pump and dump" scheme is a type of fraud that involves artificially inflating the price of an asset through false and misleading statements, in order to sell the asset at a higher price. This type of manipulation is particularly prevalent in the cryptocurrency market, where prices can be highly volatile and there is often a lack of regulation.

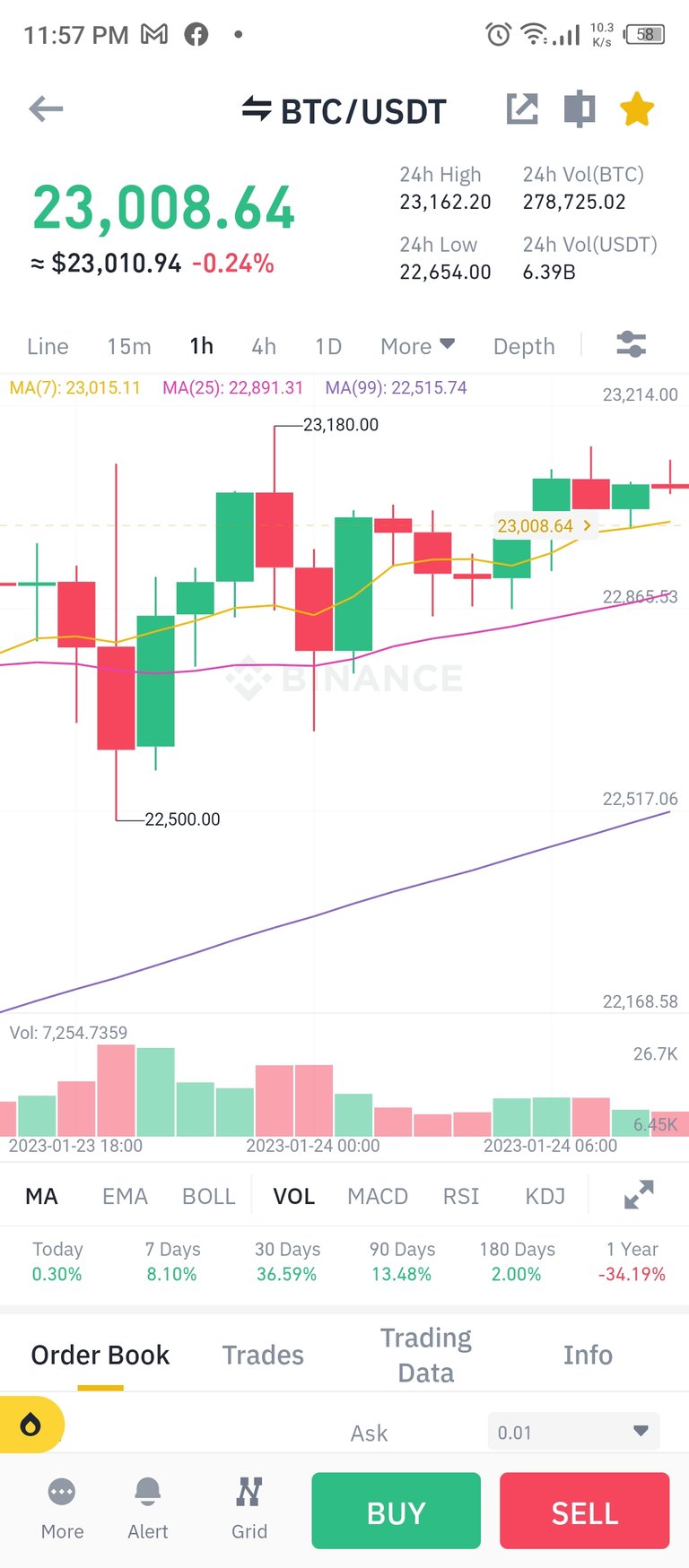

One way to identify a potential pump and dump scheme is to look for sudden and unusual spikes in the price of a cryptocurrency, often accompanied by an increase in trading volume. This can be a sign that a group of individuals or entities are working together to artificially inflate the price of the asset. Additionally, pump and dump schemes often involve the promotion of the asset through social media, forums, and other online platforms, in order to generate interest and drive up demand.

Another red flag to look for is the presence of "pump and dump" groups on social media platforms such as Telegram, Discord or WhatsApp, these groups often have thousands of members and they advertise a specific coin, encouraging all members to buy it at the same time, this creates artificial demand and causes the price to increase.

To protect yourself from becoming a victim of a pump and dump scheme, it is important to do your own research and due diligence before investing in any cryptocurrency. This includes researching the underlying technology and potential use cases of the asset, as well as looking into the team behind the project and their track record. Additionally, it's important to be skeptical of any investment opportunity that seems too good to be true, and to avoid investing in any asset that is being heavily promoted without a clear and legitimate reason.

It's also important to be aware that even if you do your due diligence and the cryptocurrency you invested in doesn't turn out to be a scam, the price may still drop due to market conditions or lack of interest from investors. Therefore, it's important to only invest what you can afford to lose and to have a clear strategy for managing risk.

In conclusion, pump and dump schemes are a common occurrence in the cryptocurrency market. They can be identified by sudden spikes in price, increased trading volume, and heavy promotion on social media and other online platforms. To protect yourself, it is important to do your own research and due diligence before investing in any cryptocurrency and to be skeptical of any investment opportunity that seems too good to be true. Additionally, it is crucial to be aware that even if you do your due diligence, the price of the cryptocurrency may still drop due to market conditions or lack of interest from investors.