By the end of this Capital One 360 review, I'm going to show you all the features of hacking a Capital One Checking account and how you can get the $400 Capital One Checking Bonus. You don't have to be employed and you don't need direct deposit. Making this a very easy bank bonus to get.

As for the actual account side, the Capital One 360 Checking account is not bad. I might actually keep this account open. There are no monthly fees or minimums and Capital One doesn't charge any ATM fees (even internationally) on their side. But you will be responsible for any ATM fees issued by the ATM owner.

| Account: | Capital One 360 Checking |

| Bonus: | $400 |

| Availability: | Nationwide |

| Requirements: | Receive at least 2 direct deposits totaling $1,000 or more within 60 days of account opening. |

| Bonus Received: | 5 months later (at the end of the month) |

| Time Commitment: | 5 months or until you get your bonus |

| Churning: | Available to anyone who has not has a Capital One 360 Checking account since January 1, 2018 or later. Basically, if you haven't opened an account in 3 years |

| Fees: | No monthly minimums and no early account termination fee |

| Offer Expires: | January 26, 2021 |

| Sign Up: | https://www.capitalone.com/bonus400/ |

Signing Up For the Account

You can sign up for a Capital One 360 checking account online or in-branch. Of course, I would only recommend signing up for the $400 bonus offer. That promotion is automatically added to your application when you apply for your Capital One checking account through this link: https://www.capitalone.com/bonus400/

The Capital One 360 checking account sign up process will take less than 10 minutes and it will be a soft-pull on your credit score. That means, there is no hard inquiry that will appear on your credit report and there will be no difference to your credit score. At the time of applying, my credit report was frozen with all three credit bureaus.

I'm unemployed, can I still open a Capital One Checking account for the bonus? During the application process, Capital One does ask for your employment status, annual income and your job title. Capital One does not ask for any employer information. Sooooo...if an unemployed person were to say they were employed, Capital One would approve their checking account without verifying that.

Your First Deposit

At the end of your account set up, you'll be prompted to fund your newly opened Capital One checking account. It is not required that you fund your account now. You also won't be able to fund your account with a credit card. So for now, you can either add an account or skip it.

Capital One 360 Checking Account Fees

There are generally no fees for the Capital One 360 account. It's pretty good when compared to Chase or US bank that have monthly fees if your balance is below a certain threshold. I actually like the Capital One checking interface, but the bonus is so good that I have to churn the account. (Close it after getting the bonus so I can be eligible for another bonus in the future)

| Monthly Minimums | None |

| Maintenance Fees | None |

| Foreign Transaction Fees | None |

| ATM Fees | None from Capital One and from AllPoint ATMS. Fees apply from ATM owners |

How To Get The Capital One 360 Checking Sign Up Bonus

The Capital One 360 $400 offer requires you to receive at least $1000 and at least 2 direct deposits within the first 60 days of opening your account. If you meet these requirements, the bonus will be added to your Capital One checking account at the end of your 5th month of having the account.

For the direct deposit, the deposit amounts could be anything as long as you get at least $1000 in deposits and 2 direct deposits. That means you can get 1000 direct deposits of $1, or 3 direct deposits of $400, or pretty much anything since the requirements are very achievable.

How to make a qualifying direct deposit

Whether you are employed or unemployed, you can still make a qualifying direct deposit to trigger the Capital One sign up Bonus. Doctor of Credit maintains an excellent list of bank transfers that qualify as direct deposits.

For Capital One, I'll be making bank transfer directly FROM my Charles Schwab account to Capital One. That means, I'll log in to my Schwab checking account, add my routing and account number for Capital One, and then initiate a transfer from Charles Schwab to Capital One which should meet the direct deposit requirement.

Just to be safe, I'll also make 2 direct deposits of $500 ($1000 total) from at least 2 more bank accounts just to be sure. Since Capital One does not give you any indication if you have met the bonus requirements (and you don't want them to see that you met these requirements via bank transfer) I like to make extra transfers with other accounts to ensure I qualify for the sign up bonus.

The biggest pain point for most people is the direct deposit. Changing up your direct deposit information with your employer is very inconvenient. That inconvenience actually stopped me from going for these bank sign-up bonuses in the past.

Can I take the money out of Capital One as soon as possible? There are no account minimums for your Capital One 360 checking account and the sign-up bonus requirements don't state that you have to keep your direct deposits in your account. As soon as your account receives the money, you can move that money out of your checking account.

When do you get the Capital One 360 checking bonus?

Capital one actually provides this table on the $400 Capital One 360 sign up page. Because the bonus structure is a little strange and getting your Capital One checking sign up bonus can take up to 5 months. It's not a fast bonus, but it is an easy sign-up bonus.

| Account opened the month of | Receive at least 2 direct deposits totaling $1,000 or more | Bonus will be paid by |

|---|---|---|

| November 2020 | Within 60 days of your account opening date | March 31, 2021 |

| December 2020 | Within 60 days of your account opening date | April 30, 2021 |

| January 2021 | Within 60 days of your account opening date | May 31, 2021 |

When should you close your Capital One checking account?

The current terms for the Capital One $400 checking promotion do not mention that you need to keep your account open for a certain length. Which means, you can close your Capital One account whenever you like. Of course, you won't get the bonus if your account is closed. Ideally, you should close your account after receiving the Capital One 360 checking promotion.

You could always keep your Capital One checking account open since there are no fees or minimums. But to qualify for future checking promotions from Capital One, you'll need to have an account closed for about 2-3 years. If getting $400 from Capital One every few years is worth it, you should close your account. Since I prefer using Charles Schwab, I don't have a problem closing the account.

How is the Capital One 360 checking sign-up bonus compared to other bonuses?

The Capital One $400 checking offer is very generous. It's pretty common to see checking account sign-up bonuses range from $50 to $300 without needing to have a large amount of money being put into your account while also having no account fees and no minimums.

Doctor of Credit maintains an excellent list of bank bonuses, and you can see that the requirements for bonuses that are $400 or more require a lot more money than the $1000 of direct deposits that Capital One is asking for.

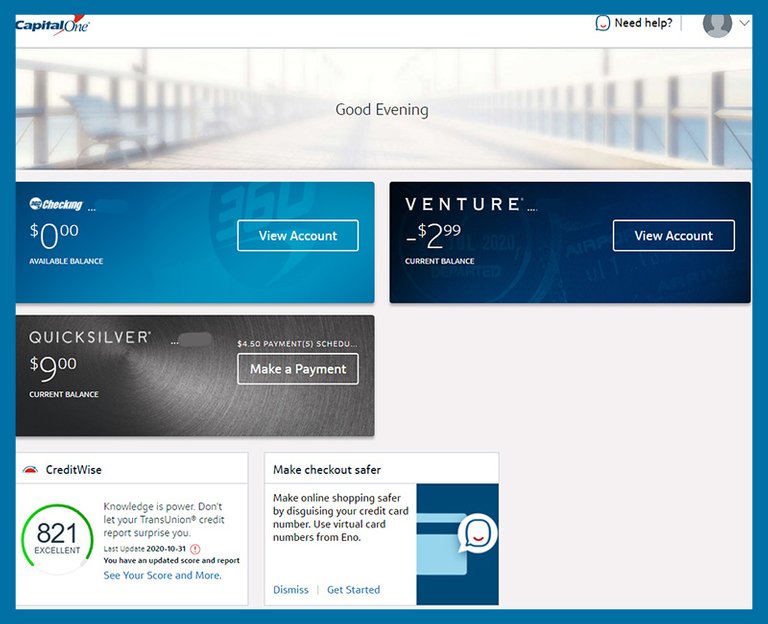

Capital One Log in Screen (They owe me $2.99)

Capital One 360 Checking Benefits

Interest-Earning Rate 0.1%

The interest you earn with your Capital One 360 Checking account is 0.1%. It's not much. With a decent savings account, you can actually be getting 1.0% or more (just a little more). I personally don't believe in savings accounts, but I do believe in having savings. I think your money is more useful while being invested. That's why I always recommend people to leverage their money by signing up for bank sign up bonuses because they will get a bigger return on their money.

With $1,000 sitting in your Capital One 360 Checking account for a year, that 0.1% will get you about $1. Yeah, $1 for every $1000 you have for the year. Your money will be devalued each year. That's why I recommend going for as much checking account bonuses as you can since it doesn't impact your credit score and there is NO LIMIT to the amount of checking accounts. By that I mean you can open at least 1 per bank with as many banks that you are eligible for.

Zelle Pay

Your Capital One checking account offers Zelle. It's a person to person payment system that is used with a lot of banks. Money is sent directly to an email address of phone number without any fees. If you're not using it for P2P transfers, the real benefit to Zelle is that you can liquidate your account quickly to another bank without having to connect your bank. Before closing your Capital One Account, consider opening another checking account and transferring money in (not using Zelle) to fulfill potential direct deposit or funding requirements.

No other discounts or Promotions

There are no additional discounts or promotions with your Capital One checking account. That's pretty normal, but newer checking accounts are offering rotating promotional bonuses (monthly or quarterly) to incentivize customers to use their debit card. This is common with the Venmo debit card, Cash App debit card, Chase Checking account and more.

What checking accounts are better than the Capital One 360 Checking?

The Capital One $400 checking account offer is unbeatable right now. I haven't seen a better offer with requirements this easy. So for the bonus, Capital One is the best right now. As you know, checking account bonuses appear seasonally and are always available for a short amount of time. Definitely get a Capital One checking account when the offer is generous.

As for competitors, the Capital One 360 checking account offers no minimum and no monthly fees. The only weak point is that they still charge you ATM fees from the ATM owner. One of the few banks that can actually beat Capital One's checking account is a Charles Schwab checking account.

With Charles Schwab, all ATM fees from anywhere in the world are refunded. I always mention Charles Schwab because he's the best. It's like he gift me $10 every month in ATM fees and I appreciate that. Although the Charles Schwab checking account has no public sign up bonus and the referral bonus can get you $100 for your sign-up, it's my keep open forever account.

Capital One 360 Review: The Experience

Capital One has one of the best user interfaces (for a bank) that I've seen. The colors are pleasant and everything I need is easy to read. They keep all the options simple and convenient. While other "banks" like Venmo and CashApp oversimplify the checking options and the other banks like Chase and US Bank make the process too formal and overwhelm you with text, Capital One is a refreshing option.

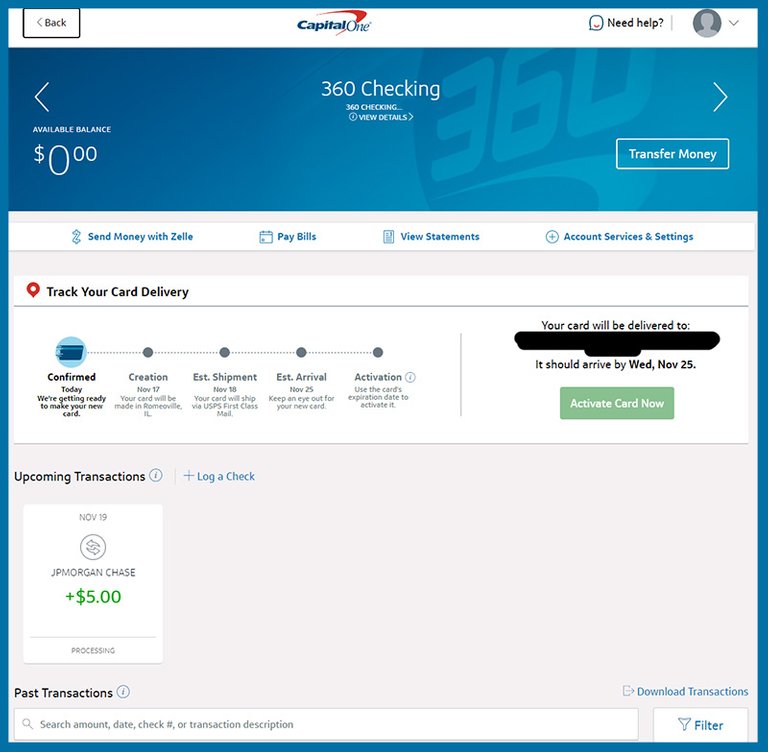

As you can tell from the screenshot below, I have an exact estimate of when my Capital One debit card will arrive in the mail. This screenshot was taken soon after opening my Capital One 360 Checking account.

Capital One 360 Checking Home Screen

I've been a Capital One customer since 2010 and have had a consistently good experience with their service. Even though Capital One doesn't have the best value for some of their credit cards, the bonuses Capital One provides can be pretty good from time to time. For reference, check out the Capital One Venture review. The credit card bonuses and cash back offers aren't the best on the market, but will still provide you a lot of value.

TLDR

The Capital One 360 checking account is overall not bad. I love that there are no minimums and that the ATM fees are only from the ATM owner (even internationally). Although, the Charles Schwab Checking account is overall better and still my favorite. Since the Capital One Checking account offers are only available to customers every 3 years, at least that's how often you can get the bonus, I'm more incentivized to close the account immediately so I can be eligible for another bonus as soon as possible.

The Capital One 360 checking bonus $400 offer is one of the MOST generous checking account offers on the market with some of the easiest terms to meet. You can literally move money into your account and out of it, then wait for your bonus. As for the actual Capital One checking account, it's pretty nice. The interface has a very pleasing look and feels much more friendly than my checking accounts with Schwab, US Bank, and Chase.

Posted from my blog with SteemPress : https://slycredit.com/capital-one-checking-review/