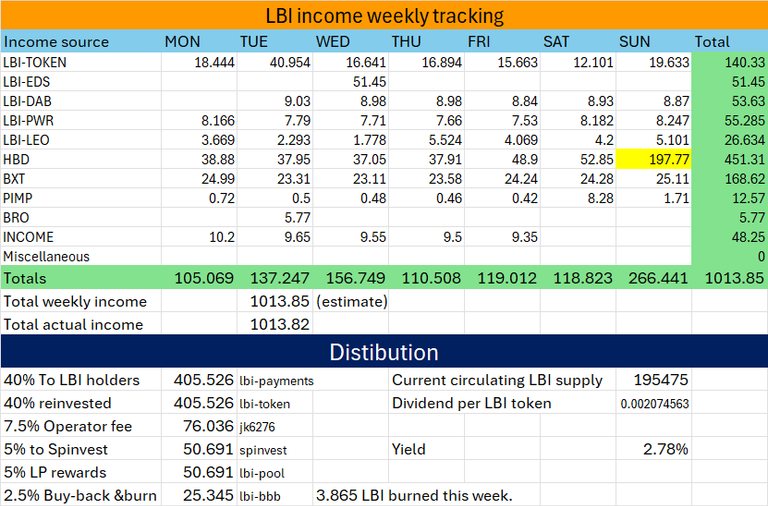

INCOME

Well I cheated a bit again this week to get us over the 1000 target. A little reminder that the income from @lbi-leo wallet is basically 1/3 of its actual income. LEO earned there gets split 3 ways - 1/3 to this income distribution, 1/3 gets staked, and 1/3 will be swapped to HIVE for more HP in the wallet. 1/3 Income, 2/3 growth.

400 LEO gone out as dividends for LBI holders, and 3.865 LBI burned for the week.

Conclusion.

Another week in the books, and we keep looking to the long term future.

Not much more to say than that really - we hold on during these down-turns and keep focusing on the goals and long term plans.

That's all I have got this week - have a good one.

Cheers,

JK.

Posted Using INLEO

I'm just wondering what Trumponomics will bring. For such moments I wished we remained safe and sound with our HBD. F.E we could buy buy Hive with it since it's down this much