Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

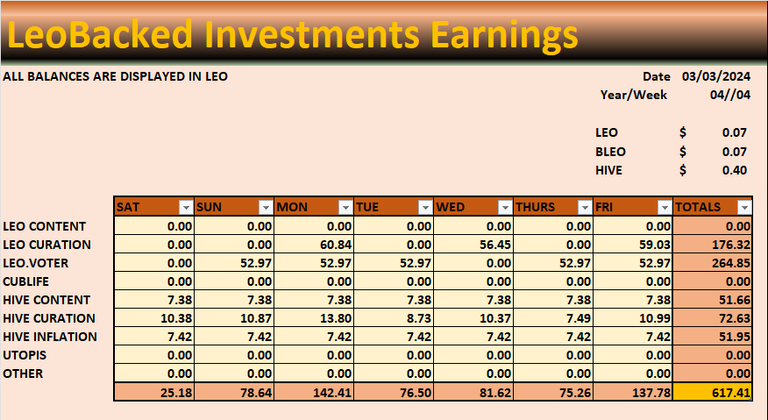

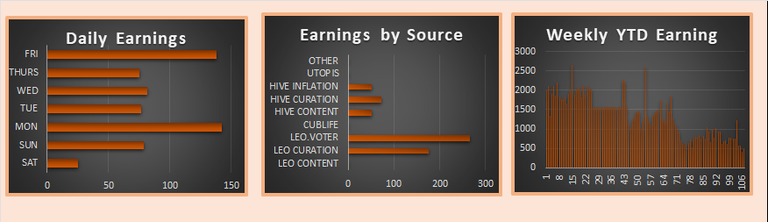

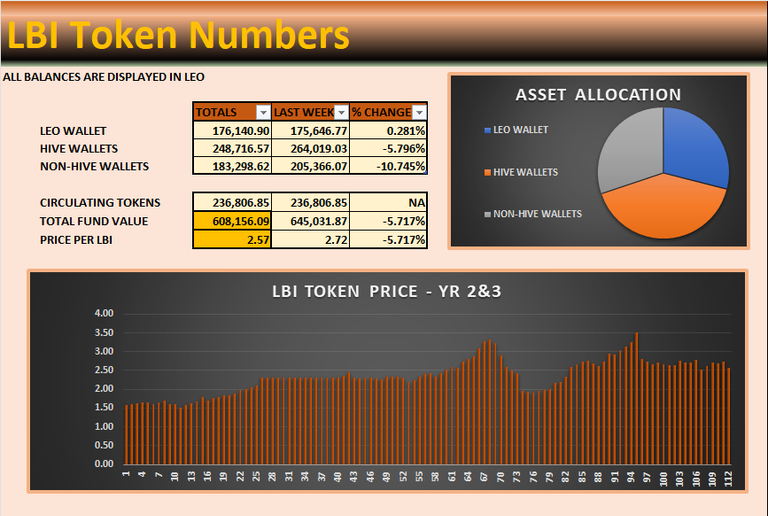

Incomes over the past few weeks have been up and down with the whole HIVE SQL happening. Incomes are round are not good, for some reason this week we only received LEO curation rewards 4 times but received HIVE curation every day. Then ontop of that, leo.voter only paid out 5 days this week which seems to be a normal thing, this reduces its APY to 8.5% APY. I am also not seeing any backpayment for all the days missed when payments where down from HIVE SQL. They said they would pay these out but, they say alot of stuff.

Aside from that, HIVE curation, inflation and content rewards are consistent.

I swapped over from receiving liquid rewards to staked rewards from leo.voter so now every week, our staked LEO balance is increasing. I have no idea were they get the 21-22% APY number from.

- @lbi-token delegates 16,550 HP to @leo.voter

- We received 264 LEO from leo.voter this week, thats 13,728 per year

- 18,728 LEO is worth 2397 HIVE

- 2397/16550 = 14.5% APY

If leo. voter ever paid out 7 days in a week, we would get 20% but it never does.

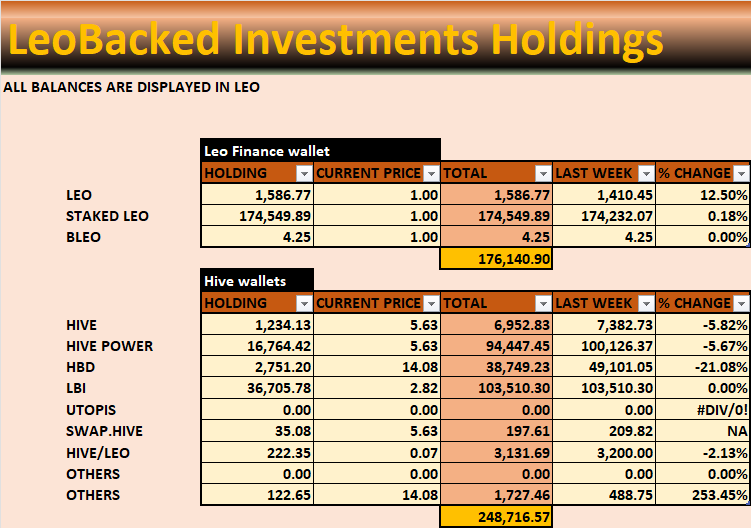

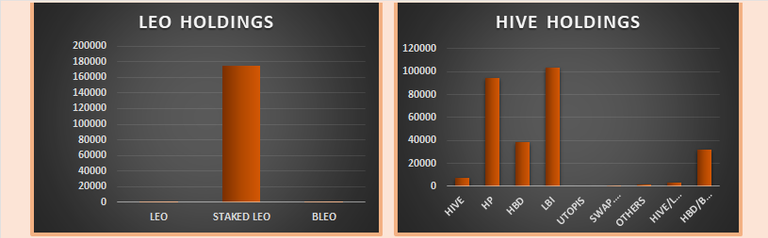

HP is growing with HP inflation and curation and we're compounding HBD interest. LEO has outperformed HIVE this week so we've lost LEO value with HIVE wallets this week.

.

.

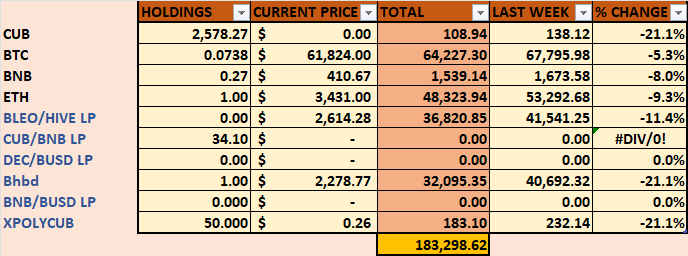

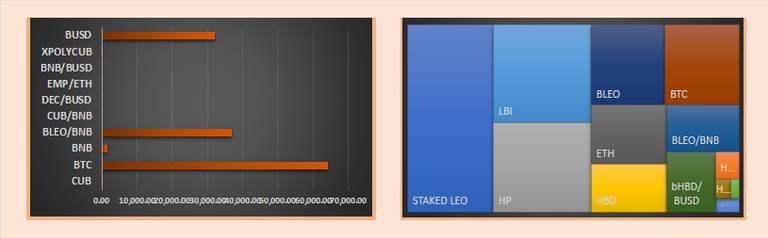

Been a really good week for BTC but an even better week for LEO as it has outperformed everything else. One problem we are having is that we can bridge the bHBD balance we have back to HIVE and converting it into another token on BSC will cost around 50% of its value because since the bHBD/BUSD LP was pulled from CUBfinance and there is no working bridge, people have been dumping bHBD which has hammered the LP and crashed the bHDB price to around 50 cents.

I opened a support ticket but was advised to not use the bridge and was not offered any solution. So we hold 2250 bHBD which is pretty useless to us because there is no working bridge. The LEO eco system as a whole does have alot of problems with its automations as pretty much nothing works as advertised so we cant be too surprised.

RECAP

LEO is up a bunch this week but we're losing money all over the place. Leo.voter paying out 5 out of 7 days, LEO curation rewards only 4 of out 7 days and then our non-liquid bHBD on top.

LEO curation rewards are currently under 6% and inflation is much higher. With little to no other use cases for LEO, it's hard to be motivated to stake LEO instead of converting it to HP and earning staked LEO at almost 3x the APY. At the same time, I understand that we need to have LEO staked so unstaking is not a question. This leaves us on the path we are already on where our bags pump a tiny faction each week and there's not much else we can do.

The bull market is starting to pick up so we'll continue on and see where it brings us. We're heading with pretty much

175k LEO

16,750 HIVE

2750 HBD

0.074 BTC

1 ETH

This is the bulk of LBI. We know that BTC and ETH will moon for the next 18 months, HIVE will bounce 2-3x in the last month of the bull run and we'll see what happens with LEO. Last cycle, LEO dropped the whole way through the bullrun after all the PB airdrop shilling pumped the price in early 2020, maybe this bullrun, we see LEO increase and get back into double digits.

Thanks for checking out this weeks report. Have a great week.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

Interesting the whole bridge thing out of BHBD back to HBD. I have been having this problem also and thought it was just me. It seems that CUB is not a priority anymore.

Exactly. I have already prepared a post about Leofinance's insolvency, but I'm afraid to post it

Ps i would still put the bHBD into f.e. bHBD-Cub pool

hey if i hold LBI i gain leo tokens? and about vote post

Any chance we will get another one of these soon?