Instead of saying that analysts were terrible at estimating the quarterly or yearly earnings of a company? This is one of the funny things about being a research analyst, especially on the sell-side.

Another funny observation is that track record seems to count for very little in the traditional finance industry. Hedge funds that go broke simply close shop and start all over again under a new name. Rinse and repeat.

People will also remember you for the outlandish predictions that you get right and forgive all the times you were wrong. A perfect example of this would be Nouriel Roubini or Dr. Doom. He correctly predicted the '08 crisis and has been pretty gloomy ever since but no one mentions how wrong he has been since then. Let's not even get into his comical Bitcoin and crypto calls.

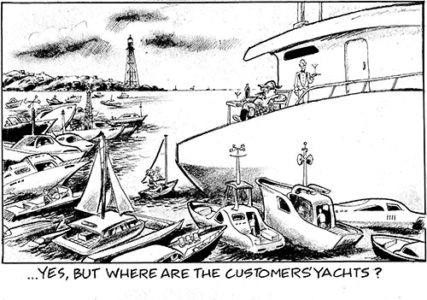

If your investment advisor or insurance agent is dressed in designer suits, wears a fancy watch and drives a Maserati, remember that is made possible by your fees. Of course, in some rare cases, they are worth it. But as the title in the classic book asks, "where are the customers' yachts?"

Which brings me to my next point, bankers are paid in the form of fees. They aren't paid to do nothing so they have an inability to keep still. Whether their advice is in your best interests remains to be seen. What is for sure, is that they will make a tidy sum if you act on it.

These observations aren't unique. Some of them have already been espoused in investment classics like the title book written way back in 1940 as well as more recent ones like Common Stocks and Uncommon Profits written in 1958.

While the world has changed a lot since these books were written, it seems like the nature of man, and in particular those who work in the financial industry, has not.