Friends and foes, welcome to this analysis of LTC-USD.

I have analysed the daily chart of Litecoin with the best of my knowledge and i am posting the statistics here. Please note that i am learning TA and i am using this article as a log for my progress.

So, without any further ado, let’s get started.

LTC has been moving inside the Descending triangle pattern since long and finally fell downwards few days back.

The first good resistance lies in the $112-$118 zone.(10% up or down maybe).

Getting back to the current situation. The price is around $95. If the price falls back further to the upper level of the next possible support($85-70) and rebounds from there to the next possible local fibonacci level of around $108, which is rougly equal to a gain of around 20-25%.

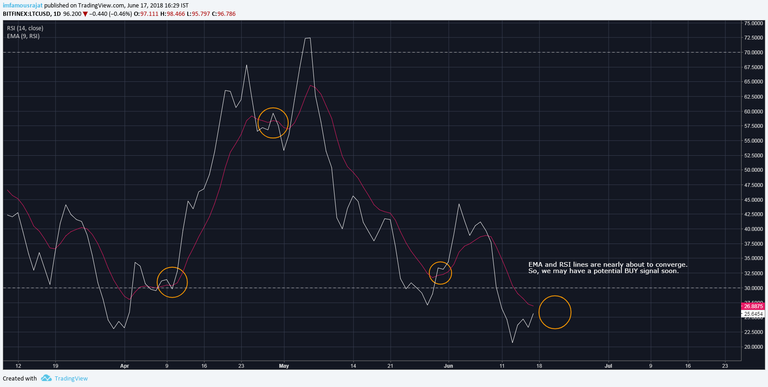

EMA + RSI

EMA and RSI lines are nearly about to converge. So, we may have a potential BUY signal soon.

Note that nothing can be stated about the strength of the buying signal. Keep an eye on other indicators too like the Volume to know about the strength.

I have smoothed out the EMA over RSI . This is done in order to vercome choppiness and get better entry and exit points.

Just remember this always that,

If the RSI line(White) is ABOVE EMA line(Red) = BUY

If the RSI line(White) is BELOW EMA line(Red) = SELL

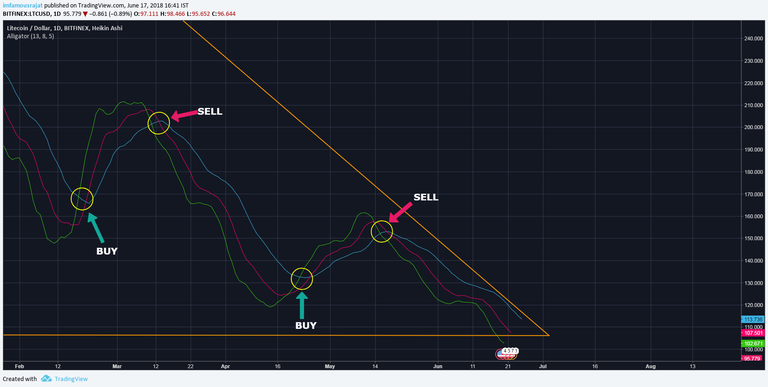

WILLIAMS ALLIGATOR

The Williams alligator shows signs of further downward movement. Since, this is a lagging indicator, this sign is justified due to massive bearish trend which started on 6th May.

Also, just remember that when the order of line is:

- GREEN > RED > BLUE = BUY

- BLUE > RED > GREEN = SELL

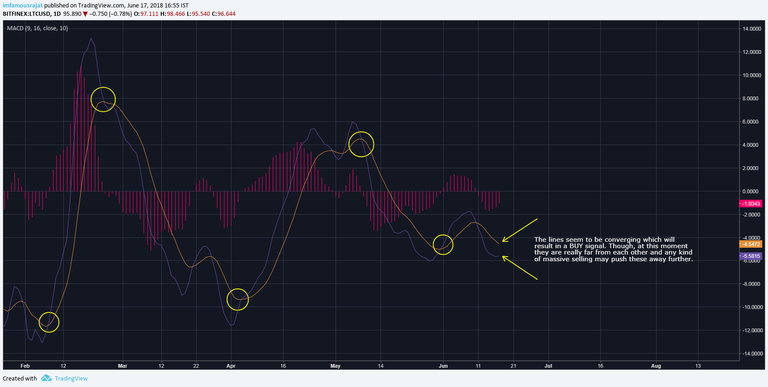

MACD

The lines seem to be converging which will result in a BUY signal. Though, at this moment they are really far from each other and any kind of massive selling may push these away further.

Note that, the MACD is converging inside a symmetrical triangle but still needs more time for development.(Will focus more on this in my next update).

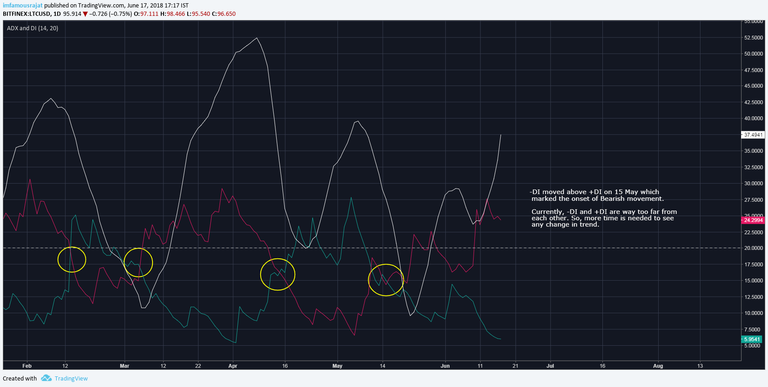

ADX AND DI

-DI moved above +DI on 15 May which marked the onset of Bearish movement. Currently, -DI and +DI are way too far from each other and ADX is resting at 37 value which means that the prevalent trend is strong. So, more time is needed to see any change in trend.

VOLUME INDICATOR AND VOLUME OSCILLATOR

The most important thing which i noticed on the daily graph is that, the with falling price, the volume has been falling continuously. This is obviously, in favour of BULLS. This clearly marks the loss BEARISH momentum.

In addition to this, the Volume oscillator indicator also indicates a loss of bearish momentum. The oscillator has a negative value of -14. For all those who don’t know how volume oscillator works, let me explain it to you in simple words. This indicator plots positive values above the zero line and negative values below the line. A positive value suggests there is enough market support to continue driving price activity in the direction of the current trend. A negative value suggests there is a lack of support, that prices may begin to become stagnant or reverse.

Litecoin is already in a clear downrend. A positive value of volume oscillator may have suggested further downward movement. But since, the value is negative, there is a lack of support and the trend may reverse soon.

CONCLUSION:

I’ll leave it for you to decide. I am neither shorting nor longing at this moment, i am just sharing this for knowledge purposes only.

P.S: This is not an investment advice, and i am just learning. This is for my learning purpose only. Invest your capital at your own risk.

Those who wish to achieve greatness, never seek for permissions.

They follow what their heart says,

and do what their mind states!

Good luck trading.!

Peace.

If you find this article/information helpful, be sure to leave an upvote and share with all your friend.

nice post paaji !!