Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

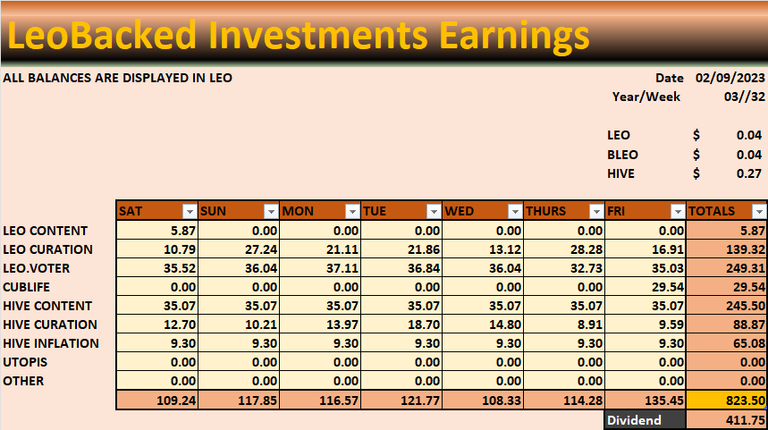

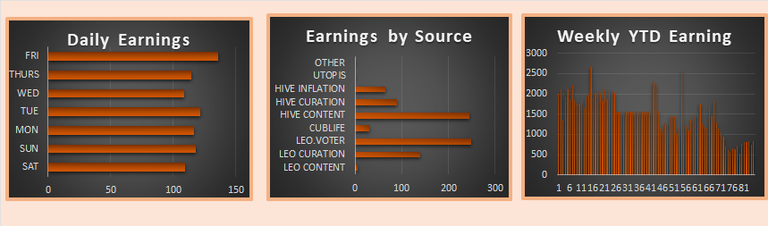

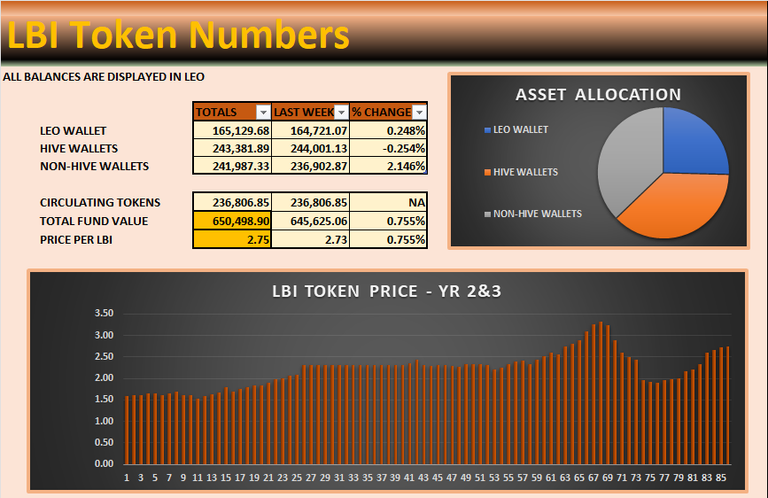

LBI income this week was decent and up alot from last week. This weeks top earner for us was leo.voter, followed very closely by HIVE content and then LEO curation coming in 3rd.

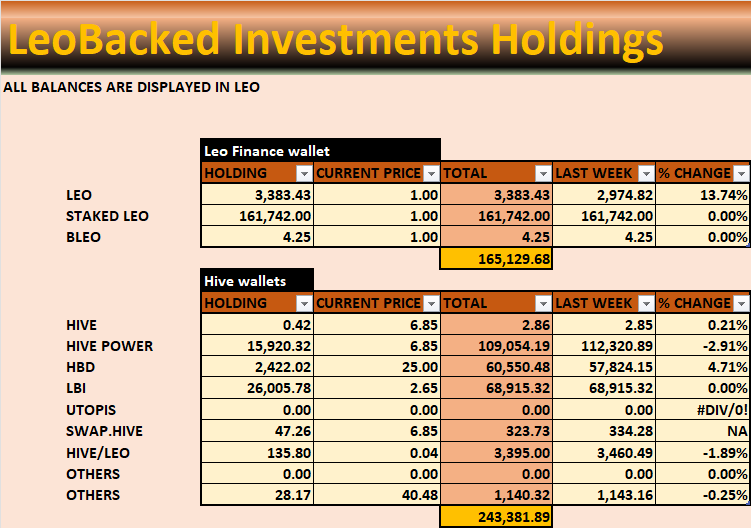

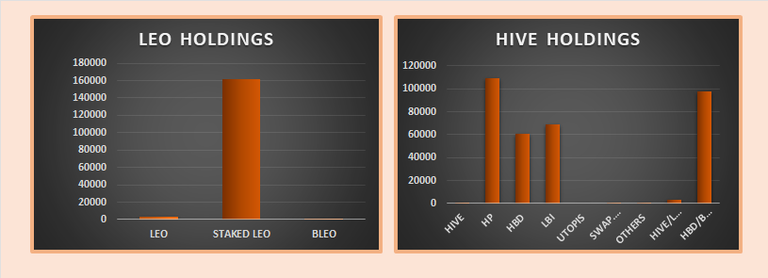

HIVE and HE holding this week do not do that much with everything expect for HBD going sideways. HBD increased this week because we collected our monthly interest payment which was for 46 HBD.

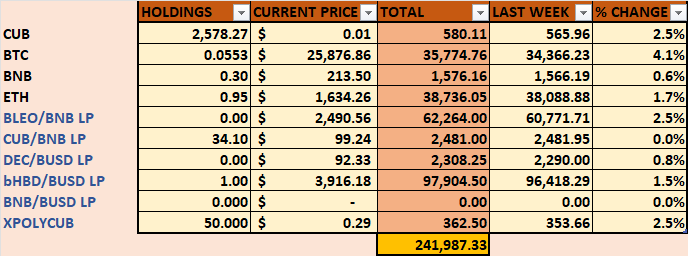

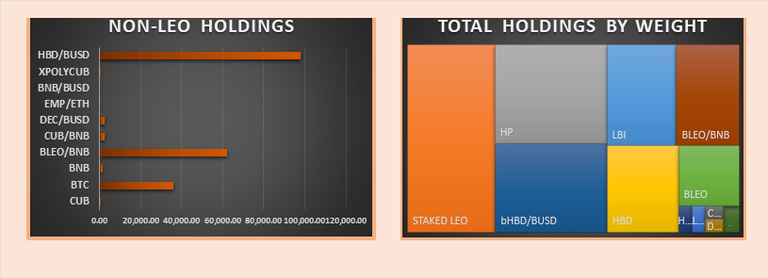

Our non-HIVE holdings increased in value this week but not by much to be honest. I continue to convert harvests into BTC and thinking in a few months toward to the end of the year would be a good time to convert our stable LP into some crypto. I see pancake off 25-30% for BTC/TUSD LP or BTC/BNB LP which is pretty good for a BTC LP.

CUBlife is no more

For those that missed the post released yesterday, i have decided to wrap up CUBlife (CL). All LP holdings have already been liquidated and there is a buy-back wall on HE for 0.65 per CL token. You can sell back you CL token here. The buy back wall is enough to buy back every CL token in circulation so there's no rush but sooner rather than later is better.

We have already bought back 25% of CUBlife tokens but im sure some token holders are not active on HIVE any more as the project is 2 years old. The back buy wall can remain for at least 6 months and then i'll see what to do after. No point in wasting good HIVE on a buy back wallet for inactive users when we could power up 90% of the HIVE to LBI and earn LEO by delegating it to leo.voter while leaving 10% in the buyback wall. If a big CL token holder returns as many will during the next bull cycle, SPI will pay them HIVE there and then and LBI can start a powerdown to pay SPI back. Something like that cause im sure there will be unclaimed HIVE. I could do a HIVE airdrop but i want the CL token back to burn them. I dont want an inactive project with circulating tokens, that is a little messy for me.

Anyways, that is this weeks report. Not much happening in crypto, we made a pump and dump during the week but overall, we're moving sideways. LEO is moving with the market so thats why the LBI token remains pretty much the same as last week. Apart from wrapping up CUBlife, its been a decent week.

Thanks for checking out the report and staying up to date.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

Sounds interesting 🤔

I like innovation and SPI sounds interesting.

Its nice that the CUBLIFE will be 100% bought back.

Some will forget I'm sure.

Could u not burn them and replace with Lwi / Hive ?

Hope it goes great 👍