Verizon (VZ): Cautious Optimism Amidst Competitive Pressures

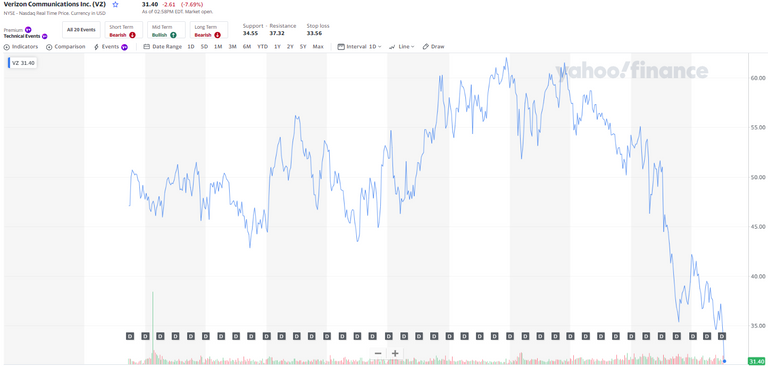

Verizon Communications (VZ) has seen its stock price decline over the past few years, falling from highs above $60 in 2020 to the low $40s today. After this underperformance, what is the outlook for Verizon's stock over the next 5 years?

There are reasons for cautious optimism. Verizon maintains a leading position in 5G network coverage and performance after spending heavily on spectrum and buildout. As the 5G upgrade cycle gains momentum over the next few years, Verizon should benefit from subscriber growth and rising revenue per user.

The company also has advantages in spectrum holdings, business diversification through acquisitions, and strong free cash flow generation that provides capital allocation flexibility. These strengths suggest Verizon has staying power.

However, competitive pressures cloud the outlook. AT&T and T-Mobile continue to vie for market share, pressuring pricing and margins. Verizon also carries a heavy debt load from its 5G investments, limiting financial flexibility. And the overall U.S. wireless market is fairly mature, making subscriber growth more challenging.

Valuation also appears reasonable but not cheap, with Verizon trading at just under 10x forward earnings. This limits upside potential without new growth drivers emerging.

In summary, Verizon's network strengths and cash generation capabilities suggest its stock should see moderate gains over the next 5 years. However, competitive industry headwinds will likely prevent dramatic outperformance. Investors may want to build positions gradually as 5G ramps up. But expectations should remain measured amidst the challenging wireless industry dynamics.