This is an article I wrote for the Al Jarida newspaper of Kuwait.

It develops my thoughts on how technology is changing the way the energy market operates and how the oil price may never rise again.

It is published here:

Al Jarida Article 24 Jan 2015 (Go to Page 16)

For oil prices, it's a flat line. Sideways. In fact with recent dramatic changes in the cost of energy we may be witnessing the end of oil. If oil stays low for long enough it may never rise again.

In June 2000, the former Oil Minister of Saudi Arabia, Sheikh Zaki Yamani, said, “Thirty years from now there will be a huge amount of oil and no buyers. Oil will be left in the ground. The Stone Age came to an end, not because we had a lack of stones, and the Oil Age will come to an end not because we have a lack of oil.” (link)

How so? I hear you ask. How have we reached the end of our modern “Stone Age”?

I say yes. Let's have a look at why.

World energy has hit and passed a price equilibrium point between two competing mediums: fossil fuels, and solar energy. This means that how we do busy will change. It will change very fast. As an example, mobile phones took out the landline market in a handful of years after they became cost effective. Mobiles were the better option technically and economically.

Energy from fossil fuels has historically been cheap and this enabled the great economic boom of the past 100 years: a population explosion from 1.7 billion people in 1900 to over 7 billion now, and GDP from $2.7 trillion (adjusted) to over $75 Trillion in roughly the same time period (per capita moving from $1,600 adj. to $10,000). The Green revolution (food production). The Technology revolution (computer development). The Connectivity Revolution (mobile phone and internet) and now the Knowledge revolution (P2P, social networking and blockchain). All fuelled by cheap energy. And now this low cost energy has engineered it's own replacement: Solar energy.

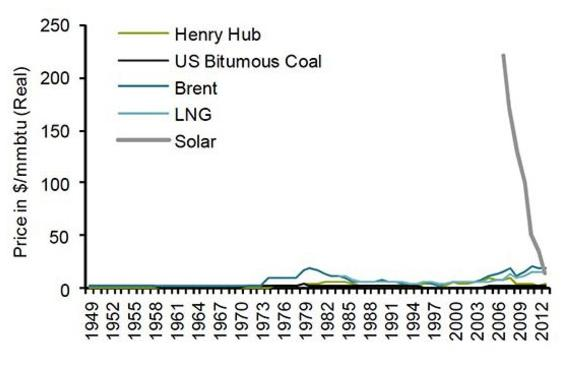

Looking at the chart below below we see these low fossil energy prices. You can also see the rise in crude oil prices to between $10 and $20 per mmbtu that caused the oil shocks of the 1970s. Wind and solar energy attempted to rise in this time but their costs were so great that when oil prices dropped again in the mid 1980's so did interest in alternative means of keeping us warm, cooking our food and illuminating our homes. Keep burning fossil fuels was the acceptable, economic solution. That is until now. In the last 6 years solar technology costs have plummeted coming from an astronomical $220/mmbtu to now being at the same level as Brent crude and LNG at around $15 per mmbtu. It's still falling.

As far as economics go, fossil fuel prices are going the wrong way (up) and solar pricing is going the right way (down).

So what is really happening with the tumbling price of oil? Is Saudi Arabia attempting to displace US supply by shutting down high priced tight oil investments? Are there moves afoot to destabilise the Middle Eastern power base by cutting revenues of Iran for their support of the Syrian regime and other related matters? Are there plans to destroy the asset side of the Russian balance sheet and topple their eastern European hegemony?

Yes, it may be all, or some of these things. For now.

But these are still small compared to the impending impact of economics and the immutable power of the sun. I don't think that solar prices are having any direct effect on oil demand right now, but I believe that very soon they will. We may find that the price of oil does not rise again, or if it does, not for very long before demand falls for the final time. Remember that more than 40% of crude oil consumption is by passenger vehicles and that's an important fact when considering the low cost of generating power from the sun.

Led by their wallets, consumers will migrate towards solutions that are supported by lower cost energy and they will seek them out as manufactures support their demands. It's a matter of availability of options. And what is the option for reducing energy costs: locally generated electricity for domestic consumption and electric vehicles or EVs for transport. EVs are 90 percent cheaper to fuel and maintain than gasoline cars (Rocky Mountain Institute).

Those options appear to ready now. Today, EVs can be purchased from many of the major vehicle manufactures from around the world. For instance BMW, Chevrolet, Citroen, Fiat, Ford, General Motors, Honda, Kia, Mahindra, Mercedes Benz, Mitsubishi, Nissan, Renault and Tesla to name a few. In fact BMW are expected to phase out internal combustion engines within 10 years (Baron Funds, September 14, 2014). So that means within the very close and near future, almost half of the demand for crude oil will evaporate. The Sheik's prediction will come true. And about the image of electric cars, in 2013 the fully electric Tesla Model S won the Car of the Year (Motor Trend) for all car types, not only EVs, and was quoted as being the best car ever tested. Ever!

What continues to drive down the cost of solar energy is mega solar projects and continued large scale PV installations. For example the Indian government has made its intentions clear to have 100 GW of installed generating capacity by 2022 and China are planning 100 GW by 2020. That's equal to 200 nuclear power stations. And pricing will be around $0.06 per kWh – on a par when levelled with present energy costs (nuclear, coal & LNG).

Is the fall in oil price here to stay. Not yet. It depends the uptake of EVs, and that is a matter of their availability. But soon low oil prices will be here to stay.

Our choice in this energy shift is to be leaders or let others lead.

follow @jeremiahjosey

Author Deck

Mr. Jeremiah Josey is an Australian who has been living in the Middle East for more than 10 years. Knowledgeable in the technology and energy markets, he is the Chairman of Swiss based Meci Group, a business and investment consultancy that operates across the Middle East, Central Asia and Russia.

See www.JeremiahJosey.com and www.Meci-Group.com for more.

Post first written in 2015 on my wordpress blog:

https://jeremiahjosey.wordpress.com/2015/01/25/the-end-of-oil-oil-pricing-for-2015-and-the-rise-of-solar-energy/

Now refreshed and reposted for the "Great Reposting" to Steemit.com